Time to Buy These Top Transportation-Shipping Stocks: CLCO, ESEA, ZIM

Quite a few shipping companies have seen their stocks added to the Zacks Rank #1 (Strong Buy) list and are standing out in terms of value.

Bolstering their valuations is that these Zacks transportation-shipping stocks are offering enticing dividends and have seen a positive trend of earnings estimate revisions which suggests more upside.

Cool Company - CLCO

Operating fuel-efficient liquified natural gas carriers, Cool Company CLCO is an up and coming shipping stock to watch after launching its IPO at the beginning of 2022.

Checking a “B” Zacks Style Scores grade for Value, CLCO trades at $11 and at a 5.6X forward P/E multiple despite fiscal 2024 EPS projected to dip to $2.03 following a tough-to-compete-against year that saw earnings at $3.25 per share. Still, FY25 EPS is expected to stabilize and rise 3%. Furthermore, FY24 and FY25 EPS estimates are nicely up over the last 60 days and Cool Company’s annual dividend yield is currently at a whopping 14.42%.

Image Source: Zacks Investment Research

Euroseas - ESEA

With a 5.56% annual dividend, Euroseas ESEA stock is very intriguing as a leader in the cargo, dry bulk, and container shipping markets. As one of the stock market’s better performers, ESEA has soared +37% year to date. Plus, at $40 ESEA still trades at just 2.8X forward earnings checking an “A” Style Scores grade for Value.

Image Source: Zacks Investment Research

While a dip is naturally expected on Euroseas robust bottom line, earnings estimate revisions for FY24 and FY25 have spiked 13% and 49% in the last 30 days respectively.

Image Source: Zacks Investment Research

ZIM Integrated - ZIM

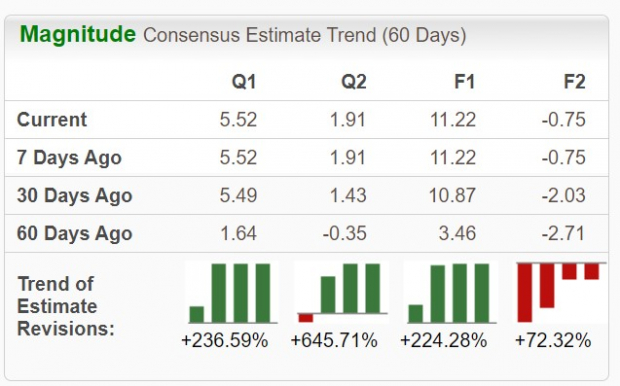

Last but not least is ZIM Integrated Shipping Services ZIM which operates a fleet and network of cargo shipping lines. Seeing a sharp rebound on its bottom line, ZIM trades at 1.8X forward earnings with FY24 EPS expected at $11.22 compared to an adjusted loss of -$5.07 a share last year.

At the moment, ZIM has an “A” Style Scores grade for Value even with FY25 EPS forecasted to drop to a loss -$0.75. That said, with ZIM's stock at a price tag of $20 the risk to reward looks favorable considering earnings estimates for FY24 and FY25 have skyrocketed in the last two months.

Image Source: Zacks Investment Research

Although ZIM’s operations are prone to the cyclicality of the broader shipping industry, the company is known to reward shareholders during times of increased profitability and reinstated its dividend with a current yield of 4.35%.

Image Source: Zacks Investment Research

Bottom Line

Keeping in mind that the plausibility of a lower inflationary environment should further enhance the operating efficiency of many shipping companies, now appears to be an ideal time to buy Cool Company, Euroseas, and ZIM Integrated’s stock.

Only $1 to See All Zacks' Buys and Sells

We're not kidding.

Several years ago, we shocked our members by offering them 30-day access to all our picks for the total sum of only $1. No obligation to spend another cent.

Thousands have taken advantage of this opportunity. Thousands did not - they thought there must be a catch. Yes, we do have a reason. We want you to get acquainted with our portfolio services like Surprise Trader, Stocks Under $10, Technology Innovators,and more, that closed 228 positions with double- and triple-digit gains in 2023 alone.

See Stocks Now >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Euroseas Ltd. (ESEA): Free Stock Analysis Report

ZIM Integrated Shipping Services Ltd. (ZIM): Free Stock Analysis Report

Cool Company Ltd. (CLCO): Free Stock Analysis Report

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal