Is Inner Mongolia Yili Industrial Group (SHSE:600887) Using Too Much Debt?

Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. Importantly, Inner Mongolia Yili Industrial Group Co., Ltd. (SHSE:600887) does carry debt. But is this debt a concern to shareholders?

When Is Debt A Problem?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we examine debt levels, we first consider both cash and debt levels, together.

Check out our latest analysis for Inner Mongolia Yili Industrial Group

What Is Inner Mongolia Yili Industrial Group's Debt?

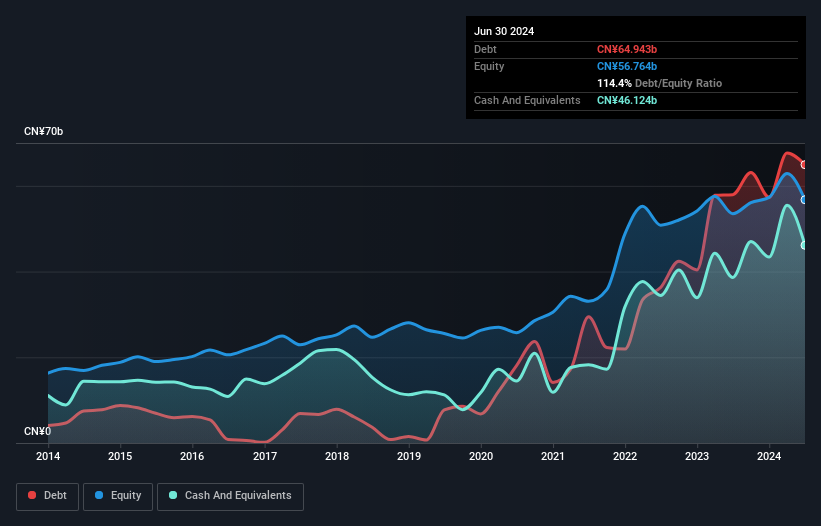

As you can see below, at the end of June 2024, Inner Mongolia Yili Industrial Group had CN¥64.9b of debt, up from CN¥57.9b a year ago. Click the image for more detail. However, because it has a cash reserve of CN¥46.1b, its net debt is less, at about CN¥18.8b.

How Strong Is Inner Mongolia Yili Industrial Group's Balance Sheet?

We can see from the most recent balance sheet that Inner Mongolia Yili Industrial Group had liabilities of CN¥80.1b falling due within a year, and liabilities of CN¥13.0b due beyond that. Offsetting this, it had CN¥46.1b in cash and CN¥9.43b in receivables that were due within 12 months. So it has liabilities totalling CN¥37.6b more than its cash and near-term receivables, combined.

While this might seem like a lot, it is not so bad since Inner Mongolia Yili Industrial Group has a huge market capitalization of CN¥167.5b, and so it could probably strengthen its balance sheet by raising capital if it needed to. But it's clear that we should definitely closely examine whether it can manage its debt without dilution.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

Inner Mongolia Yili Industrial Group has net debt of just 1.3 times EBITDA, suggesting it could ramp leverage without breaking a sweat. And remarkably, despite having net debt, it actually received more in interest over the last twelve months than it had to pay. So it's fair to say it can handle debt like a hotshot teppanyaki chef handles cooking. The good news is that Inner Mongolia Yili Industrial Group has increased its EBIT by 9.0% over twelve months, which should ease any concerns about debt repayment. There's no doubt that we learn most about debt from the balance sheet. But it is future earnings, more than anything, that will determine Inner Mongolia Yili Industrial Group's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So we clearly need to look at whether that EBIT is leading to corresponding free cash flow. Over the last three years, Inner Mongolia Yili Industrial Group recorded free cash flow worth a fulsome 89% of its EBIT, which is stronger than we'd usually expect. That positions it well to pay down debt if desirable to do so.

Our View

Inner Mongolia Yili Industrial Group's interest cover suggests it can handle its debt as easily as Cristiano Ronaldo could score a goal against an under 14's goalkeeper. And the good news does not stop there, as its conversion of EBIT to free cash flow also supports that impression! Looking at the bigger picture, we think Inner Mongolia Yili Industrial Group's use of debt seems quite reasonable and we're not concerned about it. After all, sensible leverage can boost returns on equity. Given Inner Mongolia Yili Industrial Group has a strong balance sheet is profitable and pays a dividend, it would be good to know how fast its dividends are growing, if at all. You can find out instantly by clicking this link.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal