Helens International Holdings Company Limited's (HKG:9869) P/S Is Still On The Mark Following 62% Share Price Bounce

Helens International Holdings Company Limited (HKG:9869) shares have had a really impressive month, gaining 62% after a shaky period beforehand. Still, the 30-day jump doesn't change the fact that longer term shareholders have seen their stock decimated by the 59% share price drop in the last twelve months.

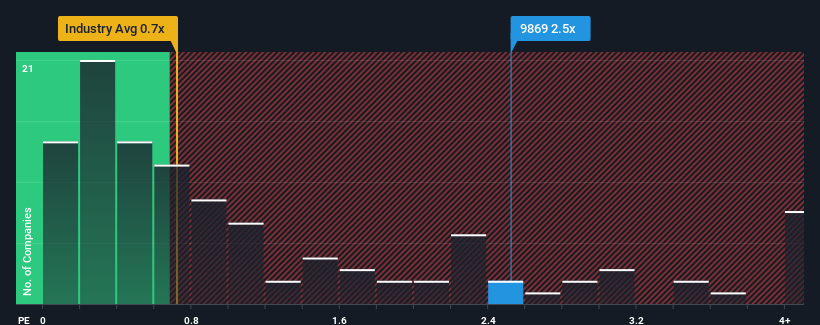

Following the firm bounce in price, when almost half of the companies in Hong Kong's Hospitality industry have price-to-sales ratios (or "P/S") below 0.7x, you may consider Helens International Holdings as a stock probably not worth researching with its 2.5x P/S ratio. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Helens International Holdings

What Does Helens International Holdings' Recent Performance Look Like?

While the industry has experienced revenue growth lately, Helens International Holdings' revenue has gone into reverse gear, which is not great. One possibility is that the P/S ratio is high because investors think this poor revenue performance will turn the corner. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Helens International Holdings.Is There Enough Revenue Growth Forecasted For Helens International Holdings?

The only time you'd be truly comfortable seeing a P/S as high as Helens International Holdings' is when the company's growth is on track to outshine the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 33%. The last three years don't look nice either as the company has shrunk revenue by 36% in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 21% as estimated by the eight analysts watching the company. With the industry only predicted to deliver 17%, the company is positioned for a stronger revenue result.

With this in mind, it's not hard to understand why Helens International Holdings' P/S is high relative to its industry peers. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Bottom Line On Helens International Holdings' P/S

Helens International Holdings' P/S is on the rise since its shares have risen strongly. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of Helens International Holdings' analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. Unless these conditions change, they will continue to provide strong support to the share price.

Before you take the next step, you should know about the 2 warning signs for Helens International Holdings that we have uncovered.

If these risks are making you reconsider your opinion on Helens International Holdings, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal