GMO Internet Group (TSE:9449) Valuation After New 4.14% Share Buyback Plan

GMO internet group (TSE:9449) just rolled out a fresh share buyback, planning to retire up to 4.14% of its outstanding stock, which can be read as a clear signal about how management views the current valuation.

See our latest analysis for GMO internet group.

The buyback lands on top of a strong run, with a year to date share price return of nearly 49% and a 46% one year total shareholder return. This suggests positive momentum that appears more than a short term pop despite some recent volatility.

If this kind of capital return story catches your eye, it is worth seeing what other tech names are doing by exploring high growth tech and AI stocks.

Yet with shares already up strongly this year and trading above the average analyst target, the key question now is whether GMO internet group is still undervalued or whether the market is fully pricing in its future growth.

Most Popular Narrative: 6.9% Overvalued

Compared to the narrative fair value of ¥3,670, GMO internet group's last close at ¥3,922 bakes in a premium that rests on ambitious growth and margin upgrades.

The transition to a holding company structure is expected to promote more autonomy and faster decision making among subsidiary companies, which can drive revenue growth through increased operational efficiency and agility. The launch and growth of the net security GMO project aims to address increasing global cybersecurity needs, creating a new revenue stream and potentially improving net margins due to high demand for security services.

Curious how steady double digit earnings growth, rising margins, and a lower future PE multiple can still support a premium price tag? The full narrative unpacks the bold revenue runway, profit expansion, and share count shrinkage that together anchor this fair value view, and shows exactly how those moving parts are discounted back to today.

Result: Fair Value of ¥3670 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, setbacks such as the Thai securities closure, along with softer FX and advertising demand, could undercut margin expansion and delay the expected earnings ramp.

Find out about the key risks to this GMO internet group narrative.

Another Angle on Valuation

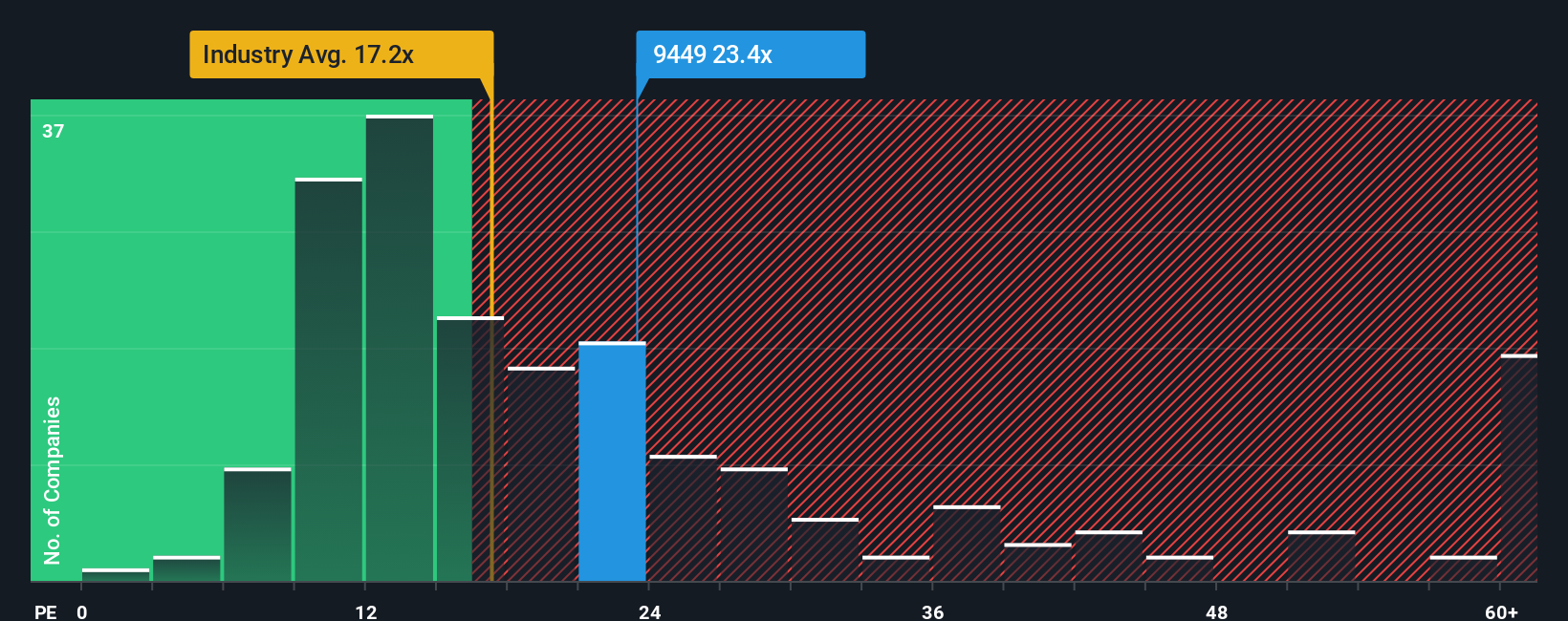

Analysts see GMO internet group as 6.9% overvalued versus their ¥3,670 fair value, but our ratio based view paints a more forgiving picture. The current PE of 23.7x sits below a 28.4x fair ratio, hinting at upside if sentiment catches up.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own GMO internet group Narrative

If this perspective does not quite fit your view, or you prefer digging into the numbers yourself, you can build a complete narrative in just a few minutes: Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding GMO internet group.

Looking for more investment ideas?

Before you move on, lock in a few high potential watchlist candidates by running targeted screens that surface quality, momentum, and income opportunities you might otherwise overlook.

- Capture fast moving small caps with improving fundamentals by scanning these 3571 penny stocks with strong financials that already show strength where it matters most.

- Position yourself for the next wave of innovation by targeting these 26 AI penny stocks at the intersection of powerful data, automation, and scalable digital platforms.

- Boost your portfolio’s cash flow potential by screening these 15 dividend stocks with yields > 3% that combine steady payouts with the capacity for long term growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal