High Insider Ownership Growth Companies To Consider In October 2024

As global markets navigate a landscape marked by record highs in U.S. stock indices and modest inflationary pressures, investors are closely watching the Federal Reserve's next moves on interest rates. With growth stocks outperforming value stocks amid these conditions, companies with high insider ownership can offer unique insights into potential confidence in long-term performance. In this context, identifying growth companies where insiders have significant stakes may provide an additional layer of assurance for investors seeking to align with corporate leadership's vested interests.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Lavvi Empreendimentos Imobiliários (BOVESPA:LAVV3) | 11.9% | 21.1% |

| Atlas Energy Solutions (NYSE:AESI) | 29.1% | 41.9% |

| Clinuvel Pharmaceuticals (ASX:CUV) | 10.4% | 27.4% |

| Seojin SystemLtd (KOSDAQ:A178320) | 30.8% | 49.1% |

| KebNi (OM:KEBNI B) | 36.3% | 86.1% |

| HANA Micron (KOSDAQ:A067310) | 18.3% | 105.8% |

| Adveritas (ASX:AV1) | 21.2% | 144.2% |

| Plenti Group (ASX:PLT) | 12.8% | 106.4% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 81.4% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 14.0% | 95% |

We're going to check out a few of the best picks from our screener tool.

Willfar Information Technology (SHSE:688100)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Willfar Information Technology Co., Ltd. offers smart utility services and IoT solutions both in China and internationally, with a market cap of CN¥19.63 billion.

Operations: Willfar Information Technology Co., Ltd. generates revenue through its offerings in smart utility services and IoT solutions across domestic and international markets.

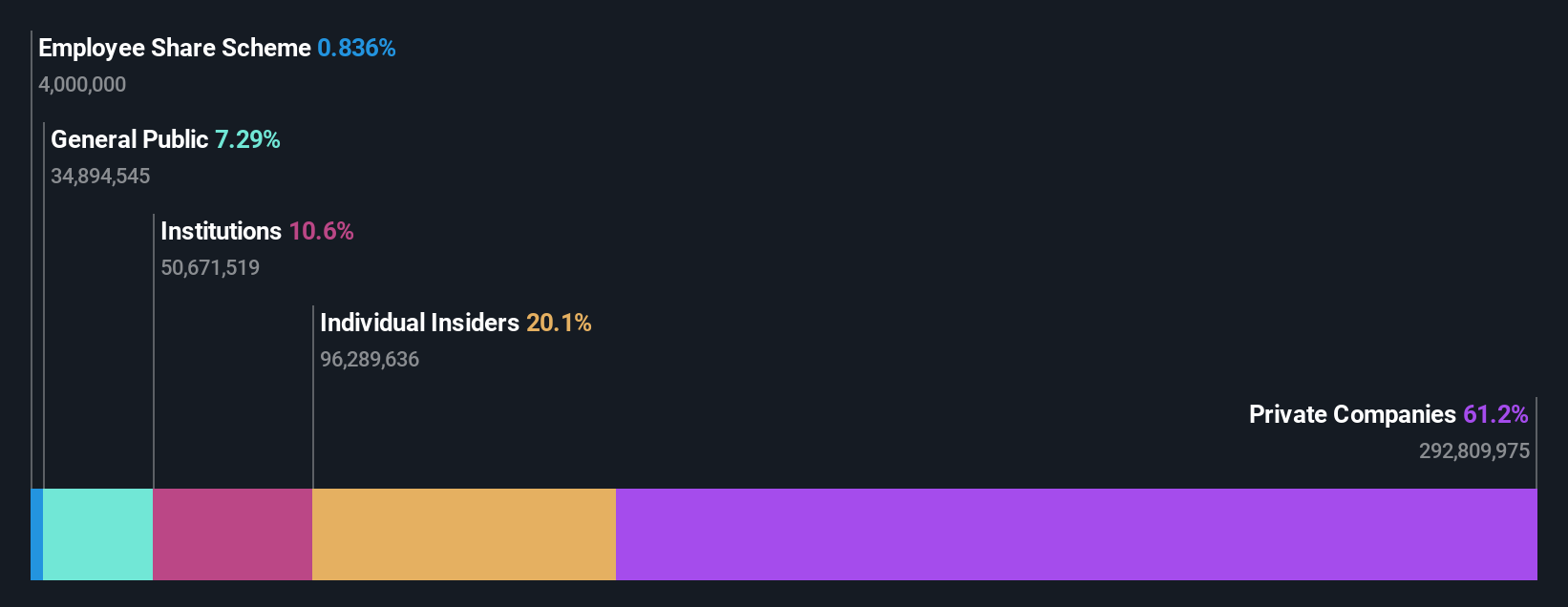

Insider Ownership: 21.2%

Willfar Information Technology is experiencing robust growth, with revenue projected to increase by 23.1% annually, outpacing the Chinese market's 13.3%. Earnings are also expected to grow significantly at 22.49% per year. The company reported a strong half-year performance with sales of CNY 1.22 billion and net income of CNY 271.82 million, reflecting substantial year-over-year growth. Despite an unstable dividend track record, its price-to-earnings ratio remains attractive compared to industry averages.

- Click here to discover the nuances of Willfar Information Technology with our detailed analytical future growth report.

- Upon reviewing our latest valuation report, Willfar Information Technology's share price might be too optimistic.

Henan Shijia Photons Technology (SHSE:688313)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Henan Shijia Photons Technology Co., Ltd. operates in the photonics industry and has a market cap of CN¥5.26 billion.

Operations: Revenue segments for the company are not provided in the text.

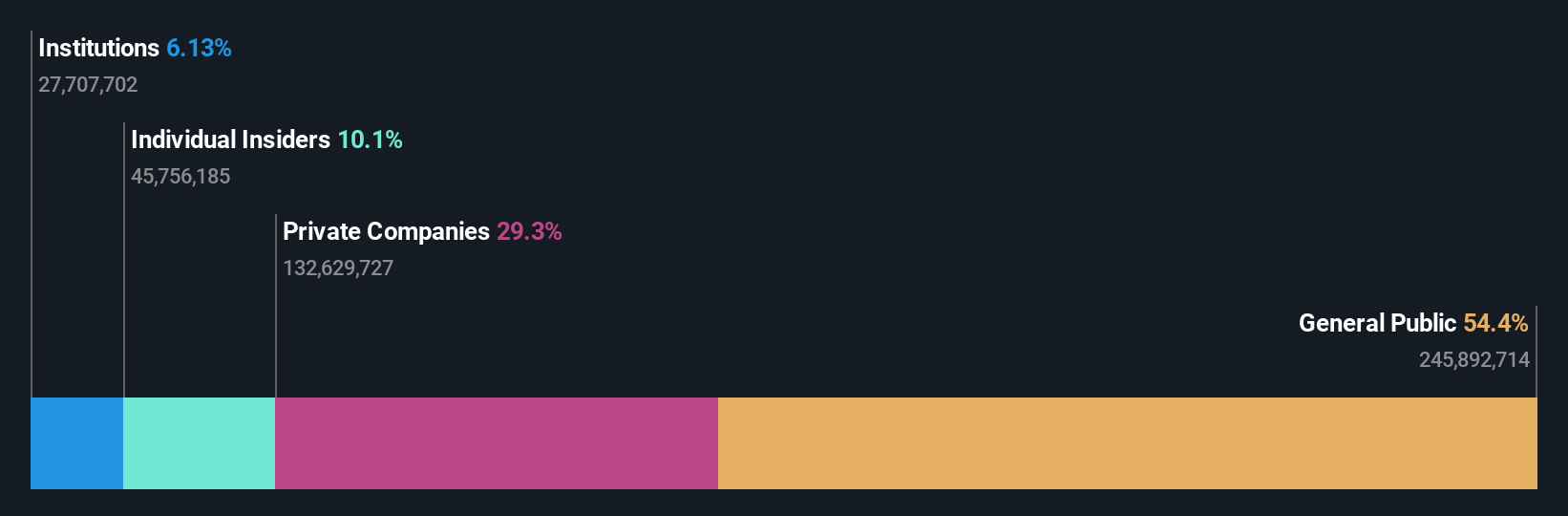

Insider Ownership: 11.7%

Henan Shijia Photons Technology is poised for substantial growth, with earnings expected to rise significantly at 62.93% annually, surpassing the Chinese market's 23.5%. The company turned profitable this year, reporting nine-month sales of CNY 729.31 million and net income of CNY 36.21 million, a marked improvement from last year's loss. Despite high revenue growth forecasts (17.2%), insider trading activity remains minimal over the past three months, and return on equity is projected to be low at 8%.

- Click to explore a detailed breakdown of our findings in Henan Shijia Photons Technology's earnings growth report.

- The valuation report we've compiled suggests that Henan Shijia Photons Technology's current price could be inflated.

Guanglian Aviation Industry (SZSE:300900)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Guanglian Aviation Industry Co., Ltd. is involved in the design and manufacture of aerospace metal and composite material parts as well as aviation technology equipment in China, with a market cap of CN¥6.72 billion.

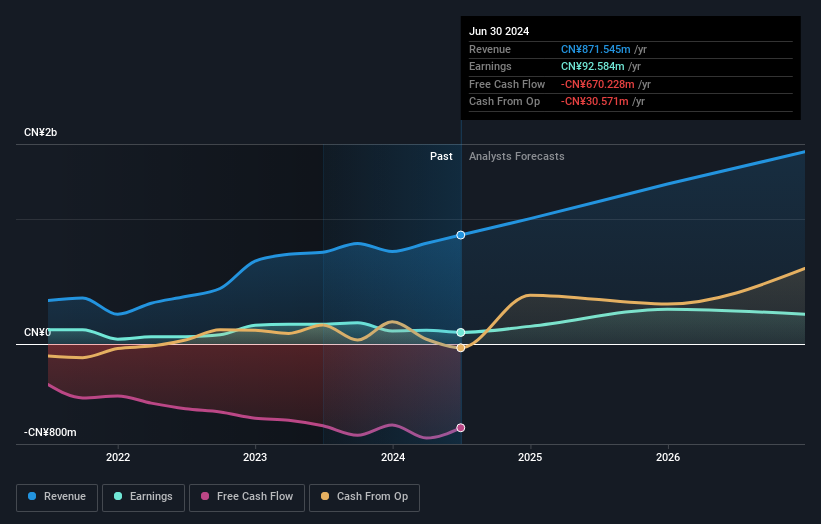

Operations: The company's revenue primarily comes from Aerospace Equipment Manufacturing, which amounts to CN¥865.05 million.

Insider Ownership: 39.4%

Guanglian Aviation Industry is set for robust growth, with earnings projected to increase by 40.41% annually, outpacing the Chinese market. Revenue is also expected to grow significantly at 22.9% per year. However, the company's profit margins have decreased from last year and interest payments are not well covered by earnings. Recent buybacks totaling CNY 16.1 million indicate confidence in its future prospects despite a volatile share price and low forecasted return on equity of 11.7%.

- Delve into the full analysis future growth report here for a deeper understanding of Guanglian Aviation Industry.

- Our valuation report here indicates Guanglian Aviation Industry may be overvalued.

Summing It All Up

- Access the full spectrum of 1484 Fast Growing Companies With High Insider Ownership by clicking on this link.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal