3 Chinese Exchange Stocks Priced Below Estimated Value

As optimism about Beijing's stimulus measures waned, Chinese equities experienced a decline over a holiday-shortened week, with the Shanghai Composite Index and the CSI 300 both posting losses. This environment of cautious sentiment presents an opportunity for investors to explore stocks that may be undervalued relative to their estimated value, offering potential for growth as market conditions evolve.

Top 10 Undervalued Stocks Based On Cash Flows In China

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| HangzhouS MedTech (SHSE:688581) | CN¥56.06 | CN¥109.32 | 48.7% |

| Wuhan Keqian BiologyLtd (SHSE:688526) | CN¥12.93 | CN¥25.45 | 49.2% |

| Range Intelligent Computing Technology Group (SZSE:300442) | CN¥30.25 | CN¥58.42 | 48.2% |

| Shandong Bailong Chuangyuan Bio-Tech (SHSE:605016) | CN¥17.50 | CN¥33.11 | 47.2% |

| Neusoft (SHSE:600718) | CN¥9.70 | CN¥19.28 | 49.7% |

| Seres GroupLtd (SHSE:601127) | CN¥90.00 | CN¥171.85 | 47.6% |

| Jiangsu Hongdou IndustrialLTD (SHSE:600400) | CN¥2.18 | CN¥4.08 | 46.6% |

| Shandong Weigao Orthopaedic Device (SHSE:688161) | CN¥25.25 | CN¥48.21 | 47.6% |

| Yangmei ChemicalLtd (SHSE:600691) | CN¥2.00 | CN¥3.89 | 48.6% |

| Jiangsu Chuanzhiboke Education Technology (SZSE:003032) | CN¥10.19 | CN¥19.19 | 46.9% |

Below we spotlight a couple of our favorites from our exclusive screener.

Aerospace CH UAVLtd (SZSE:002389)

Overview: Aerospace CH UAV Co., Ltd operates in China, focusing on the research, development, production, maintenance, and sale of capacitor films with a market capitalization of CN¥17.89 billion.

Operations: Aerospace CH UAV Co., Ltd generates its revenue from the research, development, production, maintenance, and sale of capacitor films in China.

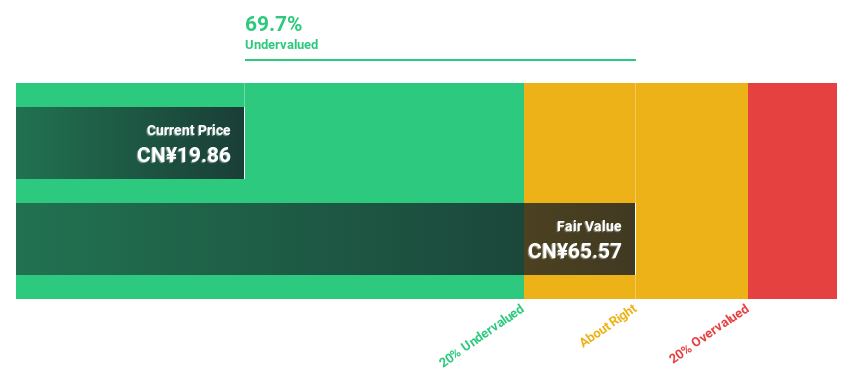

Estimated Discount To Fair Value: 30.2%

Aerospace CH UAV Ltd. is trading at CN¥18.06, significantly below its estimated fair value of CN¥25.89, suggesting it may be undervalued based on cash flows. Despite a decline in profit margins from 9.9% to 3.8%, earnings are forecasted to grow at 42.87% annually, outpacing the Chinese market's growth rate of 23.4%. Recent earnings showed a decrease in revenue and net income compared to last year, highlighting potential challenges ahead.

- The analysis detailed in our Aerospace CH UAVLtd growth report hints at robust future financial performance.

- Click here and access our complete balance sheet health report to understand the dynamics of Aerospace CH UAVLtd.

Sichuan Jiuyuan Yinhai Software.Co.Ltd (SZSE:002777)

Overview: Sichuan Jiuyuan Yinhai Software Co., Ltd offers medical insurance, digital government affairs, and smart city services to government departments and industry entities in China, with a market cap of CN¥7.99 billion.

Operations: The company's revenue segments consist of CN¥707.64 million from medical health insurance, CN¥443.39 million from digital government services, and CN¥61.83 million from smart city solutions.

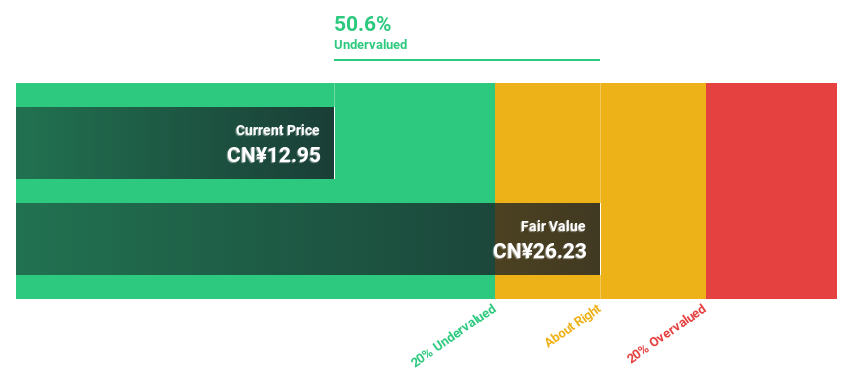

Estimated Discount To Fair Value: 46.2%

Sichuan Jiuyuan Yinhai Software.Co.Ltd. is trading at CN¥19.57, considerably below its estimated fair value of CN¥36.36, indicating potential undervaluation based on cash flows. Despite a drop in profit margins from 13.7% to 7.7%, earnings are projected to grow significantly at 34.94% annually, surpassing the Chinese market's growth rate of 23.4%. Recent earnings revealed declines in revenue and net income compared to last year, presenting ongoing challenges for the company.

- In light of our recent growth report, it seems possible that Sichuan Jiuyuan Yinhai Software.Co.Ltd's financial performance will exceed current levels.

- Take a closer look at Sichuan Jiuyuan Yinhai Software.Co.Ltd's balance sheet health here in our report.

Thunder Software TechnologyLtd (SZSE:300496)

Overview: Thunder Software Technology Co., Ltd. develops operating-system products for various international markets, including China, Europe, the United States, and Japan, with a market cap of CN¥27.31 billion.

Operations: Thunder Software Technology Co., Ltd. generates revenue from its operating-system products across China, Europe, the United States, Japan, and other international markets.

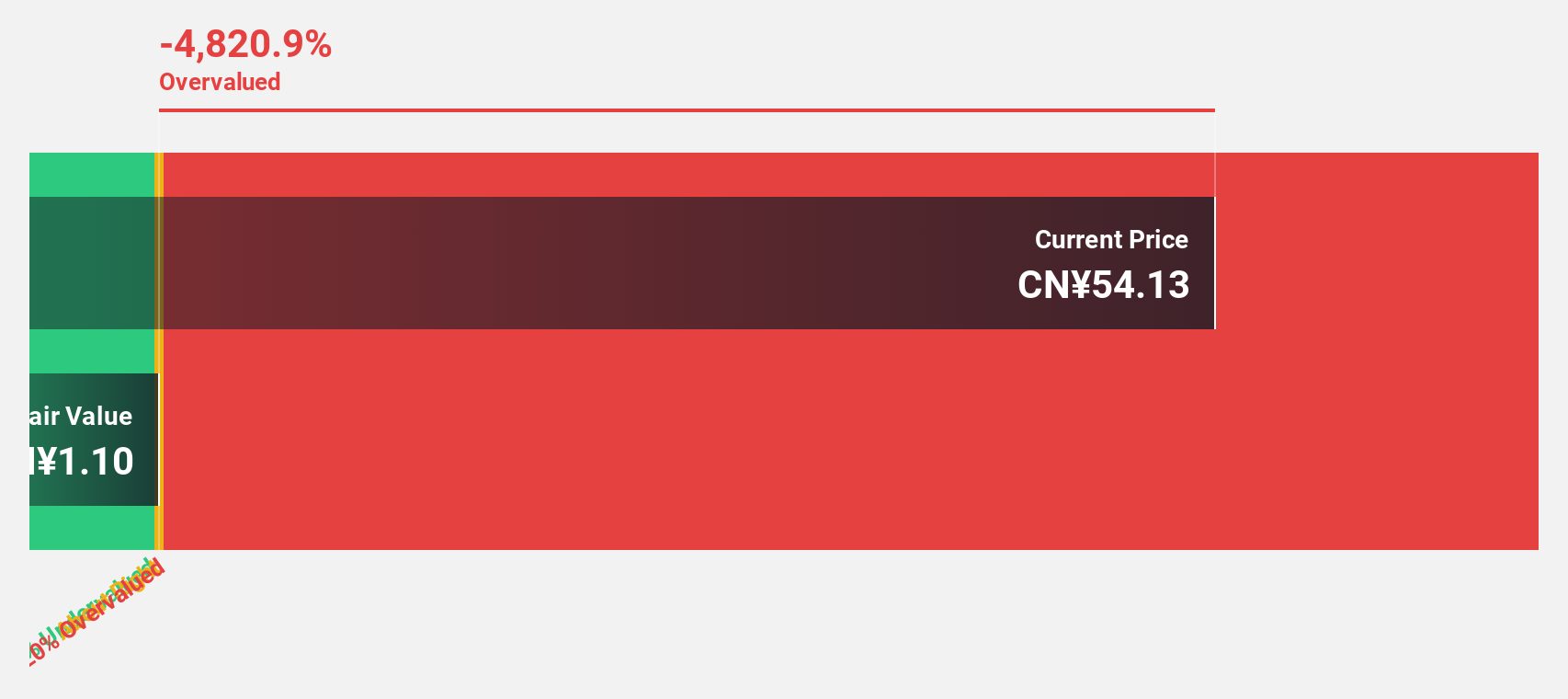

Estimated Discount To Fair Value: 42.6%

Thunder Software Technology Ltd. is trading at CN¥59.47, significantly below its estimated fair value of CN¥103.52, highlighting potential undervaluation based on cash flows. Despite a decline in profit margins from 14% to 3.5%, earnings are expected to grow substantially at 34.4% annually, outpacing the Chinese market's growth rate of 23.4%. Recent results showed a decrease in revenue and net income compared to last year, reflecting current operational challenges.

- Insights from our recent growth report point to a promising forecast for Thunder Software TechnologyLtd's business outlook.

- Navigate through the intricacies of Thunder Software TechnologyLtd with our comprehensive financial health report here.

Seize The Opportunity

- Gain an insight into the universe of 108 Undervalued Chinese Stocks Based On Cash Flows by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal