3 Dividend Stocks On SIX Swiss Exchange Yielding Up To 5%

The Swiss market has shown resilience, rebounding from a weak start to gain momentum as the European Central Bank's interest rate cut boosted investor confidence. With the SMI closing higher and several major companies posting gains, investors are increasingly looking at dividend stocks on the SIX Swiss Exchange for potential steady income in a fluctuating economic environment.

Top 10 Dividend Stocks In Switzerland

| Name | Dividend Yield | Dividend Rating |

| Cembra Money Bank (SWX:CMBN) | 5.05% | ★★★★★★ |

| Vaudoise Assurances Holding (SWX:VAHN) | 4.71% | ★★★★★★ |

| St. Galler Kantonalbank (SWX:SGKN) | 4.45% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.79% | ★★★★★★ |

| EFG International (SWX:EFGN) | 4.66% | ★★★★★☆ |

| TX Group (SWX:TXGN) | 4.32% | ★★★★★☆ |

| Julius Bär Gruppe (SWX:BAER) | 4.75% | ★★★★★☆ |

| Luzerner Kantonalbank (SWX:LUKN) | 3.77% | ★★★★★☆ |

| Basellandschaftliche Kantonalbank (SWX:BLKB) | 4.73% | ★★★★★☆ |

| DKSH Holding (SWX:DKSH) | 3.51% | ★★★★★☆ |

We'll examine a selection from our screener results.

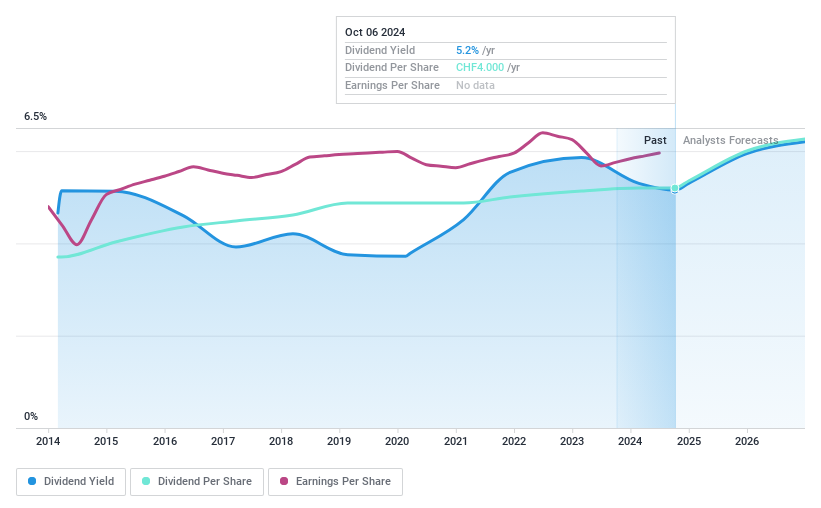

Cembra Money Bank (SWX:CMBN)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Cembra Money Bank AG is a Swiss company offering consumer finance products and services, with a market cap of CHF2.32 billion.

Operations: Cembra Money Bank AG generates its revenue through various consumer finance products and services in Switzerland.

Dividend Yield: 5.1%

Cembra Money Bank offers a compelling dividend profile, with stable and growing payouts over the past decade. Recent earnings reports show net income of CHF 78.34 million for the first half of 2024, supporting its reliable dividends. The bank's payout ratio is currently at a sustainable 72.7%, forecasted to improve to 69.3% in three years, ensuring dividend coverage by earnings remains strong. Additionally, its attractive yield ranks in the top quartile among Swiss dividend payers.

- Click here to discover the nuances of Cembra Money Bank with our detailed analytical dividend report.

- The valuation report we've compiled suggests that Cembra Money Bank's current price could be quite moderate.

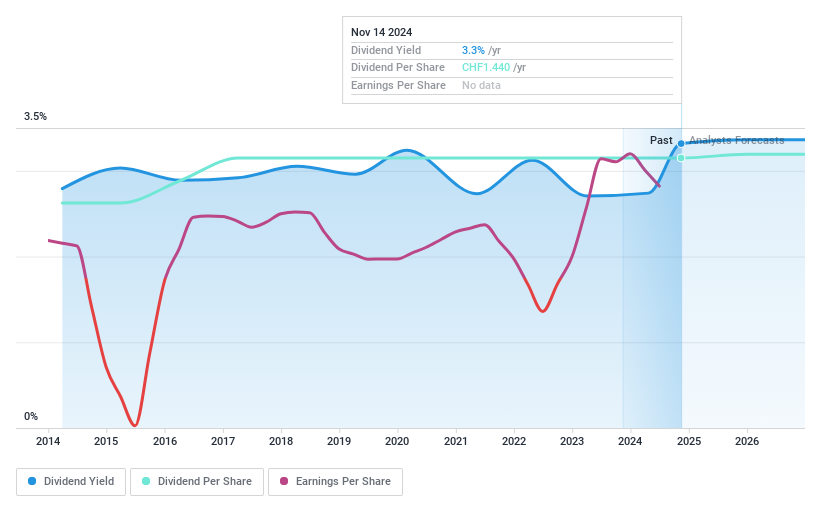

Romande Energie Holding (SWX:REHN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Romande Energie Holding SA is involved in the production, distribution, and marketing of electrical and thermal energy in Switzerland, with a market cap of CHF1.22 billion.

Operations: Romande Energie Holding SA generates revenue primarily from its Grids segment (CHF318.28 million), Energy Solutions (CHF486.76 million), and Romande Energie Services (CHF157.72 million).

Dividend Yield: 3%

Romande Energie Holding's dividends have grown steadily over the past decade, supported by a low payout ratio of 23.5%, indicating strong coverage by earnings. However, the dividend yield of 3.02% is modest compared to top Swiss payers, and concerns arise as dividends are not covered by free cash flows. Recent earnings show a decline in net income to CHF 65.28 million for H1 2024, reflecting challenges that may impact future payouts despite favorable valuation metrics like a low P/E ratio of 7.8x.

- Take a closer look at Romande Energie Holding's potential here in our dividend report.

- Our valuation report here indicates Romande Energie Holding may be undervalued.

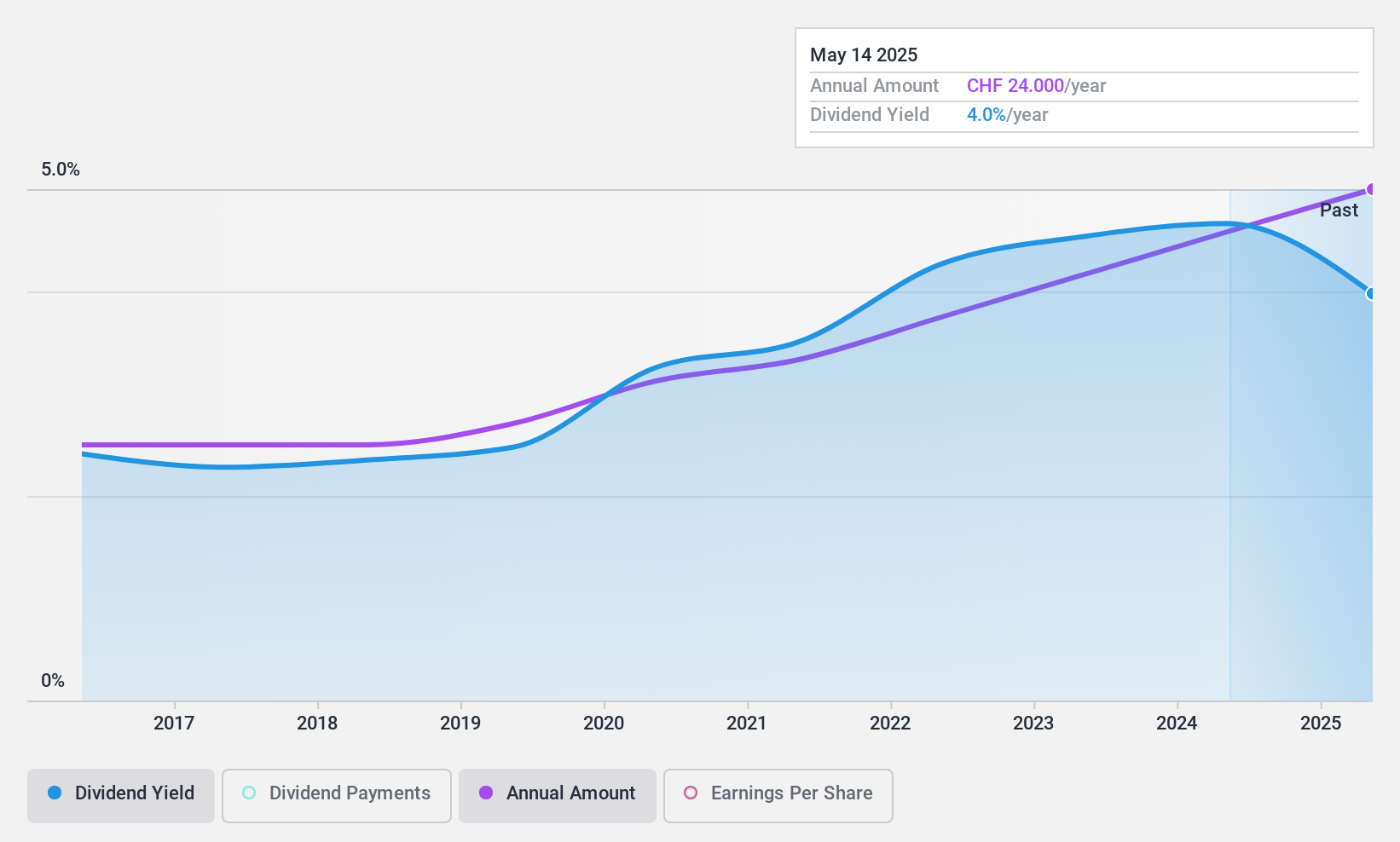

Vaudoise Assurances Holding (SWX:VAHN)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Vaudoise Assurances Holding SA offers insurance products and services mainly in Switzerland, with a market cap of CHF1.35 billion.

Operations: Vaudoise Assurances Holding SA generates revenue through its insurance products and services primarily in Switzerland.

Dividend Yield: 4.7%

Vaudoise Assurances Holding offers a compelling dividend profile with a yield of 4.71%, placing it among the top 25% of Swiss dividend payers. The dividends are well-supported by earnings and free cash flows, evidenced by payout ratios of 44.3% and 30.3%, respectively, ensuring sustainability. Over the past decade, dividends have been stable and growing without significant volatility. Recent earnings growth to CHF 81.17 million further solidifies its capacity to maintain robust payouts.

- Unlock comprehensive insights into our analysis of Vaudoise Assurances Holding stock in this dividend report.

- Our expertly prepared valuation report Vaudoise Assurances Holding implies its share price may be lower than expected.

Turning Ideas Into Actions

- Investigate our full lineup of 27 Top SIX Swiss Exchange Dividend Stocks right here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal