How Investors Are Reacting To Unity (U) Analyst Upgrades And Its New Epic Games Partnership

- In recent days, Unity Software drew fresh attention as multiple research firms upgraded their views and highlighted the company’s role in powering over half of the world’s mobile games, alongside expanding use of its tools in areas like automotive and architecture.

- Analysts also pointed to Unity’s growing presence in game engines, mobile advertising, and alternative payment solutions, plus a new collaboration to bring Unity-built games into Fortnite, as reasons for renewed confidence in its longer-term expansion potential.

- We’ll now examine how the new Epic Games partnership, alongside upbeat analyst commentary, may reshape Unity Software’s investment narrative.

We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Unity Software Investment Narrative Recap

To own Unity, you need to believe its core engine and ad network can turn market share in gaming and adjacent industries into a sustainably profitable business, despite ongoing losses and heavy investment. The Epic Games partnership and cluster of analyst upgrades support the near term catalyst of stronger platform monetisation, but do little to reduce the key risk that high R&D and operating costs could keep profitability elusive even as revenue grows.

The new collaboration with Epic Games, which will let Unity-built games publish into Fortnite and extend Unity’s commerce tools to Unreal developers, directly ties into that monetisation catalyst by broadening potential transaction volume and developer touchpoints. If this starts to show up in higher usage of Unity’s ad and payments infrastructure, it could reinforce the bullish analyst narrative that the company’s ecosystem has room to scale, even as competitive and cost pressures remain front of mind.

Yet while enthusiasm has increased recently, investors should still be aware of the risk that persistently high AI and product development spending could...

Read the full narrative on Unity Software (it's free!)

Unity Software's narrative projects $2.3 billion revenue and $313.8 million earnings by 2028.

Uncover how Unity Software's forecasts yield a $43.70 fair value, in line with its current price.

Exploring Other Perspectives

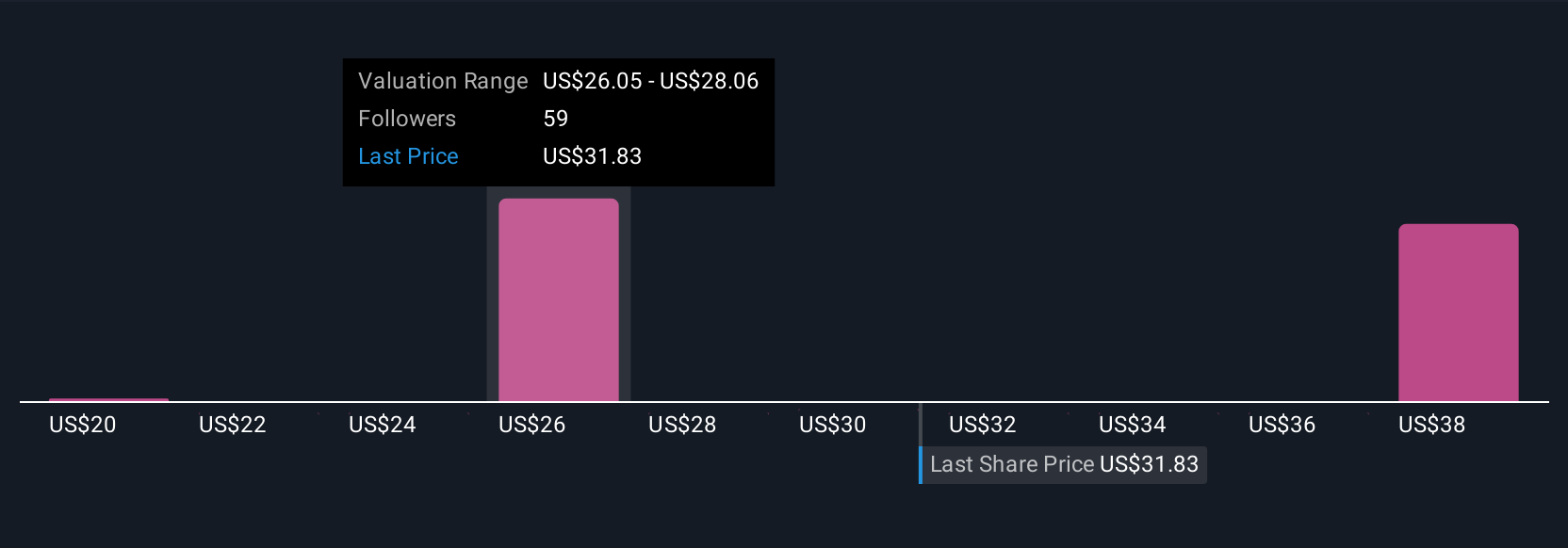

Eight fair value estimates from the Simply Wall St Community span roughly US$24 to US$56 per share, underlining how widely opinions differ on Unity’s prospects. You can weigh those against the key concern that heavy AI and product investment may delay any real earnings progress and consider what that might mean for the company’s ability to translate its current momentum into lasting financial improvement.

Explore 8 other fair value estimates on Unity Software - why the stock might be worth 45% less than the current price!

Build Your Own Unity Software Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Unity Software research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Unity Software research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Unity Software's overall financial health at a glance.

Ready For A Different Approach?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal