Will Zeta Global Holdings (ZETA) Lean on AI Innovation to Sustain Its Long-Term Growth Narrative?

- Earlier this month, Zeta Global Holdings Corp. reported strong third-quarter results attributed to its advanced artificial intelligence and data capabilities, launching its Athena conversational AI agent and raising revenue guidance for the fourth quarter and full year.

- Meanwhile, Whetstone Capital Advisors fully exited its position in Zeta Global, but the move has been characterized as portfolio rebalancing rather than a reflection of concerns over the company’s fundamentals or future outlook.

- We'll explore how Zeta Global's raised revenue guidance and the Athena AI launch may influence its investment narrative and growth potential.

We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Zeta Global Holdings Investment Narrative Recap

To be a shareholder in Zeta Global Holdings, you need to believe in the company's ability to outpace competitors by leveraging proprietary AI and first-party data to drive digital marketing results, especially as privacy regulations evolve and generative AI becomes more common. The recent earnings beat and raised revenue guidance serve as a short-term catalyst, underlining momentum, while the ongoing net losses remain the most significant risk. The Whetstone Capital Advisors exit doesn't materially impact the fundamental narrative or short-term outlook for these factors.

Among the recent news, the launch of Zeta's Athena conversational AI stands out as most relevant. Athena is designed to improve marketing workflow efficiency and ROI for clients, directly supporting the investment thesis around Zeta's product innovation as a driver of growth. Whether these advancements are enough to maintain differentiation in a crowded and rapidly evolving software market is a critical point for investors.

On the other hand, any investor should be aware that persistent unprofitability could mean...

Read the full narrative on Zeta Global Holdings (it's free!)

Zeta Global Holdings is projected to reach $1.9 billion in revenue and $106.5 million in earnings by 2028. This outlook is based on analysts expecting 18.3% annual revenue growth and an increase in earnings of $143.1 million from the current loss of $-36.6 million.

Uncover how Zeta Global Holdings' forecasts yield a $29.36 fair value, a 70% upside to its current price.

Exploring Other Perspectives

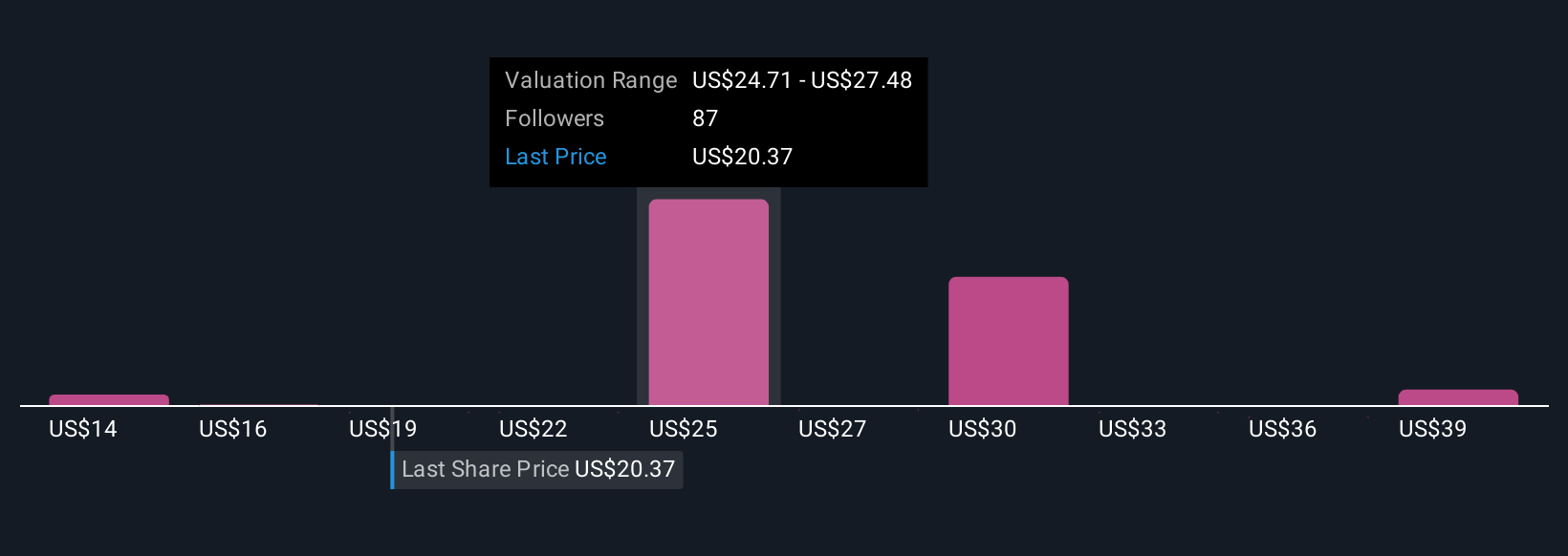

Twenty-nine individual fair value estimates from the Simply Wall St Community range from US$14.28 to US$41.34 per share. While many see upside, ongoing net losses present a real test for Zeta’s long-term performance, so explore several viewpoints before deciding.

Explore 29 other fair value estimates on Zeta Global Holdings - why the stock might be worth over 2x more than the current price!

Build Your Own Zeta Global Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Zeta Global Holdings research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Zeta Global Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Zeta Global Holdings' overall financial health at a glance.

Searching For A Fresh Perspective?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Find companies with promising cash flow potential yet trading below their fair value.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal