3 Growth Companies On SIX Swiss Exchange With Up To 21% Insider Ownership

Over the last 7 days, the Swiss market has remained flat, yet it has experienced a notable 13% increase over the past year, with earnings expected to grow by 12% annually in the coming years. In this context of steady growth and positive outlooks, identifying companies with substantial insider ownership can be advantageous as it often indicates confidence from those closest to the business.

Top 10 Growth Companies With High Insider Ownership In Switzerland

| Name | Insider Ownership | Earnings Growth |

| LEM Holding (SWX:LEHN) | 29.9% | 20.5% |

| Stadler Rail (SWX:SRAIL) | 14.5% | 24.1% |

| VAT Group (SWX:VACN) | 10.2% | 22.8% |

| Straumann Holding (SWX:STMN) | 32.7% | 21.7% |

| Addex Therapeutics (SWX:ADXN) | 19% | 33.3% |

| Swissquote Group Holding (SWX:SQN) | 11.4% | 12.6% |

| Temenos (SWX:TEMN) | 21.8% | 14.4% |

| Partners Group Holding (SWX:PGHN) | 17% | 14.2% |

| Hocn (SWX:HOCN) | 14.6% | 122.2% |

| Sensirion Holding (SWX:SENS) | 19.9% | 102.7% |

Let's uncover some gems from our specialized screener.

Swissquote Group Holding (SWX:SQN)

Simply Wall St Growth Rating: ★★★★☆☆

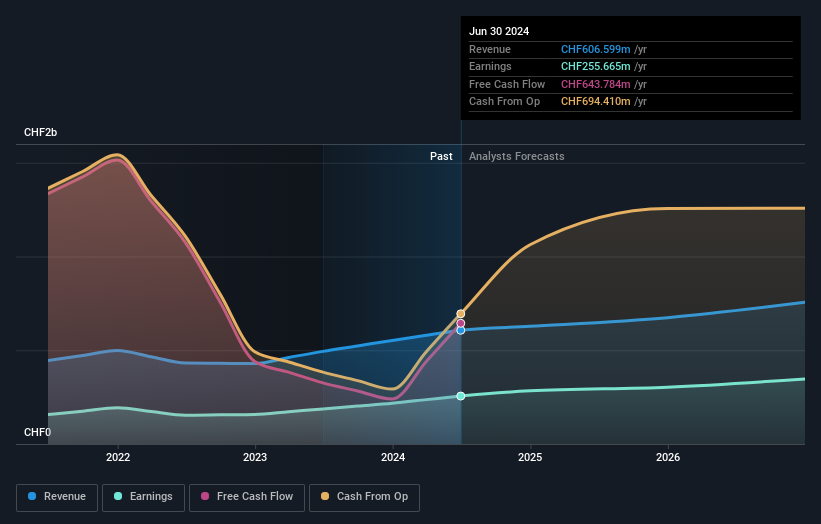

Overview: Swissquote Group Holding Ltd offers a range of online financial services to various customer segments globally, with a market cap of CHF4.54 billion.

Operations: The company generates revenue through Leveraged Forex, contributing CHF93.28 million, and Securities Trading, which accounts for CHF488.98 million.

Insider Ownership: 11.4%

Swissquote Group Holding has shown strong earnings growth, with a recent half-year net income of CHF 144.56 million, up from CHF 106.53 million year-on-year. The company's revenue is projected to grow at 11.1% annually, surpassing the Swiss market's average of 4.3%. Trading at a significant discount to its estimated fair value, Swissquote's earnings are expected to grow faster than the broader Swiss market, highlighting its potential as a growth-focused investment opportunity in Switzerland.

- Navigate through the intricacies of Swissquote Group Holding with our comprehensive analyst estimates report here.

- The valuation report we've compiled suggests that Swissquote Group Holding's current price could be quite moderate.

Temenos (SWX:TEMN)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Temenos AG develops, markets, and sells integrated banking software systems to financial institutions globally, with a market cap of CHF4.63 billion.

Operations: The company's revenue is derived from two primary segments: Product, generating $879.99 million, and Services, contributing $132.98 million.

Insider Ownership: 21.8%

Temenos is positioned for growth with its forecasted earnings increase of 14.4% annually, outpacing the Swiss market's average. Despite a high debt level, it trades at a discount to its estimated fair value, suggesting potential undervaluation. Recent executive changes aim to enhance global expansion and leverage AI-driven solutions. The completion of a CHF 200 million share buyback indicates confidence in the company's future prospects amidst strategic shifts like considering selling its fund management unit for EUR 600 million.

- Delve into the full analysis future growth report here for a deeper understanding of Temenos.

- Our expertly prepared valuation report Temenos implies its share price may be lower than expected.

V-ZUG Holding (SWX:VZUG)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: V-ZUG Holding AG develops, manufactures, markets, sells, and services kitchen and laundry appliances for private households in Switzerland and internationally, with a market cap of CHF366.43 million.

Operations: The company's revenue from household appliances amounts to CHF571.35 million.

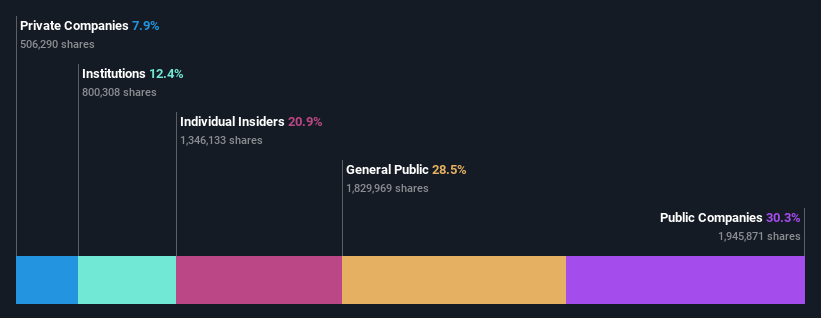

Insider Ownership: 20.9%

V-ZUG Holding is poised for significant earnings growth, with forecasts indicating a 38.7% annual increase, surpassing the Swiss market's average. Despite a volatile share price and revenue growth trailing behind its earnings, V-ZUG trades at a substantial discount to its fair value. Recent half-year results showed net income doubling to CHF 8.73 million on sales of CHF 284.08 million, reflecting operational improvements amidst stable insider ownership levels without recent trading activity.

- Click here to discover the nuances of V-ZUG Holding with our detailed analytical future growth report.

- Our valuation report here indicates V-ZUG Holding may be undervalued.

Where To Now?

- Embark on your investment journey to our 14 Fast Growing SIX Swiss Exchange Companies With High Insider Ownership selection here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal