Is American Bitcoin’s Share Unlock Volatility Altering The Investment Case For Hut 8 (HUT)?

- In recent days, Hut 8’s majority-owned subsidiary American Bitcoin Corp. experienced extreme volatility after previously locked-up shares became tradable and early investors started realizing profits, even as Bitcoin prices were strong.

- This turbulence has spilled over to Hut 8, raising fresh questions about how its American Bitcoin exposure affects investor confidence, corporate governance, and the resilience of its broader energy and digital infrastructure platform.

- We’ll now examine how the American Bitcoin share unlock and resulting volatility could reshape Hut 8’s investment narrative and risk profile.

These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Hut 8 Investment Narrative Recap

To own Hut 8, you have to believe its “power first” model can turn volatile Bitcoin-linked assets into more stable, contracted infrastructure income. The American Bitcoin share unlock has intensified near term sentiment risk but does not obviously change the core thesis that Hut 8’s value will hinge on how well it balances Bitcoin exposure with recurring AI and data center revenues, while managing execution risk on large, capital intensive projects like Riverbend and Vega.

Against this backdrop, Hut 8’s agreement to sell its 310 megawatt Ontario natural gas power portfolio to TransAlta is especially relevant, because it directly touches the company’s reliance on fossil fuel based assets, regulatory exposure, and its ability to recycle capital into higher conviction power and compute projects that support the key catalysts investors are watching most closely.

Yet this recent bout of American Bitcoin driven volatility also underlines a less obvious risk that investors should be aware of, namely how tightly Hut 8’s share price is still tied to...

Read the full narrative on Hut 8 (it's free!)

Hut 8's narrative projects $767.3 million revenue and $140.6 million earnings by 2028. This implies 76.9% yearly revenue growth but a $13.4 million earnings decrease from $154.0 million today.

Uncover how Hut 8's forecasts yield a $57.87 fair value, a 35% upside to its current price.

Exploring Other Perspectives

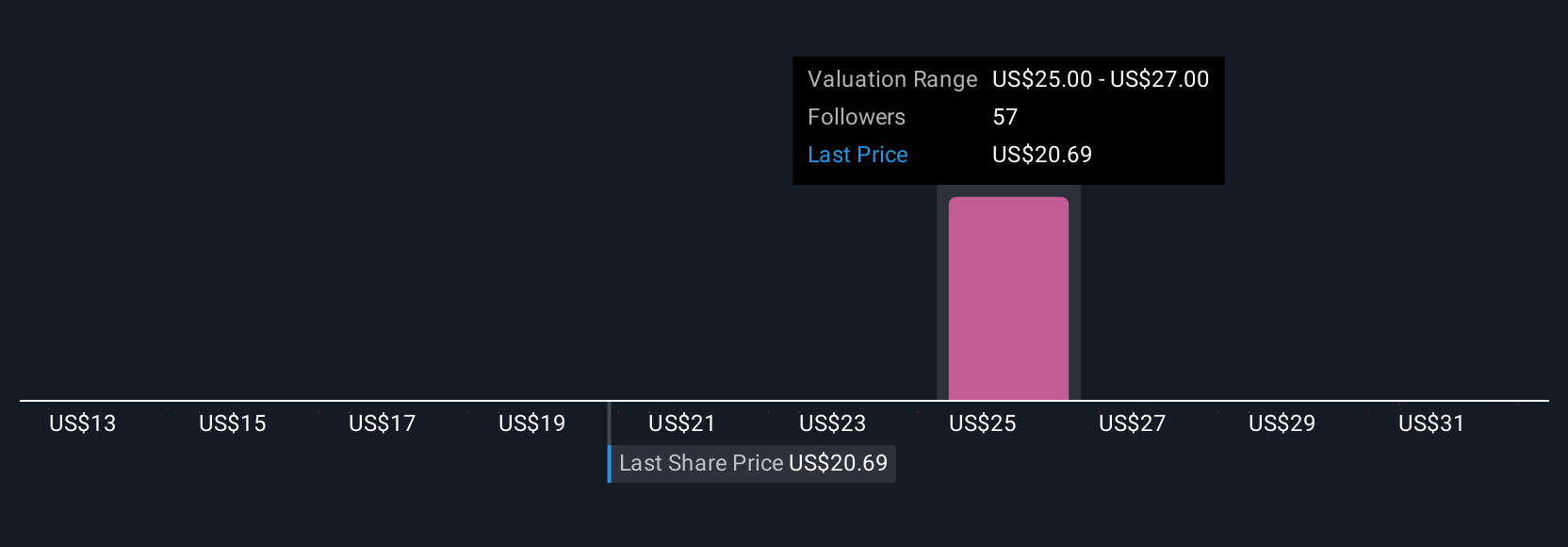

Six members of the Simply Wall St Community currently peg Hut 8’s fair value between US$13 and US$57.87, reflecting a wide spread of views on upside and downside. When you set those opinions against the company’s increasing tilt toward long term contracted energy and AI infrastructure, it becomes clear why taking in several different viewpoints can materially change how you think about Hut 8’s future resilience and risk profile.

Explore 6 other fair value estimates on Hut 8 - why the stock might be worth less than half the current price!

Build Your Own Hut 8 Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Hut 8 research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Hut 8 research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Hut 8's overall financial health at a glance.

Looking For Alternative Opportunities?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal