Dowa Holdings Co., Ltd.'s (TSE:5714) Shares Lagging The Market But So Is The Business

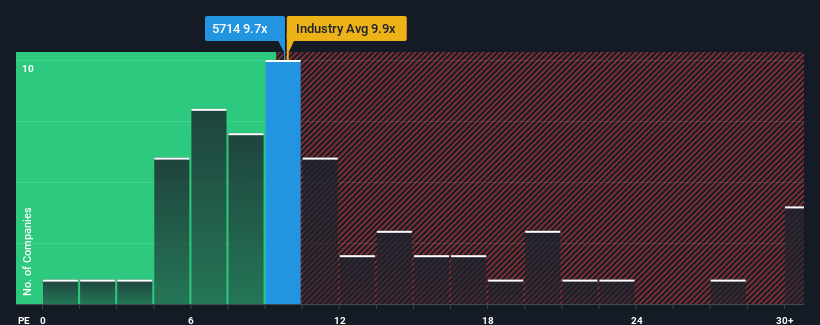

With a price-to-earnings (or "P/E") ratio of 9.7x Dowa Holdings Co., Ltd. (TSE:5714) may be sending bullish signals at the moment, given that almost half of all companies in Japan have P/E ratios greater than 14x and even P/E's higher than 21x are not unusual. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

Dowa Holdings certainly has been doing a good job lately as it's been growing earnings more than most other companies. One possibility is that the P/E is low because investors think this strong earnings performance might be less impressive moving forward. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

View our latest analysis for Dowa Holdings

Does Growth Match The Low P/E?

In order to justify its P/E ratio, Dowa Holdings would need to produce sluggish growth that's trailing the market.

If we review the last year of earnings growth, the company posted a terrific increase of 60%. Despite this strong recent growth, it's still struggling to catch up as its three-year EPS frustratingly shrank by 24% overall. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Looking ahead now, EPS is anticipated to slump, contracting by 1.4% per year during the coming three years according to the seven analysts following the company. Meanwhile, the broader market is forecast to expand by 9.6% each year, which paints a poor picture.

In light of this, it's understandable that Dowa Holdings' P/E would sit below the majority of other companies. However, shrinking earnings are unlikely to lead to a stable P/E over the longer term. There's potential for the P/E to fall to even lower levels if the company doesn't improve its profitability.

The Final Word

It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of Dowa Holdings' analyst forecasts revealed that its outlook for shrinking earnings is contributing to its low P/E. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

Many other vital risk factors can be found on the company's balance sheet. Our free balance sheet analysis for Dowa Holdings with six simple checks will allow you to discover any risks that could be an issue.

You might be able to find a better investment than Dowa Holdings. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal