Undiscovered Gems Three Promising Stocks In October 2024

Over the last 7 days, the United States market has risen by 1.1%, contributing to a remarkable 36% climb over the past year, with earnings forecasted to grow by 15% annually. In this thriving environment, identifying stocks that are not only promising but also relatively undiscovered can provide unique opportunities for investors seeking to capitalize on emerging growth potential.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Morris State Bancshares | 10.20% | -0.28% | 6.97% | ★★★★★★ |

| River Financial | 122.41% | 16.43% | 18.50% | ★★★★★★ |

| Mission Bancorp | 25.37% | 16.23% | 20.16% | ★★★★★★ |

| Teekay | NA | -6.48% | 55.79% | ★★★★★★ |

| First Northern Community Bancorp | NA | 7.12% | 10.04% | ★★★★★★ |

| Omega Flex | NA | 1.31% | 3.88% | ★★★★★★ |

| Banco Latinoamericano de Comercio Exterior S. A | 311.64% | 21.07% | 24.77% | ★★★★★☆ |

| Valhi | 38.71% | 2.57% | -19.76% | ★★★★★☆ |

| Chain Bridge Bancorp | 10.64% | 41.34% | 18.53% | ★★★★☆☆ |

| FRMO | 0.13% | 19.43% | 29.70% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

Sezzle (NasdaqCM:SEZL)

Simply Wall St Value Rating: ★★★★★☆

Overview: Sezzle Inc. is a technology-enabled payments company operating mainly in the United States and Canada, with a market cap of $1.14 billion.

Operations: Sezzle generates revenue primarily through lending to end-customers, with this segment contributing $192.69 million. The company's financial performance includes a market cap of approximately $1.14 billion.

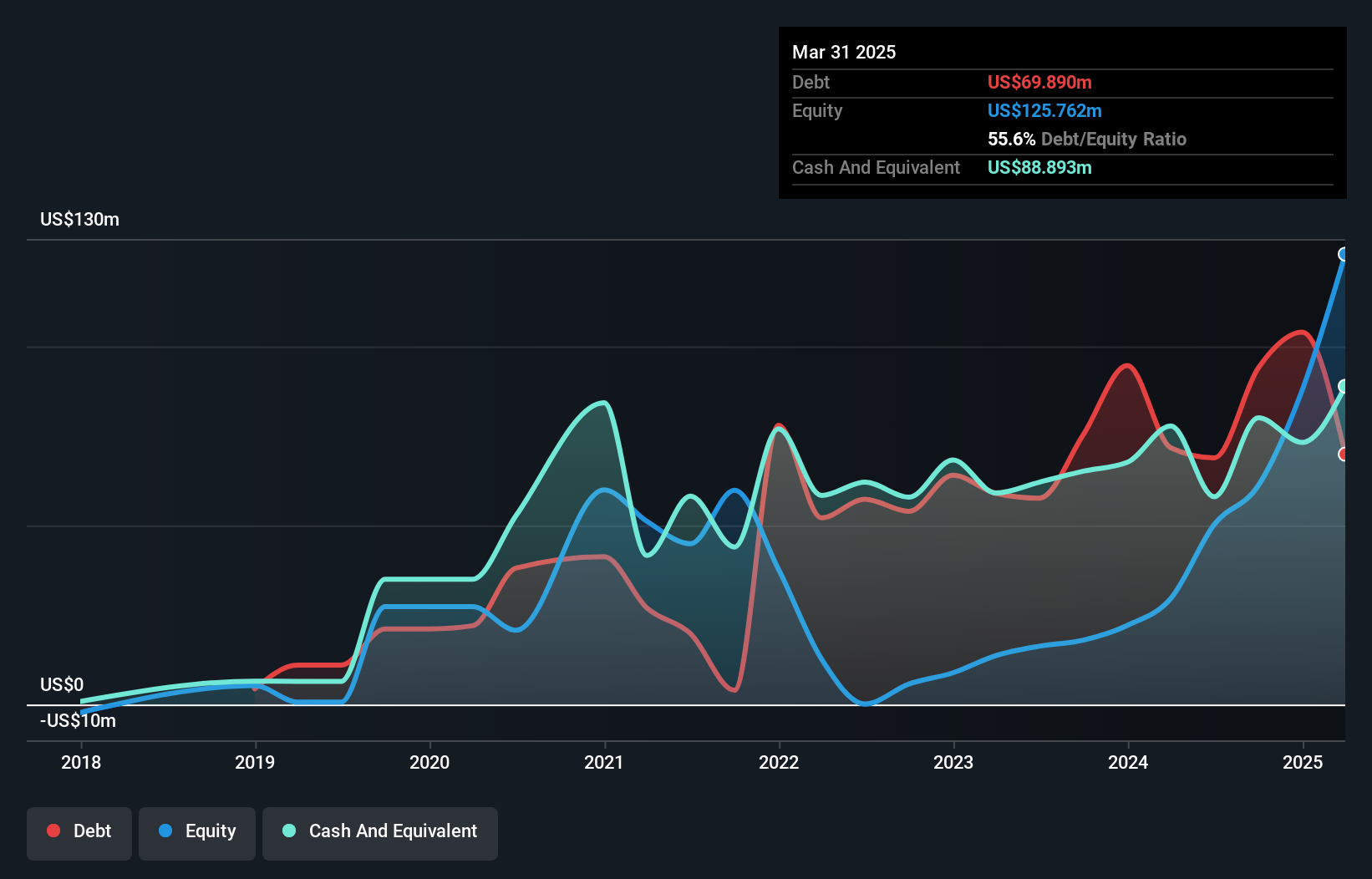

Sezzle, a nimble player in the payment solutions space, has demonstrated impressive growth with earnings surging 434.8% over the past year, outpacing its industry peers. The company’s net debt to equity ratio stands at a satisfactory 21.6%, reflecting prudent financial management as it reduced from 1676.6% over five years. Recent strategic moves include a partnership with WebBank and securing the Minnesota Timberwolves jersey patch deal, both likely to bolster brand visibility and market reach. However, significant insider selling and reliance on non-repeatable tax benefits pose potential risks that investors should weigh carefully against future growth projections.

Centrus Energy (NYSEAM:LEU)

Simply Wall St Value Rating: ★★★★★☆

Overview: Centrus Energy Corp. is a company that provides nuclear fuel components and services to the nuclear power industry across various countries, with a market capitalization of approximately $1.26 billion.

Operations: Centrus Energy generates revenue primarily from its Low-Enriched Uranium (LEU) segment, contributing $320.80 million, and Technical Solutions segment, adding $71.80 million. The company has a market capitalization of approximately $1.26 billion.

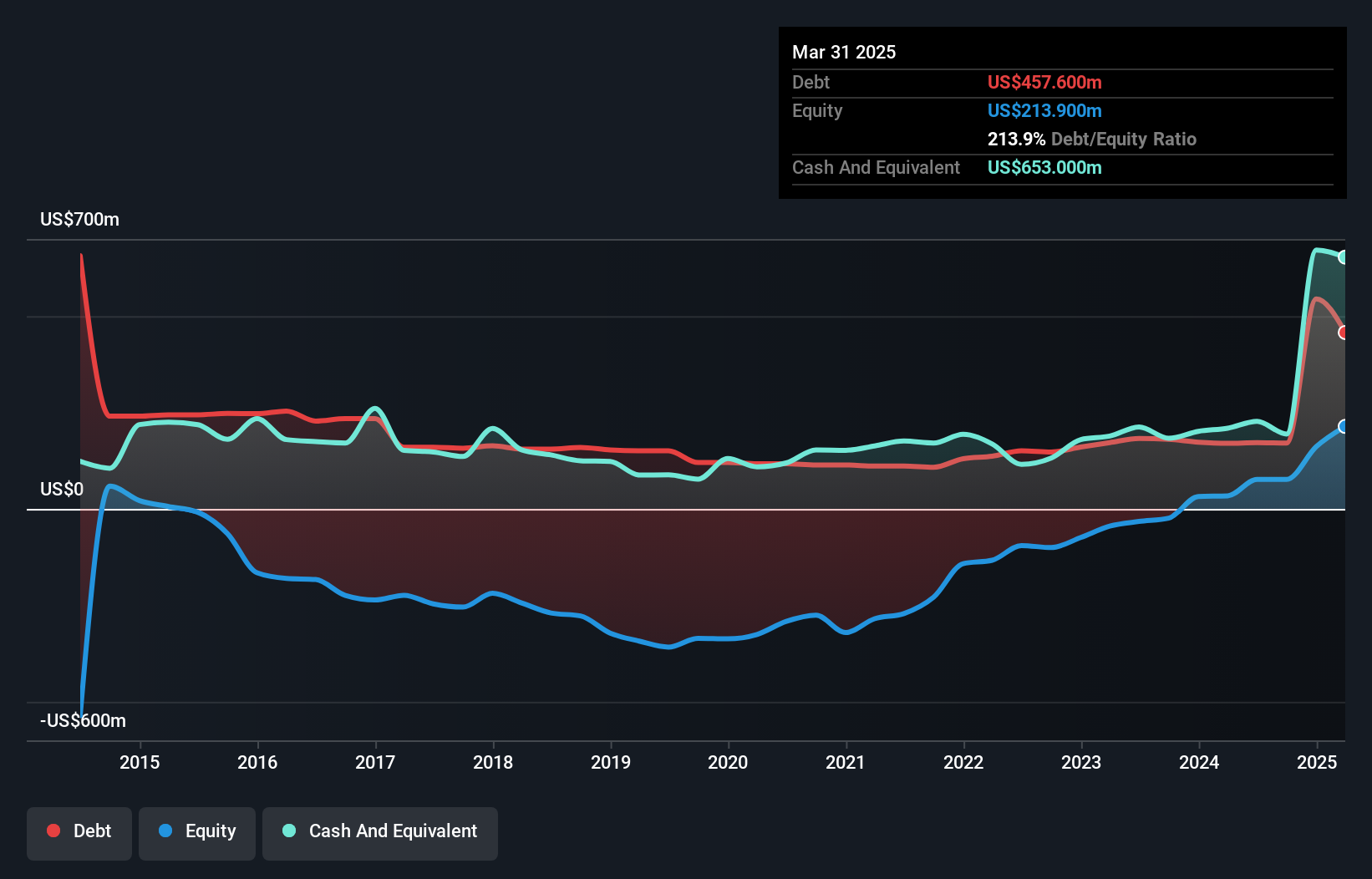

Centrus Energy, a nimble player in the nuclear fuel sector, shows promising strides with its earnings growth of 164.9% over the past year, outpacing the broader Oil and Gas industry. The company has transitioned from negative shareholder equity five years ago to positive equity today, reflecting improved financial health. Despite a volatile share price recently and significant insider selling in recent months, Centrus trades at 51.7% below its estimated fair value. With high-quality earnings and more cash than total debt, it seems well-positioned financially despite an expected average earnings decline of 28.6% annually over the next three years.

- Click here to discover the nuances of Centrus Energy with our detailed analytical health report.

Examine Centrus Energy's past performance report to understand how it has performed in the past.

Worthington Steel (NYSE:WS)

Simply Wall St Value Rating: ★★★★★☆

Overview: Worthington Steel, Inc. operates as a steel processor in North America with a market capitalization of approximately $1.75 billion.

Operations: Worthington Steel generates revenue primarily from its Metal Processors and Fabrication segment, totaling $3.36 billion.

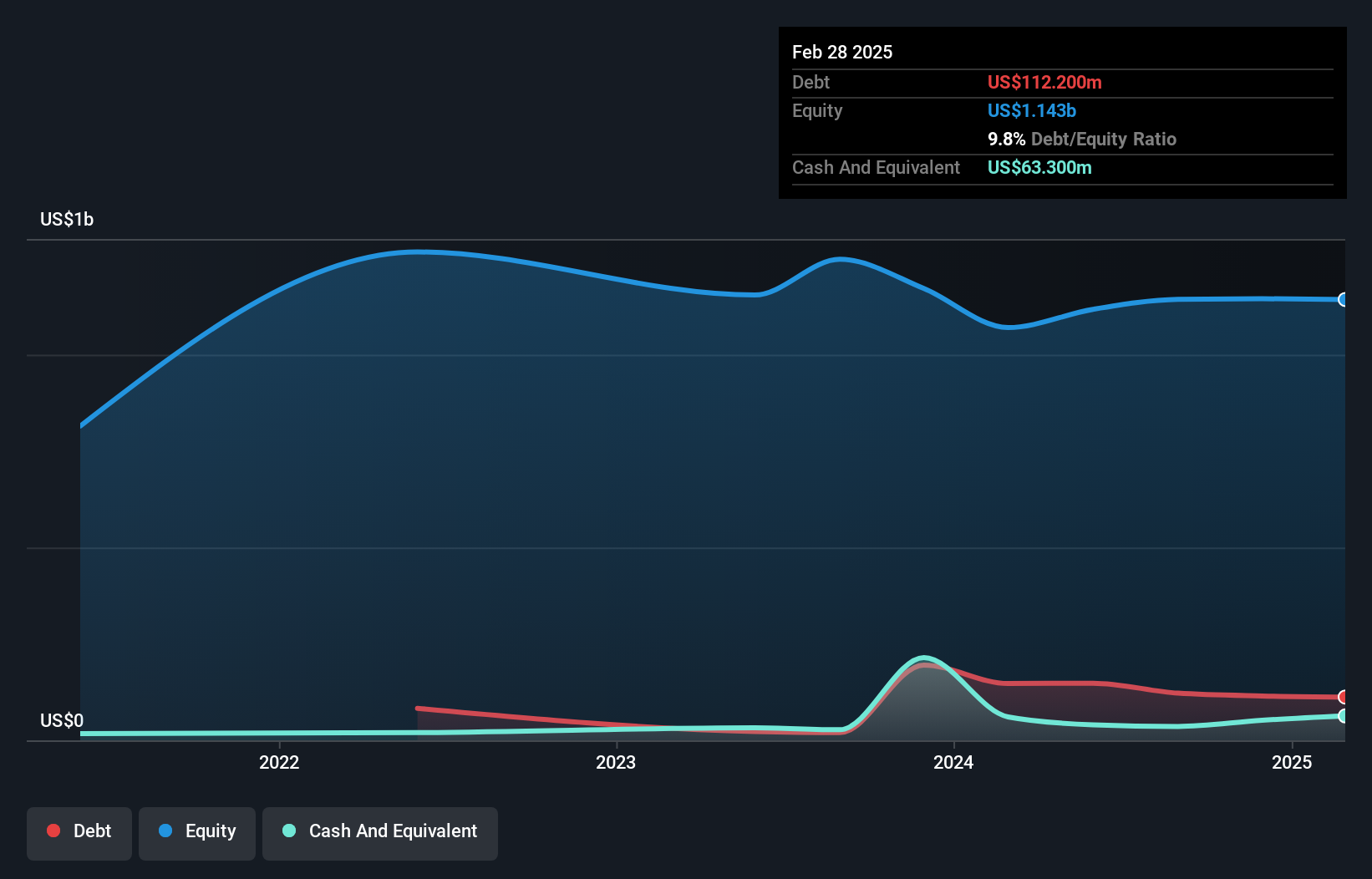

Worthington Steel, a smaller player in the industry, is making waves with its robust earnings growth of 7.9% over the past year, outpacing the broader Metals and Mining sector's -23%. Trading at a notable 31.6% below its estimated fair value, it presents an intriguing opportunity for investors seeking undervalued stocks. The company's net debt to equity ratio stands at a satisfactory 7.5%, ensuring financial stability while maintaining high-quality earnings and positive free cash flow. Recent quarterly results showed sales of US$834 million and net income of US$28.4 million, reflecting current market challenges but also potential for future recovery.

- Navigate through the intricacies of Worthington Steel with our comprehensive health report here.

Understand Worthington Steel's track record by examining our Past report.

Seize The Opportunity

- Delve into our full catalog of 221 US Undiscovered Gems With Strong Fundamentals here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal