3 ASX Dividend Stocks Yielding 3.3% To Enhance Your Portfolio

Over the last 7 days, the Australian market has risen by 1.1%, contributing to a robust 17% increase over the past year, with earnings forecasted to grow by 12% annually. In this thriving environment, dividend stocks yielding around 3.3% can offer a compelling opportunity for investors seeking steady income and potential capital appreciation.

Top 10 Dividend Stocks In Australia

| Name | Dividend Yield | Dividend Rating |

| Fortescue (ASX:FMG) | 9.85% | ★★★★★☆ |

| Perenti (ASX:PRN) | 7.08% | ★★★★★☆ |

| Super Retail Group (ASX:SUL) | 6.76% | ★★★★★☆ |

| Nick Scali (ASX:NCK) | 4.26% | ★★★★★☆ |

| Collins Foods (ASX:CKF) | 3.20% | ★★★★★☆ |

| Fiducian Group (ASX:FID) | 4.47% | ★★★★★☆ |

| MFF Capital Investments (ASX:MFF) | 3.55% | ★★★★★☆ |

| National Storage REIT (ASX:NSR) | 4.31% | ★★★★★☆ |

| Premier Investments (ASX:PMV) | 4.38% | ★★★★★☆ |

| Sugar Terminals (NSX:SUG) | 7.59% | ★★★★☆☆ |

Click here to see the full list of 38 stocks from our Top ASX Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

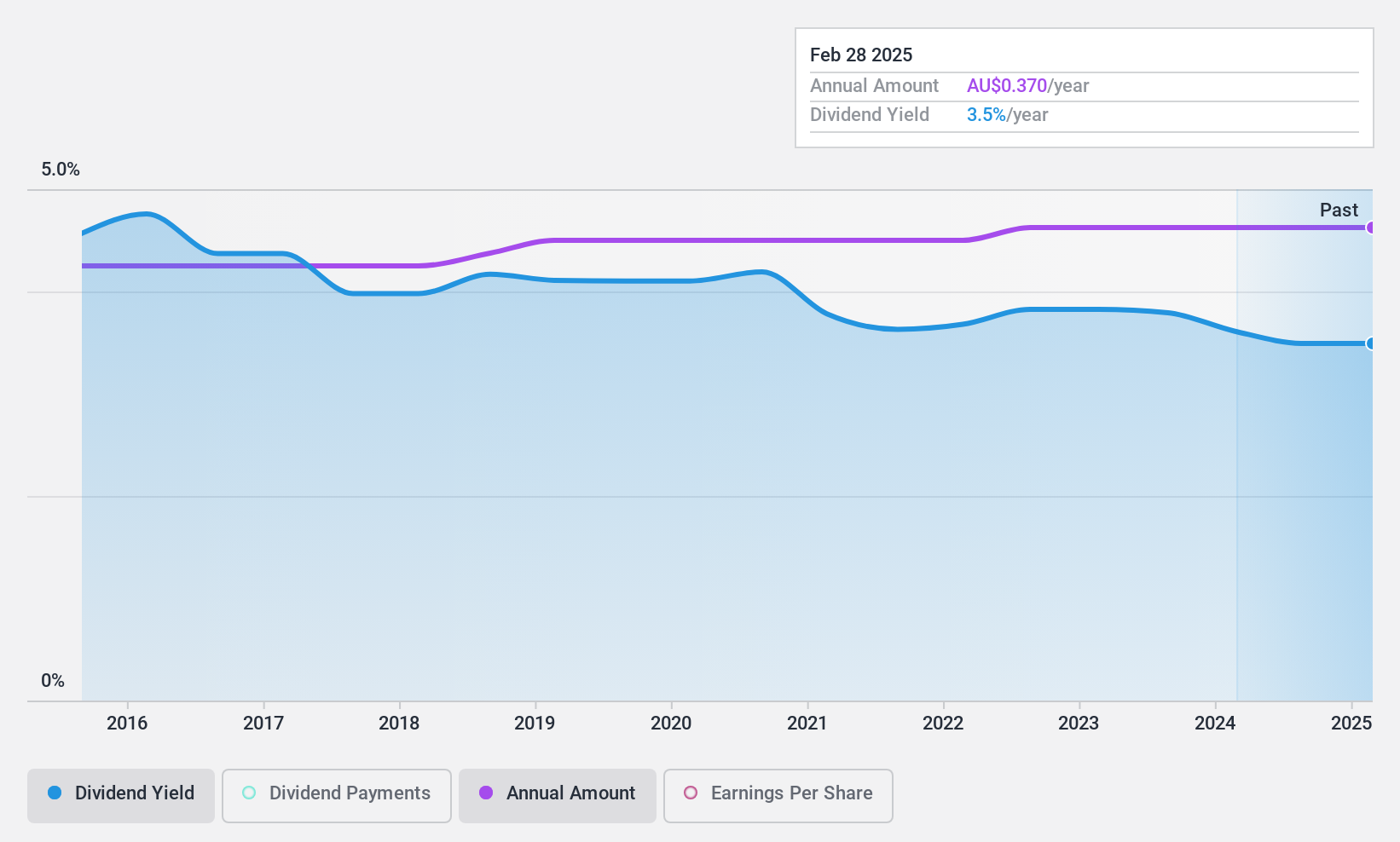

Australian United Investment (ASX:AUI)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Australian United Investment Company Limited is a publicly owned investment manager with a market cap of A$1.37 billion.

Operations: Australian United Investment Company Limited generates revenue primarily from its investment segment, amounting to A$57.76 million.

Dividend Yield: 3.4%

Australian United Investment has maintained stable and growing dividends over the past decade, but its current dividend yield of 3.36% is low compared to top-tier Australian dividend stocks. The payout ratio is high at 95%, indicating dividends are not well covered by earnings, though cash flows currently support them with a cash payout ratio of 89.7%. Recent financial results show a decline in net income to A$49.12 million, impacting dividend sustainability concerns.

- Delve into the full analysis dividend report here for a deeper understanding of Australian United Investment.

- Our valuation report here indicates Australian United Investment may be overvalued.

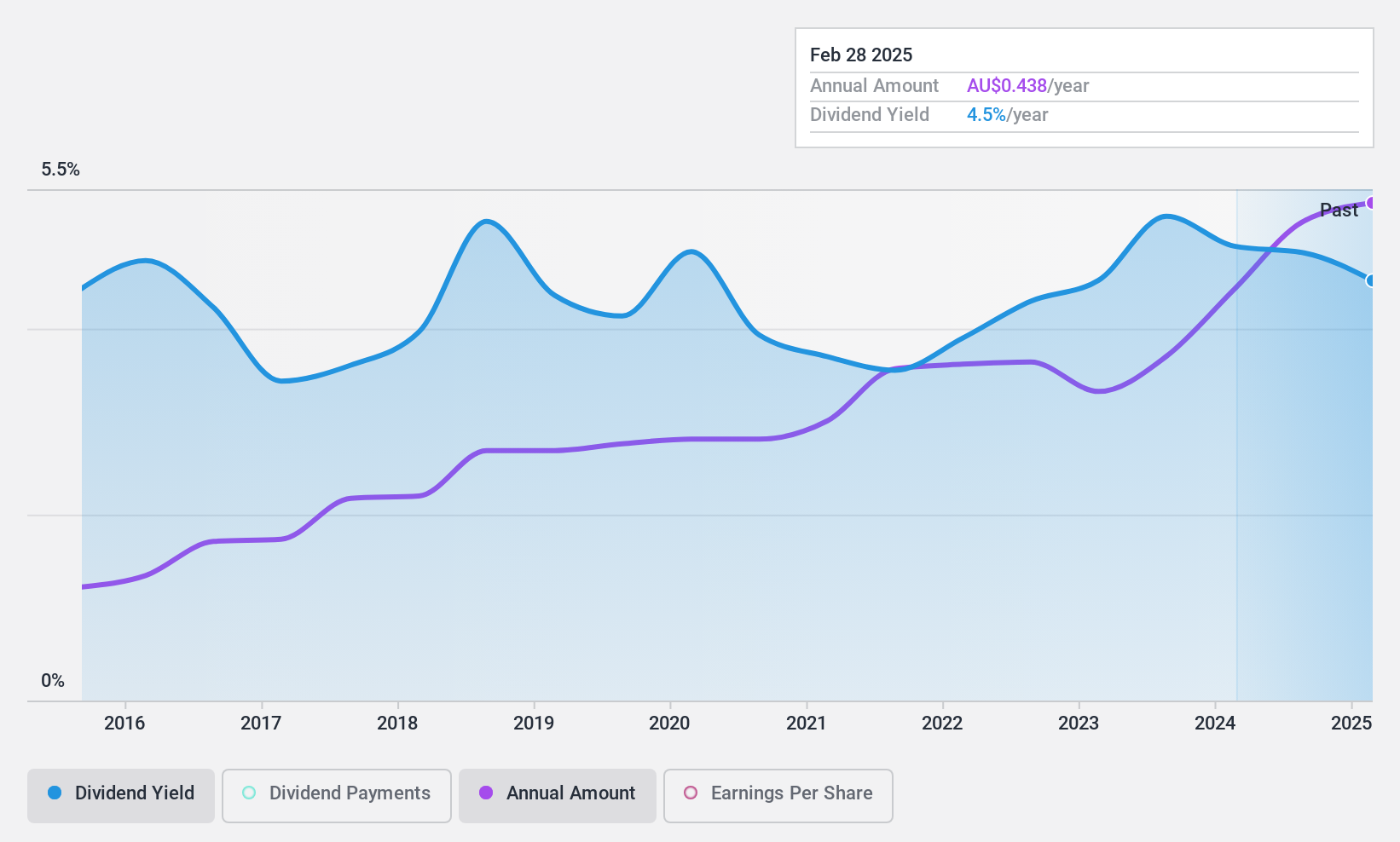

Fiducian Group (ASX:FID)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Fiducian Group Ltd, with a market cap of A$276.69 million, operates in Australia through its subsidiaries providing financial services.

Operations: Fiducian Group Ltd generates revenue through several segments including Funds Management (A$22.08 million), Corporate Services (A$15.06 million), Financial Planning (A$27.69 million), and Platform Administration (A$15.97 million).

Dividend Yield: 4.5%

Fiducian Group has consistently provided stable and growing dividends over the past decade, with a current yield of 4.47%, which is below the top tier in Australia. The dividend is well-covered by both earnings and cash flows, with payout ratios of 82.3% and 63.8%, respectively, indicating sustainability. Recent financial performance shows an increase in net income to A$15.04 million from A$12.32 million, supporting continued dividend reliability despite a lower yield compared to leading payers.

- Click to explore a detailed breakdown of our findings in Fiducian Group's dividend report.

- According our valuation report, there's an indication that Fiducian Group's share price might be on the cheaper side.

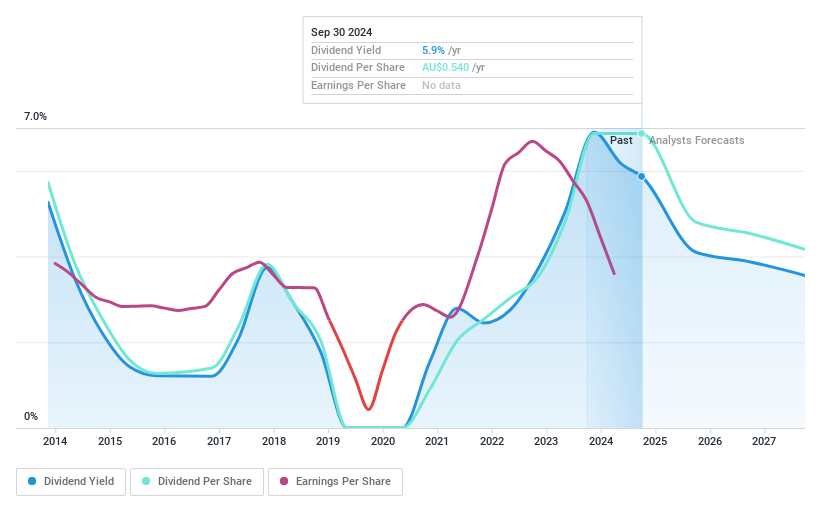

GrainCorp (ASX:GNC)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: GrainCorp Limited is an agribusiness and processing company with operations across Australasia, Asia, North America, Europe, the Middle East, and North Africa; it has a market cap of A$1.98 billion.

Operations: GrainCorp Limited's revenue from its agribusiness segment amounts to A$6.82 billion.

Dividend Yield: 6%

GrainCorp maintains dividend sustainability with a cash payout ratio of 37.3% and earnings coverage at 63.4%, though its dividends have been volatile and unreliable over the past decade. The current yield of 5.98% is slightly below Australia's top tier. Recent strategic alliances, including a partnership with Ampol and IFM Investors to explore renewable fuels, may impact future growth prospects but do not directly address dividend stability concerns.

- Navigate through the intricacies of GrainCorp with our comprehensive dividend report here.

- Insights from our recent valuation report point to the potential overvaluation of GrainCorp shares in the market.

Summing It All Up

- Delve into our full catalog of 38 Top ASX Dividend Stocks here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal