Is There an Opportunity in U.S. Bancorp After Latest Regulatory Headlines?

- Ever wondered if U.S. Bancorp is trading at a bargain or if its price has already moved ahead of its true value? You are not alone. Investors everywhere are looking for clarity in today’s market.

- After a steady climb, shares are up 1.0% over the past week and have gained 5.8% in the last month, but the stock remains nearly flat over the year, dipping just -0.9%.

- Recent headlines have put traditional banks like U.S. Bancorp in the spotlight, as the industry grapples with evolving regulatory expectations and shifts in consumer banking habits. These developments have added a layer of interest and potential volatility to U.S. Bancorp’s story.

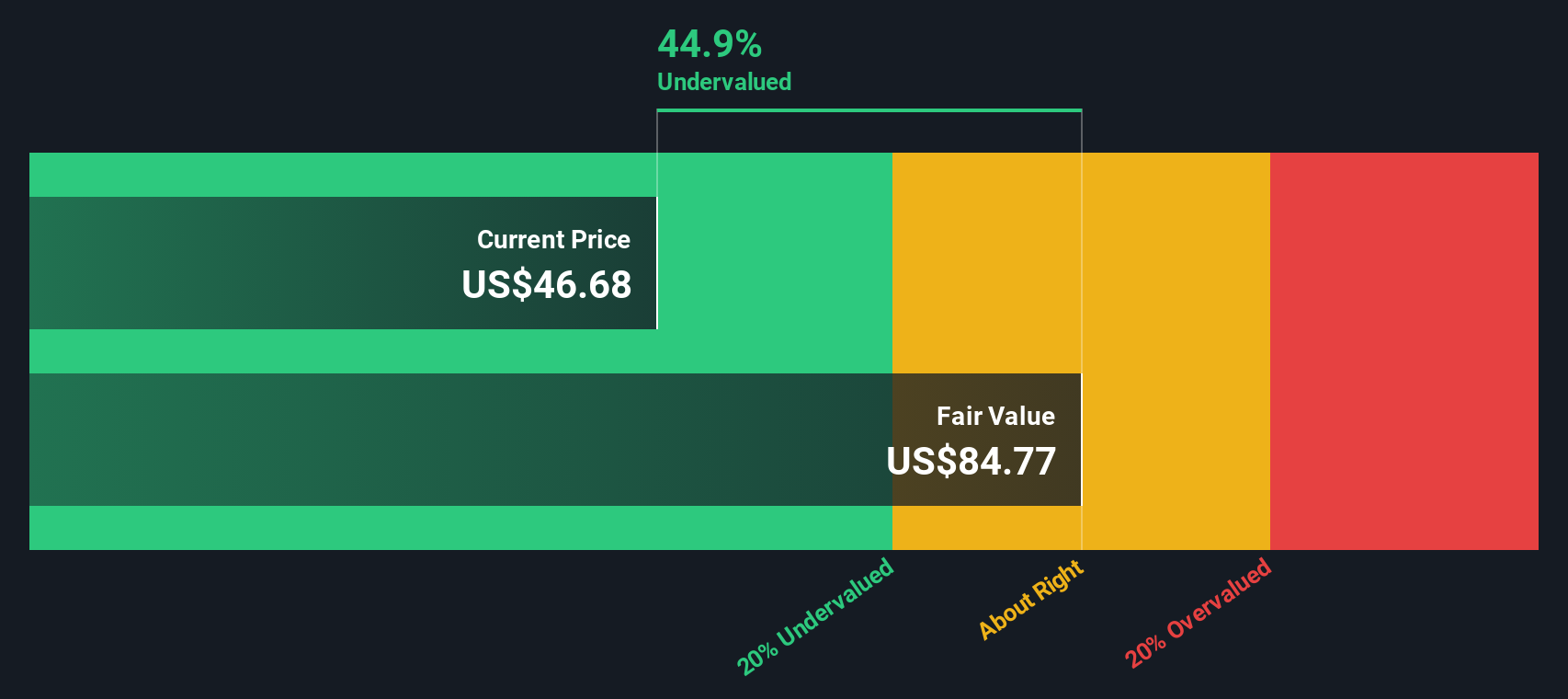

- When it comes to value, U.S. Bancorp earns a 5 out of 6 on our valuation score, meaning it appears undervalued by most measures we track. We will break down what this means using several common approaches, and at the end, reveal a fresh perspective on how to truly judge its value.

Find out why U.S. Bancorp's -0.9% return over the last year is lagging behind its peers.

Approach 1: U.S. Bancorp Excess Returns Analysis

The Excess Returns valuation model measures how effectively a company generates profits above the cost of its equity capital. This approach is especially useful for banks as it focuses on return on invested capital and long-term growth in shareholder value, rather than short-term earnings swings.

For U.S. Bancorp, the model uses several key figures to gauge value. The current Book Value stands at $36.32 per share, while projected Stable EPS is $5.18 per share, according to weighted future Return on Equity estimates from 15 analysts. The Cost of Equity is $3.13 per share, and the resulting Excess Return generated is $2.04 per share. Over the long run, analysts estimate a Stable Book Value of $40.17 per share, based on input from 13 analysts, and U.S. Bancorp’s average Return on Equity is an impressive 12.89%.

The intrinsic value derived from this model is $85.20 per share. Compared to the current market price, this suggests the stock is 42.0% undervalued. The implication is that the market may be underestimating U.S. Bancorp’s ability to consistently generate returns above its cost of capital over time.

Result: UNDERVALUED

Our Excess Returns analysis suggests U.S. Bancorp is undervalued by 42.0%. Track this in your watchlist or portfolio, or discover 928 more undervalued stocks based on cash flows.

Approach 2: U.S. Bancorp Price vs Earnings

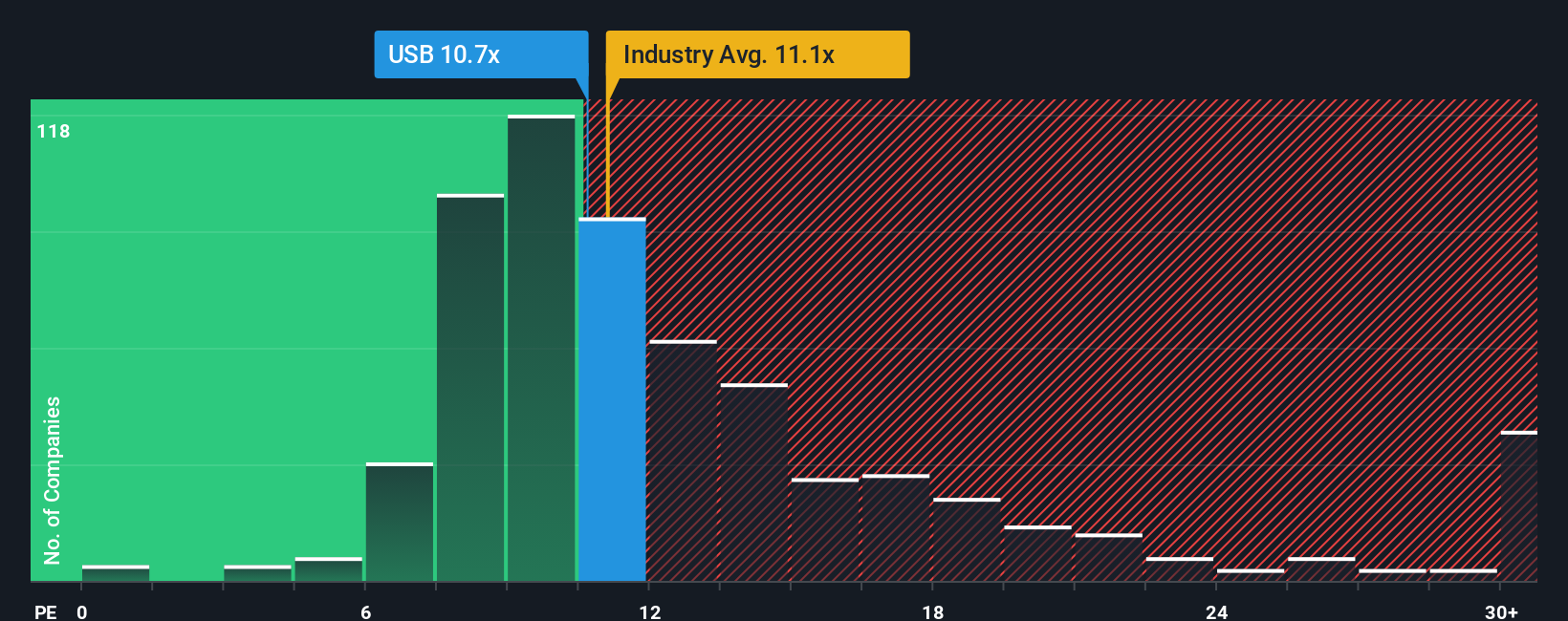

The price-to-earnings (PE) ratio is a widely used metric for valuing profitable companies because it provides a straightforward way to measure how much investors are willing to pay for each dollar of current earnings. Since U.S. Bancorp is consistently profitable, the PE ratio offers helpful perspective on its market valuation.

It is important to remember that a “normal” or “fair” PE ratio will vary based on a company’s expected growth rate, risk profile, and economic conditions. Higher growth potential and lower risk usually justify a higher PE ratio, while slower-growing or riskier businesses should trade at a discount.

U.S. Bancorp’s current PE ratio is 11.3x. For context, that sits just below the banking industry average of 11.5x and is meaningfully below the peer average of 18.1x. However, there are more precise methods than broad peer or industry comparisons. Simply Wall St’s Fair Ratio for U.S. Bancorp is 14.2x, reflecting an analysis that incorporates the company’s profit margin, future earnings growth, market cap, and sector risks, rather than just broad comparisons.

The Fair Ratio provides a more personalized benchmark because it is tailored to U.S. Bancorp’s specific situation, offering a clearer picture than simply looking at what similar banks are trading for. In this case, U.S. Bancorp’s PE is noticeably below its Fair Ratio, indicating that the shares may be undervalued based on their current earnings power and risk profile.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1441 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your U.S. Bancorp Narrative

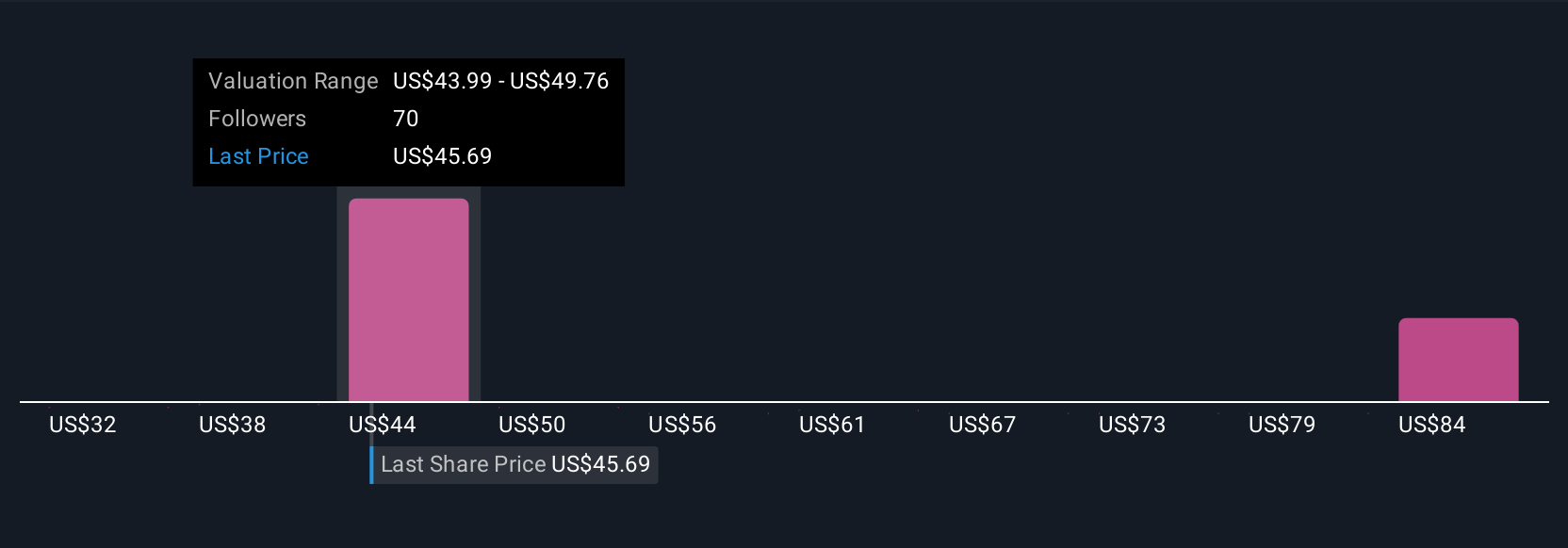

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. In simple terms, a Narrative is your personal story or perspective about a company, where you connect what you believe about its future—such as revenue growth, earnings, and profit margins—to a financial forecast and ultimately a fair value estimate.

Narratives allow investors to translate a company's business story into numbers, making it easy to see how optimistic or cautious assumptions play out in real time. This approach is now accessible on Simply Wall St’s Community page, where millions of investors can build, share, and compare these stories for any stock, including U.S. Bancorp.

With Narratives, you can quickly see if your view of the company implies it's undervalued or overpriced, based on the gap between your calculated Fair Value and the current market Price. Plus, whenever new news or earnings information becomes available, Narratives update automatically, ensuring your analysis stays relevant.

For U.S. Bancorp, for instance, one investor might expect big gains from ongoing digital transformation and set a high fair value, while another may highlight regional risks or slower margin growth and estimate a much lower value. Narratives help you visualize these possibilities, making investment decisions more personal and informed than ever.

Do you think there's more to the story for U.S. Bancorp? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal