Three Undiscovered Gems in the United Kingdom Market

The United Kingdom market has seen a steady performance, remaining flat over the last week but showing an 8.8% increase over the past year, with earnings forecasted to grow by 14% annually. In this environment, identifying stocks that combine potential for growth with strong fundamentals can uncover promising opportunities for investors seeking to capitalize on these market conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In The United Kingdom

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Livermore Investments Group | NA | 9.92% | 13.65% | ★★★★★★ |

| M&G Credit Income Investment Trust | NA | 17.28% | 15.80% | ★★★★★★ |

| Metals Exploration | NA | 12.92% | 73.62% | ★★★★★★ |

| London Security | 0.22% | 10.13% | 7.75% | ★★★★★★ |

| Globaltrans Investment | 15.40% | 2.68% | 16.51% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| VH Global Sustainable Energy Opportunities | NA | 18.30% | 20.03% | ★★★★★★ |

| Kodal Minerals | NA | nan | 72.74% | ★★★★★★ |

| BBGI Global Infrastructure | 0.02% | 3.08% | 6.85% | ★★★★★☆ |

| Goodwin | 52.21% | 9.26% | 13.12% | ★★★★★☆ |

We're going to check out a few of the best picks from our screener tool.

Fonix (AIM:FNX)

Simply Wall St Value Rating: ★★★★★★

Overview: Fonix Plc is a company that offers mobile payments, messaging, and managed services to various sectors including media, charity, gaming, ticketing, and mobility in the United Kingdom with a market cap of £254.86 million.

Operations: Revenue from facilitating mobile payments and messaging amounted to £76.09 million. The company's gross profit margin is 31%.

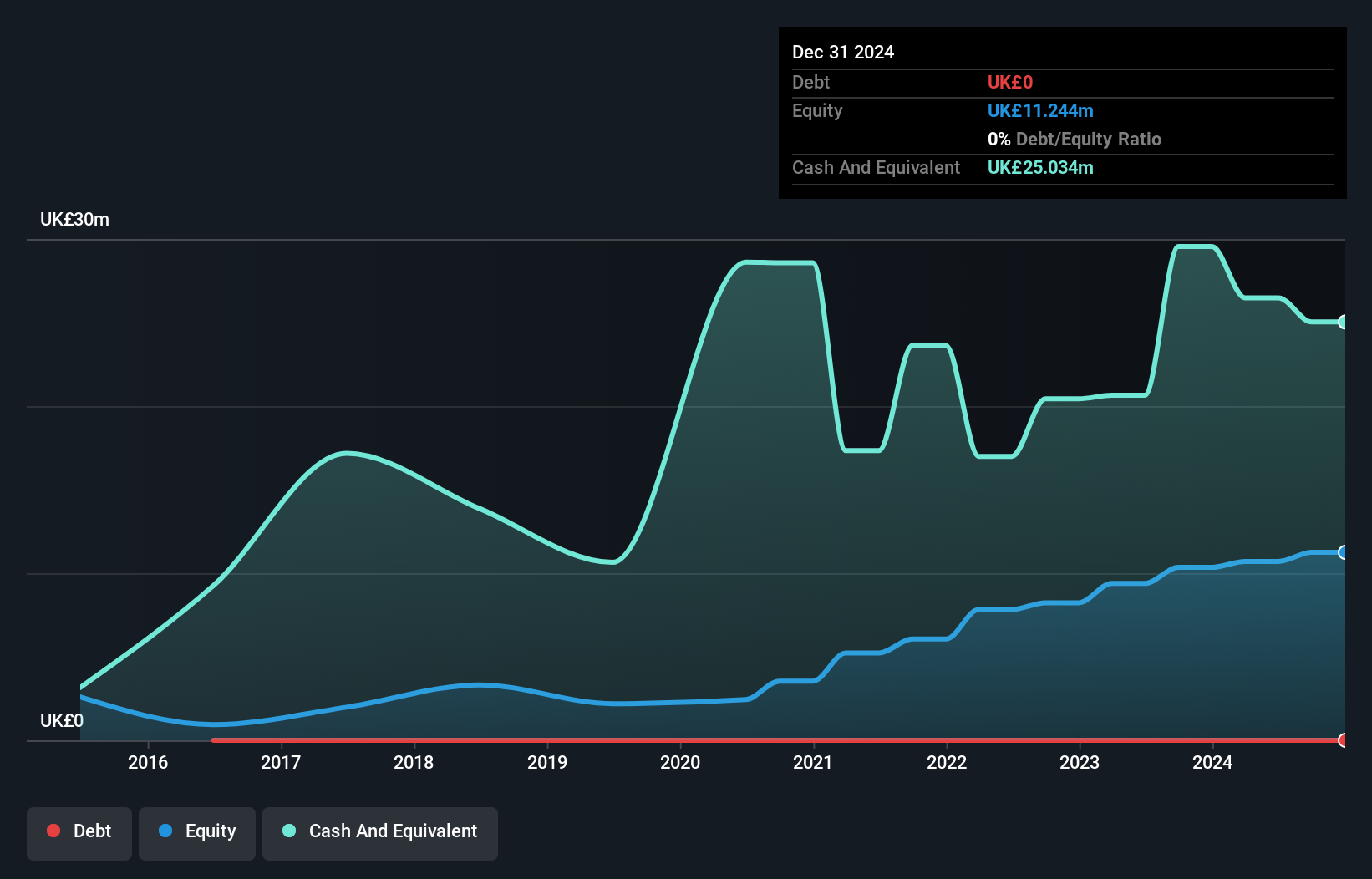

Fonix, a nimble player in the UK market, reported a solid financial year with sales climbing to £76.09 million from £64.92 million previously, and net income reaching £10.62 million against last year's £8.8 million. Earnings per share improved to 0.107 GBP from 0.088 GBP, highlighting its robust performance despite industry challenges. The company is debt-free and boasts high-quality earnings, outpacing industry growth with a notable 20% increase in earnings over the past year.

- Delve into the full analysis health report here for a deeper understanding of Fonix.

Review our historical performance report to gain insights into Fonix's's past performance.

Warpaint London (AIM:W7L)

Simply Wall St Value Rating: ★★★★★★

Overview: Warpaint London PLC, along with its subsidiaries, focuses on the production and sale of cosmetics and has a market capitalization of £435.36 million.

Operations: The company's primary revenue streams are from its Own Brand segment, generating £96.72 million, and a smaller contribution from the Close-Out segment at £2.12 million.

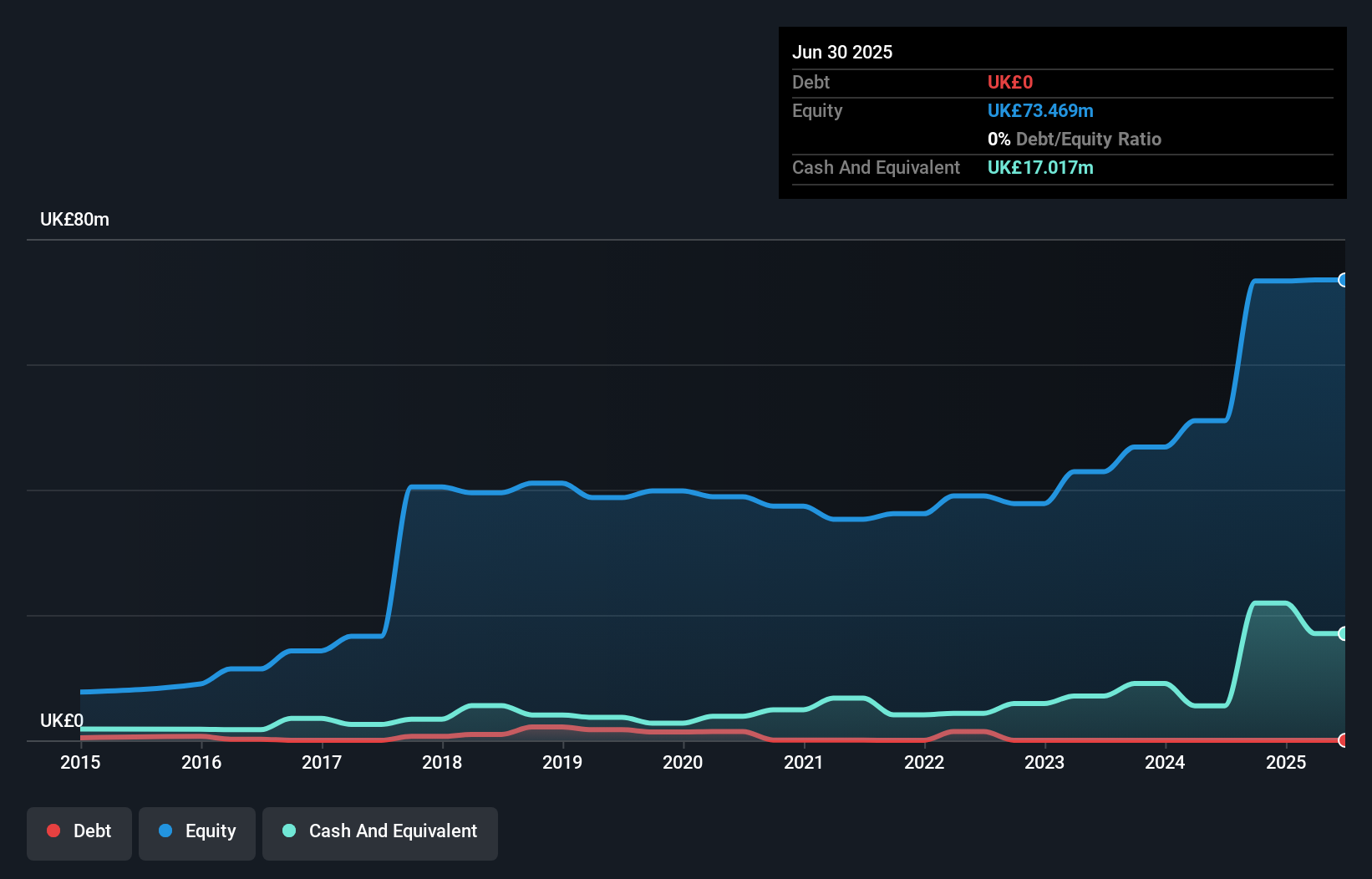

Warpaint London, a nimble player in the personal products sector, showcases impressive growth with earnings skyrocketing 106.1% over the past year, outpacing industry norms. The company is debt-free, enhancing its financial health and flexibility. Recent earnings reveal sales of £45.85 million and net income of £8.02 million for H1 2024, reflecting strong operational performance. Furthermore, Warpaint's commitment to shareholder returns is evident with an increased interim dividend of 3.5 pence per share announced recently.

Seplat Energy (LSE:SEPL)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Seplat Energy Plc is involved in oil and gas exploration, production, and gas processing across Nigeria, the Bahamas, Italy, Switzerland, Barbados, and England with a market capitalization of £1.24 billion.

Operations: Seplat Energy generates revenue primarily from oil and gas, with oil contributing $815.03 million and gas $120.87 million.

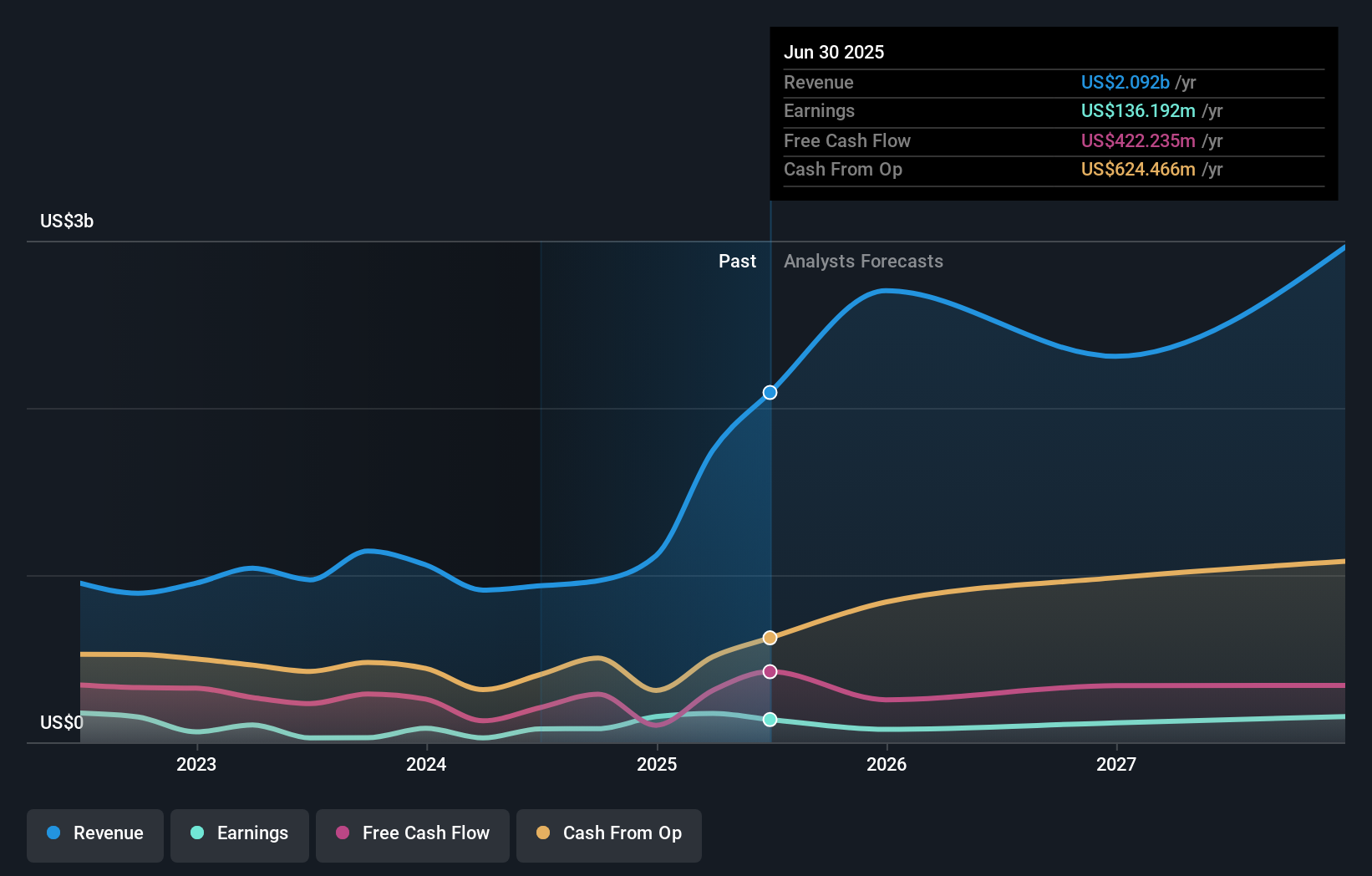

Seplat Energy, a smaller player in the oil and gas sector, showcases impressive earnings growth of 207.6% over the past year, outpacing industry averages. The company holds a satisfactory net debt to equity ratio of 20.6%, with interest payments well covered by EBIT at 5.8 times coverage. Recent reports indicate sales for Q2 2024 reached US$241 million, up from US$216 million in the previous year, while net income improved to US$39 million from a loss last year.

- Unlock comprehensive insights into our analysis of Seplat Energy stock in this health report.

Gain insights into Seplat Energy's historical performance by reviewing our past performance report.

Make It Happen

- Navigate through the entire inventory of 82 UK Undiscovered Gems With Strong Fundamentals here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal