Exploring 3 Undervalued Small Caps With Insider Activity In None

As global markets navigate a complex landscape, with U.S. stocks reaching new highs amidst an earnings season filled with surprises, small-cap stocks continue to capture investor interest. The S&P 600 Index for small-cap companies reflects this momentum, highlighting the potential opportunities within this segment despite broader economic challenges such as modestly higher inflation and shifting Federal Reserve policies. In such an environment, identifying promising small-cap stocks often involves looking at those that show resilience and potential for growth even when insider activity is absent, focusing on their fundamentals and market positioning.

Top 10 Undervalued Small Caps With Insider Buying

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Bytes Technology Group | 22.8x | 5.8x | 9.36% | ★★★★★☆ |

| Genus | 172.5x | 2.0x | 7.65% | ★★★★★☆ |

| Hanover Bancorp | 10.4x | 2.4x | 42.53% | ★★★★☆☆ |

| Primaris Real Estate Investment Trust | 13.0x | 3.5x | 44.04% | ★★★★☆☆ |

| Sagicor Financial | 1.4x | 0.3x | -48.27% | ★★★★☆☆ |

| Calfrac Well Services | 2.5x | 0.2x | 18.09% | ★★★★☆☆ |

| Marlowe | NA | 0.7x | 41.06% | ★★★★☆☆ |

| Robert Walters | 40.7x | 0.2x | 42.87% | ★★★☆☆☆ |

| Community West Bancshares | 18.7x | 2.9x | 42.25% | ★★★☆☆☆ |

| Orion Group Holdings | NA | 0.3x | -99.10% | ★★★☆☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

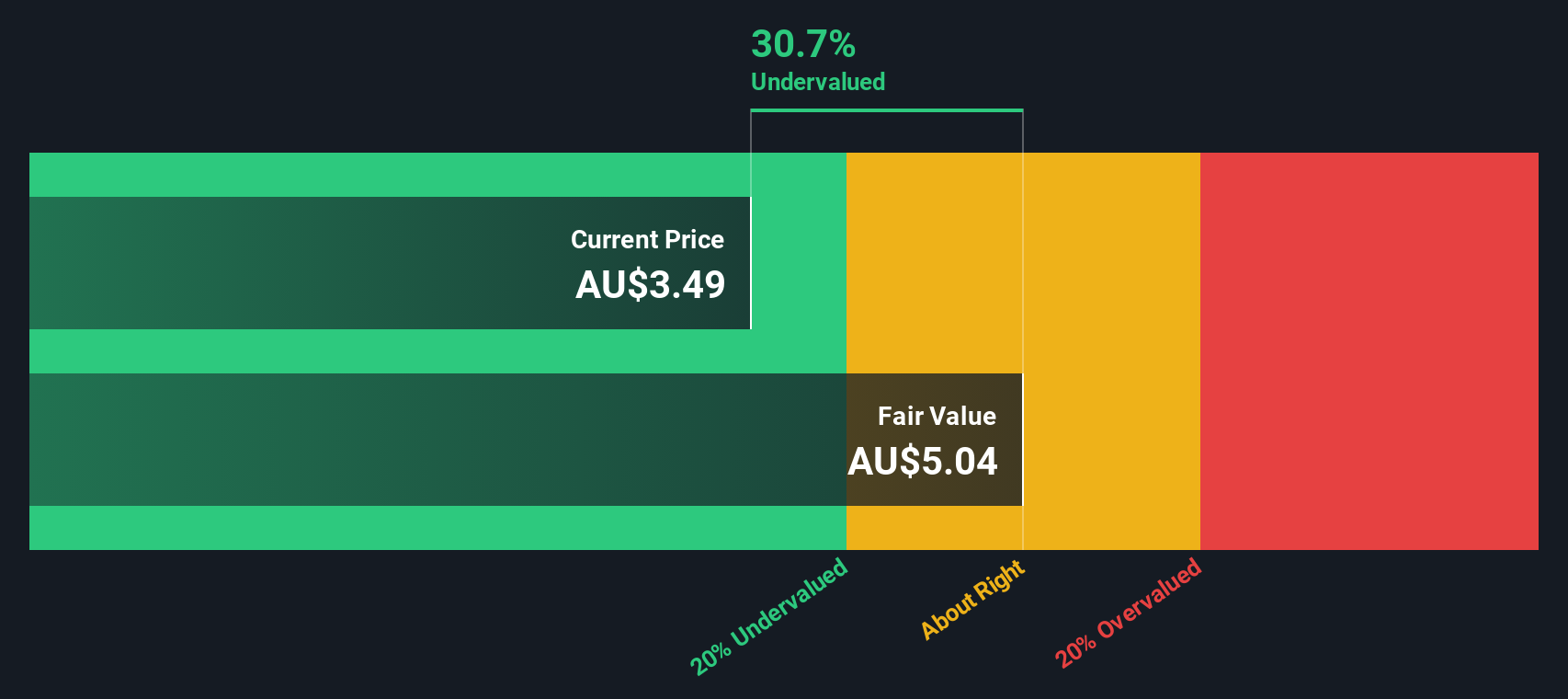

Insignia Financial (ASX:IFL)

Simply Wall St Value Rating: ★★★★★☆

Overview: Insignia Financial operates in the financial services sector, providing advice, platforms, and asset management services, with a market capitalization of A$2.5 billion.

Operations: The company's revenue primarily comes from its Platforms and Advice segments, with significant contributions also from Asset Management. Over recent periods, the gross profit margin has shown an upward trend, reaching 36.72% as of October 2024. Operating expenses have increased notably in the latest period to A$655.6 million, impacting net income figures negatively.

PE: -11.3x

Insignia Financial, a smaller company in the market, recently faced a challenging year with sales of A$1.94 billion and a net loss of A$185.3 million for the fiscal year ending June 2024. Despite these setbacks, insider confidence is evident as Allan Griffiths purchased 100,000 shares for A$231,564 in September 2024. The company's earnings are projected to grow by over 51% annually, suggesting potential future value despite current financial hurdles.

- Delve into the full analysis valuation report here for a deeper understanding of Insignia Financial.

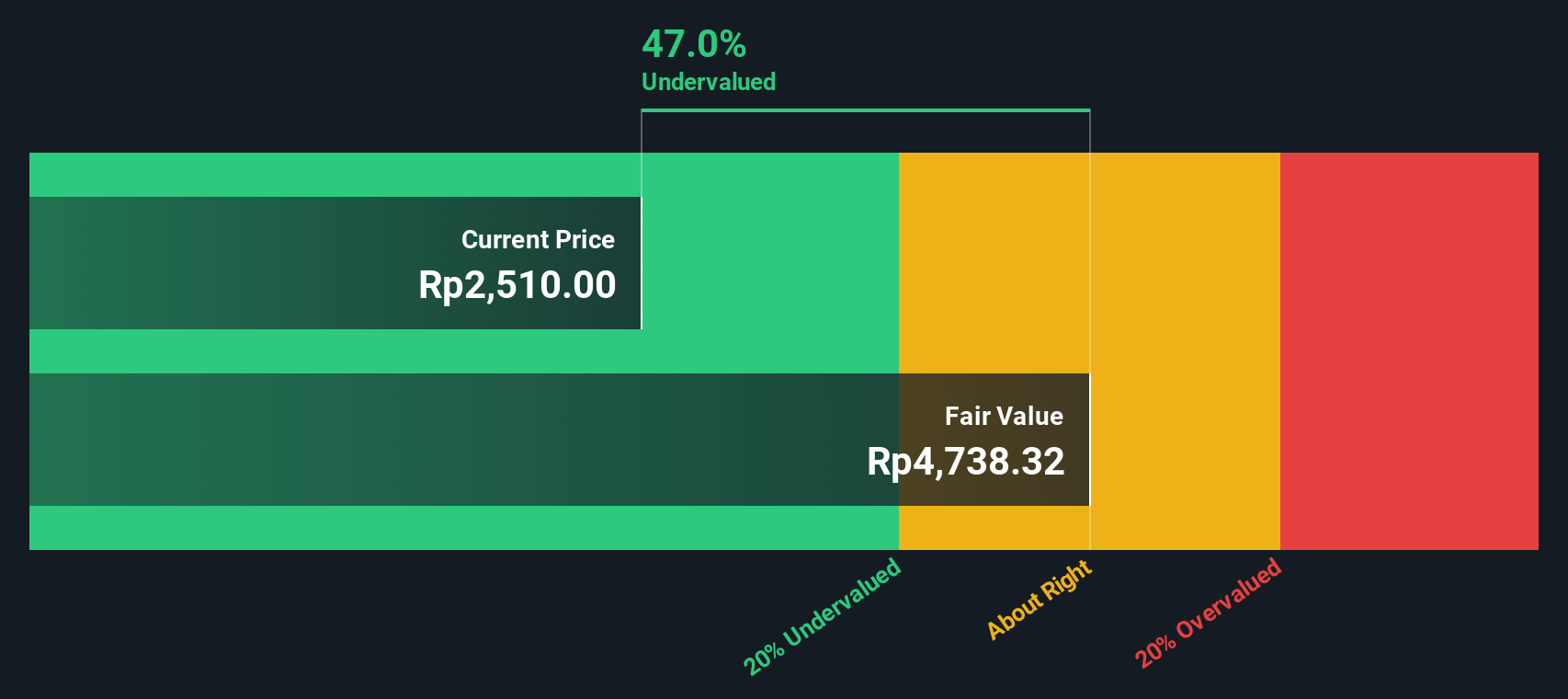

Semen Indonesia (Persero) (IDX:SMGR)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Semen Indonesia (Persero) is a leading cement producer in Indonesia, involved in both cement and non-cement production operations, with a market capitalization of IDR 47.53 trillion.

Operations: The company's revenue primarily comes from Cement Production and Non-Cement Production, totaling IDR 47.16 billion. Over the periods observed, the Gross Profit Margin has shown a declining trend from 44.29% to 24.89%.

PE: 16.2x

Semen Indonesia, a company with external borrowing as its sole funding source, recently showcased insider confidence when Agung Wiharto purchased 521,139 shares for approximately IDR 2.01 billion between July and August 2024. Despite a drop in sales to IDR 16.41 trillion and net income to IDR 501 million for the first half of the year compared to the previous period, earnings are projected to grow by over 16% annually. This suggests potential growth opportunities amid current challenges.

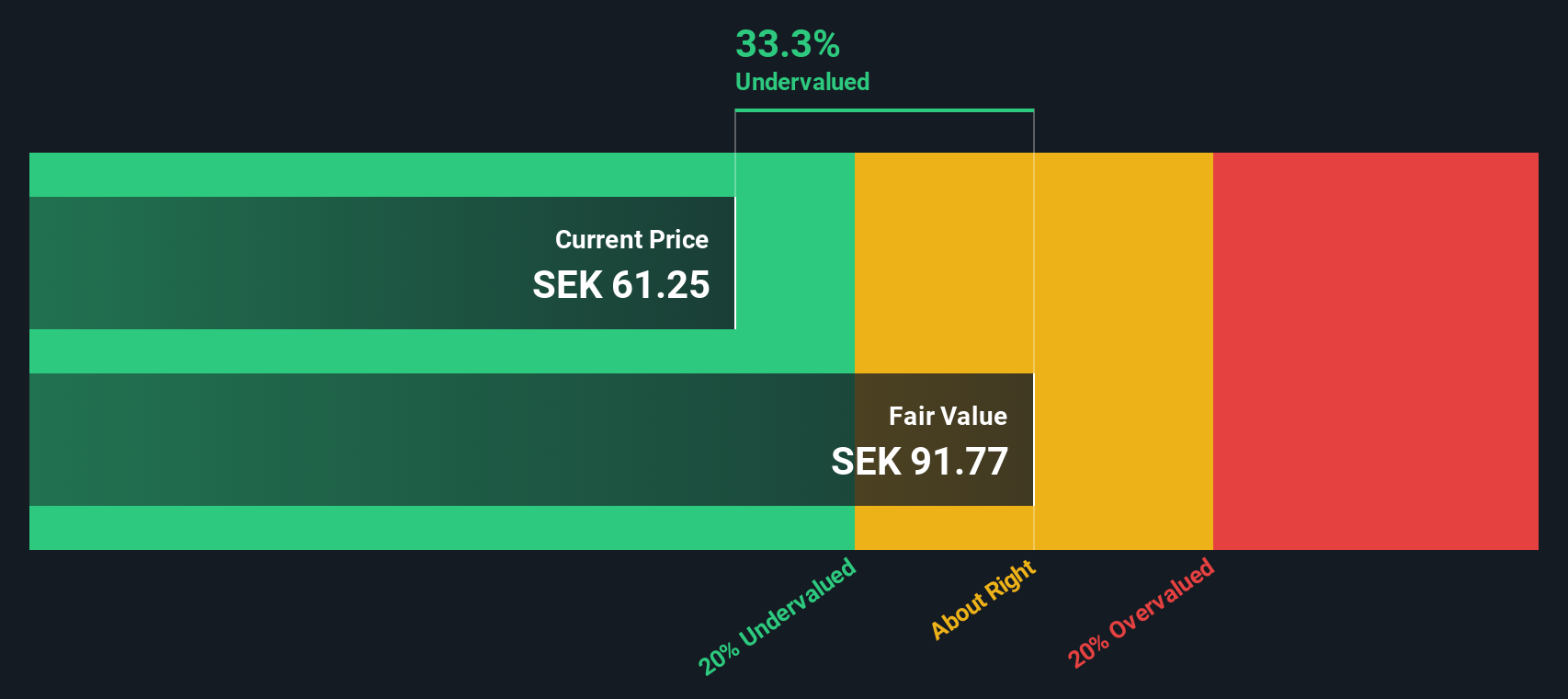

Truecaller (OM:TRUE B)

Simply Wall St Value Rating: ★★★★★☆

Overview: Truecaller is a communications software company that provides caller identification, spam blocking, and messaging services, with a market capitalization of approximately SEK 18.76 billion.

Operations: Truecaller's revenue primarily stems from its communications software segment, with recent figures reaching SEK 1.72 billion. The company has experienced fluctuations in its gross profit margin, which was at 75.64% as of the latest period. Operating expenses are significant, particularly in general and administrative costs, contributing to the overall financial structure and impacting net income margins over time.

PE: 32.8x

Truecaller, a smaller company in the tech space, shows potential for growth despite challenges. Earnings are projected to rise by 21.73% annually, signaling future expansion opportunities. However, reliance on external borrowing highlights financial risks. Recent insider confidence is evident through share purchases authorized in July 2024 to support their Share Program 2024. Strategic partnerships like the one with Halan enhance its market position by improving communication security and efficiency for users. The appointment of Seema Jindal strengthens regulatory compliance efforts in India, crucial for sustained growth and innovation in a competitive landscape.

- Click to explore a detailed breakdown of our findings in Truecaller's valuation report.

Gain insights into Truecaller's past trends and performance with our Past report.

Next Steps

- Gain an insight into the universe of 191 Undervalued Small Caps With Insider Buying by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal