Stryker (SYK): Evaluating Valuation as Earnings Grow but Share Price Stalls

Stryker (SYK) has been quietly treading water, with the stock roughly flat over the past month and down about 7% in the past 3 months, despite solid double digit earnings growth.

See our latest analysis for Stryker.

Zooming out, Stryker’s latest 1 year total shareholder return of negative 3.9 percent contrasts with a strong 3 year total shareholder return above 50 percent. This signals that longer term momentum remains constructive even as short term sentiment cools.

If Stryker’s mixed recent share price return has you rethinking your watchlist, this could be a good moment to explore other quality healthcare stocks with different risk reward profiles.

With earnings still climbing and the share price treading water, are investors overlooking value in a high quality medtech compounder, or is Stryker’s future growth already fully baked into today’s valuation?

Most Popular Narrative Narrative: 15.9% Undervalued

With Stryker last closing at $364.35 versus a narrative fair value around the low $430s, the prevailing view leans toward meaningful upside from here.

The ongoing industry shift to outpatient and minimally invasive procedures, where Stryker is a leading supplier of ASC infrastructure and advanced surgical solutions, positions the company to benefit from increased procedure volumes and deeper customer penetration, bolstering both revenue and operating leverage.

Curious how modest revenue growth assumptions can still translate into much faster profit expansion and a rich future earnings multiple? Unpack the full playbook behind this valuation.

Result: Fair Value of $433.19 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent regulatory delays and supply chain disruptions could cap international growth and margins and challenge the upbeat long term earnings narrative.

Find out about the key risks to this Stryker narrative.

Another View: Multiples Paint a Pricier Picture

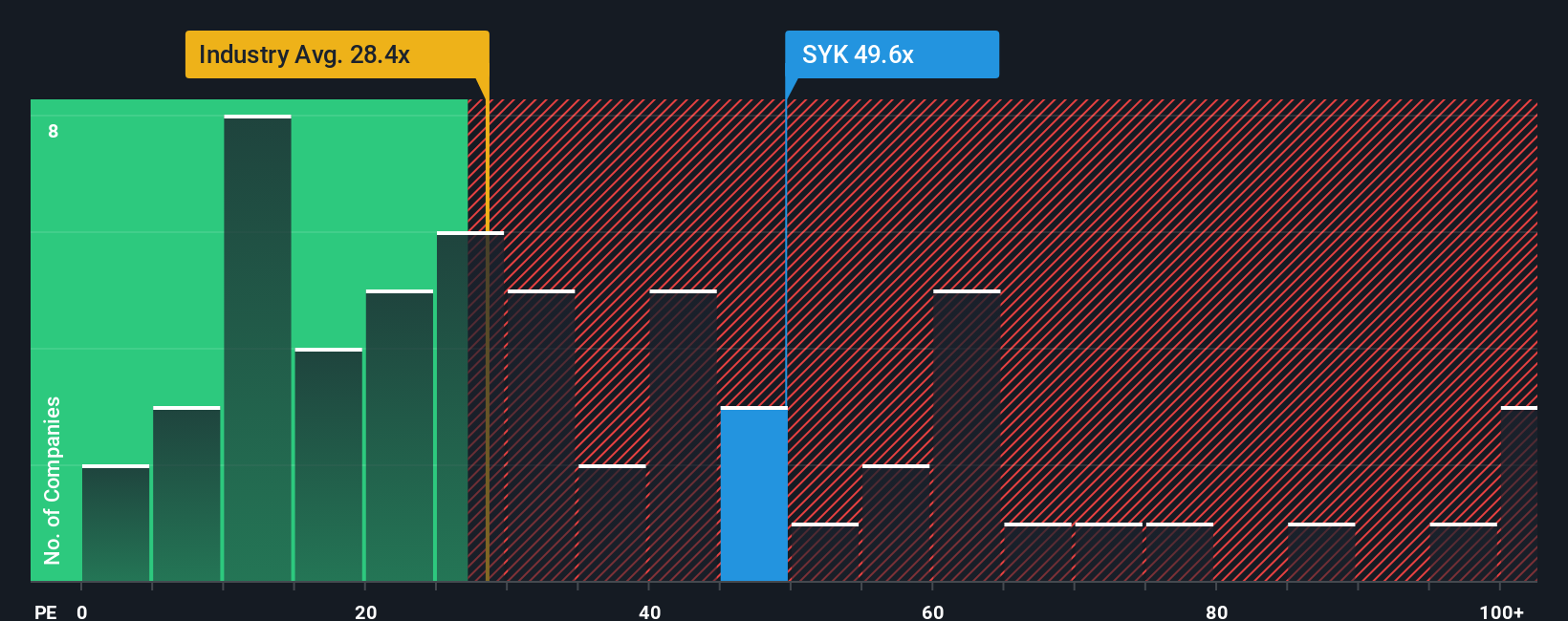

While the narrative fair value suggests upside, Stryker’s 47.3x earnings multiple looks stretched versus US medical equipment peers at 28.9x and a fair ratio of 37.3x. That premium implies limited margin for error if growth or margins fall short. Are investors paying too much for quality?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Stryker Narrative

If you are not aligned with this perspective or simply prefer digging into the numbers yourself, you can craft a tailored view in minutes: Do it your way.

A great starting point for your Stryker research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Right now is a smart time to broaden your opportunity set, because the Simply Wall Street Screener surfaces focused, data driven stock ideas you do not want to overlook.

- Tap into rapid innovation by scanning these 26 AI penny stocks that harness algorithmic breakthroughs and scalable data platforms for potentially outsized growth.

- Turn volatility into potential reward with these 81 cryptocurrency and blockchain stocks targeting businesses building real world solutions on blockchain and digital asset infrastructure.

- Strengthen your income stream through these 15 dividend stocks with yields > 3% designed to highlight companies with reliable, above average yields and solid fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal