The 5.4% return this week takes Anhui Jianghuai Automobile GroupLtd's (SHSE:600418) shareholders five-year gains to 497%

Buying shares in the best businesses can build meaningful wealth for you and your family. And highest quality companies can see their share prices grow by huge amounts. To wit, the Anhui Jianghuai Automobile Group Corp.,Ltd. (SHSE:600418) share price has soared 492% over five years. And this is just one example of the epic gains achieved by some long term investors. It's also good to see the share price up 55% over the last quarter.

Since the stock has added CN¥3.4b to its market cap in the past week alone, let's see if underlying performance has been driving long-term returns.

Check out our latest analysis for Anhui Jianghuai Automobile GroupLtd

While Anhui Jianghuai Automobile GroupLtd made a small profit, in the last year, we think that the market is probably more focussed on the top line growth at the moment. As a general rule, we think this kind of company is more comparable to loss-making stocks, since the actual profit is so low. For shareholders to have confidence a company will grow profits significantly, it must grow revenue.

In the last 5 years Anhui Jianghuai Automobile GroupLtd saw its revenue shrink by 2.9% per year. This is in stark contrast to the strong share price growth of 43%, compound, per year. Obviously, whatever the market is excited about, it's not a track record of revenue growth. At the risk of upsetting holders, this does suggest that hope for a better future is playing a significant role in the share price action.

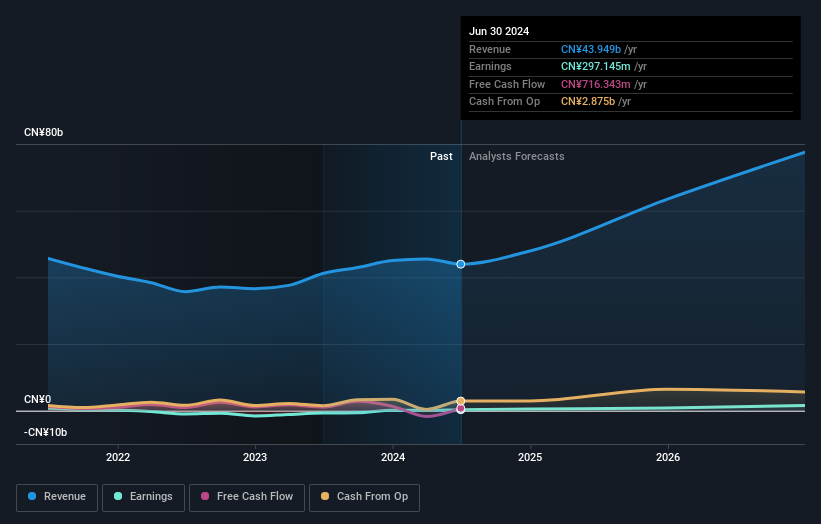

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. You can see what analysts are predicting for Anhui Jianghuai Automobile GroupLtd in this interactive graph of future profit estimates.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. We note that for Anhui Jianghuai Automobile GroupLtd the TSR over the last 5 years was 497%, which is better than the share price return mentioned above. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

It's good to see that Anhui Jianghuai Automobile GroupLtd has rewarded shareholders with a total shareholder return of 113% in the last twelve months. Of course, that includes the dividend. That's better than the annualised return of 43% over half a decade, implying that the company is doing better recently. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Consider for instance, the ever-present spectre of investment risk. We've identified 2 warning signs with Anhui Jianghuai Automobile GroupLtd , and understanding them should be part of your investment process.

We will like Anhui Jianghuai Automobile GroupLtd better if we see some big insider buys. While we wait, check out this free list of undervalued stocks (mostly small caps) with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal