3 Asian Dividend Stocks Yielding Up To 4.4%

As Asian markets navigate a landscape marked by resilient technology shares and shifting economic dynamics, investors are increasingly focusing on opportunities that offer steady income amid market fluctuations. In this context, dividend stocks become particularly appealing as they provide not only potential for capital appreciation but also a reliable income stream, making them an attractive option for those seeking stability in uncertain times.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Yamato Kogyo (TSE:5444) | 3.86% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 5.54% | ★★★★★★ |

| Torigoe (TSE:2009) | 3.99% | ★★★★★★ |

| NCD (TSE:4783) | 4.49% | ★★★★★★ |

| Kyoritsu Electric (TSE:6874) | 3.71% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.01% | ★★★★★★ |

| Changjiang Publishing & MediaLtd (SHSE:600757) | 4.45% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.83% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 3.78% | ★★★★★★ |

| Binggrae (KOSE:A005180) | 4.44% | ★★★★★★ |

Click here to see the full list of 1033 stocks from our Top Asian Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

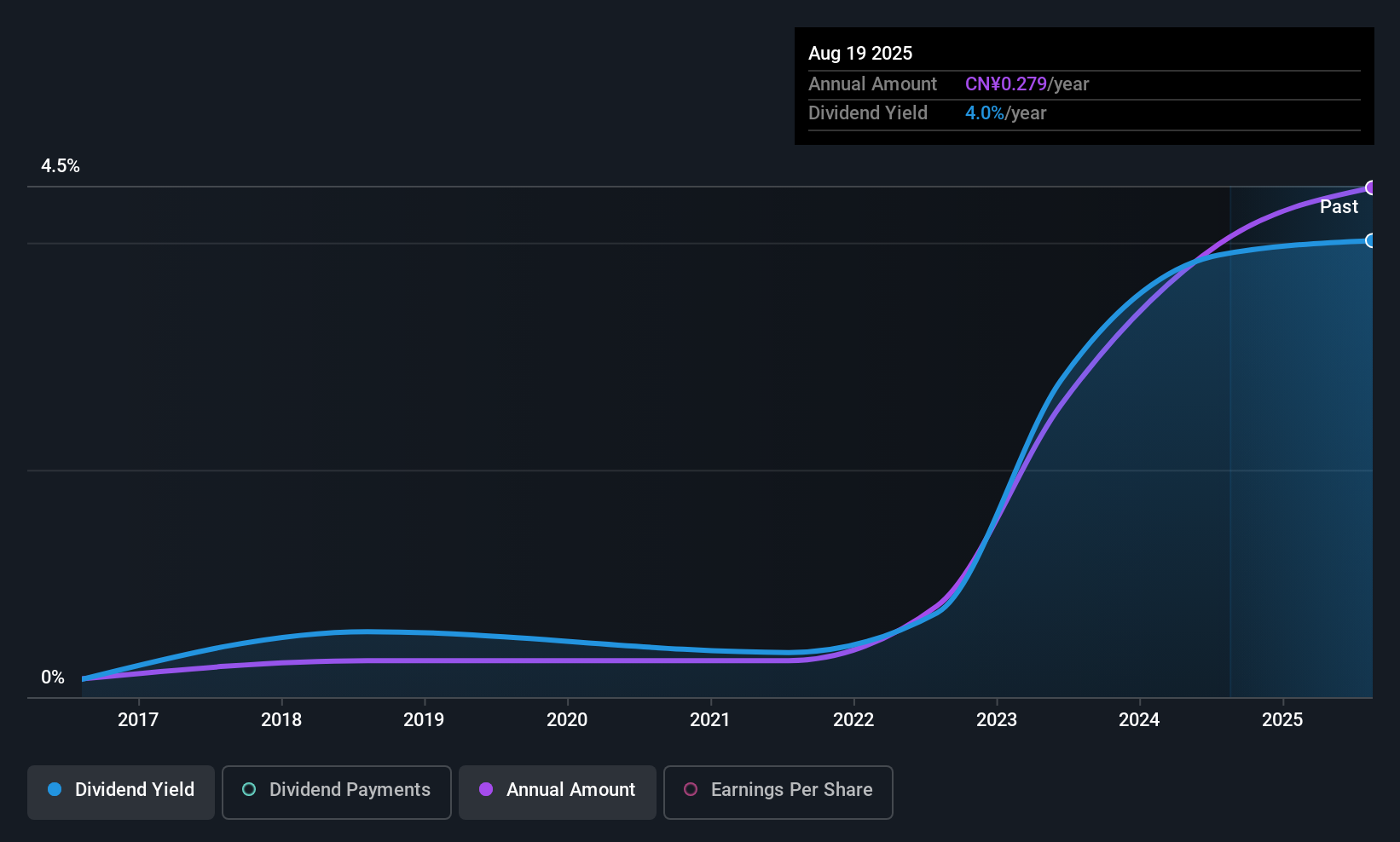

COSCO SHIPPING Specialized CarriersLtd (SHSE:600428)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: COSCO SHIPPING Specialized Carriers Co., Ltd. operates in the shipping industry, focusing on specialized transportation services, with a market cap of CN¥19.98 billion.

Operations: COSCO SHIPPING Specialized Carriers Co., Ltd. generates its revenue primarily from Ocean Transportation, amounting to CN¥21.35 billion.

Dividend Yield: 3.8%

COSCO SHIPPING Specialized Carriers Ltd. offers a compelling dividend profile with its dividends well-covered by both earnings (payout ratio: 41.2%) and cash flows (cash payout ratio: 19.3%). However, the dividend payments have been volatile over the past decade, indicating an unreliable track record despite growth in recent years. The stock trades at a significant discount to estimated fair value, enhancing its appeal for value-focused investors seeking high-yield opportunities within China's market.

- Dive into the specifics of COSCO SHIPPING Specialized CarriersLtd here with our thorough dividend report.

- Our valuation report unveils the possibility COSCO SHIPPING Specialized CarriersLtd's shares may be trading at a discount.

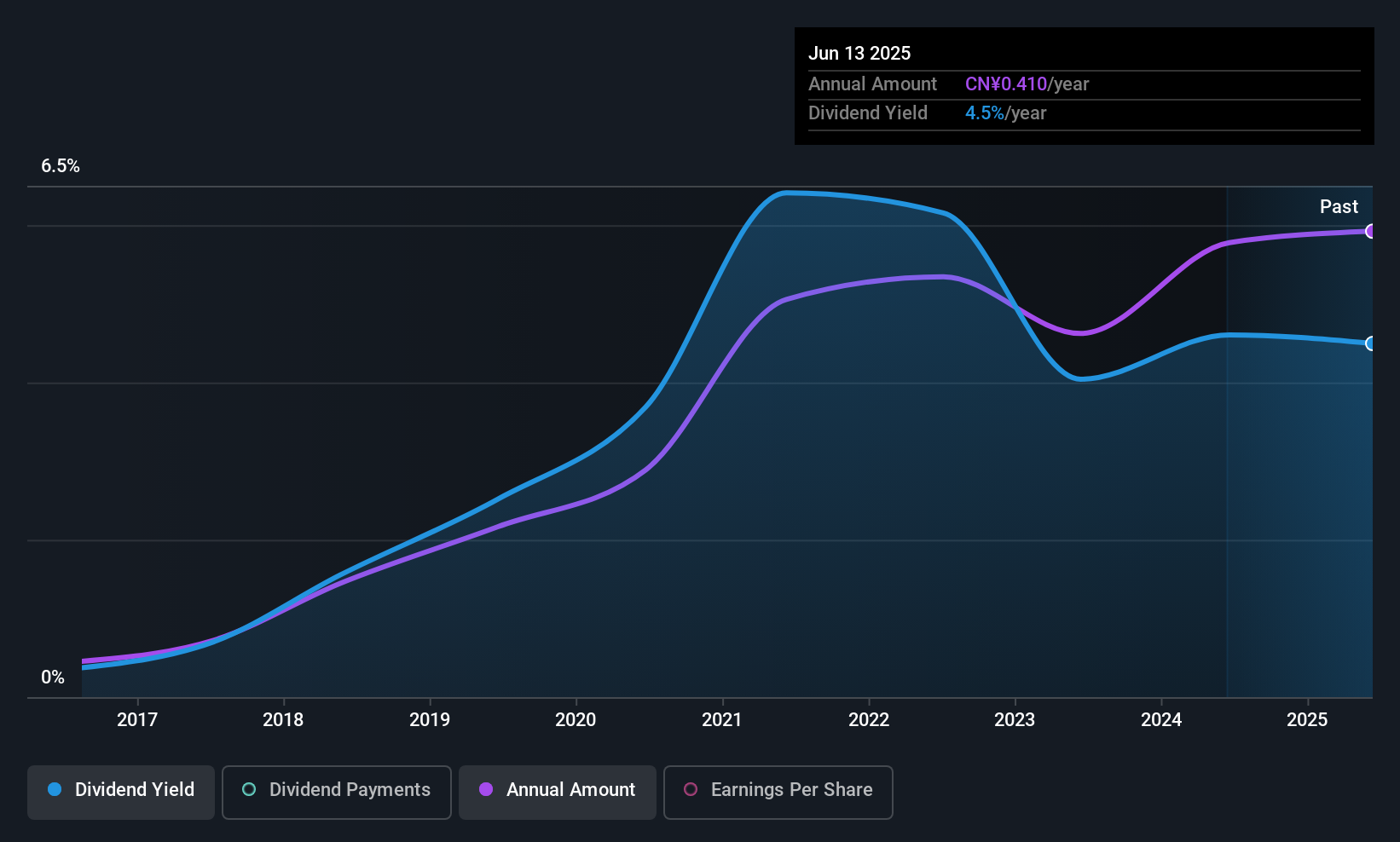

Changjiang Publishing & MediaLtd (SHSE:600757)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Changjiang Publishing & Media Co., Ltd operates as a publishing company in China with a market cap of CN¥11.19 billion.

Operations: Changjiang Publishing & Media Co., Ltd generates its revenue from various segments within the publishing industry in China.

Dividend Yield: 4.4%

Changjiang Publishing & Media Ltd. provides an attractive dividend profile with a high yield of 4.45%, placing it in the top 25% of CN market payers. Its dividends are well-covered by earnings (payout ratio: 44.6%) and cash flows (cash payout ratio: 56.2%), demonstrating sustainability and stability over the past decade without volatility. Despite a slight decline in sales, net income rose significantly to CNY 859.21 million, supporting its reliable dividend track record.

- Click here to discover the nuances of Changjiang Publishing & MediaLtd with our detailed analytical dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Changjiang Publishing & MediaLtd shares in the market.

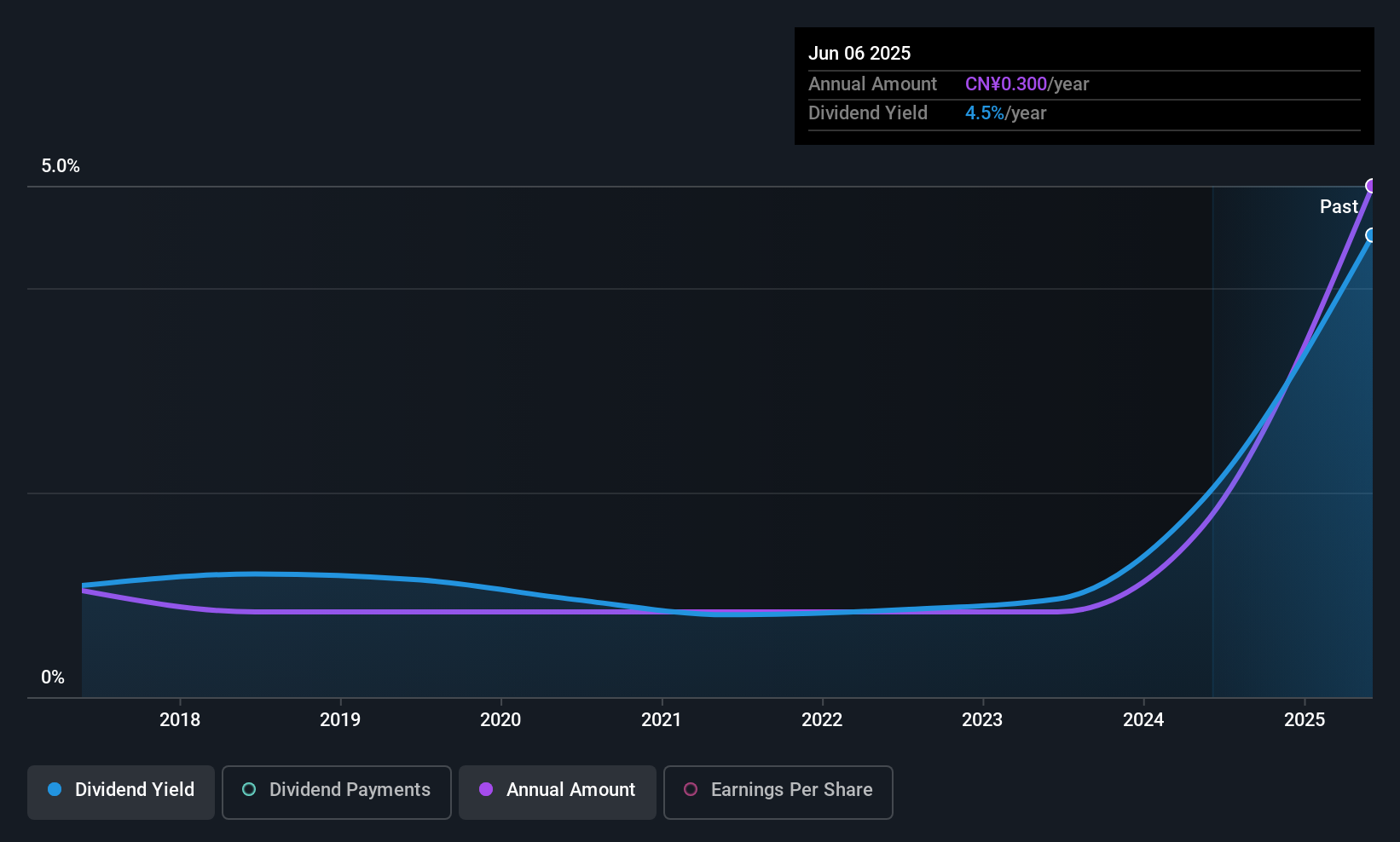

Jiangsu Rainbow Heavy Industries (SZSE:002483)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Jiangsu Rainbow Heavy Industries Co., Ltd. operates in the heavy machinery industry and has a market cap of CN¥6.11 billion.

Operations: Jiangsu Rainbow Heavy Industries Co., Ltd. generates revenue from various segments in the heavy machinery industry.

Dividend Yield: 4.4%

Jiangsu Rainbow Heavy Industries offers a competitive dividend yield of 4.35%, ranking in the top 25% of CN market payers. Despite a volatile dividend history, recent payouts are well-supported by earnings (payout ratio: 58.1%) and cash flows (cash payout ratio: 25.1%). The company reported decreased sales and net income for the first nine months of 2025, but its dividends have grown over the past decade, indicating potential for sustained future payments.

- Navigate through the intricacies of Jiangsu Rainbow Heavy Industries with our comprehensive dividend report here.

- Our valuation report here indicates Jiangsu Rainbow Heavy Industries may be undervalued.

Turning Ideas Into Actions

- Click this link to deep-dive into the 1033 companies within our Top Asian Dividend Stocks screener.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal