How Investors May Respond To OGE Energy (OGE) Raising $172.5 Million Through New Share Issuance

- In November 2025, OGE Energy Corp. completed a follow-on equity offering, issuing 4,011,628 new common shares and raising approximately US$172.5 million at a price of US$43 per share.

- The increased share count and capital raise present new considerations for investors, as these types of financings can influence future earnings per share calculations and overall company valuation.

- We'll examine how the recent equity offering and influx of fresh capital may influence OGE Energy's investment outlook and narrative.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

OGE Energy Investment Narrative Recap

To be a shareholder in OGE Energy, you need to have confidence in the long-term demand for regulated electricity in its key Oklahoma and Arkansas markets, as well as the company’s ability to earn steady returns from infrastructure investment. The November 2025 equity raise and larger share count do not appear to significantly shift the near-term catalyst of stable customer growth, nor do they remove the current key risk of region-specific economic softness weighing on future revenues, any impact to near-term valuation or earnings per share seems limited so far.

Among recent announcements, the company’s guidance projecting 2025 earnings in the upper half of its US$2.21 to US$2.33 per share range stands out as especially relevant. While the equity offering brings in additional capital, maintaining earnings growth and preserving per-share value remain priorities, particularly as the company continues to expand its grid and serve growing commercial and residential demand.

However, in contrast, investors should be aware that ongoing weakness in industrial and oilfield demand remains a risk that could...

Read the full narrative on OGE Energy (it's free!)

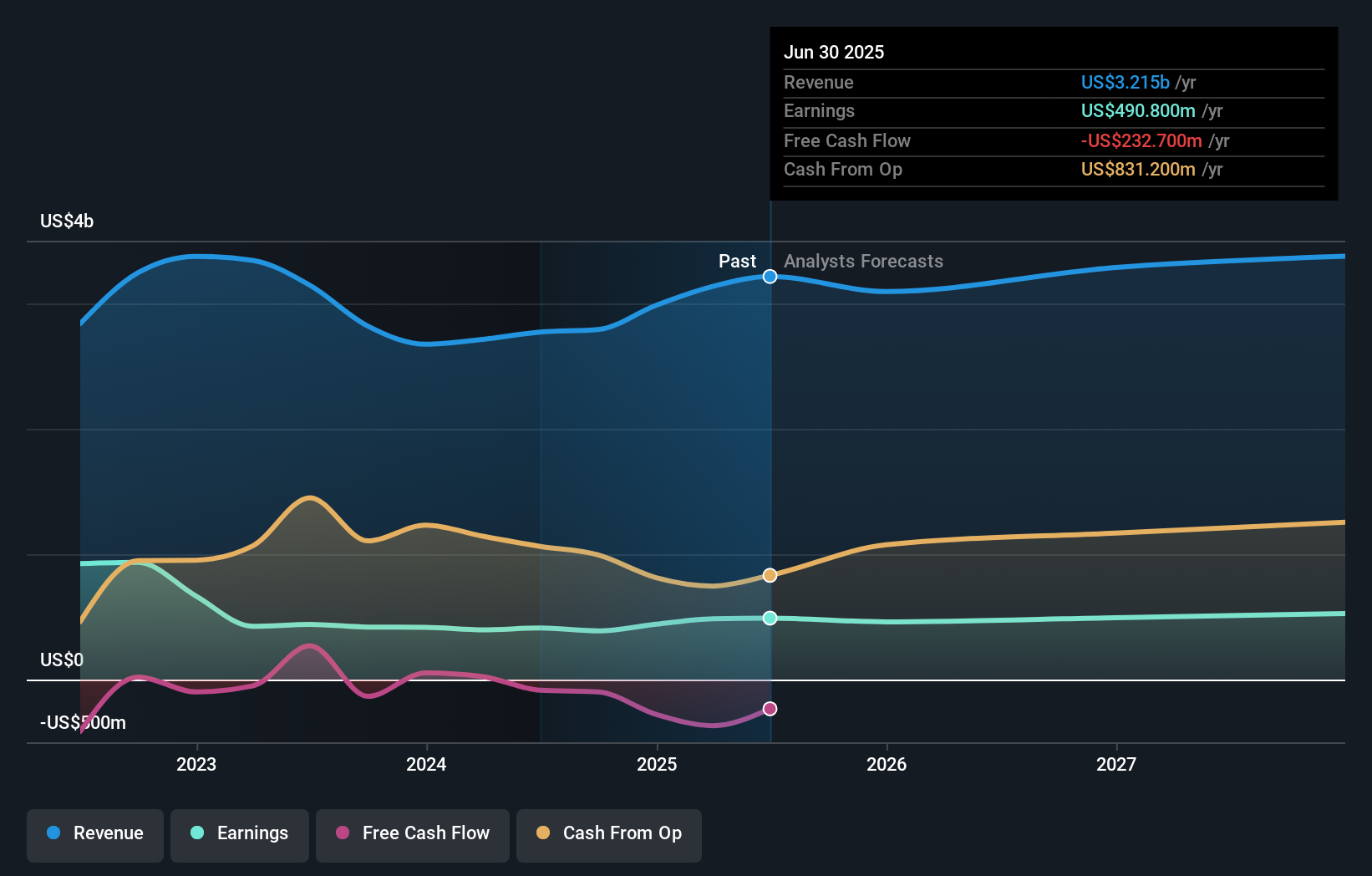

OGE Energy's narrative projects $3.5 billion in revenue and $545.7 million in earnings by 2028. This requires a 2.7% yearly revenue growth and a $54.9 million earnings increase from current earnings of $490.8 million.

Uncover how OGE Energy's forecasts yield a $47.15 fair value, a 5% upside to its current price.

Exploring Other Perspectives

The Simply Wall St Community provided a single fair value estimate of US$47.15 for OGE Energy. As you review this consensus, keep in mind that sector-specific headwinds, like persistent industrial load softness, could materially affect future results and these viewpoints are just the start of a much broader conversation.

Explore another fair value estimate on OGE Energy - why the stock might be worth just $47.15!

Build Your Own OGE Energy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your OGE Energy research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free OGE Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate OGE Energy's overall financial health at a glance.

Contemplating Other Strategies?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal