Top Dividend Stocks To Enhance Your Investment Portfolio

As global markets navigate a mix of record highs in U.S. indices and economic challenges in Europe, investors are keenly observing the shifting dynamics influenced by earnings surprises and inflation trends. In this context, dividend stocks stand out as a compelling option for those seeking consistent income streams amidst market volatility, offering potential stability and growth to enhance investment portfolios.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 7.12% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.19% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.16% | ★★★★★★ |

| KurimotoLtd (TSE:5602) | 5.29% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.99% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.52% | ★★★★★★ |

| Innotech (TSE:9880) | 4.83% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 4.27% | ★★★★★★ |

| James Latham (AIM:LTHM) | 5.71% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.83% | ★★★★★★ |

Click here to see the full list of 2048 stocks from our Top Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Oriental Weavers Carpets Company (S.A.E) (CASE:ORWE)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Oriental Weavers Carpets Company (S.A.E), along with its subsidiaries, is engaged in the global manufacturing and sale of carpets, rugs, and related raw materials, with a market cap of EGP18.22 billion.

Operations: Oriental Weavers Carpets Company (S.A.E) generates its revenue through the global production and distribution of carpets, rugs, and associated raw materials.

Dividend Yield: 4.6%

Oriental Weavers Carpets Company offers a stable dividend profile, supported by a low payout ratio of 38.3% and cash payout ratio of 29.9%, indicating sustainability. Despite a lower yield of 4.56% compared to top-tier EG market payers, its dividends have been reliable and growing over the past decade. Recent inclusion in indices like the S&P Pan Arab Composite highlights its market recognition, while significant earnings growth reinforces financial robustness for continued dividend support.

- Unlock comprehensive insights into our analysis of Oriental Weavers Carpets Company (S.A.E) stock in this dividend report.

- According our valuation report, there's an indication that Oriental Weavers Carpets Company (S.A.E)'s share price might be on the expensive side.

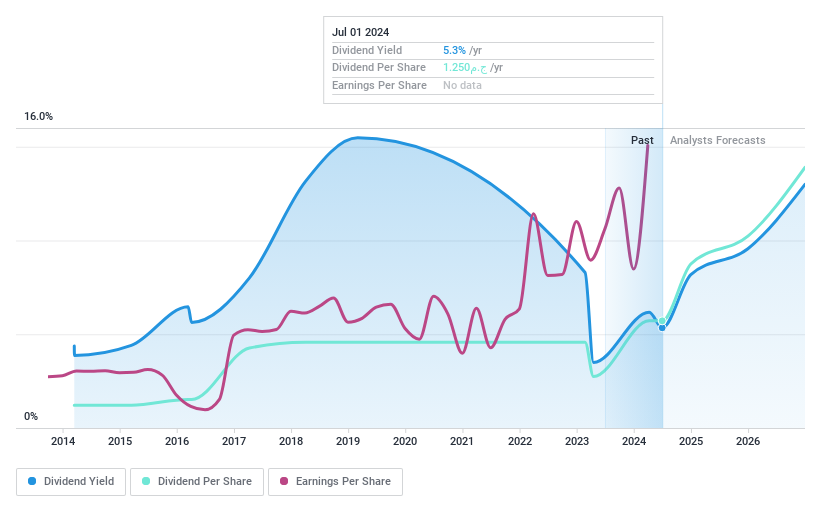

National General Insurance (P.J.S.C.) (DFM:NGI)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: National General Insurance Co. (P.J.S.C.) operates in the United Arab Emirates, offering a range of life and general insurance as well as reinsurance products, with a market cap of AED755.47 million.

Operations: National General Insurance Co. (P.J.S.C.) generates its revenue primarily from insurance, amounting to AED891.97 million, and investments, contributing AED99.84 million.

Dividend Yield: 6.9%

National General Insurance Co. (P.J.S.C.) offers a high dividend yield of 6.95%, placing it among the top 25% in the AE market. However, its dividends are not well covered by free cash flow, with a high cash payout ratio of 374.1%. Earnings have surged significantly, improving net income to AED 80.85 million for the first half of 2024. Despite past volatility and unreliability in dividend payments, recent earnings growth suggests potential stability improvements.

- Get an in-depth perspective on National General Insurance (P.J.S.C.)'s performance by reading our dividend report here.

- Our expertly prepared valuation report National General Insurance (P.J.S.C.) implies its share price may be too high.

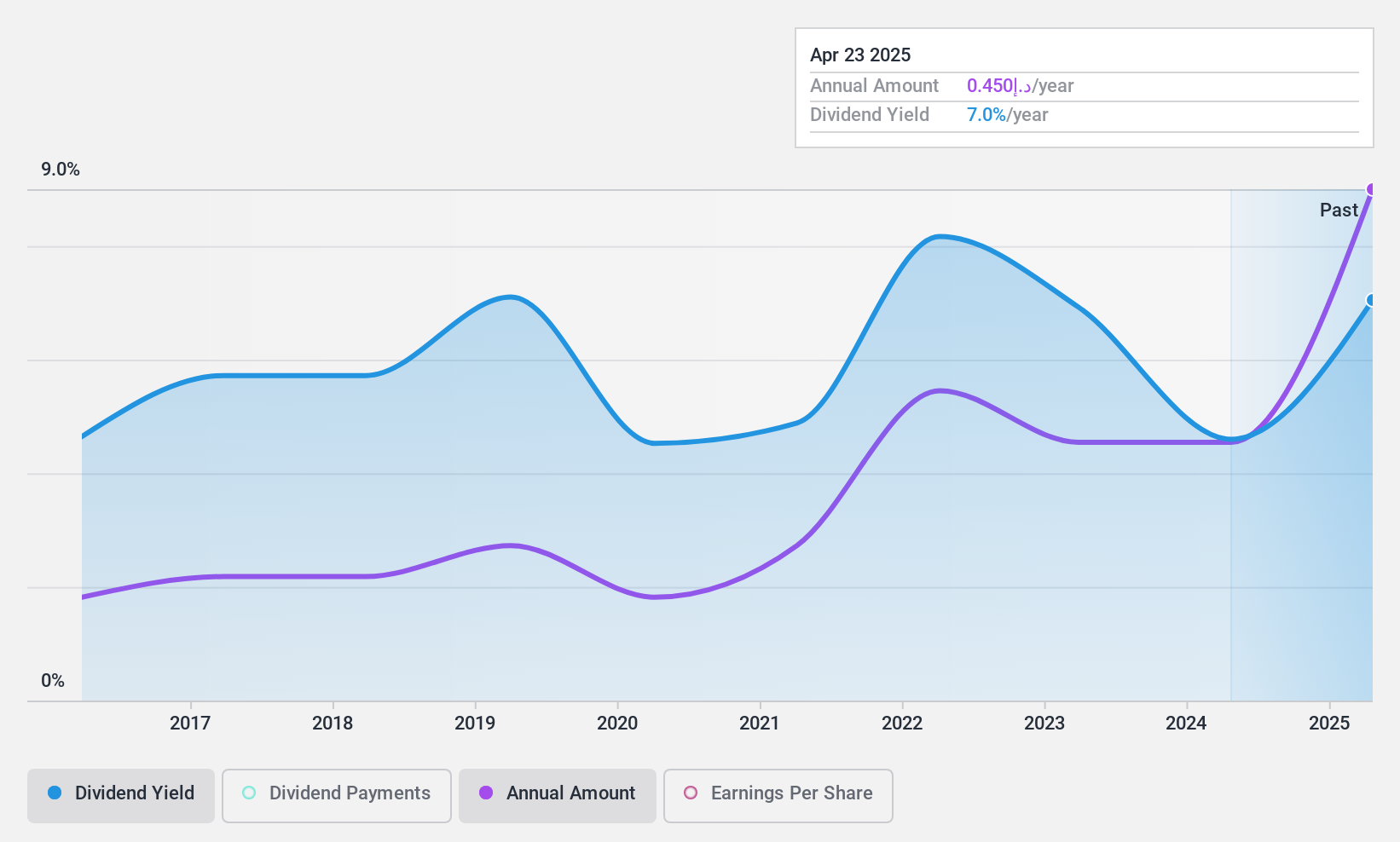

Total Bangun Persada (IDX:TOTL)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: PT Total Bangun Persada Tbk, along with its subsidiaries, offers construction services mainly in Indonesia and has a market cap of IDR2.37 trillion.

Operations: The company's revenue primarily comes from its Construction segment, which generated IDR3.23 billion.

Dividend Yield: 5.8%

Total Bangun Persada's dividend yield of 5.76% ranks in the top 25% in Indonesia, supported by a sustainable payout ratio of 62.6%. However, its six-year dividend history shows volatility and unreliability, with no growth in payments. Recent earnings have increased significantly to IDR 112.65 billion for H1 2024, enhancing coverage by cash flows at a low cash payout ratio of 28.4%. A proposed acquisition by Shimizu Corporation could impact future dividends.

- Delve into the full analysis dividend report here for a deeper understanding of Total Bangun Persada.

- The valuation report we've compiled suggests that Total Bangun Persada's current price could be quite moderate.

Where To Now?

- Dive into all 2048 of the Top Dividend Stocks we have identified here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal