Brunswick (BC): Assessing Valuation After Recent Share Price Rebound

Brunswick (BC) has quietly put together a solid stretch of returns, with the stock up around 2 % in the past week and roughly 7 % over the past 3 months.

See our latest analysis for Brunswick.

Zooming out, that steady 3 month share price return of about 7 % comes after a tougher 1 year stretch where total shareholder return is still down double digits. Recent gains therefore look more like early rebuilding of momentum than a full turnaround.

Given that backdrop, it can be useful to see what else is catching a bid in consumer and leisure names and compare Brunswick with fast growing stocks with high insider ownership.

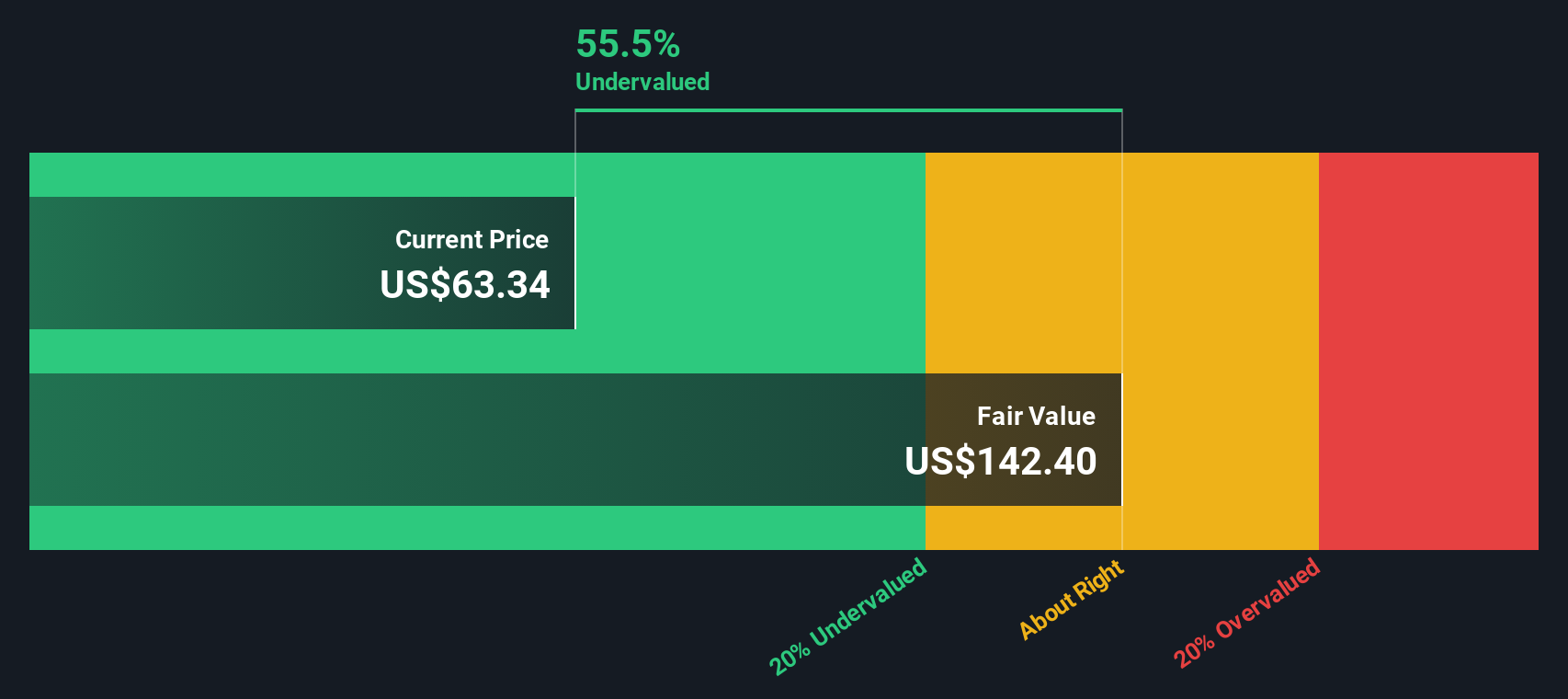

With shares still below last year’s levels but trading near analysts’ targets and our intrinsic value estimates, is Brunswick quietly undervalued after a tough patch, or are markets already pricing in a rebound in marine demand?

Most Popular Narrative: 8.3% Undervalued

With Brunswick last closing at $68.33 against a narrative fair value of $74.53, the implied upside depends heavily on how its future earnings story unfolds.

Brunswick's ongoing expansion of high-margin, recurring revenue streams such as digital boating services and the Freedom Boat Club strengthens margin stability and earnings quality, reinforced by the successful launch of new franchise locations (e.g., Dubai) and the continued global leadership of the club model.

Want to see what powers that upside call? The narrative leans on ambitious margin gains, accelerating earnings and a surprisingly modest future valuation multiple. Curious which assumptions matter most?

Result: Fair Value of $74.53 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that upside depends on value segment demand stabilizing, and tariffs or broader macro pressures not undermining Brunswick’s margin and earnings recovery.

Find out about the key risks to this Brunswick narrative.

Another Angle on Value

While the narrative fair value sees Brunswick as only modestly undervalued, our SWS DCF model is far more optimistic, putting fair value closer to $112.23, roughly 39 % above today’s price. If that gap narrows, will it be via higher earnings or a re-rated multiple?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Brunswick Narrative

If you see things differently or would rather dig into the numbers yourself, you can build a personalized view of Brunswick in just minutes using Do it your way.

A great starting point for your Brunswick research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, consider strengthening your watchlist by using our screeners to uncover fresh opportunities that many investors may still be overlooking.

- Explore potential market mispricing with these 933 undervalued stocks based on cash flows where strong cash flows suggest the market has not fully appreciated the underlying value.

- Target structural themes in healthcare by focusing on breakthroughs powered by these 30 healthcare AI stocks that are reshaping diagnostics, treatments, and patient outcomes.

- Refine your income strategy by reviewing these 14 dividend stocks with yields > 3% that may support long term compounding through consistent payouts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal