Undiscovered Gems In Japan For October 2024

Japan's stock markets have been on the rise, with the Nikkei 225 Index gaining 2.45% and the broader TOPIX Index up 0.45%, bolstered by yen weakness which has improved profit outlooks for exporters. In this environment, identifying promising small-cap stocks that can capitalize on favorable currency trends and economic conditions becomes crucial for investors seeking potential growth opportunities.

Top 10 Undiscovered Gems With Strong Fundamentals In Japan

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Tokyo Tekko | 10.81% | 7.30% | 7.30% | ★★★★★★ |

| Ryoyu Systems | NA | 1.08% | 8.08% | ★★★★★★ |

| KurimotoLtd | 20.73% | 3.34% | 18.64% | ★★★★★★ |

| Central Forest Group | NA | 7.05% | 14.29% | ★★★★★★ |

| Kanda HoldingsLtd | 30.47% | 4.35% | 18.02% | ★★★★★★ |

| AOKI Holdings | 28.27% | 0.91% | 37.15% | ★★★★★★ |

| Nippon Denko | 18.00% | 4.31% | 48.41% | ★★★★★★ |

| Icom | NA | 4.68% | 14.92% | ★★★★★★ |

| Hakuto | 56.93% | 8.02% | 27.72% | ★★★★☆☆ |

| FDK | 89.57% | -0.88% | 25.34% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

Koshidaka Holdings (TSE:2157)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Koshidaka Holdings Co., Ltd. is engaged in the karaoke and bath house businesses both in Japan and internationally, with a market capitalization of approximately ¥96.73 billion.

Operations: Koshidaka Holdings generates revenue primarily from its karaoke business, which accounts for approximately ¥61.25 billion. The company also has a real estate management segment contributing around ¥1.59 billion to its revenue mix.

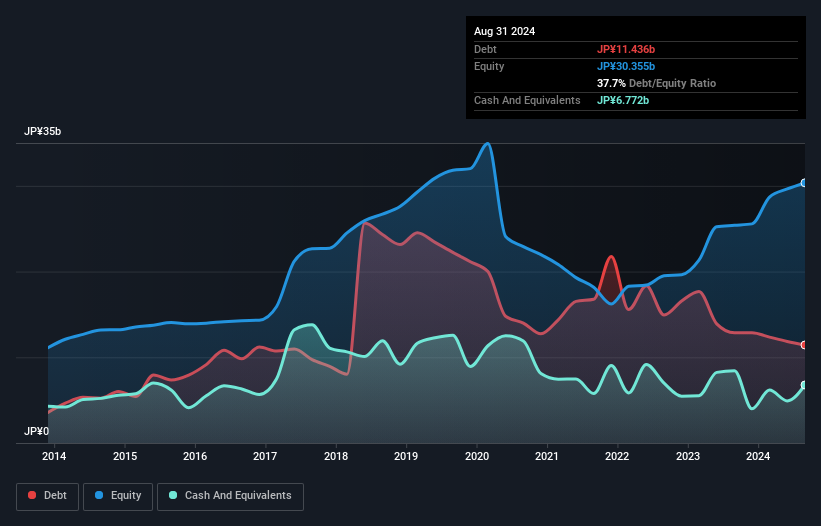

Koshidaka Holdings stands out with a price-to-earnings ratio of 14.4x, which is notably below the hospitality industry average of 22.2x, suggesting good value relative to peers. Despite recent negative earnings growth of -5.2%, the company forecasts a promising annual earnings growth rate of 13.98%. Its debt management appears robust, with a net debt to equity ratio reduced from 69.9% to a satisfactory 15.4% over five years, and interest payments well covered by EBIT at an impressive 1626x coverage level.

- Delve into the full analysis health report here for a deeper understanding of Koshidaka Holdings.

Evaluate Koshidaka Holdings' historical performance by accessing our past performance report.

PAL GROUP Holdings (TSE:2726)

Simply Wall St Value Rating: ★★★★★★

Overview: PAL GROUP Holdings CO., LTD. is involved in the planning, manufacture, wholesale, and retail of men's and women's clothing and accessories in Japan, with a market capitalization of approximately ¥273.06 billion.

Operations: PAL GROUP Holdings generates revenue primarily from its clothing business, which accounts for ¥121.28 billion, and its miscellaneous goods/accessories segment contributing ¥75.51 billion.

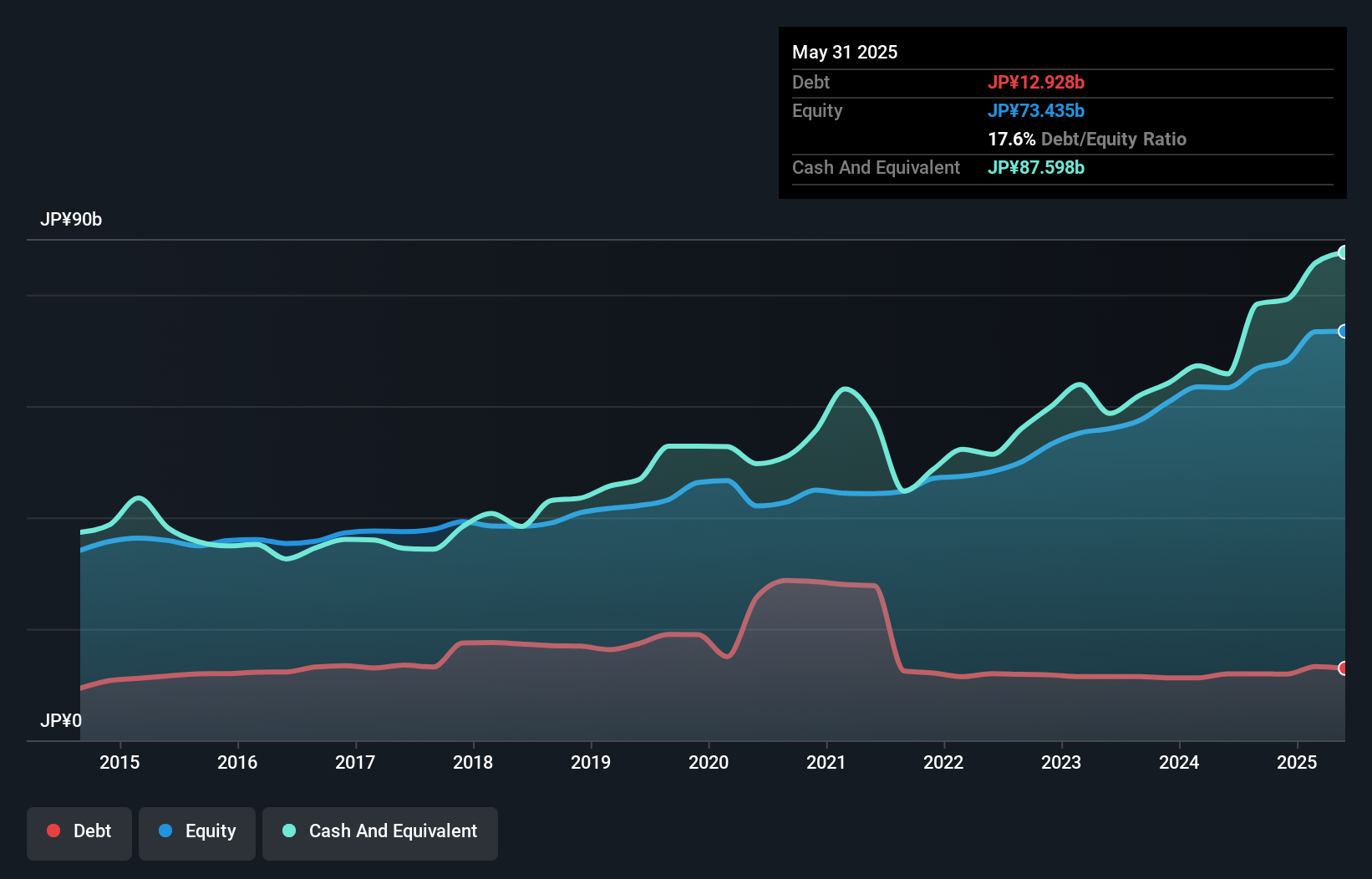

PAL GROUP Holdings, a nimble player in the Japanese market, has shown impressive financial resilience. Over five years, its debt-to-equity ratio improved from 41.2% to 18.9%, indicating prudent financial management. Trading at 30.5% below estimated fair value suggests potential for appreciation. With earnings growth of 18.8% last year and robust EBIT covering interest payments by 215 times, PAL's financial health seems solid. The company is set to announce Q2 results on October 15, offering further insights into its trajectory.

Matsuya (TSE:8237)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Matsuya Co., Ltd. operates department stores in Ginza and Asakusa, Japan, with a market cap of ¥44.73 billion.

Operations: The company generates revenue primarily through its department stores located in Ginza and Asakusa. It focuses on retail sales, which are a significant part of its income stream. The financial performance is influenced by factors such as consumer spending patterns and operational efficiency within these locations.

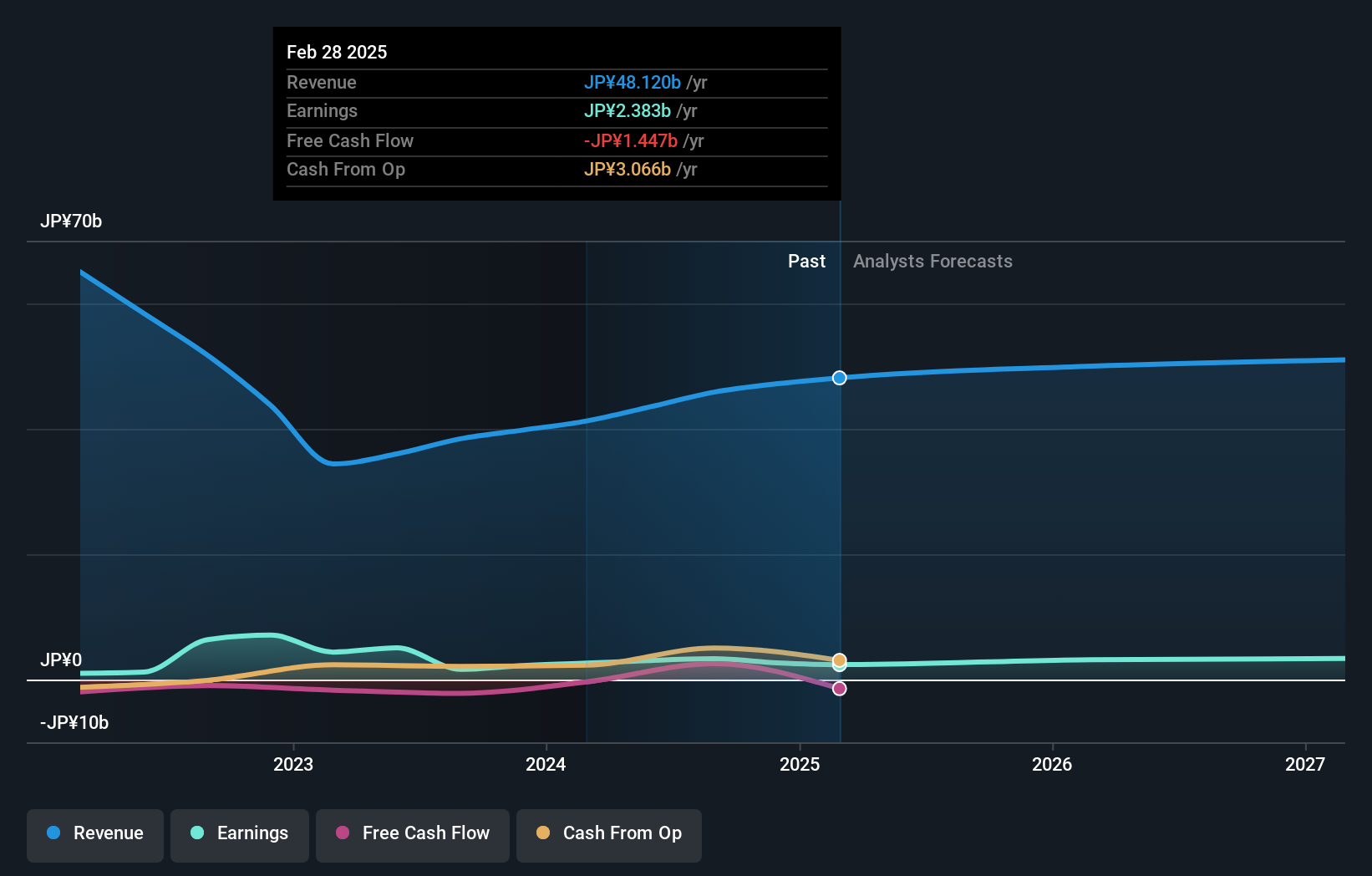

Matsuya showcases a compelling story, with its debt to equity ratio dropping from 90.9% to 59.7% over five years, indicating improved financial health. Despite a high net debt to equity ratio of 47.6%, the company's interest payments are comfortably covered by EBIT at 131.6 times, suggesting strong operational performance. Notably, Matsuya's earnings growth of 103% outpaces the industry average of 12.6%. Recent sales figures reflect mixed results: September saw a modest increase of just 1%, contrasting sharply with July's robust rise of nearly 37%.

- Click here to discover the nuances of Matsuya with our detailed analytical health report.

Gain insights into Matsuya's historical performance by reviewing our past performance report.

Make It Happen

- Take a closer look at our Japanese Undiscovered Gems With Strong Fundamentals list of 729 companies by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal