3 High-Yield Dividend Stocks On US Exchanges To Boost Your Portfolio

As the U.S. stock market continues to reach new heights, with the Dow Jones Industrial Average marking its 39th record close of the year, investors are keenly observing how economic indicators and corporate earnings shape their portfolios. Amid this backdrop of robust market activity and strong demand in sectors like semiconductors, high-yield dividend stocks present an attractive opportunity for those looking to enhance their investment returns through steady income streams.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| WesBanco (NasdaqGS:WSBC) | 4.52% | ★★★★★★ |

| Columbia Banking System (NasdaqGS:COLB) | 5.19% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.97% | ★★★★★★ |

| Dillard's (NYSE:DDS) | 5.42% | ★★★★★★ |

| Silvercrest Asset Management Group (NasdaqGM:SAMG) | 4.47% | ★★★★★★ |

| Farmers National Banc (NasdaqCM:FMNB) | 4.43% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.92% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.47% | ★★★★★★ |

| OTC Markets Group (OTCPK:OTCM) | 4.45% | ★★★★★★ |

| First Interstate BancSystem (NasdaqGS:FIBK) | 5.72% | ★★★★★★ |

Click here to see the full list of 159 stocks from our Top US Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

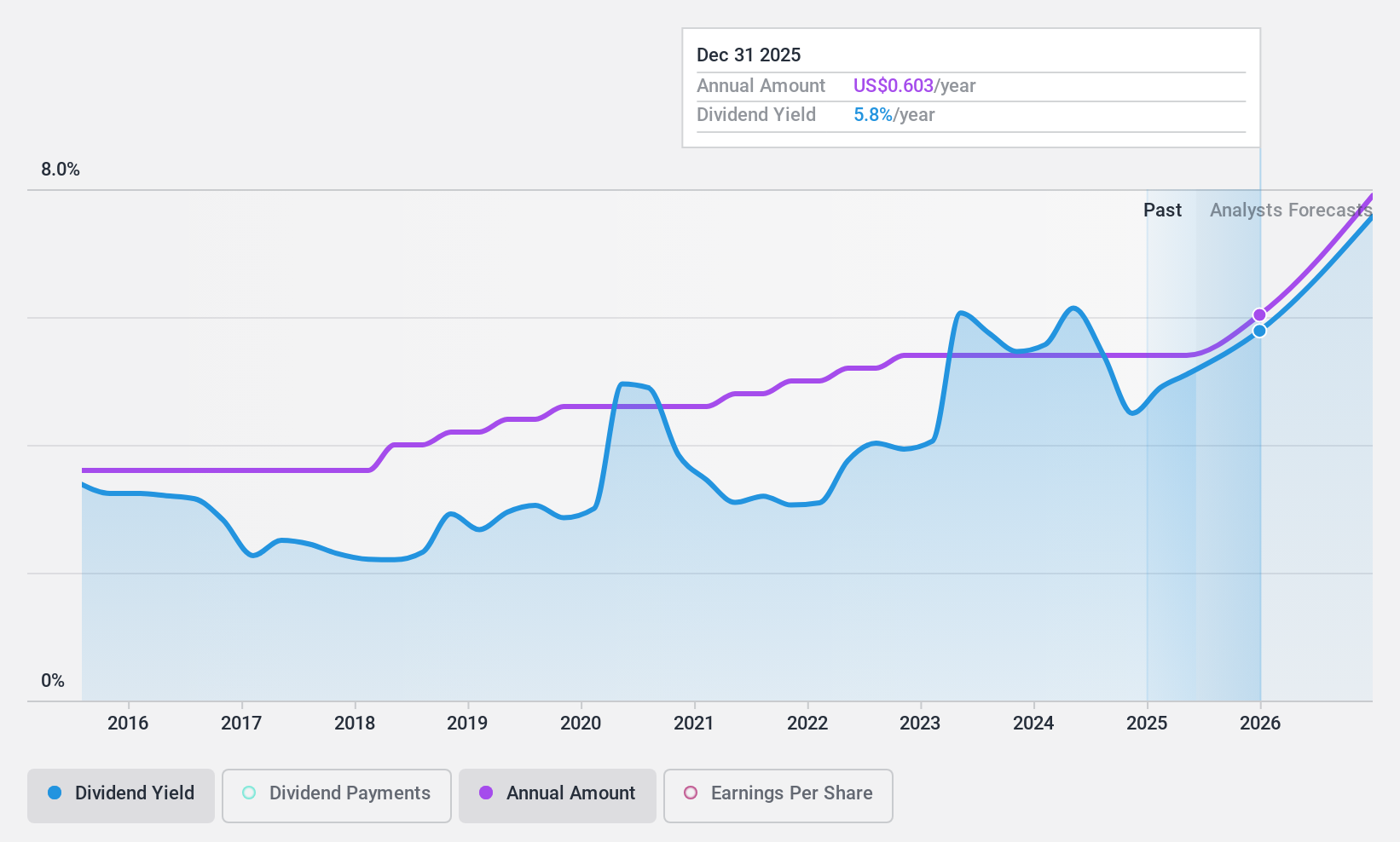

Brookline Bancorp (NasdaqGS:BRKL)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Brookline Bancorp, Inc. is a bank holding company for Brookline Bank, offering commercial, business, and retail banking services to corporate, municipal, and retail customers in the United States with a market cap of $953.13 million.

Operations: Brookline Bancorp generates revenue of $335.68 million from its banking business segment, which encompasses a range of financial services for various customer types in the United States.

Dividend Yield: 5%

Brookline Bancorp's dividend of US$0.135 per share, approved for August 2024, reflects its stable and reliable payout history over the past decade. Despite a dip in recent quarterly earnings to US$16.37 million from US$21.85 million a year ago, dividends remain covered by earnings with a payout ratio of 62.6%. The stock trades significantly below estimated fair value and offers an attractive yield of 4.98%, placing it among the top 25% of U.S. dividend payers.

- Unlock comprehensive insights into our analysis of Brookline Bancorp stock in this dividend report.

- Our expertly prepared valuation report Brookline Bancorp implies its share price may be lower than expected.

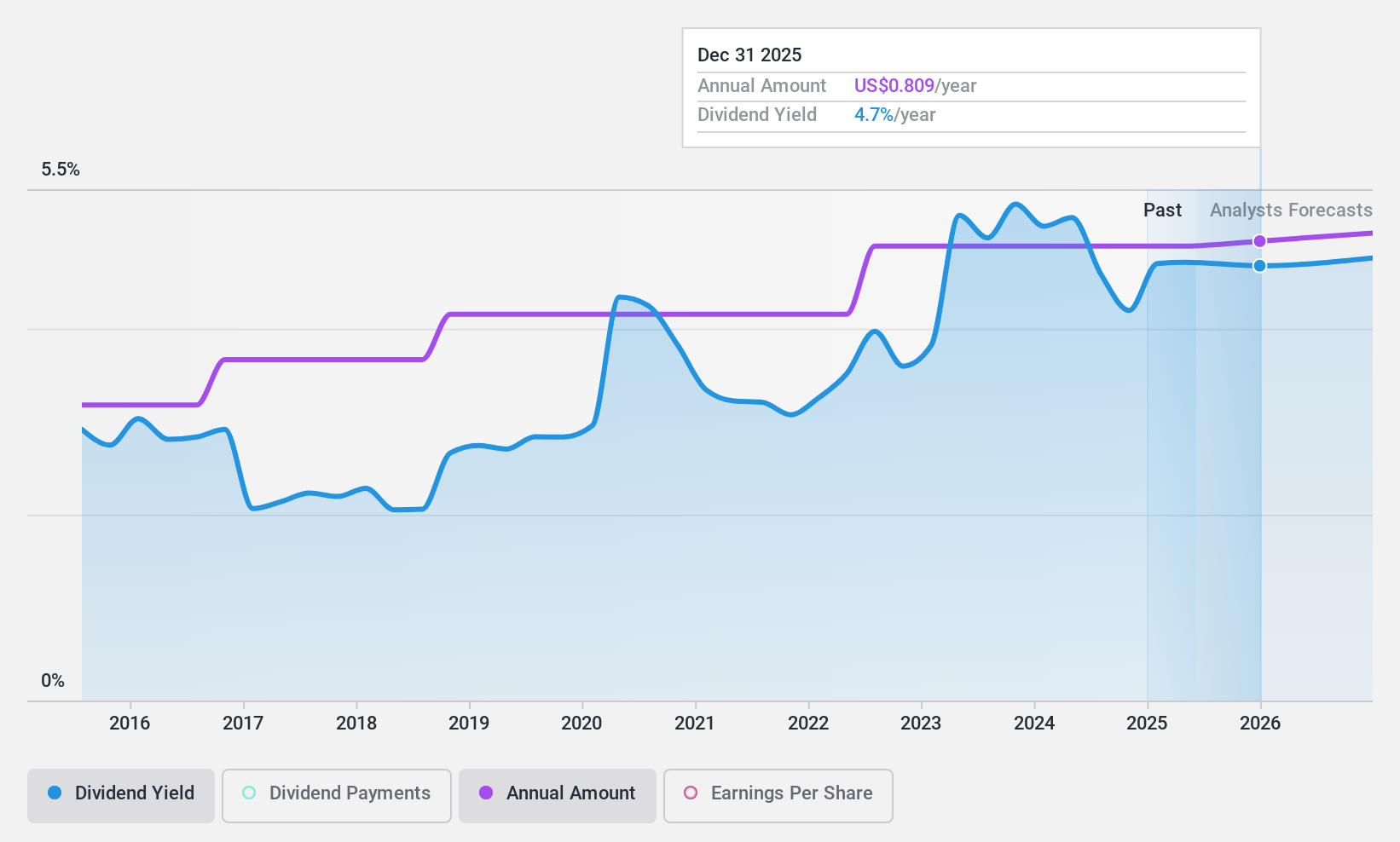

OceanFirst Financial (NasdaqGS:OCFC)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: OceanFirst Financial Corp., with a market cap of $1.12 billion, operates as the bank holding company for OceanFirst Bank N.A., providing banking services.

Operations: OceanFirst Financial Corp. generates revenue primarily through its Community Banking Operations, amounting to $376.06 million.

Dividend Yield: 4.1%

OceanFirst Financial's dividend of US$0.20 per share, reaffirmed for November 2024, underscores its consistent payout history with 111 consecutive quarterly dividends. Despite a decline in Q2 net income to US$24.37 million from US$27.8 million the previous year, dividends are well-covered by earnings with a payout ratio of 48.2%. The stock is trading at an attractive value compared to peers and offers a reliable yield of 4.11%, though slightly below top-tier U.S. dividend payers.

- Take a closer look at OceanFirst Financial's potential here in our dividend report.

- In light of our recent valuation report, it seems possible that OceanFirst Financial is trading behind its estimated value.

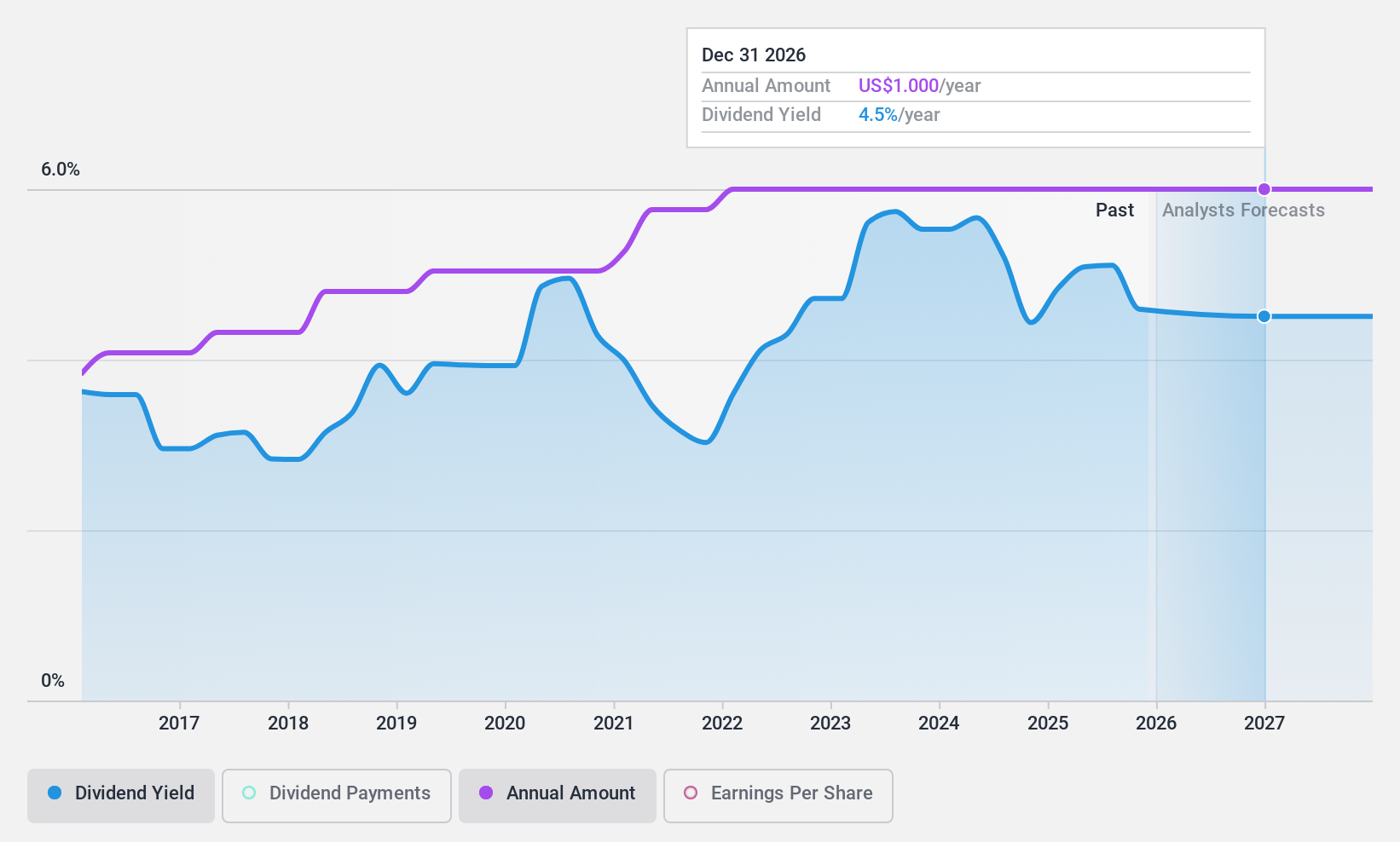

West Bancorporation (NasdaqGS:WTBA)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: West Bancorporation, Inc. is a financial holding company offering community banking and trust services to individuals and small- to medium-sized businesses in the United States, with a market cap of approximately $340.36 million.

Operations: West Bancorporation, Inc. generates revenue primarily through its community banking segment, which accounts for $76.33 million.

Dividend Yield: 4.9%

West Bancorporation offers a reliable dividend yield of 4.86%, placing it in the top 25% of U.S. dividend payers, with stable and growing payments over the past decade. Despite trading at nearly 57% below estimated fair value, its payout ratio of 78.2% suggests dividends are currently covered by earnings, though sustainability data is lacking. Recent Q2 earnings showed a slight decline to US$5.19 million from US$5.86 million year-on-year, with dividends recently reaffirmed at US$0.25 per share.

- Click here to discover the nuances of West Bancorporation with our detailed analytical dividend report.

- Our valuation report unveils the possibility West Bancorporation's shares may be trading at a discount.

Turning Ideas Into Actions

- Get an in-depth perspective on all 159 Top US Dividend Stocks by using our screener here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal