Discovering Undiscovered Gems in South Korea October 2024

In the last week, the South Korean market has stayed flat but is up 4.1% over the past year, with earnings forecast to grow by 29% annually. In this environment, identifying stocks that are poised for growth can be particularly rewarding as they may offer unique opportunities amidst stable market conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In South Korea

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Samyang | 49.49% | 6.68% | 23.96% | ★★★★★★ |

| Korea Cast Iron Pipe Ind | NA | 1.97% | 8.84% | ★★★★★★ |

| Korea Airport ServiceLtd | NA | 3.97% | 42.22% | ★★★★★★ |

| Miwon Chemicals | 0.08% | 11.70% | 14.38% | ★★★★★★ |

| NOROO PAINT & COATINGS | 13.99% | 5.04% | 7.74% | ★★★★★★ |

| Korea Ratings | NA | 1.13% | 0.54% | ★★★★★★ |

| Woori Technology Investment | NA | 25.66% | -1.45% | ★★★★★★ |

| Synergy Innovation | 12.39% | 12.87% | 28.82% | ★★★★★★ |

| Oriental Precision & EngineeringLtd | 54.53% | 3.14% | 0.80% | ★★★★★☆ |

| Itcen | 64.57% | 14.33% | -24.39% | ★★★★★☆ |

Underneath we present a selection of stocks filtered out by our screen.

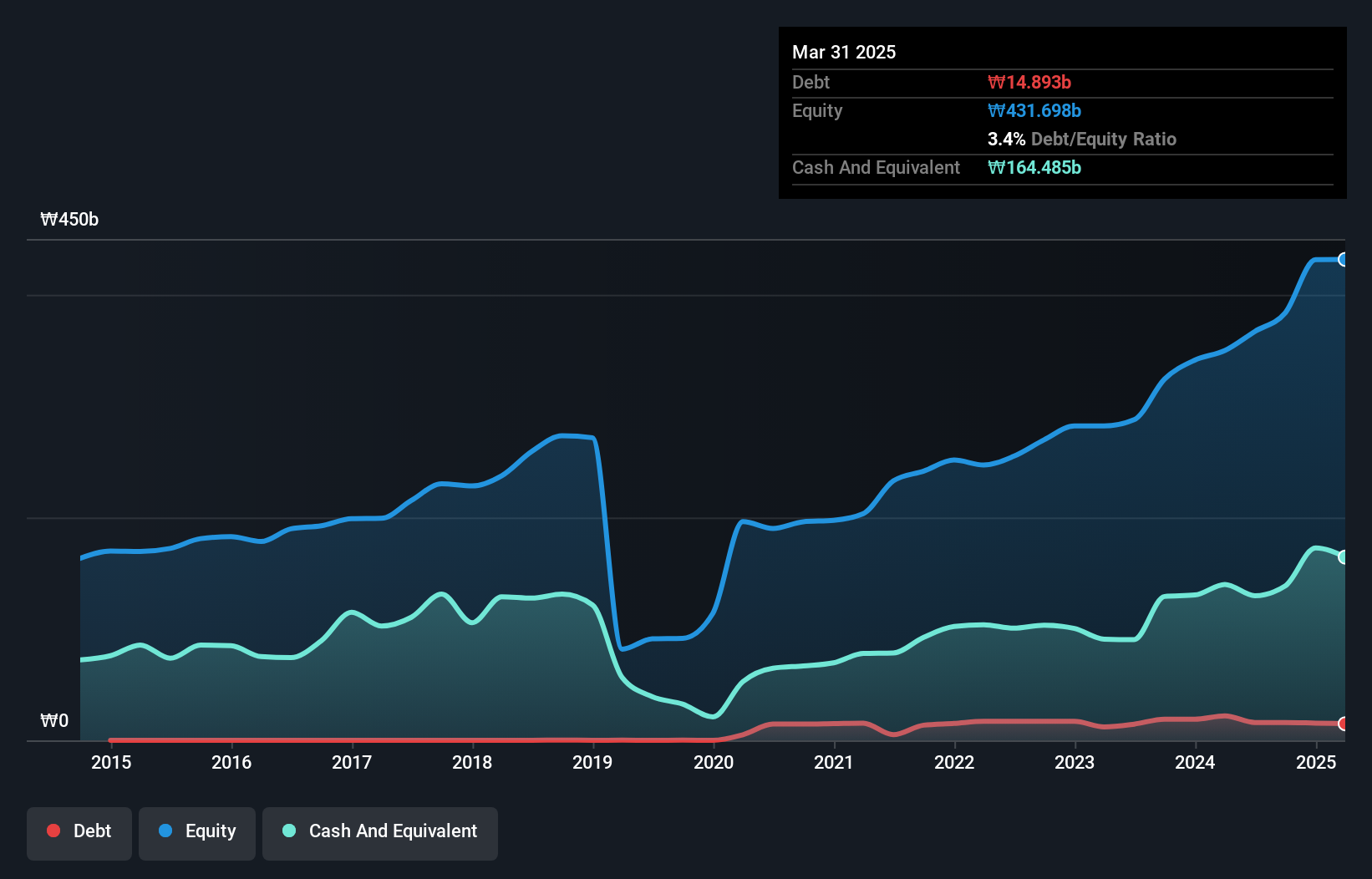

PSK HOLDINGS (KOSDAQ:A031980)

Simply Wall St Value Rating: ★★★★★☆

Overview: PSK HOLDINGS Inc. is engaged in the global production and sale of semiconductor manufacturing and flat panel display equipment, with a market capitalization of ₩1.18 trillion.

Operations: PSK generates revenue primarily from its semiconductor manufacturing equipment segment, which accounts for ₩132.98 billion.

PSK Holdings, recently added to the S&P Global BMI Index, has shown impressive earnings growth of 40.8% over the past year, outpacing the semiconductor industry's -10%. Despite a volatile share price and shareholder dilution, it remains financially sound with more cash than total debt and positive free cash flow. A notable ₩26.4 billion one-off gain influenced recent results, while future earnings are forecasted to grow at 20.74% annually, indicating potential for continued success in its sector.

- Get an in-depth perspective on PSK HOLDINGS' performance by reading our health report here.

Gain insights into PSK HOLDINGS' past trends and performance with our Past report.

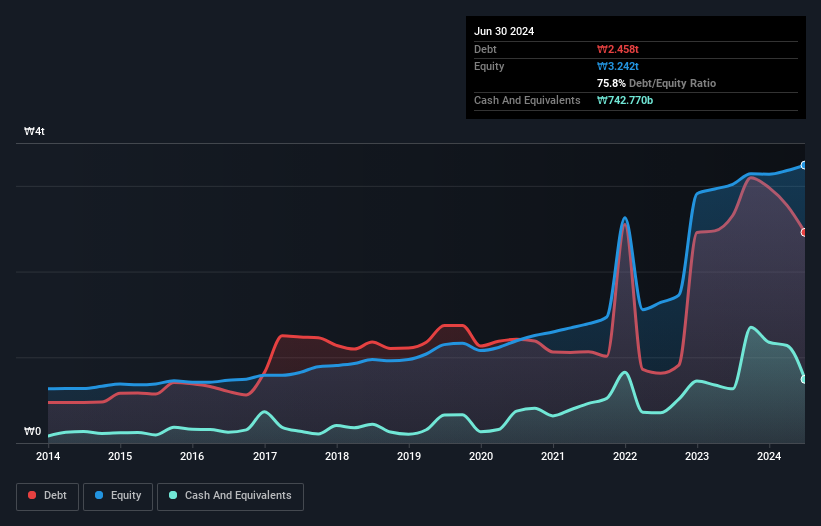

Dongwon Industries (KOSE:A006040)

Simply Wall St Value Rating: ★★★★★☆

Overview: Dongwon Industries Co., Ltd. operates in the marine and fisheries, distribution, and logistics sectors both in South Korea and internationally, with a market capitalization of ₩1.26 trillion.

Operations: Dongwon Industries generates revenue primarily from its Food Processing and Distribution Sector, contributing ₩6.49 trillion, followed by the Logistics Business at ₩1.41 trillion. The Packaging Material Sector also adds significantly with ₩1.31 trillion in revenue.

Dongwon Industries, a promising player in South Korea's market, has shown robust earnings growth of 51.7% over the past year, outpacing the broader food industry. Despite a high net debt to equity ratio of 52.9%, its interest payments are well covered with an EBIT coverage of 5.1x. Recently added to the S&P Global BMI Index, Dongwon trades at a significant discount of 35.3% below its estimated fair value, indicating potential for value appreciation amidst strong financial performance and strategic positioning in its sector.

- Click here to discover the nuances of Dongwon Industries with our detailed analytical health report.

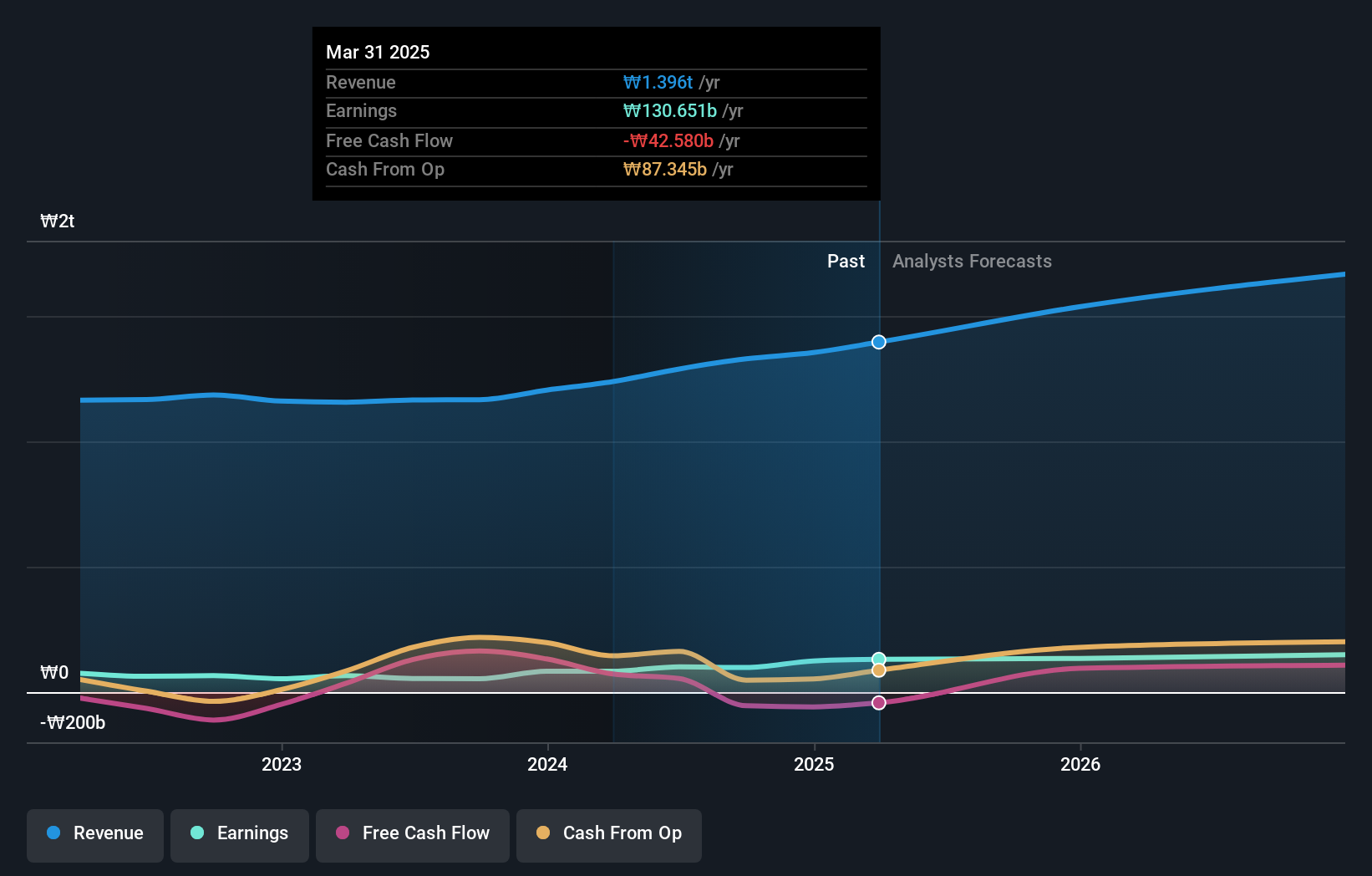

Kyung Dong Navien (KOSE:A009450)

Simply Wall St Value Rating: ★★★★★★

Overview: Kyung Dong Navien Co., Ltd. specializes in the manufacturing and sale of machinery and heat combustion equipment in South Korea, with a market cap of ₩1.31 trillion.

Operations: Kyung Dong Navien generates revenue primarily from the air conditioning manufacturing and sale segment, amounting to approximately ₩1.29 billion.

Kyung Dong Navien, a notable player in South Korea's heating solutions market, has shown impressive financial health. Over the past five years, its debt to equity ratio decreased from 46.4% to 22.4%, indicating strong financial management. The company's earnings grew by 85%, surpassing the building industry's average of 28%. With a net debt to equity ratio of just 6.5% and interest payments well covered at 27 times EBIT, it seems poised for continued stability and growth in its sector.

Taking Advantage

- Click here to access our complete index of 183 KRX Undiscovered Gems With Strong Fundamentals.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal