Fastenal (FAST): Valuation Check After Strong November Net Sales and Daily Sales Growth

Fastenal (FAST) just reported a 6% rise in November net sales, with daily sales jumping roughly 12%. That kind of steady volume growth is exactly what gets investors digging into the stock’s setup.

See our latest analysis for Fastenal.

The solid November sales update lands at a time when Fastenal’s share price, now around $41.22, has recently cooled off after a strong year to date. The 90 day share price return is notably weaker than its double digit year to date share price gain and much more muted than its impressive multi year total shareholder returns, suggesting long term momentum is intact even as near term sentiment recalibrates.

If Fastenal’s steady growth has you thinking more broadly about industrial names, it could be a good moment to scan fast growing stocks with high insider ownership for other under the radar compounders.

With revenue and earnings still growing close to double digits and the share price cooling off after multi year gains, is Fastenal quietly slipping into undervalued territory, or is the market already factoring in years of future growth?

Most Popular Narrative Narrative: 5.2% Undervalued

With Fastenal closing at $41.22 against a narrative fair value of about $43.46, the storyline leans modestly positive while hinging on execution.

The analysts have a consensus price target of $44.35 for Fastenal based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $53.0, and the most bearish reporting a price target of just $29.5.

Want to see what keeps that growth engine running in a sluggish market, and why a premium earnings multiple still features in this framework? The narrative breaks down a carefully staged revenue ramp, a slow build in margins, and a future valuation anchor that looks more like a high quality compounder than a typical distributor.

Result: Fair Value of $43.46 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that upside leans heavily on Fastenal navigating tariff driven cost pressures and defending margins in a sluggish demand backdrop.

Find out about the key risks to this Fastenal narrative.

Another Lens on Valuation

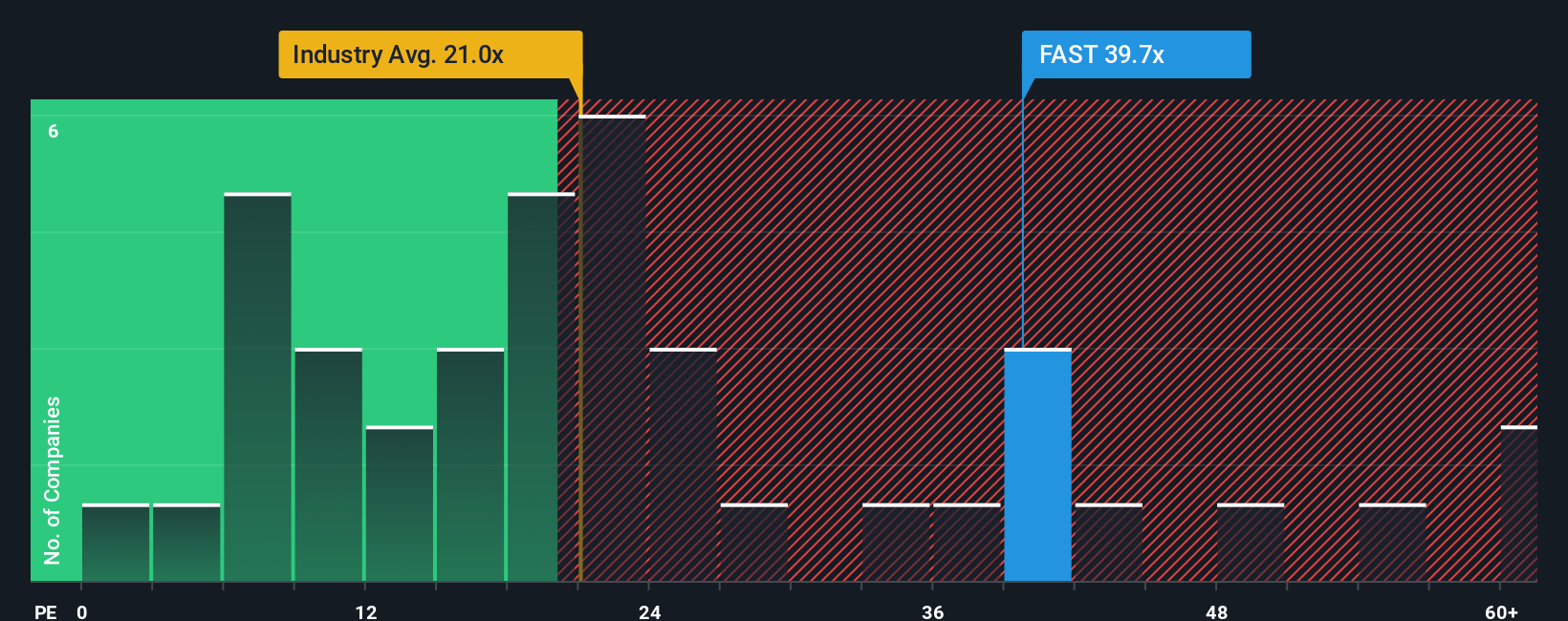

Step away from narratives and Fastenal suddenly looks pricey. Its P/E of 38.6 times towers over the US Trade Distributors average of 19.4 times and even the 26.7 times fair ratio that our work suggests the market could drift toward, raising the risk of multiple compression if growth stumbles.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Fastenal Narrative

If this framework does not quite match your own view, you can dive into the numbers yourself and build a custom thesis in minutes, Do it your way.

A great starting point for your Fastenal research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Fastenal might be compelling, but you will sharpen your edge by scanning a broader field of opportunities tailored to different strategies and risk appetites.

- Lock in potential income streams by reviewing these 14 dividend stocks with yields > 3% that may help anchor your portfolio with reliable cash returns.

- Ride the next wave of technological disruption by targeting these 25 AI penny stocks positioned at the forefront of intelligent automation and data driven innovation.

- Position yourself early in emerging innovation cycles by assessing these 27 quantum computing stocks that could reshape computing, security, and complex problem solving.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal