Musk's “Robotaxi Flatbread” market doesn't buy, and Tesla (TSLA.US)'s high valuation is about to falter

The Zhitong Finance App learned that the driverless autonomous taxi Robotaxi, which was heavily unveiled by global electric vehicle leader Tesla (TSLA.US) last week, seems to have greatly disappointed investors in the financial market. Musk, who has always been good at “painting cakes” for investors to boost Tesla's valuation level, rarely overturned. The “Robotaxi Flatbread” he drew did not receive full recognition from Wall Street and Tesla stock followers. This disappointment caused some Wall Street investment institutions to question whether the stock's large premium valuation could continue.

Judging from Tesla's recent stock price trend, Musk's long-hyped Robotaxi failed to be favored by global capital, causing Tesla's stock price to continue to fall after the Robotaxi press conference. Since launching this driverless autonomous taxi last week, Tesla's stock price has dropped 7.5%. Wall Street investment agency Bernstein (Bernstein) said that Robotaxi is biased towards grand narratives, but it seems irrelevant to Tesla's weak performance and support expensive valuations at this stage.

The so-called Robotaxi is more like a “dazzling promise,” but this kind of promise, or “long-term planning,” can be described as essential for Tesla's stock to continue to rise and maintain a high valuation. Robotaxi is also an important part of Musk's own vision for Tesla's future development, which is fully driven by artificial intelligence and humanoid robots. Musk previously even called out what seemed crazy market capitalization expectations at Tesla's shareholders' meeting. Musk predicted that with the combined support of fully autonomous driving technology and Optimus Prime robots, Tesla's market value would exceed 30 trillion US dollars.

Ark Investment Management Company, founded and led by “Sister Mu Tou”, recently updated its target price for Tesla. Ark expects Tesla's stock price to reach 2,600 US dollars by 2029. Ark's main logic for strongly bullish Tesla's stock price is that it is expected that by 2029, nearly 90% of Tesla's market value and profit will be due to the RoboTaxi driverless taxi network built based on an extremely powerful AI supercomputing system.

However, in terms of the actual situation shown at the Robotaxi press conference, Ark's aggressive expectations seemed out of touch with reality. Since investors have many questions about the specific technical details of Robotaxi driverless autonomous vehicles and the approximate time frame of the “Robotaxi Blueprint Plan,” many market concerns such as how the updated FSD has advantages over autonomous driving competitors, the progress of FSD regulation, and when exactly RoboTaxi will go on sale have not been answered.

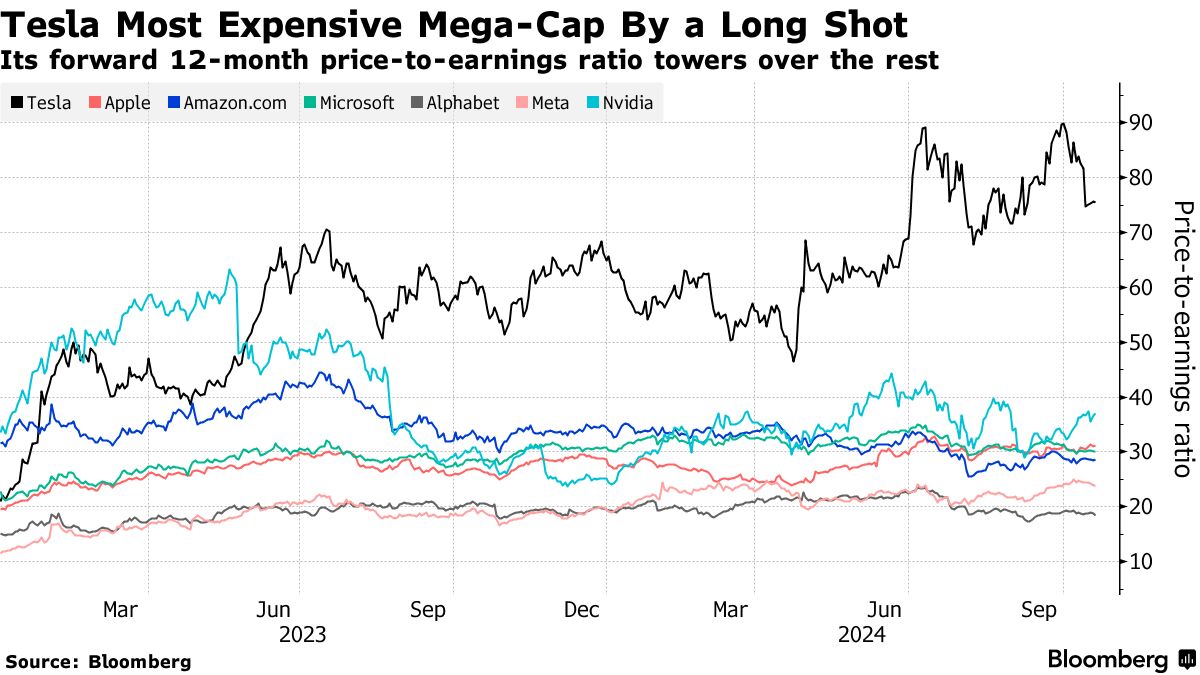

As a result, Tesla's expected price-earnings ratio of up to 75x seems too expensive for Wall Street traders, and also very expensive compared to US tech giants with high overall valuations.

“It's still a carrot on a rope.” Steve Sosnick, chief strategist at Yingtou Securities, said. “How many new investors are willing to buy this expensive stock when Tesla's core automotive business inevitably slows down and the company doesn't show how it will grow more rapidly in the future?”

An outrageous phenomenon: Tesla's valuation is far higher than the Nasdaq 100 Index, yet it falls far short of the Index

Admittedly, Tesla investors generally have high hopes for the autonomous driving business and the ultimate success of Robotaxi cars. Analyst Tony Sacknaghi from Bernstein estimates that Tesla's core electric vehicle business may be worth less than 200 billion US dollars, which indicates that its current market value reflects the total value of all other businesses (including Robotaxi and Optimus humanoid robots) of about 600 billion US dollars. This expectation is clearly very high. More importantly, this part of the business exists more in virtual imagination rather than specific operating results.

Tesla's stock price has dropped 7.5% since the high-profile Robotaxi press event on October 10, but this has hardly weakened its overly premium valuation. Tesla is still the most expensive stock index among the “Seven US Tech Giants” (that is, Magnificent 7), and even though the stock price has outperformed almost all tech giants since this year, its valuation has been higher than them for a long time. Tesla's valuation is higher than that of Nvidia, the AI chip hegemon with a market capitalization exceeding 3 trillion US dollars, far exceeding the undervaluation of traditional automobile manufacturing giants such as General Motors and Ford Motor Company.

Furthermore, Tesla's valuation is also much more expensive than the 26x expected price-earnings ratio of the Nasdaq 100 Index. What's even more outrageous is that Tesla's stock price has fallen by more than 10% since this year, yet the Nasdaq 100 Index, which covers tech giants such as Nvidia, Apple, and Tesla, has risen sharply by more than 20%.

“Regarding Tesla's valuation, my biggest concern is how strong Tesla's performance will be to reach the high price-earnings ratio figure of 75x,” said Sosnick of Yingtou Securities. “The only way that works is if you have the technology to completely change the world, like Tesla once did, but the current valuation requires a major technological leap on a larger scale.”

Undoubtedly, last week's grand event failed to inspire confidence among investors around the world that this major leap is yet to come. At the same time, slowing global demand for electric vehicles and increased competition with many Chinese competitors are continuously affecting their sales and profits.

“The plans shown by Tesla's Robotaxi campaign are indeed long-term, but lack specific delivery expectations or new drivers for incremental revenue.” Sacknaghi from Bernstein wrote in a report.

At the Robotaxi event, the company showcased an unmanned autonomous two-door sedan taxi called Cybercab, a concept car, and an upgraded prototype of the Optimus humanoid robot, but lacked many of the key details investors wanted to see. These include how Tesla is moving from selling advanced driver assistance functions to fully autonomous vehicles, the path, process, and schedule for obtaining regulatory approval, and core evidence that its Robotaxi is far ahead of competitors such as Waymo, a subsidiary of Alphabet Inc.

There are other more serious issues. Robotaxi autonomous taxis, for example, “probably” won't be put into production until 2026. The media reported earlier this week that some workers may have remotely controlled some features of the Tesla humanoid robot during the event.

Bernstein's Sacknaghi pointed out that Tesla still lags far behind its competitors in terms of regulatory approval for autonomous driving technology, and expressed concern that even if it becomes the first electric vehicle company to achieve fully autonomous driving that completely frees human hands, rivals may soon follow Tesla's footsteps.

He wrote, “We believe the Robotaxi incident did not provide enough details to ease our concerns, and I believe many investors may share the same concerns.”

Multiple opinions: As long as Musk is alive, there's no reason to be bearish on Tesla

What is certain is that there are still some Tesla bullish followers or Musk fans who are willing to give Tesla a chance to continue performing, and this view is mainly based on their long-standing trust in Musk himself.

“First, Tesla is a technology company managed by Musk.” Nicolas Colas, co-founder of DataTrek Research, said. “As long as Musk is still alive, generating novel ideas, and succeeding in other innovative businesses, people will say that if this person can accurately return the rocket, he can of course solve all problems related to autonomous driving.”

Despite this, after Tesla's stock price rebounded sharply by 70% before Robotaxi's autonomous taxi campaign, Tesla's stock price still seems to be full of great challenges.

The next core catalyst worth watching is the third-quarter results to be announced next week. Wall Street analysts generally believe that the company's profit will drop 10% year over year, mainly due to weak demand for electric vehicles under the Federal Reserve's long-term high interest rates and increased market competition in the electric vehicle industry.

“What concerns us in the short term is any substantial weak data relating to electric vehicle sales, which is still Tesla's 'bread and butter'.” Brian Mobley, portfolio manager from Zacks Investment Management, said.

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal