Even after rising 3.7% this past week, Curaleaf Holdings (TSE:CURA) shareholders are still down 68% over the past three years

If you are building a properly diversified stock portfolio, the chances are some of your picks will perform badly. But the long term shareholders of Curaleaf Holdings, Inc. (TSE:CURA) have had an unfortunate run in the last three years. Sadly for them, the share price is down 68% in that time. Shareholders have had an even rougher run lately, with the share price down 27% in the last 90 days.

The recent uptick of 3.7% could be a positive sign of things to come, so let's take a look at historical fundamentals.

Check out our latest analysis for Curaleaf Holdings

Given that Curaleaf Holdings didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. When a company doesn't make profits, we'd generally hope to see good revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last three years, Curaleaf Holdings saw its revenue grow by 8.1% per year, compound. That's a pretty good rate of top-line growth. That contrasts with the weak share price, which has fallen 19% compounded, over three years. The market must have had really high expectations to be disappointed with this progress. So this is one stock that might be worth investigating further, or even adding to your watchlist.

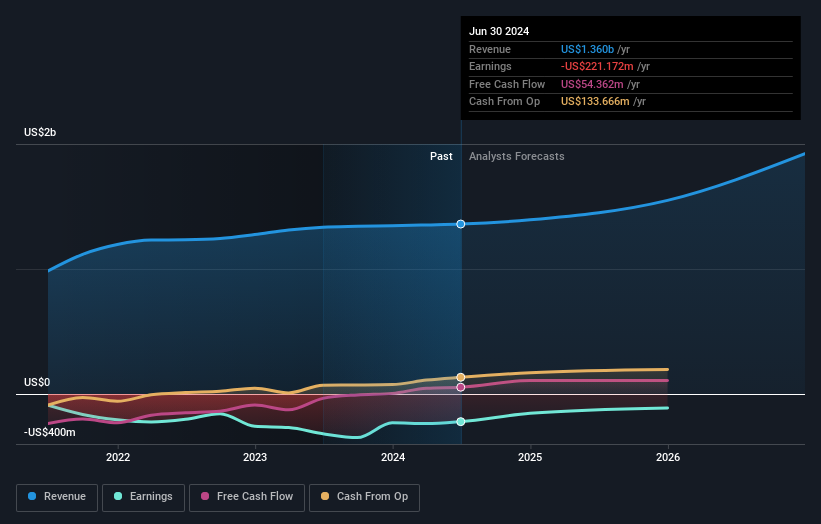

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

Curaleaf Holdings is well known by investors, and plenty of clever analysts have tried to predict the future profit levels. You can see what analysts are predicting for Curaleaf Holdings in this interactive graph of future profit estimates.

A Different Perspective

While the broader market gained around 29% in the last year, Curaleaf Holdings shareholders lost 18%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 7% per year over five years. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. To that end, you should be aware of the 1 warning sign we've spotted with Curaleaf Holdings .

Of course Curaleaf Holdings may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Canadian exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal