German Dividend Stocks To Consider In October 2024

As the German economy faces a forecasted contraction for a second consecutive year, recent reports highlight challenges such as declining factory orders, though industrial production has shown some resilience. Despite these economic hurdles, dividend stocks in Germany continue to attract attention for their potential to provide steady income streams amid market volatility. In this context, selecting strong dividend stocks involves assessing companies with stable earnings and robust cash flows that can sustain payouts even during economic downturns.

Top 10 Dividend Stocks In Germany

| Name | Dividend Yield | Dividend Rating |

| Edel SE KGaA (XTRA:EDL) | 6.28% | ★★★★★★ |

| Deutsche Post (XTRA:DHL) | 4.88% | ★★★★★★ |

| SAF-Holland (XTRA:SFQ) | 5.99% | ★★★★★☆ |

| OVB Holding (XTRA:O4B) | 4.69% | ★★★★★☆ |

| INDUS Holding (XTRA:INH) | 5.65% | ★★★★★☆ |

| Uzin Utz (XTRA:UZU) | 3.28% | ★★★★★☆ |

| Mercedes-Benz Group (XTRA:MBG) | 9.31% | ★★★★★☆ |

| Allianz (XTRA:ALV) | 4.56% | ★★★★★☆ |

| FRoSTA (DB:NLM) | 3.25% | ★★★★★☆ |

| MVV Energie (XTRA:MVV1) | 3.73% | ★★★★★☆ |

Click here to see the full list of 33 stocks from our Top German Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

Edel SE KGaA (XTRA:EDL)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Edel SE & Co. KGaA, along with its subsidiaries, functions as an independent music company in Europe with a market cap of €101.69 million.

Operations: Edel SE & Co. KGaA, along with its subsidiaries, operates as an independent music company in Europe.

Dividend Yield: 6.3%

Edel SE KGaA offers an attractive dividend yield of 6.28%, placing it among the top 25% of dividend payers in Germany. Its dividends are well-covered by earnings (payout ratio: 52.7%) and cash flows (cash payout ratio: 71%), indicating sustainability. Despite a high debt level, its financial position supports stable and reliable dividends over the past decade, with consistent growth in payments. The stock trades at a good value relative to peers and industry standards, enhancing its appeal for income-focused investors.

- Navigate through the intricacies of Edel SE KGaA with our comprehensive dividend report here.

- In light of our recent valuation report, it seems possible that Edel SE KGaA is trading behind its estimated value.

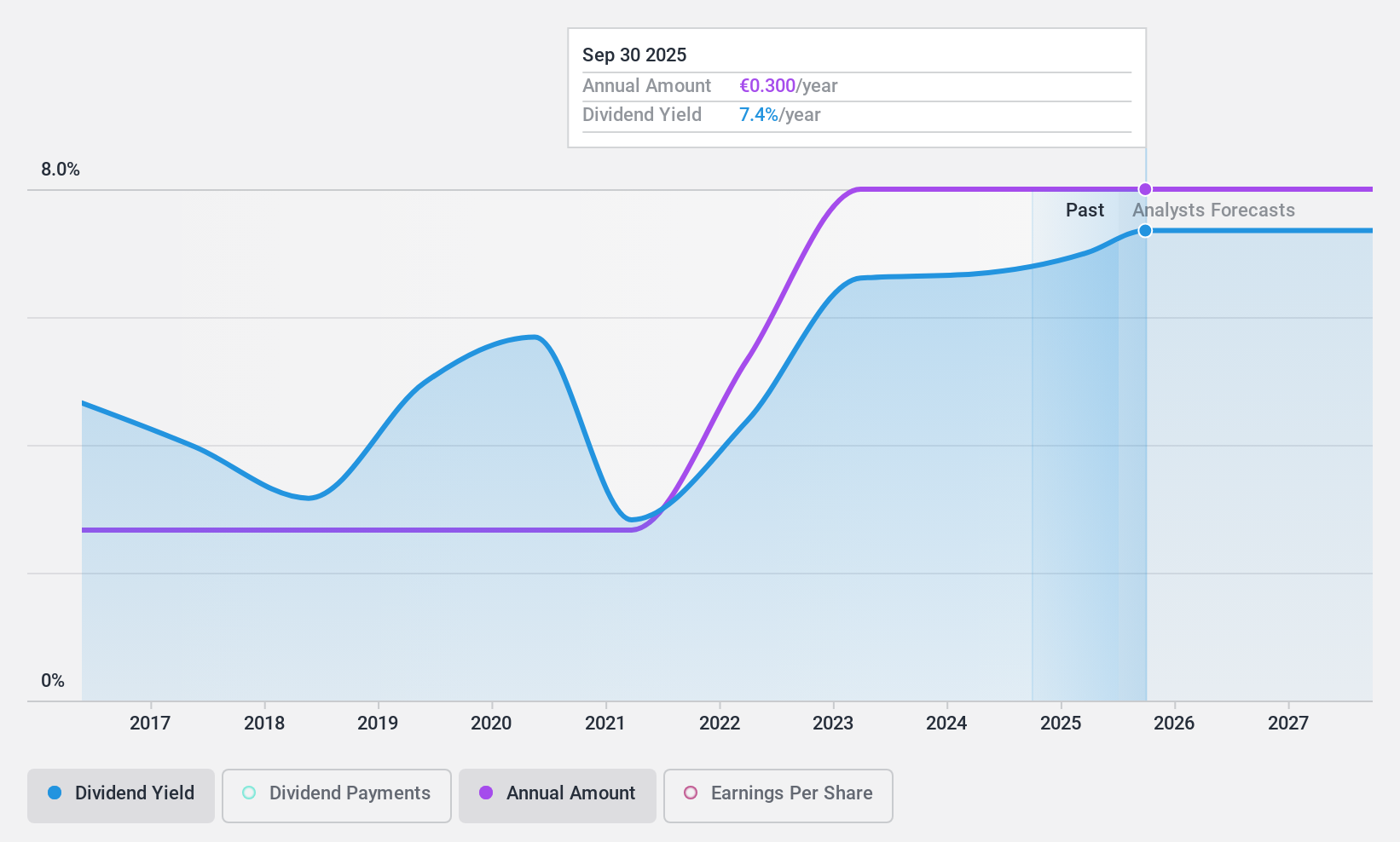

PWO (XTRA:PWO)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: PWO AG manufactures and sells lightweight construction aluminum sheet components made of steel for the mobility industry across Germany, Czechia, Canada, Mexico, Serbia, and China with a market cap of €93.13 million.

Operations: PWO AG generates revenue primarily from its Auto Parts & Accessories segment, amounting to €564.29 million.

Dividend Yield: 5.9%

PWO's dividend yield of 5.87% ranks it in the top 25% of German dividend payers, with payments well-covered by earnings (38% payout ratio) and cash flows (19.5% cash payout ratio). However, the company's dividends have been volatile over the past decade, with significant drops. Recent earnings show a decline in net income to €3.4 million for Q2 2024 from €5.4 million a year ago, impacting overall financial stability.

- Delve into the full analysis dividend report here for a deeper understanding of PWO.

- According our valuation report, there's an indication that PWO's share price might be on the cheaper side.

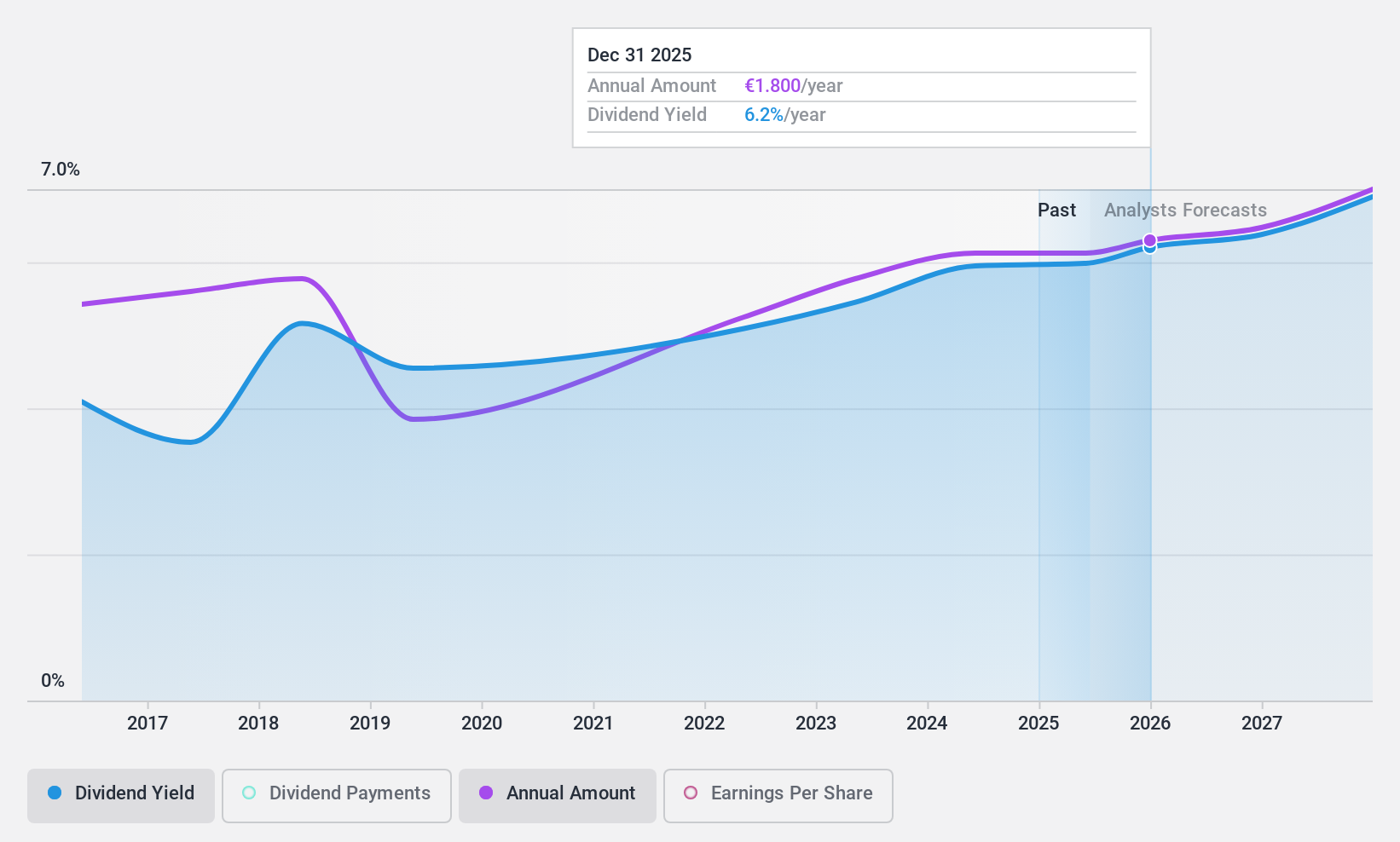

Südzucker (XTRA:SZU)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Südzucker AG is a company that produces and sells sugar products across Germany, the European Union, the United Kingdom, the United States, and internationally with a market cap of €2.21 billion.

Operations: Südzucker AG's revenue is derived from several segments, including Fruit (€1.60 billion), Sugar (€4.62 billion), Starch (€1.11 billion), CropEnergies (€1.13 billion), and Special Products excluding Starch (€2.37 billion).

Dividend Yield: 8.3%

Südzucker's dividend yield of 8.31% places it among the top 25% of German dividend payers, supported by a payout ratio of 54.7% and a cash payout ratio of 48.2%. Despite this, dividends have been volatile over the past decade, with fluctuating payments. Recent earnings reveal a decline in net income to €59 million for Q2 2024 from €189 million the previous year, indicating challenges in maintaining financial performance amidst high debt levels.

- Click to explore a detailed breakdown of our findings in Südzucker's dividend report.

- Our valuation report here indicates Südzucker may be undervalued.

Taking Advantage

- Discover the full array of 33 Top German Dividend Stocks right here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal