Anhui Jianghuai Automobile Group Corp.,Ltd. (SHSE:600418) Looks Just Right With A 37% Price Jump

Anhui Jianghuai Automobile Group Corp.,Ltd. (SHSE:600418) shares have continued their recent momentum with a 37% gain in the last month alone. The annual gain comes to 113% following the latest surge, making investors sit up and take notice.

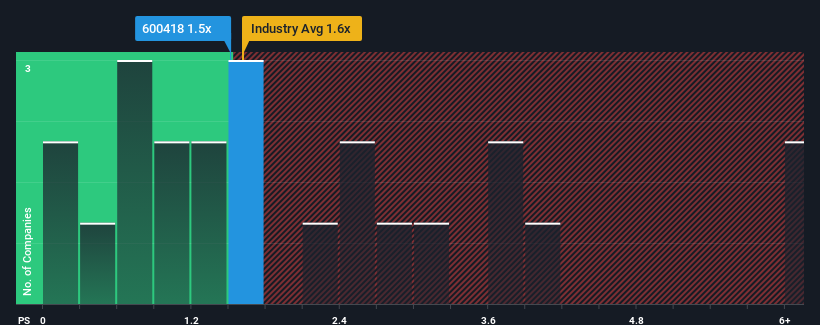

Even after such a large jump in price, you could still be forgiven for feeling indifferent about Anhui Jianghuai Automobile GroupLtd's P/S ratio of 1.5x, since the median price-to-sales (or "P/S") ratio for the Auto industry in China is also close to 1.6x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

View our latest analysis for Anhui Jianghuai Automobile GroupLtd

What Does Anhui Jianghuai Automobile GroupLtd's P/S Mean For Shareholders?

With revenue growth that's inferior to most other companies of late, Anhui Jianghuai Automobile GroupLtd has been relatively sluggish. Perhaps the market is expecting future revenue performance to lift, which has kept the P/S from declining. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on Anhui Jianghuai Automobile GroupLtd will help you uncover what's on the horizon.How Is Anhui Jianghuai Automobile GroupLtd's Revenue Growth Trending?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Anhui Jianghuai Automobile GroupLtd's to be considered reasonable.

Retrospectively, the last year delivered a decent 6.7% gain to the company's revenues. However, this wasn't enough as the latest three year period has seen an unpleasant 3.7% overall drop in revenue. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Shifting to the future, estimates from the eight analysts covering the company suggest revenue should grow by 25% per year over the next three years. With the industry predicted to deliver 25% growth per year, the company is positioned for a comparable revenue result.

With this information, we can see why Anhui Jianghuai Automobile GroupLtd is trading at a fairly similar P/S to the industry. It seems most investors are expecting to see average future growth and are only willing to pay a moderate amount for the stock.

The Final Word

Anhui Jianghuai Automobile GroupLtd appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our look at Anhui Jianghuai Automobile GroupLtd's revenue growth estimates show that its P/S is about what we expect, as both metrics follow closely with the industry averages. At this stage investors feel the potential for an improvement or deterioration in revenue isn't great enough to push P/S in a higher or lower direction. Unless these conditions change, they will continue to support the share price at these levels.

And what about other risks? Every company has them, and we've spotted 2 warning signs for Anhui Jianghuai Automobile GroupLtd you should know about.

If you're unsure about the strength of Anhui Jianghuai Automobile GroupLtd's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal