Is Everus Construction Group’s (ECG) Recent Share Price Momentum Backed by Its Valuation?

Everus Construction Group (ECG) has quietly built strong momentum, with the stock climbing about 9% over the past month and nearly 27% in the past 3 months, outpacing many industrial peers.

See our latest analysis for Everus Construction Group.

Those gains sit on top of a strong year to date, with a 36.4% year to date share price return and 38.5% one year total shareholder return. This suggests momentum is still building as investors reassess Everus Construction Group’s growth profile and risk.

If Everus’s recent run has you thinking more broadly about infrastructure and industrial names, it could be worth exploring fast growing stocks with high insider ownership for other under the radar growth ideas with committed insiders.

With earnings still growing steadily and the share price sitting roughly 12 percent below consensus targets, investors now face a key question: is Everus Construction Group still a buying opportunity, or is the market already pricing in its future growth?

Price-to-Earnings of 26.2x: Is it justified?

On a price-to-earnings basis, Everus Construction Group looks slightly cheap relative to peers, even after the recent share price surge to $94.48.

The price-to-earnings ratio compares what investors pay today with the company’s current earnings per share. It is often used as a practical yardstick for a profitable, steadily growing contractor like Everus.

With a P/E of 26.2 times, the market is paying less for each dollar of Everus’s earnings than for many comparable construction names. This suggests investors may still be underpricing its recent acceleration in profit growth and high return on equity.

The discount becomes clearer when set against the broader industry, where the US Construction sector trades around 33.3 times earnings. Even the peer group average is higher at 28.2 times. These are levels the market could plausibly revert toward as Everus continues to deliver high quality earnings.

Explore the SWS fair ratio for Everus Construction Group

Result: Price-to-Earnings of 26.2x (ABOUT RIGHT)

However, investors should still watch for slowing infrastructure spending and project delays, which could pressure Everus’s mid single digit revenue and profit growth trajectory.

Find out about the key risks to this Everus Construction Group narrative.

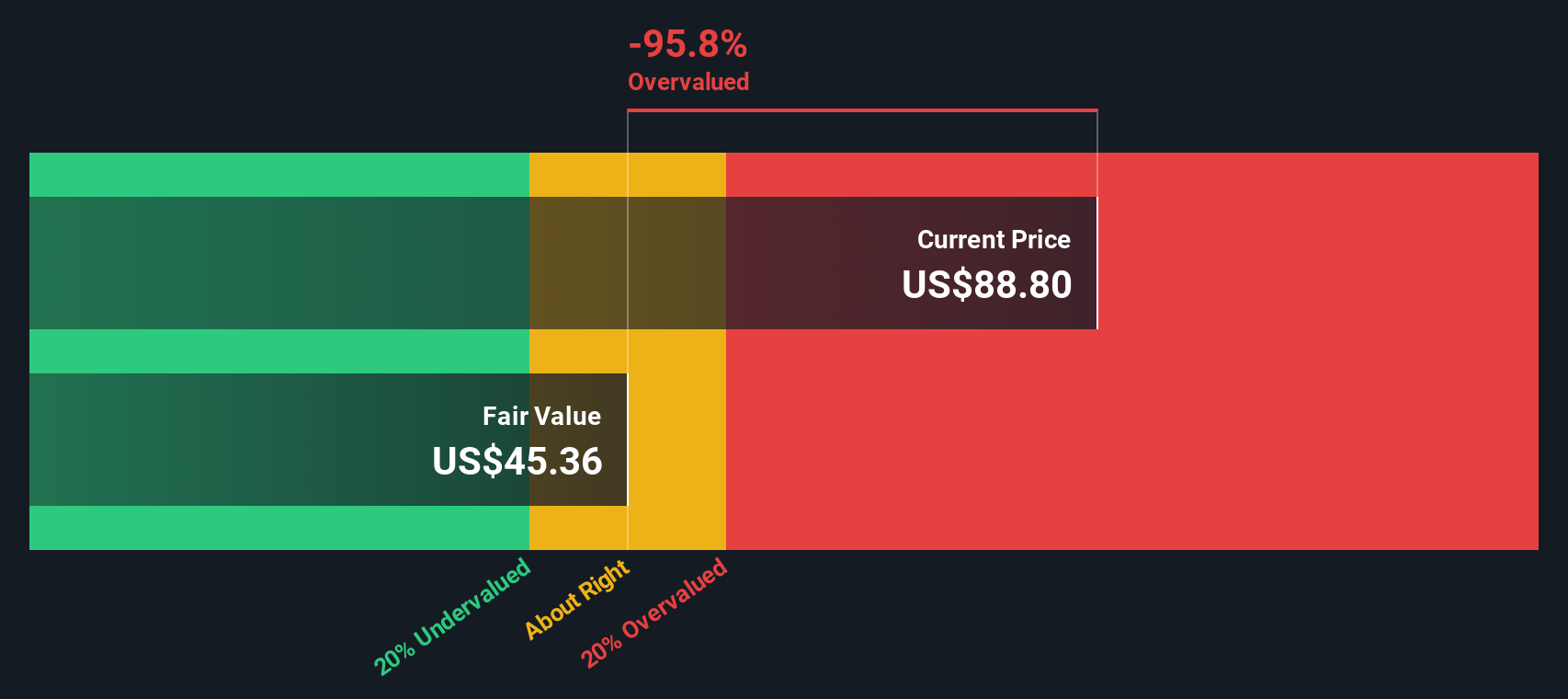

Another View: DCF Flags a Very Different Story

Our DCF model paints a sharper contrast, suggesting Everus Construction Group is trading well above its estimated fair value of $40.16, versus the current $94.48. In other words, cash flow assumptions point to overvaluation, not a mild discount. Is momentum running ahead of fundamentals?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Everus Construction Group for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 907 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Everus Construction Group Narrative

If you see the numbers differently, or want to dig into the details yourself, you can build a personalised view in just minutes with Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Everus Construction Group.

Ready for more high conviction ideas?

Do not stop with Everus. Use the Simply Wall St Screener now to uncover focused, data driven ideas that could upgrade your next investing decision.

- Capture mispriced opportunities by targeting these 907 undervalued stocks based on cash flows that strong cash flow analysis suggests the market is overlooking.

- Ride powerful innovation trends by zeroing in on these 26 AI penny stocks positioned at the heart of the artificial intelligence boom.

- Lock in reliable income potential by filtering for these 14 dividend stocks with yields > 3% that can strengthen and stabilise your portfolio returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal