How Earnings Beats and New AI Tools Could Reframe Samsara (IOT) Investors’ Long-Term Narrative

- In recent quarters, Samsara has continued to beat earnings and revenue expectations while rolling out new AI tools to broaden its connected operations offerings.

- This combination of consistent financial outperformance and deeper AI integration is sharpening Samsara’s position within the fast-evolving IoT logistics market.

- Next, we’ll explore how Samsara’s ongoing AI-driven product expansion could reshape its investment narrative and longer-term growth expectations.

Find companies with promising cash flow potential yet trading below their fair value.

Samsara Investment Narrative Recap

To own Samsara, you need to believe its connected operations cloud can keep turning IoT data and AI into stickier, higher value customer relationships. The latest earnings beat and raised revenue targets support the near term catalyst of continued ARR growth, but do not remove the key risk that long enterprise sales cycles and early stage AI monetization still leave future revenue contribution uncertain.

Among recent announcements, the expanded AI powered Route Planning, Commercial Navigation and Fault Code Intelligence suite is most relevant here, as it ties Samsara’s large data asset directly to new, potentially higher margin software use cases that could deepen adoption if customers see clear efficiency and safety benefits.

Yet, despite this progress, investors still need to be aware of how early stage AI products and long, complex sales cycles could...

Read the full narrative on Samsara (it's free!)

Samsara's narrative projects $2.4 billion revenue and $311.3 million earnings by 2028. This requires 21.2% yearly revenue growth and a $432 million earnings increase from -$120.7 million today.

Uncover how Samsara's forecasts yield a $48.20 fair value, a 24% upside to its current price.

Exploring Other Perspectives

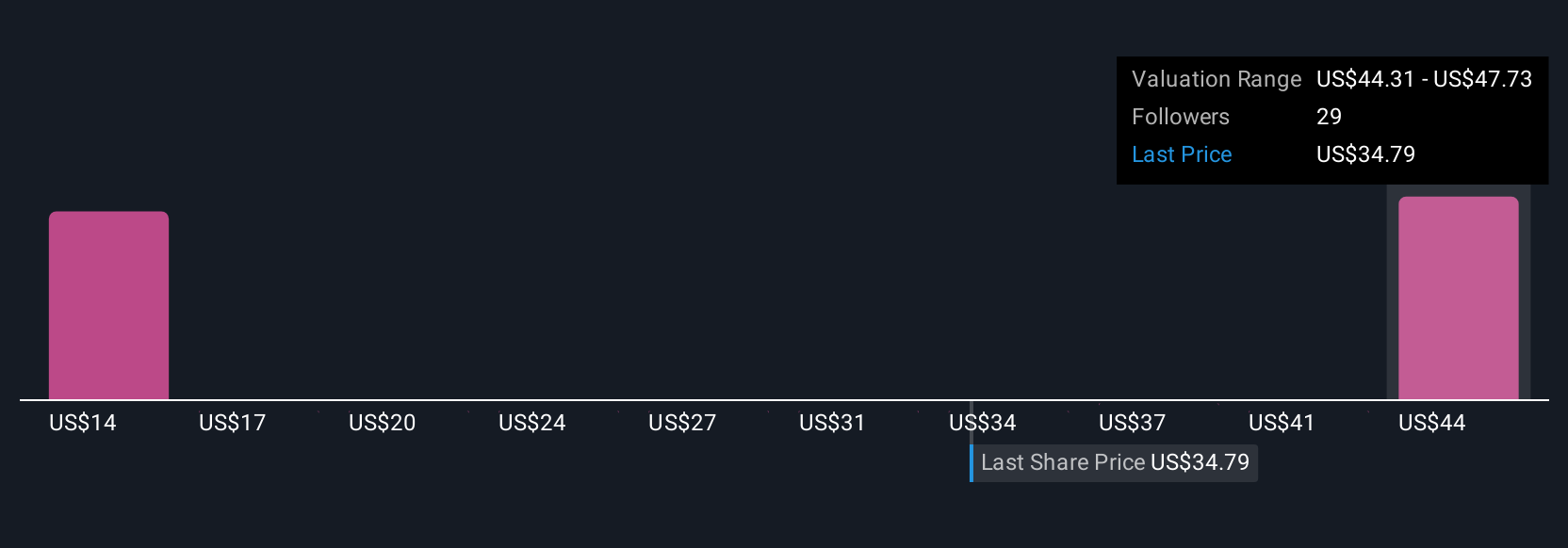

Ten fair value estimates from the Simply Wall St Community span roughly US$13.51 to US$59.16, showing how far apart individual views can be. Against that backdrop, Samsara’s reliance on long enterprise sales cycles and still unproven AI monetization means you may want to compare several of these perspectives before forming your own view on the business.

Explore 10 other fair value estimates on Samsara - why the stock might be worth as much as 52% more than the current price!

Build Your Own Samsara Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Samsara research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Samsara research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Samsara's overall financial health at a glance.

Looking For Alternative Opportunities?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal