Guidance Cut From Higher Exchange Costs Could Be A Game Changer For Centene (CNC)

- Earlier this quarter, Centene sharply cut its earnings guidance after experiencing higher-than-expected medical utilization in its federal exchange plans and ongoing pressure in its Medicaid business, with states slow to update reimbursement rates.

- A key concern now is that expected changes to federal exchange subsidy policy could leave Centene managing a smaller, sicker enrollee base, complicating its path to stabilizing profitability.

- We’ll now examine how this guidance cut, driven by heavier exchange utilization, reshapes Centene’s previously more optimistic investment narrative.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Centene Investment Narrative Recap

To own Centene, you generally need to believe that it can restore underwriting discipline in its exchange and Medicaid books while managing policy risk around subsidies and rates. The latest guidance cut directly pressures the main short term catalyst, a clear earnings recovery, and reinforces the biggest near term risk: utilization and reimbursement moving in the wrong direction at the same time.

The company’s updated full year 2025 outlook, now calling for a GAAP diluted loss per share not exceeding US$12.85, brings that profit recovery question into sharper focus. It ties the heavier exchange utilization and Medicaid rate issues to a concrete financial reset and gives investors a reference point to judge whether future utilization trends and rate negotiations are actually improving or merely stabilizing at a weaker level.

Yet behind the headline loss guidance, one risk investors should be aware of is how potential subsidy changes could reshape Centene’s exchange membership and...

Read the full narrative on Centene (it's free!)

Centene's narrative projects $195.6 billion revenue and $2.1 billion earnings by 2028. This requires 7.0% yearly revenue growth with earnings remaining flat from $2.1 billion today.

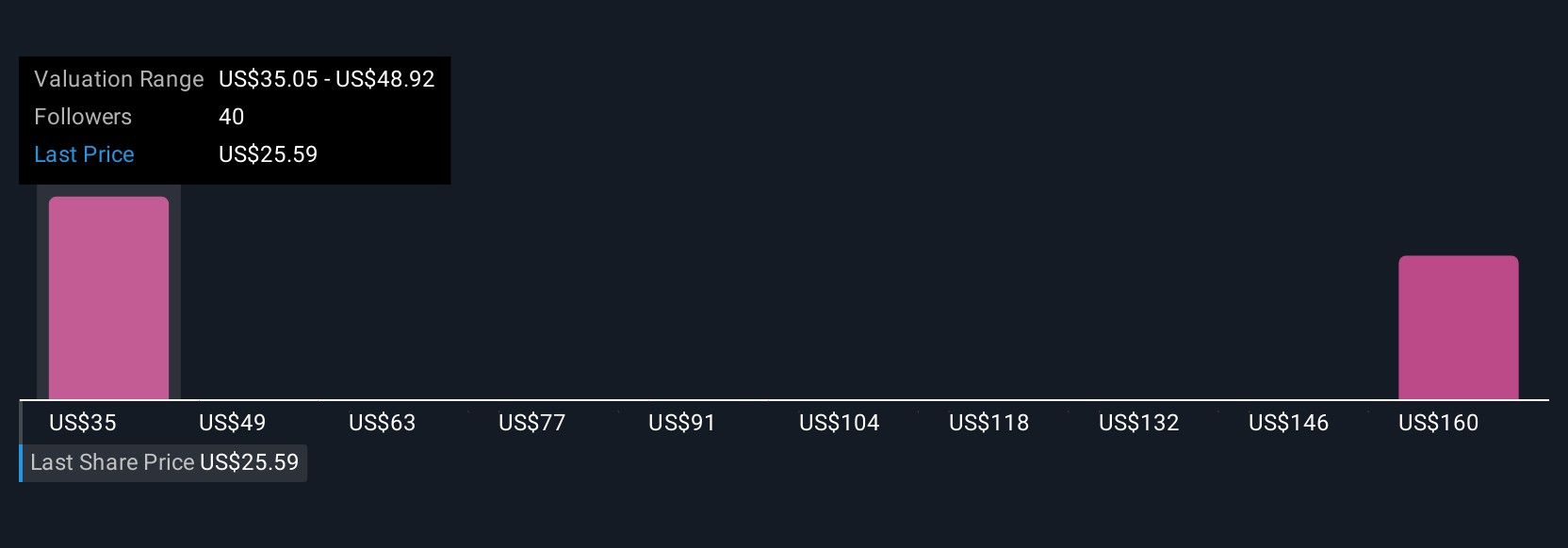

Uncover how Centene's forecasts yield a $39.41 fair value, in line with its current price.

Exploring Other Perspectives

Sixteen fair value estimates from the Simply Wall St Community span roughly US$31.58 to US$191.51, showing just how far apart views on Centene sit. When you set that spread against the recent cut to earnings guidance driven by higher exchange utilization and Medicaid rate uncertainty, it underlines why many market participants are rethinking what a sustainable profit profile here might look like and why it can pay to review several viewpoints before forming your own.

Explore 16 other fair value estimates on Centene - why the stock might be worth 19% less than the current price!

Build Your Own Centene Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Centene research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Centene research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Centene's overall financial health at a glance.

Ready For A Different Approach?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal