High Growth Tech Stocks In Australia October 2024

The Australian market has shown impressive momentum, climbing 1.1% in the last week and up 17% over the past year, with earnings forecasted to grow by 12% annually. In this dynamic environment, identifying high growth tech stocks involves looking for companies that not only align with current market trends but also demonstrate strong potential for sustainable earnings growth.

Top 10 High Growth Tech Companies In Australia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Clinuvel Pharmaceuticals | 22.32% | 27.42% | ★★★★★★ |

| Pureprofile | 14.94% | 80.73% | ★★★★★☆ |

| Adherium | 86.80% | 73.66% | ★★★★★★ |

| ImExHS | 20.47% | 111.20% | ★★★★★★ |

| Telix Pharmaceuticals | 20.19% | 38.31% | ★★★★★★ |

| AVA Risk Group | 32.56% | 118.83% | ★★★★★★ |

| Careteq | 37.17% | 126.21% | ★★★★★☆ |

| Pointerra | 56.62% | 126.45% | ★★★★★★ |

| Wrkr | 36.31% | 100.29% | ★★★★★★ |

| Adveritas | 57.98% | 144.21% | ★★★★★★ |

Click here to see the full list of 62 stocks from our ASX High Growth Tech and AI Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Pro Medicus (ASX:PME)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Pro Medicus Limited is a healthcare informatics company that develops and supplies imaging software and radiology information system services to hospitals, imaging centers, and healthcare groups across Australia, North America, and Europe, with a market cap of A$19.42 billion.

Operations: Pro Medicus generates revenue primarily through the production of integrated software applications for the healthcare industry, amounting to A$161.50 million. The company operates across key markets including Australia, North America, and Europe.

Pro Medicus, an Australian tech firm specializing in healthcare imaging software, has demonstrated robust financial health with a notable 36.5% earnings growth over the past year, outpacing the industry average of 15.4%. This growth trajectory is complemented by a forecasted annual revenue increase of 17%, which although not exceeding the high-growth threshold of 20%, still surpasses the broader Australian market's expectation of 5.5%. Additionally, R&D investments remain a pivotal focus for Pro Medicus as evidenced by their consistent allocation towards innovation to maintain competitive edge and drive future growth. Recent financial disclosures reveal that Pro Medicus reported a significant jump in net income to AUD 82.79 million from AUD 60.65 million year-over-year and an increase in dividends by 33.3%, signaling strong profitability and shareholder confidence. These figures underscore the company’s ability to leverage its technical expertise and market position to generate substantial economic returns while continuing to innovate within its sector.

- Take a closer look at Pro Medicus' potential here in our health report.

Understand Pro Medicus' track record by examining our Past report.

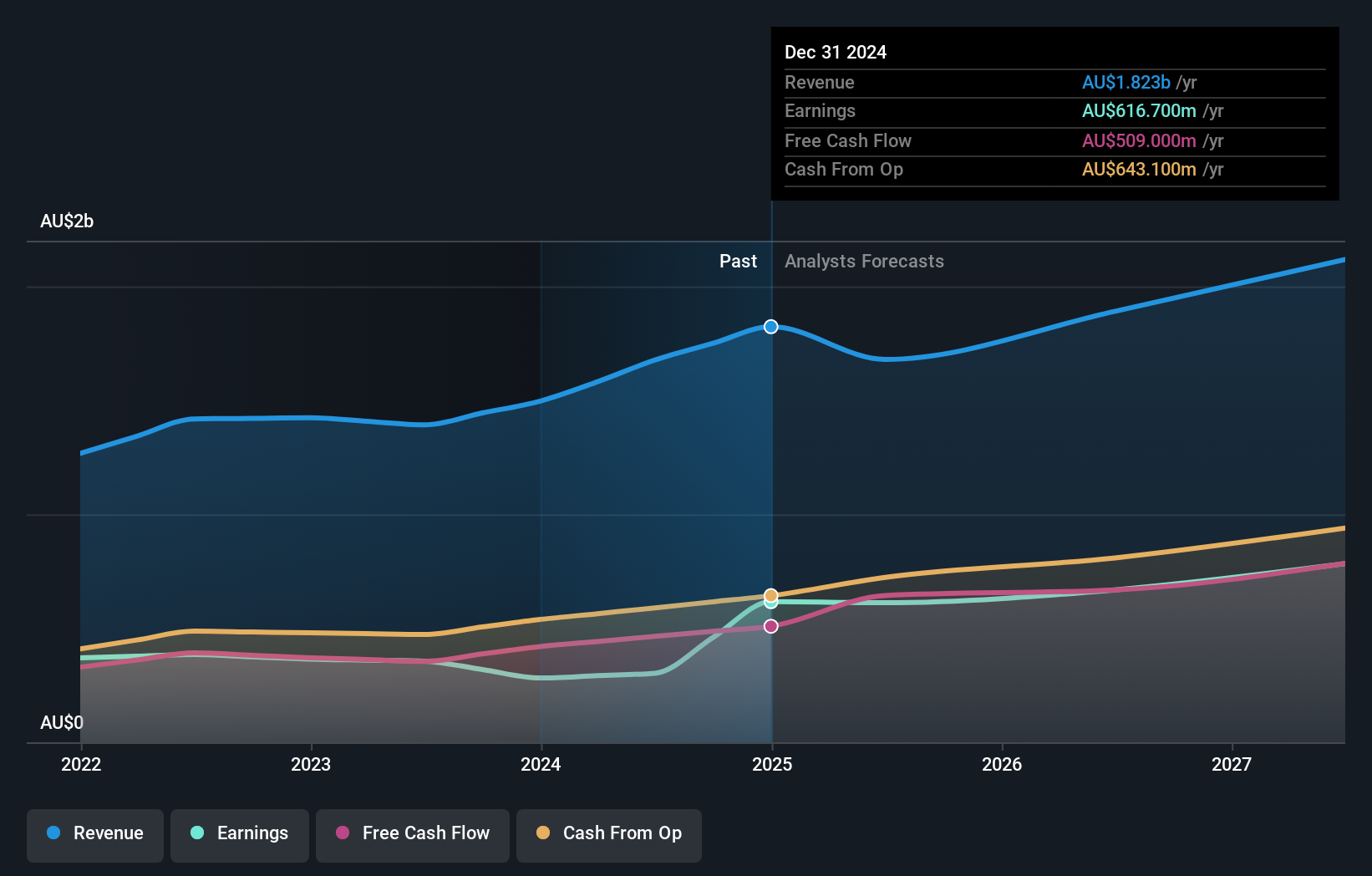

REA Group (ASX:REA)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: REA Group Limited operates an online property advertising business across Australia, India, the United States, Malaysia, Singapore, Thailand, Vietnam, and other international markets with a market cap of A$29.43 billion.

Operations: The company's primary revenue streams include property and online advertising in Australia, generating A$1.25 billion, and financial services contributing A$320.60 million. Additionally, operations in India add A$103.10 million to the overall revenue model.

REA Group, navigating through a challenging landscape, has managed to post a revenue growth of 6.5% per year, slightly outpacing the Australian market average of 5.5%. This performance is complemented by an anticipated earnings increase of 16.8% annually, which notably exceeds the broader market's forecast of 12.2%. Despite facing a significant one-off loss of A$153.6 million last fiscal year, REA Group's strategic focus on R&D has not waned; their commitment is evident in their sustained investment in innovation to stay relevant and competitive within the Interactive Media and Services industry. Moreover, recent corporate actions including a dividend increase to A$1.02 per share reflect confidence in financial stability and future growth prospects.

- Click to explore a detailed breakdown of our findings in REA Group's health report.

Assess REA Group's past performance with our detailed historical performance reports.

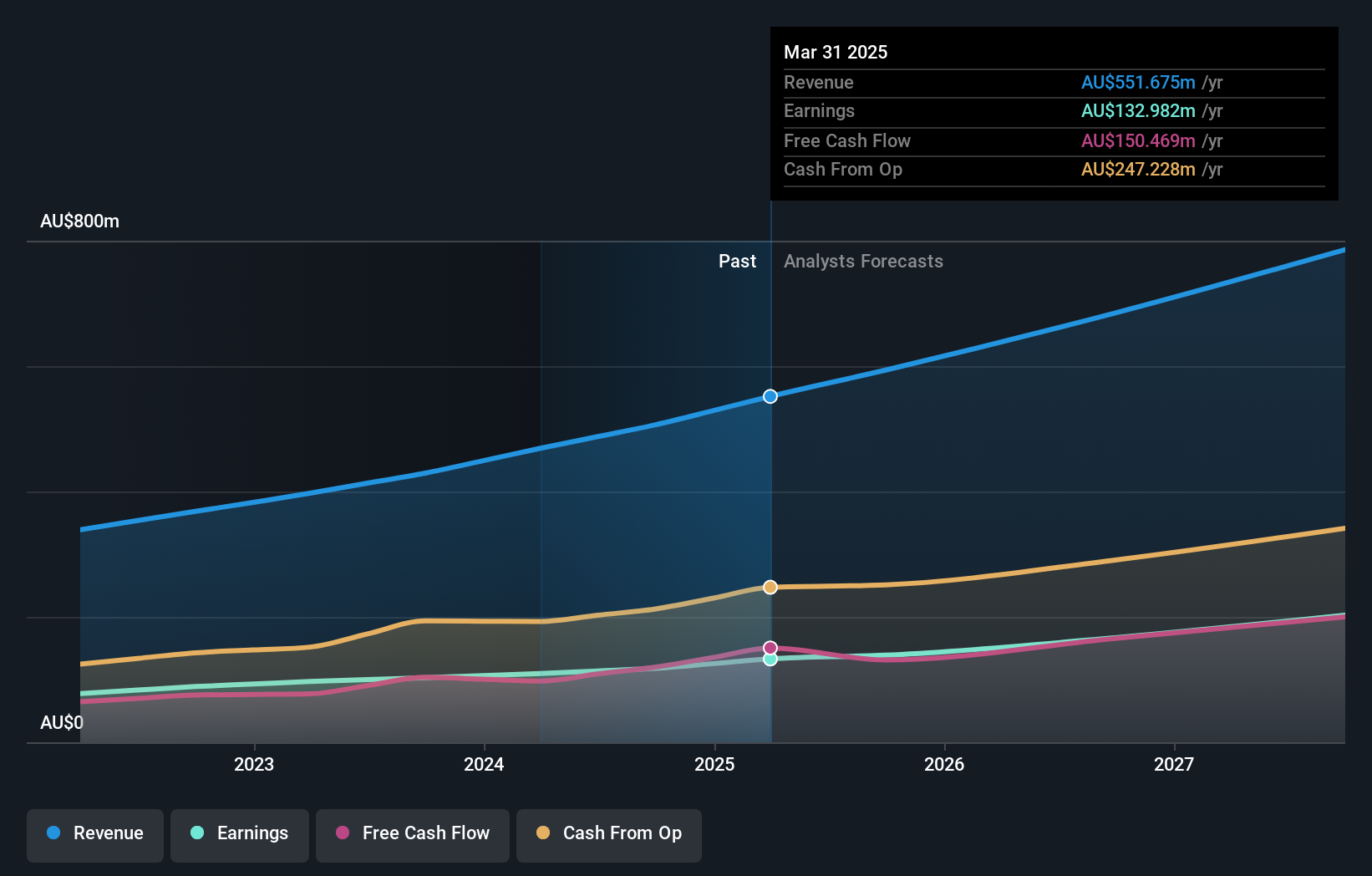

Technology One (ASX:TNE)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Technology One Limited is an Australian company that develops, markets, sells, implements, and supports integrated enterprise business software solutions globally with a market cap of A$7.99 billion.

Operations: The company generates revenue through three primary segments: Software (A$317.24 million), Corporate (A$83.83 million), and Consulting (A$68.13 million).

Technology One, amidst a dynamic tech landscape in Australia, demonstrates robust growth potential with revenue and earnings forecasts outpacing the broader market. With a projected annual revenue increase of 10.8%, it surpasses the national average of 5.5%. This is complemented by an anticipated earnings growth of 13.6% per year, significantly ahead of the Australian market forecast at 12.2%. The company's commitment to innovation is underscored by its R&D efforts; notably, R&D expenses have been strategically allocated to foster advancements that keep pace with evolving technological demands. At their recent Analyst/Investor Day, Technology One highlighted these initiatives as central to their strategy for maintaining competitive advantage in the software industry, ensuring ongoing relevance and market leadership.

- Delve into the full analysis health report here for a deeper understanding of Technology One.

Gain insights into Technology One's historical performance by reviewing our past performance report.

Taking Advantage

- Unlock more gems! Our ASX High Growth Tech and AI Stocks screener has unearthed 59 more companies for you to explore.Click here to unveil our expertly curated list of 62 ASX High Growth Tech and AI Stocks.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal