Undiscovered Gems in the UK Featuring 3 Promising Small Caps

Over the last 7 days, the United Kingdom market has risen by 1.6%, contributing to an impressive 11% increase over the past year, with earnings forecasted to grow by 14% annually. In this thriving environment, identifying promising small-cap stocks can offer unique opportunities for investors seeking potential growth beyond well-known large-cap companies.

Top 10 Undiscovered Gems With Strong Fundamentals In The United Kingdom

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Andrews Sykes Group | NA | 2.15% | 4.93% | ★★★★★★ |

| M&G Credit Income Investment Trust | NA | 17.28% | 15.80% | ★★★★★★ |

| Metals Exploration | NA | 12.92% | 73.62% | ★★★★★★ |

| London Security | 0.22% | 10.13% | 7.75% | ★★★★★★ |

| Globaltrans Investment | 15.40% | 2.68% | 16.51% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Kodal Minerals | NA | nan | 72.74% | ★★★★★★ |

| VH Global Sustainable Energy Opportunities | NA | 18.30% | 20.03% | ★★★★★★ |

| BBGI Global Infrastructure | 0.02% | 3.08% | 6.85% | ★★★★★☆ |

| Goodwin | 52.21% | 9.26% | 13.12% | ★★★★★☆ |

Let's uncover some gems from our specialized screener.

Renew Holdings (AIM:RNWH)

Simply Wall St Value Rating: ★★★★★☆

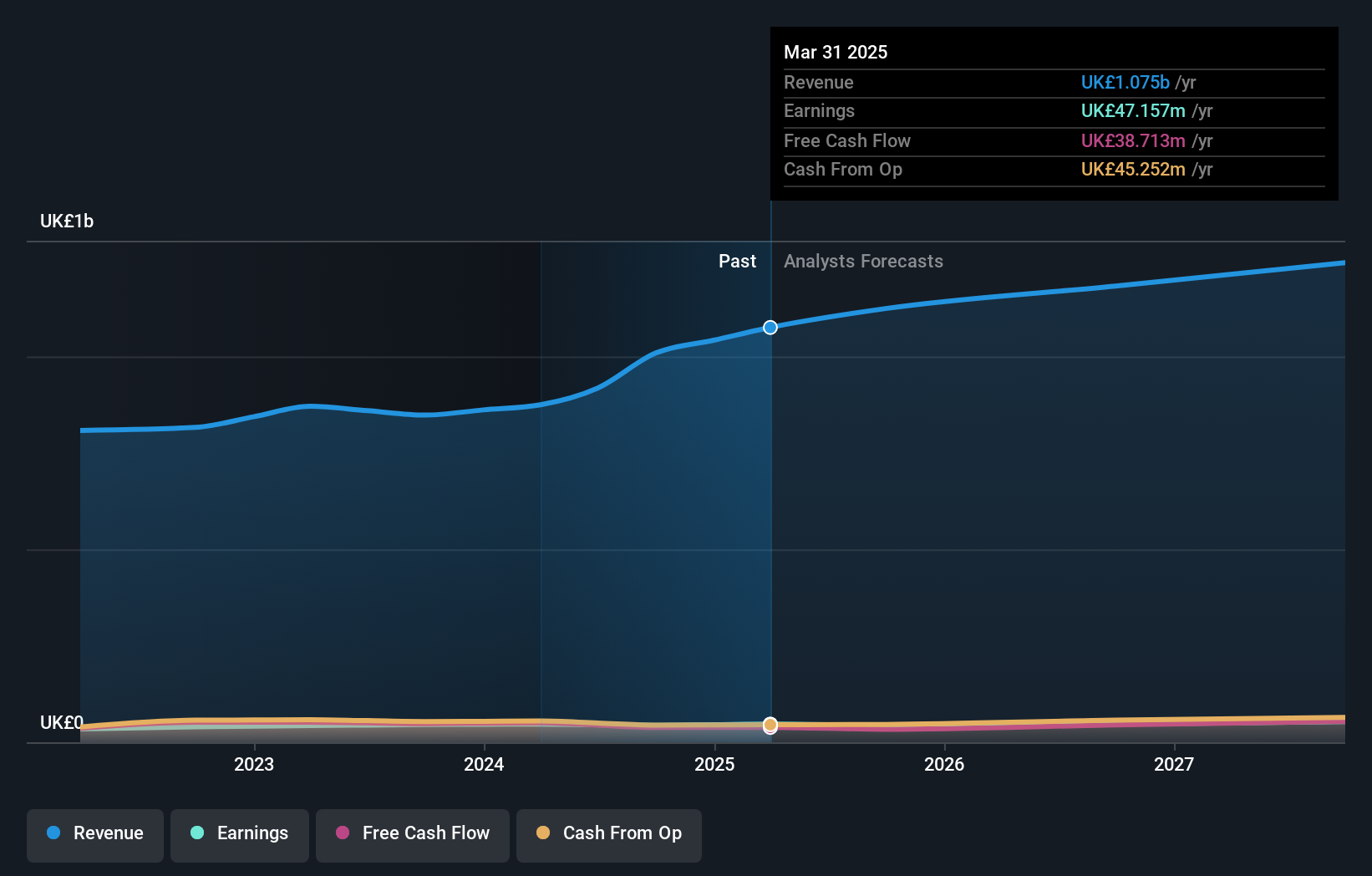

Overview: Renew Holdings plc is a UK-based contractor specializing in engineering services and specialist building, with a market capitalization of £911.67 million.

Operations: The company generates revenue primarily from engineering services (£910.83 million) and specialist building (£84.80 million). The engineering services segment contributes significantly more to the total revenue compared to the specialist building segment.

Renew Holdings, a notable player in the UK market, stands out with its strong financial health and strategic positioning. The company is debt-free, a significant improvement from five years ago when its debt to equity ratio was 32%. Over the past five years, earnings have grown at an impressive rate of 18.1% annually. Despite trailing the construction industry's recent growth of 18.7%, Renew's high-quality earnings and trading value—currently at 15% below estimated fair value—suggest potential for future appreciation. With positive free cash flow and no concerns over interest payments due to zero debt, Renew appears well-positioned for sustained performance.

- Click here and access our complete health analysis report to understand the dynamics of Renew Holdings.

Understand Renew Holdings' track record by examining our Past report.

Warpaint London (AIM:W7L)

Simply Wall St Value Rating: ★★★★★★

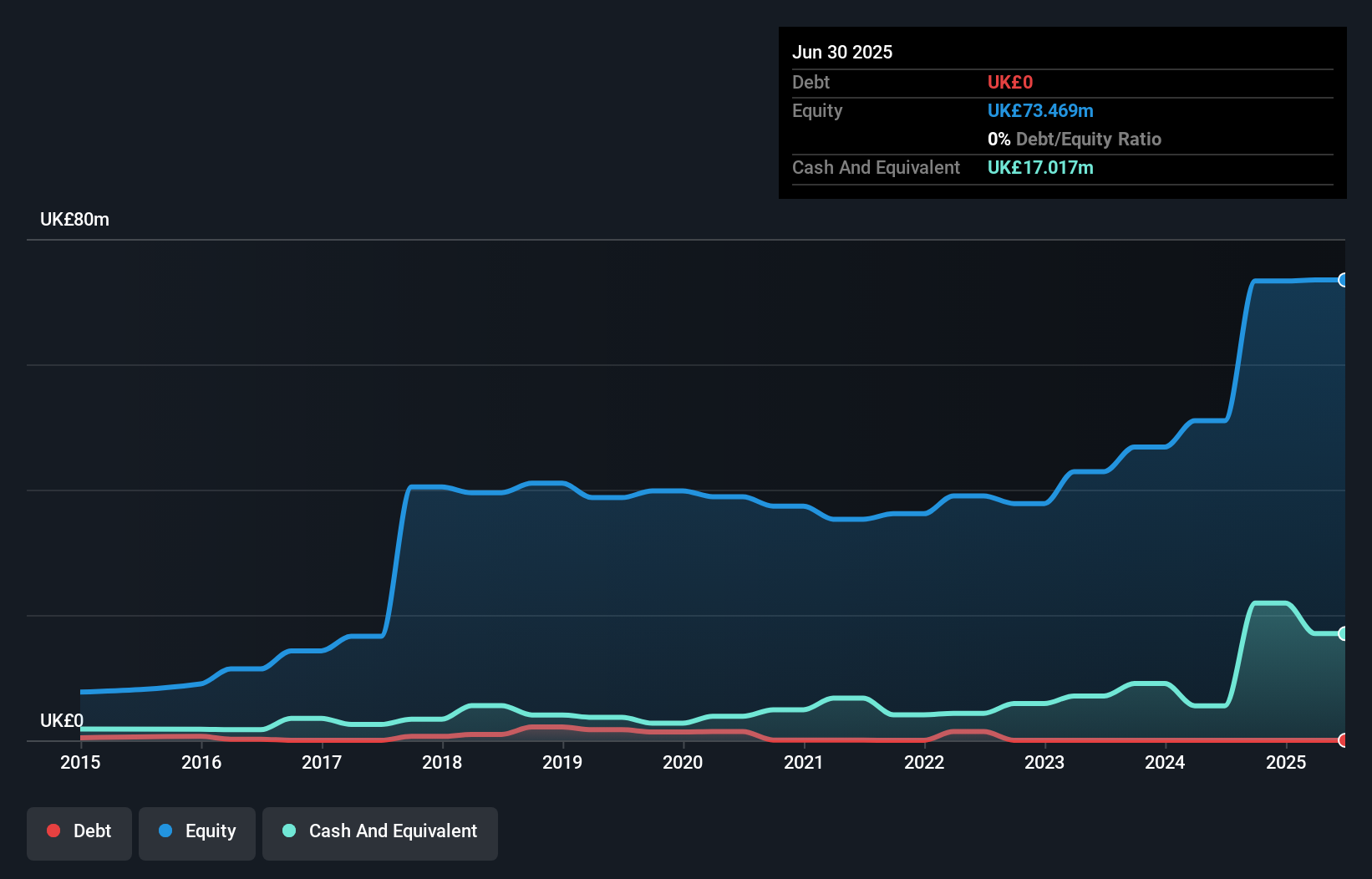

Overview: Warpaint London PLC, along with its subsidiaries, is engaged in the production and sale of cosmetics, with a market capitalization of £436.14 million.

Operations: The company's revenue primarily comes from its Own Brand segment, generating £96.72 million, while the Close-Out segment contributes £2.12 million.

Warpaint London, a dynamic player in the beauty sector, has shown robust financial health with impressive earnings growth of 106.1% over the past year, outpacing its industry peers. The company is debt-free, having reduced its debt-to-equity ratio from 4.4% five years ago to zero today. Recent half-year results revealed sales of £45.85 million and net income of £8.02 million, up from last year's figures of £36.69 million and £4.78 million respectively, highlighting strong profitability with basic earnings per share rising to £0.10 from £0.06 previously—an encouraging sign for potential investors considering future prospects in this vibrant market segment.

- Click to explore a detailed breakdown of our findings in Warpaint London's health report.

Assess Warpaint London's past performance with our detailed historical performance reports.

Yellow Cake (AIM:YCA)

Simply Wall St Value Rating: ★★★★★★

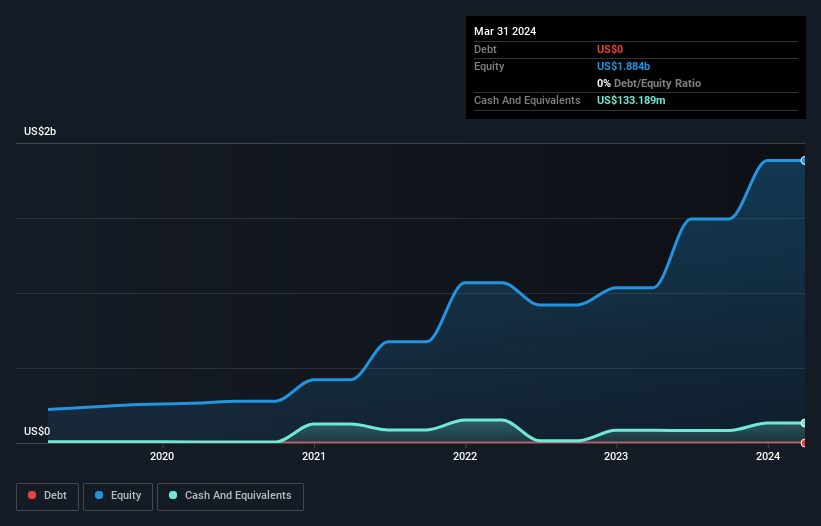

Overview: Yellow Cake plc operates in the uranium sector with a market capitalization of £1.28 billion.

Operations: Yellow Cake generates revenue primarily from holding U3O8 for long-term capital appreciation, amounting to $735.02 million.

Yellow Cake, a notable player in the uranium market, has shown impressive financial recovery with revenue of US$735 million for the year ending March 2024, bouncing back from a negative figure of US$96.9 million previously. The company turned its fortunes around with net income reaching US$727 million compared to a net loss of US$102.94 million last year. Its price-to-earnings ratio stands at an attractive 2.3x, significantly lower than the UK market average of 16.7x, suggesting potential undervaluation relative to peers and industry standards despite forecasted earnings decline over the next three years by an average of 78%.

- Delve into the full analysis health report here for a deeper understanding of Yellow Cake.

Gain insights into Yellow Cake's past trends and performance with our Past report.

Key Takeaways

- Click this link to deep-dive into the 81 companies within our UK Undiscovered Gems With Strong Fundamentals screener.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal