WuXi Biologics (SEHK:2269) Deepens Middle East Ties With Qatar CRDMO Hub Plan – What Really Changes?

- WuXi Biologics (Cayman) recently announced a Memorandum of Understanding with the Qatar Free Zones Authority to establish its first integrated CRDMO center in the Middle East, extending its global biologics development and manufacturing network into the region.

- By pairing its one-stop CRDMO capabilities in complex biologics with Qatar’s push to build a regional biotech hub, WuXi Biologics is positioning itself as an early infrastructure partner in shaping the Middle East’s biopharmaceutical ecosystem.

- Next, we’ll explore how this planned Middle East CRDMO hub could reshape WuXi Biologics’ global footprint and long-term investment narrative.

AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

WuXi Biologics (Cayman) Investment Narrative Recap

To own WuXi Biologics, you need to believe its global CRDMO model can keep attracting international biologics projects while managing geopolitical and regulatory scrutiny. The Qatar MoU broadens its network, but does not materially change the near term focus on US and European client exposure, where policy risk and potential contract loss remain the most immediate swing factors for the business.

Among recent developments, the EMA approval of WuXi Biologics’ Dundalk facility in Ireland stands out alongside the Qatar initiative, as both expand its global reach and regulatory footprint. Together, they underline how new capacity and multi region compliance could support future project flow, but also increase the importance of maintaining high utilization and protecting margins if biotech funding or client outsourcing trends soften.

However, investors should be aware that WuXi Biologics’ heavy global expansion could leave it exposed if...

Read the full narrative on WuXi Biologics (Cayman) (it's free!)

WuXi Biologics (Cayman)'s narrative projects CN¥31.1 billion revenue and CN¥6.5 billion earnings by 2028. This requires 15.8% yearly revenue growth and about CN¥2.3 billion earnings increase from CN¥4.2 billion today.

Uncover how WuXi Biologics (Cayman)'s forecasts yield a HK$39.39 fair value, a 20% upside to its current price.

Exploring Other Perspectives

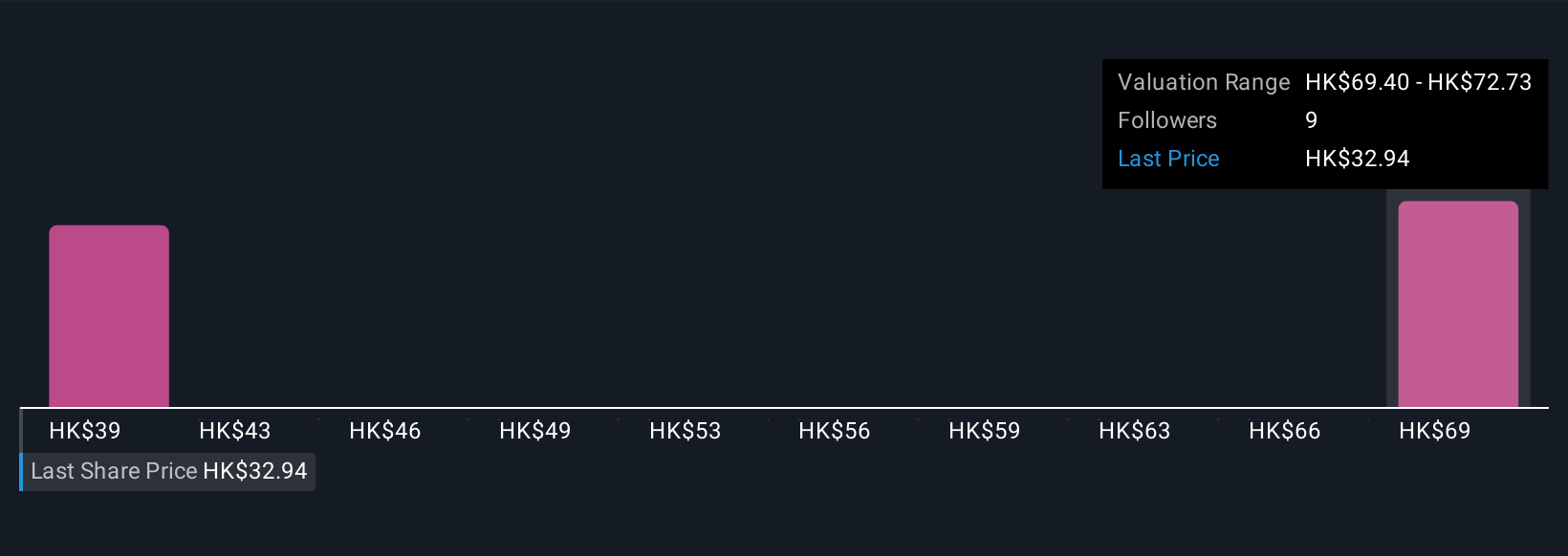

Two fair value estimates from the Simply Wall St Community span roughly HK$39 to HK$73, showing that individual views on upside vary widely. When you set that next to WuXi Biologics’ ongoing geopolitical and regulatory exposure, it underlines why many investors prefer to compare several perspectives before forming a view on the company’s prospects.

Explore 2 other fair value estimates on WuXi Biologics (Cayman) - why the stock might be worth over 2x more than the current price!

Build Your Own WuXi Biologics (Cayman) Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your WuXi Biologics (Cayman) research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free WuXi Biologics (Cayman) research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate WuXi Biologics (Cayman)'s overall financial health at a glance.

Interested In Other Possibilities?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal