Earnings Tell The Story For Kunshan Dongwei Technology Co.,Ltd. (SHSE:688700) As Its Stock Soars 39%

Those holding Kunshan Dongwei Technology Co.,Ltd. (SHSE:688700) shares would be relieved that the share price has rebounded 39% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 35% in the last twelve months.

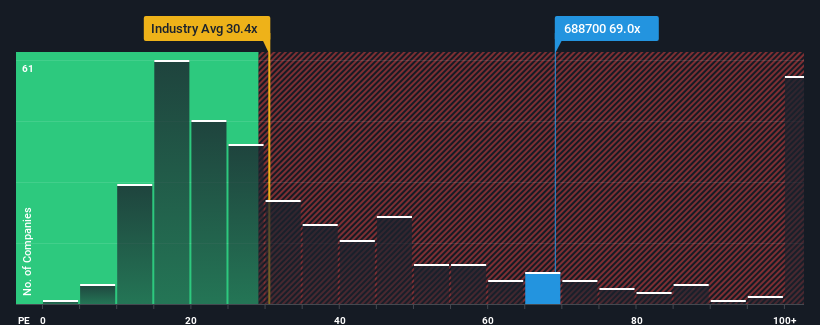

Since its price has surged higher, Kunshan Dongwei TechnologyLtd may be sending very bearish signals at the moment with a price-to-earnings (or "P/E") ratio of 69x, since almost half of all companies in China have P/E ratios under 31x and even P/E's lower than 18x are not unusual. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

Kunshan Dongwei TechnologyLtd has been struggling lately as its earnings have declined faster than most other companies. It might be that many expect the dismal earnings performance to recover substantially, which has kept the P/E from collapsing. If not, then existing shareholders may be very nervous about the viability of the share price.

Check out our latest analysis for Kunshan Dongwei TechnologyLtd

What Are Growth Metrics Telling Us About The High P/E?

Kunshan Dongwei TechnologyLtd's P/E ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the market.

Retrospectively, the last year delivered a frustrating 65% decrease to the company's bottom line. As a result, earnings from three years ago have also fallen 46% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Shifting to the future, estimates from the five analysts covering the company suggest earnings should grow by 71% per annum over the next three years. Meanwhile, the rest of the market is forecast to only expand by 18% each year, which is noticeably less attractive.

In light of this, it's understandable that Kunshan Dongwei TechnologyLtd's P/E sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Key Takeaway

Kunshan Dongwei TechnologyLtd's P/E is flying high just like its stock has during the last month. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

As we suspected, our examination of Kunshan Dongwei TechnologyLtd's analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. Unless these conditions change, they will continue to provide strong support to the share price.

Before you settle on your opinion, we've discovered 4 warning signs for Kunshan Dongwei TechnologyLtd (1 doesn't sit too well with us!) that you should be aware of.

If these risks are making you reconsider your opinion on Kunshan Dongwei TechnologyLtd, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal