3 Undervalued Small Caps In Australia With Notable Insider Activity

Over the last 7 days, the Australian market has risen by 1.1%, contributing to a robust 17% increase over the past year, with earnings anticipated to grow by 12% annually in the coming years. In this dynamic environment, identifying stocks that are attractively priced and exhibit notable insider activity can offer valuable insights into potential opportunities within the small-cap sector.

Top 10 Undervalued Small Caps With Insider Buying In Australia

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Magellan Financial Group | 8.4x | 5.3x | 30.24% | ★★★★★☆ |

| GWA Group | 17.0x | 1.6x | 39.87% | ★★★★★☆ |

| SHAPE Australia | 14.6x | 0.3x | 32.45% | ★★★★☆☆ |

| Collins Foods | 18.5x | 0.7x | 4.76% | ★★★★☆☆ |

| Bapcor | NA | 0.8x | 46.03% | ★★★★☆☆ |

| Aurelia Metals | NA | 1.1x | 49.22% | ★★★★☆☆ |

| Tabcorp Holdings | NA | 0.5x | 19.21% | ★★★★☆☆ |

| Fiducian Group | 18.4x | 3.4x | 4.77% | ★★★☆☆☆ |

| Dicker Data | 21.0x | 0.7x | -72.51% | ★★★☆☆☆ |

| Coventry Group | 239.6x | 0.4x | -18.55% | ★★★☆☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

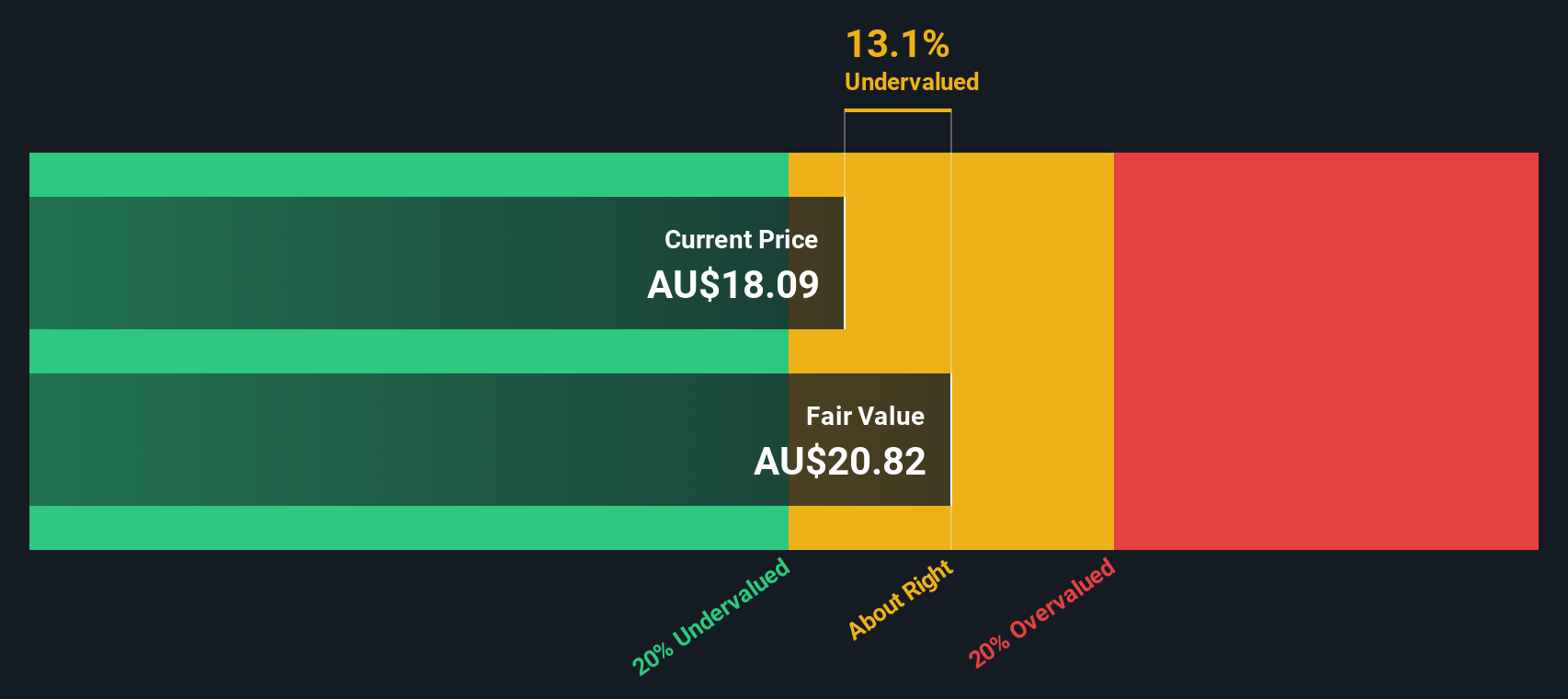

Eagers Automotive (ASX:APE)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Eagers Automotive operates primarily in the car retailing sector, with a market capitalization of A$3.93 billion.

Operations: Car Retailing is the primary revenue stream, contributing significantly to total earnings. The company's cost structure is dominated by COGS, which impacts its gross profit margin, recorded at 18.17% as of October 2024. Operating expenses and non-operating expenses also play a substantial role in financial outcomes.

PE: 11.5x

Eagers Automotive, a contender among smaller Australian stocks, shows potential despite some financial challenges. Recent insider confidence is evident as Nicholas Politis acquired 200,000 shares for A$2.09 million between July and October 2024. The company's sales rose to A$5.46 billion in the first half of 2024 from A$4.82 billion a year earlier, yet net income dipped to A$116 million from A$137.76 million. While relying on external borrowing adds risk, its consistent dividend payments reflect stability and potential growth opportunities ahead.

- Click here and access our complete valuation analysis report to understand the dynamics of Eagers Automotive.

Explore historical data to track Eagers Automotive's performance over time in our Past section.

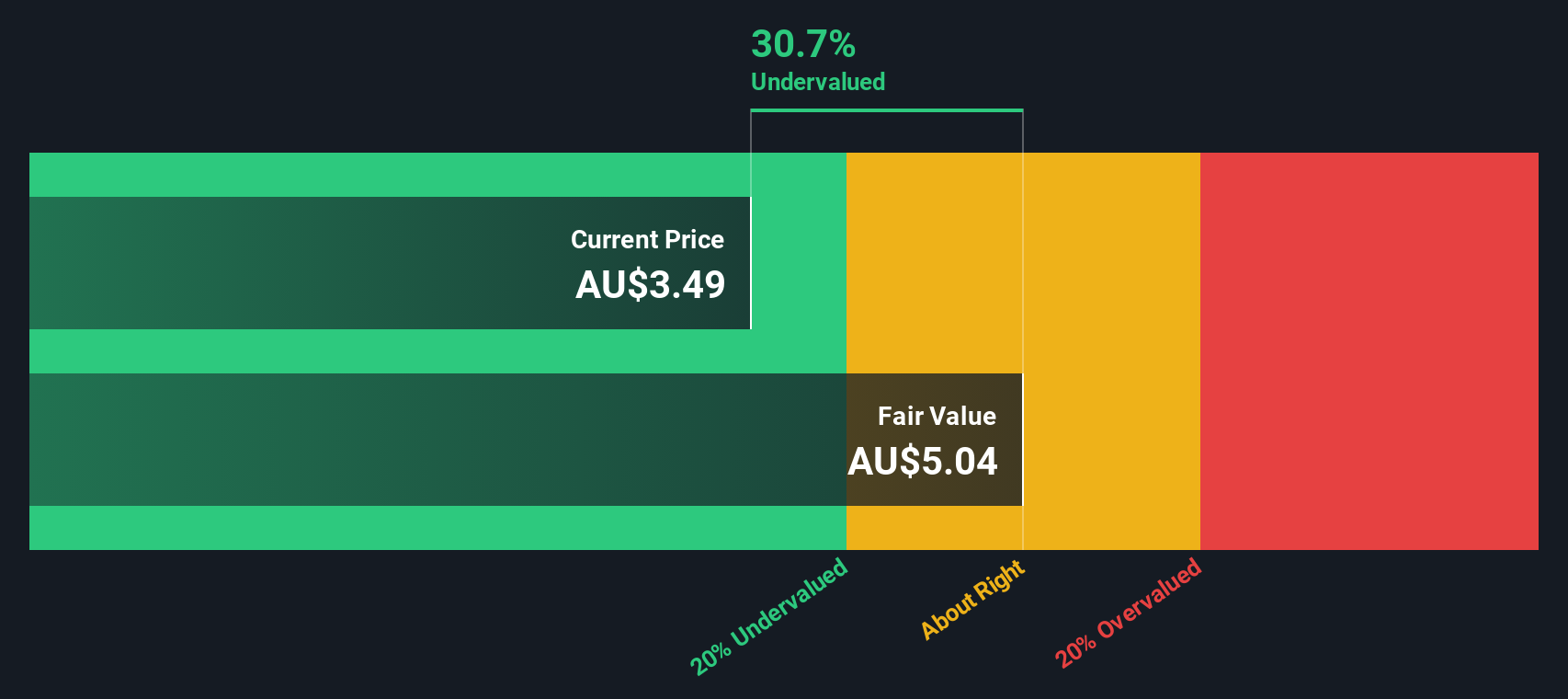

Insignia Financial (ASX:IFL)

Simply Wall St Value Rating: ★★★★★☆

Overview: Insignia Financial operates as a comprehensive financial services provider, offering advice, platforms, and asset management solutions, with a market capitalization of A$2.55 billion.

Operations: The company generates revenue primarily from Platforms (A$1.16 billion), Advice (A$527.9 million), and Asset Management (A$222.8 million). The gross profit margin has shown variability, reaching 36.72% recently. Operating expenses are a significant cost component, with general and administrative expenses being the largest at A$286.4 million in the latest period analyzed.

PE: -11.3x

Insignia Financial, a smaller Australian company, has recently caught attention due to insider confidence demonstrated by Allan Griffiths purchasing 100,000 shares for A$231,564 in September 2024. Despite reporting a net loss of A$185.3 million for the year ending June 2024 compared to a prior net income of A$51.4 million, earnings are projected to grow by over 51% annually. The company relies solely on riskier external borrowing for funding and has undergone some executive changes recently.

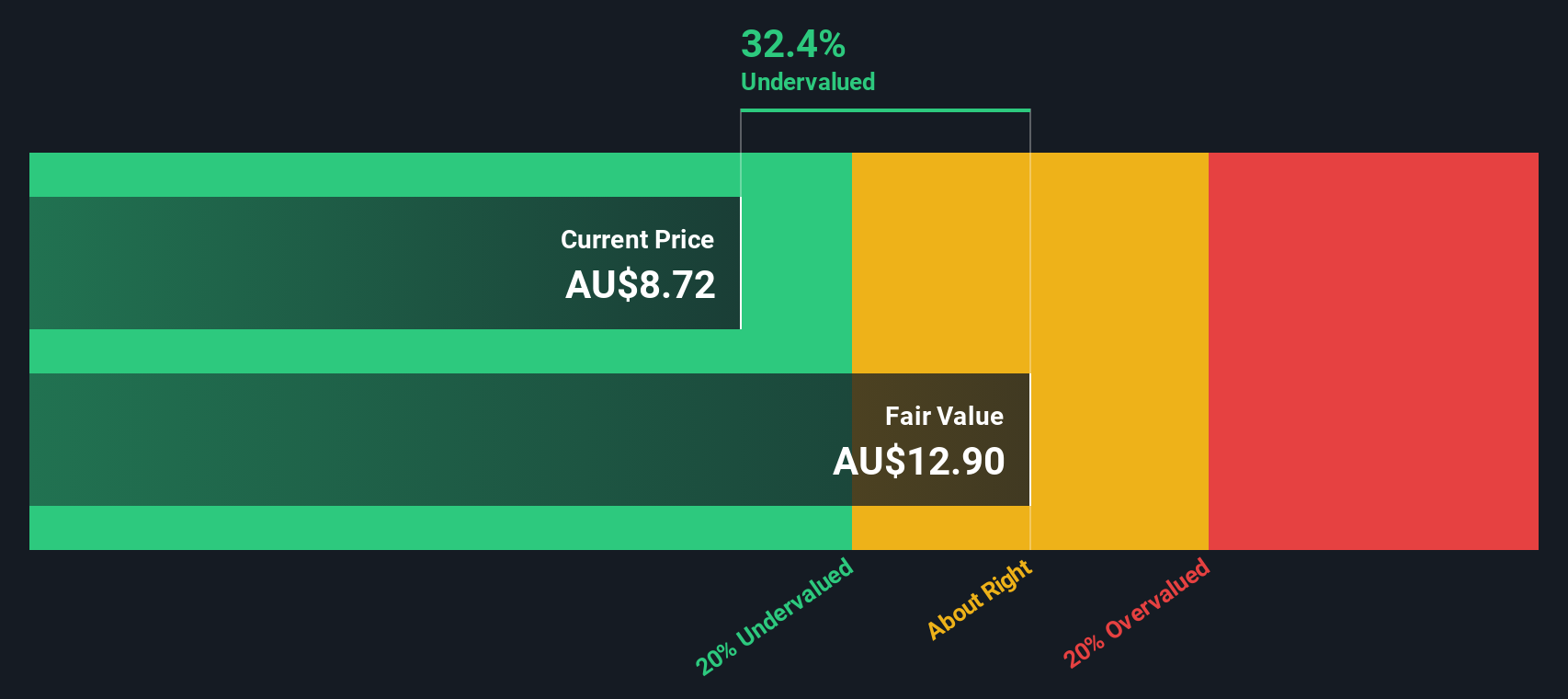

Magellan Financial Group (ASX:MFG)

Simply Wall St Value Rating: ★★★★★☆

Overview: Magellan Financial Group is an Australian-based investment management company with operations primarily in investment management services, fund investments, and corporate activities, boasting a market capitalization of A$3.5 billion.

Operations: Magellan Financial Group's revenue streams are primarily driven by Investment Management Services, followed by Fund Investments and Corporate activities. The company has experienced fluctuations in its gross profit margin, reaching 90.26% at its peak and declining to 72.86% more recently. Operating expenses include significant allocations for general and administrative costs, alongside sales and marketing expenditures.

PE: 8.4x

Magellan Financial Group, a smaller player in Australia's financial sector, showcases intriguing potential. Despite forecasts of a 9.2% annual earnings decline over the next three years, its recent performance tells a different story. The company reported A$238.76 million in net income for the year ending June 2024, up from A$182.66 million previously, indicating resilience amidst challenges. With insider confidence reflected through significant share repurchases totaling A$52.47 million since March 2022 and an extended buyback plan until April 2025, there's optimism about future stability and growth prospects despite reliance on external borrowing for funding needs.

- Delve into the full analysis valuation report here for a deeper understanding of Magellan Financial Group.

Understand Magellan Financial Group's track record by examining our Past report.

Seize The Opportunity

- Take a closer look at our Undervalued ASX Small Caps With Insider Buying list of 24 companies by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal