3 Top TSX Dividend Stocks For Your Portfolio

Over the last 7 days, the Canadian market has risen by 1.4%, contributing to a remarkable 24% increase over the past year, with earnings expected to grow by 15% annually in the coming years. In this robust environment, dividend stocks that offer reliable income and potential for capital appreciation stand out as strong candidates for enhancing your portfolio's stability and growth.

Top 10 Dividend Stocks In Canada

| Name | Dividend Yield | Dividend Rating |

| Whitecap Resources (TSX:WCP) | 6.97% | ★★★★★★ |

| Labrador Iron Ore Royalty (TSX:LIF) | 7.91% | ★★★★★☆ |

| Olympia Financial Group (TSX:OLY) | 7.23% | ★★★★★☆ |

| Power Corporation of Canada (TSX:POW) | 5.09% | ★★★★★☆ |

| Enghouse Systems (TSX:ENGH) | 3.35% | ★★★★★☆ |

| Russel Metals (TSX:RUS) | 4.14% | ★★★★★☆ |

| Firm Capital Mortgage Investment (TSX:FC) | 8.48% | ★★★★★☆ |

| Sun Life Financial (TSX:SLF) | 4.13% | ★★★★★☆ |

| Royal Bank of Canada (TSX:RY) | 3.28% | ★★★★★☆ |

| Canadian Natural Resources (TSX:CNQ) | 4.33% | ★★★★★☆ |

Click here to see the full list of 29 stocks from our Top TSX Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

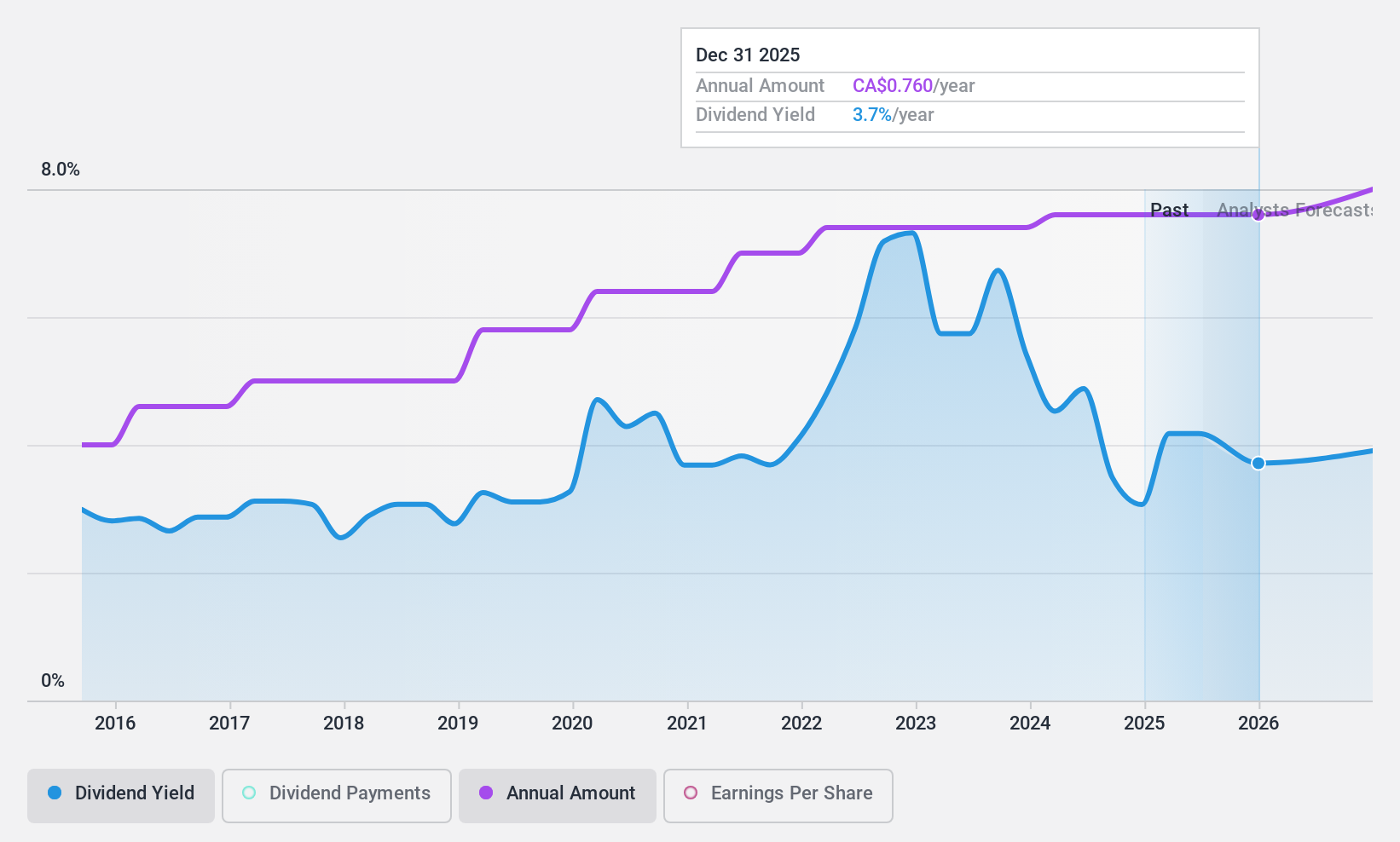

Aecon Group (TSX:ARE)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Aecon Group Inc. is a construction and infrastructure development company serving private and public sector clients in Canada, the United States, and internationally, with a market cap of CA$1.42 billion.

Operations: Aecon Group Inc.'s revenue is primarily derived from its Construction segment, which generated CA$4.04 billion, while its Concessions segment contributed CA$34.47 million.

Dividend Yield: 3.3%

Aecon Group's dividend reliability is underpinned by a stable 10-year growth history, despite recent financial challenges including a net loss of C$123.89 million in Q2 2024. The dividend yield of 3.33% is modest compared to top Canadian payers, and while dividends are well-covered by cash flows with a low cash payout ratio, the high earnings payout ratio suggests potential sustainability concerns. Recent contracts like the Winnipeg and Surrey Langley projects bolster future revenue prospects.

- Click here and access our complete dividend analysis report to understand the dynamics of Aecon Group.

- According our valuation report, there's an indication that Aecon Group's share price might be on the expensive side.

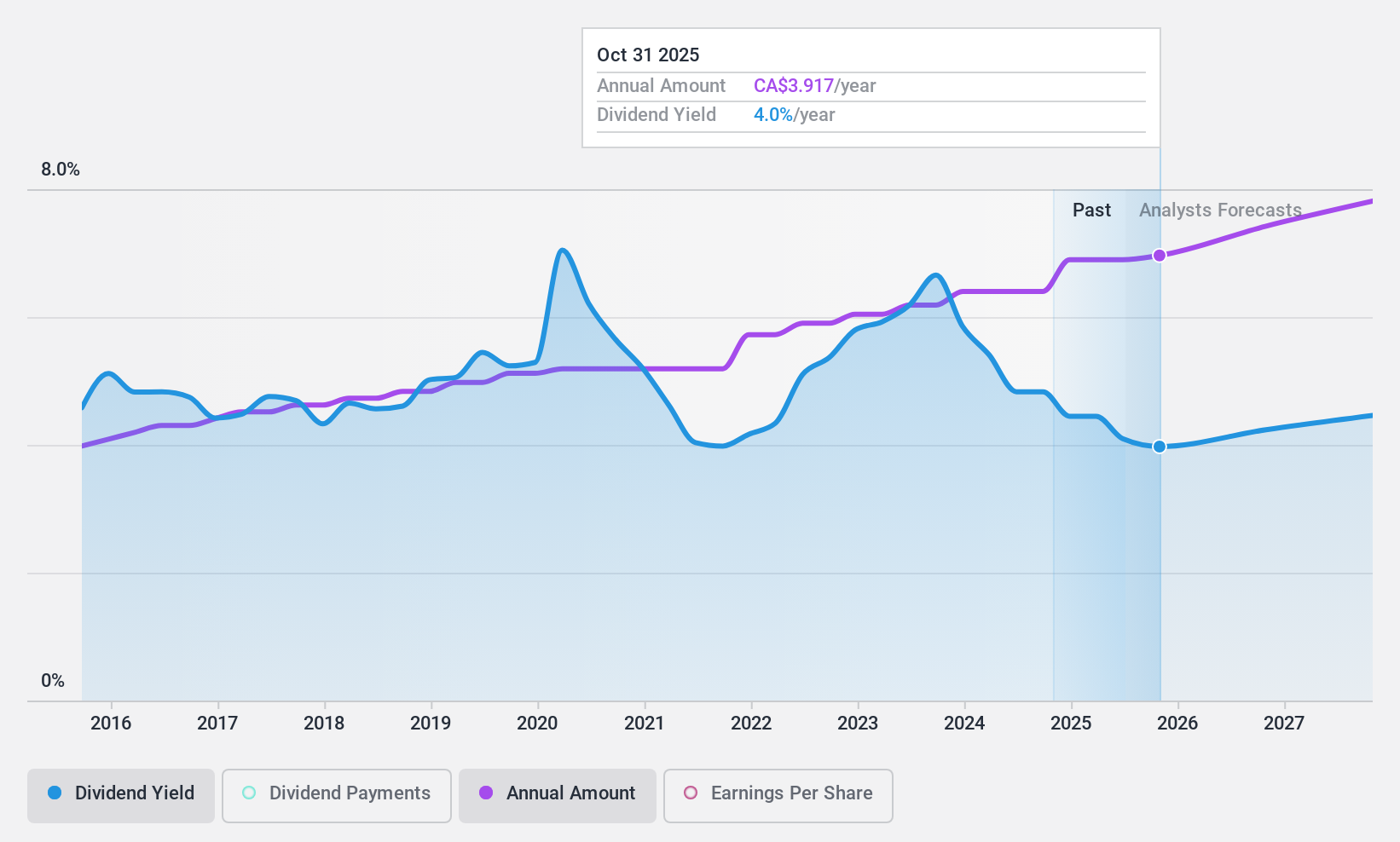

Canadian Imperial Bank of Commerce (TSX:CM)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Canadian Imperial Bank of Commerce is a diversified financial institution offering a range of financial products and services to personal, business, public sector, and institutional clients in Canada, the United States, and internationally with a market cap of CA$81.13 billion.

Operations: Canadian Imperial Bank of Commerce generates revenue from several segments, including Canadian Personal and Business Banking (CA$8.80 billion), Capital Markets and Direct Financial Services (CA$5.61 billion), U.S. Commercial Banking and Wealth Management (CA$2.02 billion), and Canadian Commercial Banking and Wealth Management (CA$5.46 billion).

Dividend Yield: 4.2%

Canadian Imperial Bank of Commerce offers a stable dividend with a current yield of 4.19%, though lower than top Canadian payers. The dividends, covered by earnings at a 51.7% payout ratio, have grown steadily over the past decade. Recent financial results show increased earnings and net income, supporting dividend sustainability. However, significant insider selling raises caution. Recent strategic initiatives like CIBC by Expedia could enhance client engagement but may not directly impact dividends immediately.

- Unlock comprehensive insights into our analysis of Canadian Imperial Bank of Commerce stock in this dividend report.

- Our expertly prepared valuation report Canadian Imperial Bank of Commerce implies its share price may be lower than expected.

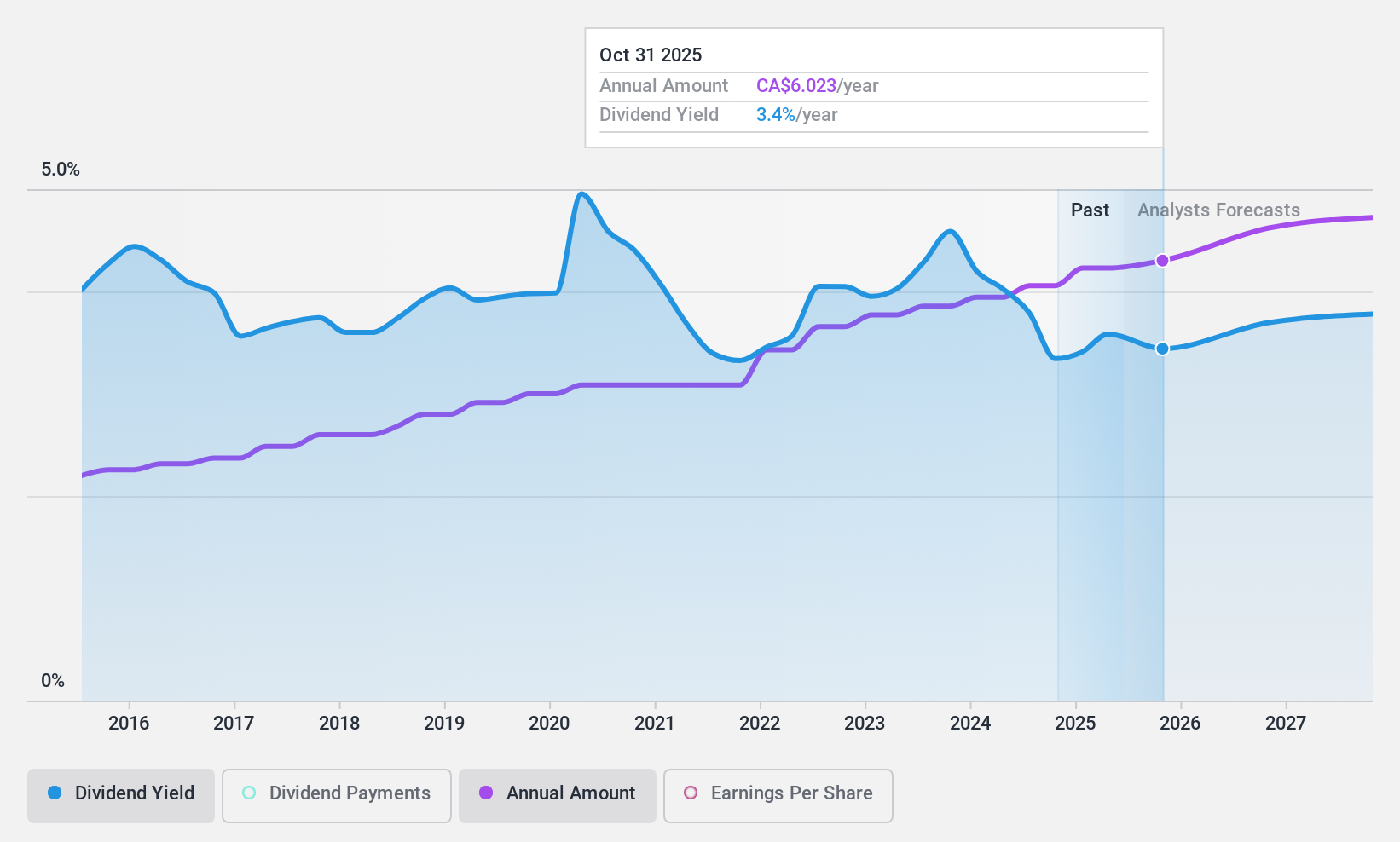

Royal Bank of Canada (TSX:RY)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Royal Bank of Canada operates as a diversified financial services company worldwide with a market cap of approximately CA$245.22 billion.

Operations: Royal Bank of Canada's revenue segments include CA$5.86 billion from Insurance, CA$11.19 billion from Capital Markets, CA$17.92 billion from Wealth Management, and CA$21.78 billion from Personal & Commercial Banking.

Dividend Yield: 3.3%

Royal Bank of Canada maintains a stable dividend with a yield of 3.28%, lower than the top Canadian payers, yet well-covered by earnings at a 49% payout ratio. Dividends have grown consistently over the past decade, reflecting reliability and sustainability. Recent earnings growth supports this stability, despite trading below estimated fair value. The bank's recent fixed-income offerings, including substantial notes issuance, strengthen its capital position but do not directly influence dividend prospects immediately.

- Click here to discover the nuances of Royal Bank of Canada with our detailed analytical dividend report.

- Upon reviewing our latest valuation report, Royal Bank of Canada's share price might be too optimistic.

Make It Happen

- Click here to access our complete index of 29 Top TSX Dividend Stocks.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal