3 Top Growth Companies With High Insider Ownership On Euronext Paris

As the French CAC 40 Index experiences a modest rise amid European hopes for quicker interest rate cuts, investors are increasingly focusing on growth companies with high insider ownership as potential opportunities. In the current market environment, stocks that combine robust growth prospects with significant insider commitment can be particularly attractive, as they often signal confidence in the company's future from those closest to its operations.

Top 10 Growth Companies With High Insider Ownership In France

| Name | Insider Ownership | Earnings Growth |

| Groupe OKwind Société anonyme (ENXTPA:ALOKW) | 20.6% | 36% |

| VusionGroup (ENXTPA:VU) | 13.4% | 81.7% |

| Icape Holding (ENXTPA:ALICA) | 30.2% | 33.9% |

| Arcure (ENXTPA:ALCUR) | 21.4% | 26.6% |

| STIF Société anonyme (ENXTPA:ALSTI) | 16.4% | 22.9% |

| La Française de l'Energie (ENXTPA:FDE) | 19.9% | 31.9% |

| Munic (ENXTPA:ALMUN) | 27.1% | 174.1% |

| Adocia (ENXTPA:ADOC) | 11.7% | 64% |

| S.M.A.I.O (ENXTPA:ALSMA) | 17.4% | 103.8% |

| MedinCell (ENXTPA:MEDCL) | 15.8% | 93.9% |

Here we highlight a subset of our preferred stocks from the screener.

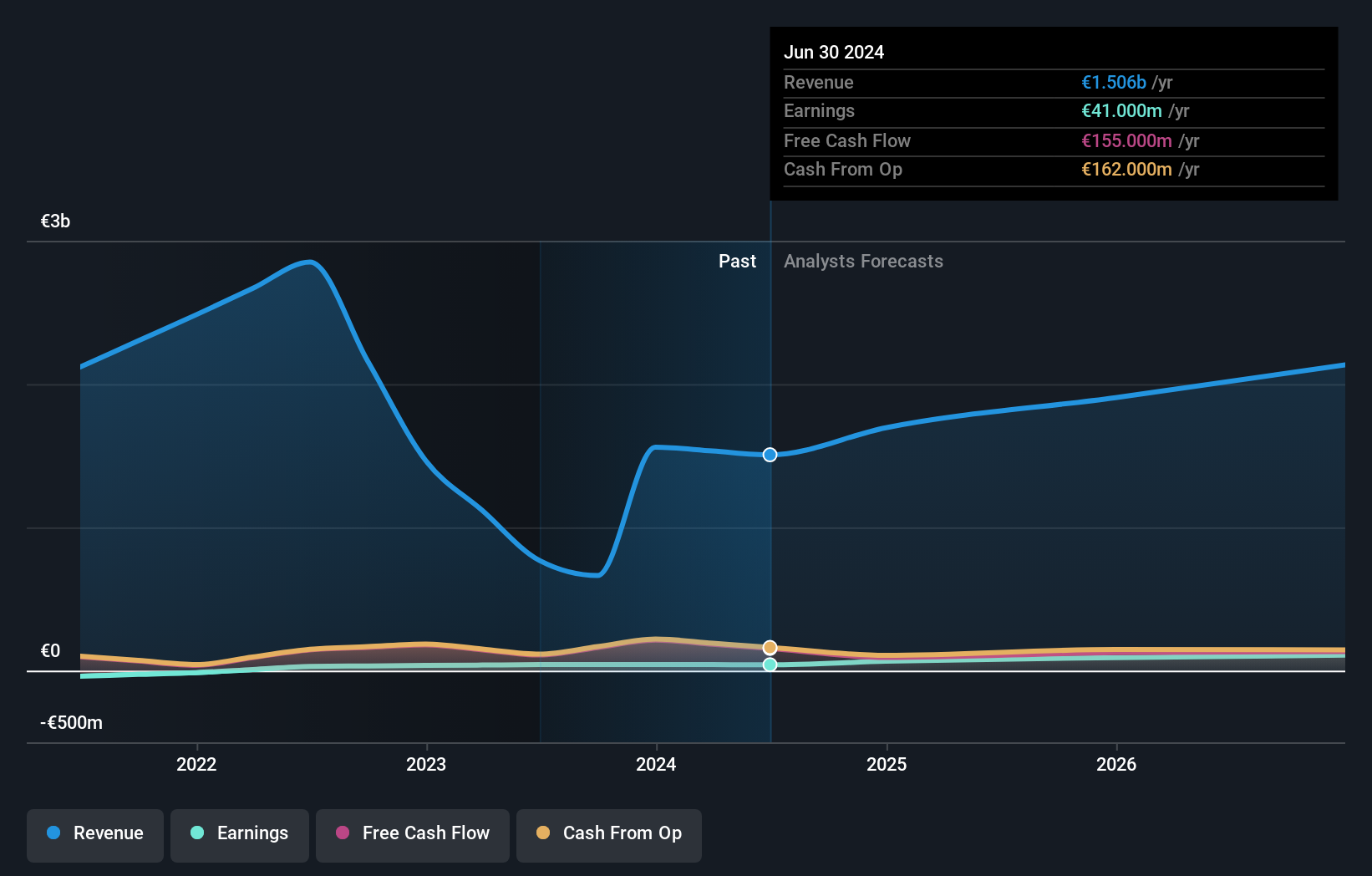

Exclusive Networks (ENXTPA:EXN)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Exclusive Networks SA is a global cybersecurity specialist focusing on digital infrastructure, with a market cap of €2.14 billion.

Operations: The company generates revenue from its key geographical segments, including €480 million from APAC, €4.19 billion from EMEA, and €705 million from the Americas.

Insider Ownership: 13.1%

Earnings Growth Forecast: 33.5% p.a.

Exclusive Networks is undergoing a significant transition as private equity firms Clayton, Dubilier & Rice and Permira propose to take it private in a €2.2 billion deal. The company, with high insider ownership at 66.7%, is expected to see earnings grow significantly faster than the French market at 33.5% annually over the next three years, despite recent declines in profit margins and sales. This transaction includes an exceptional distribution of €5.29 per share, enhancing shareholder value amidst regulatory approvals and refinancing plans.

- Click here to discover the nuances of Exclusive Networks with our detailed analytical future growth report.

- Our expertly prepared valuation report Exclusive Networks implies its share price may be too high.

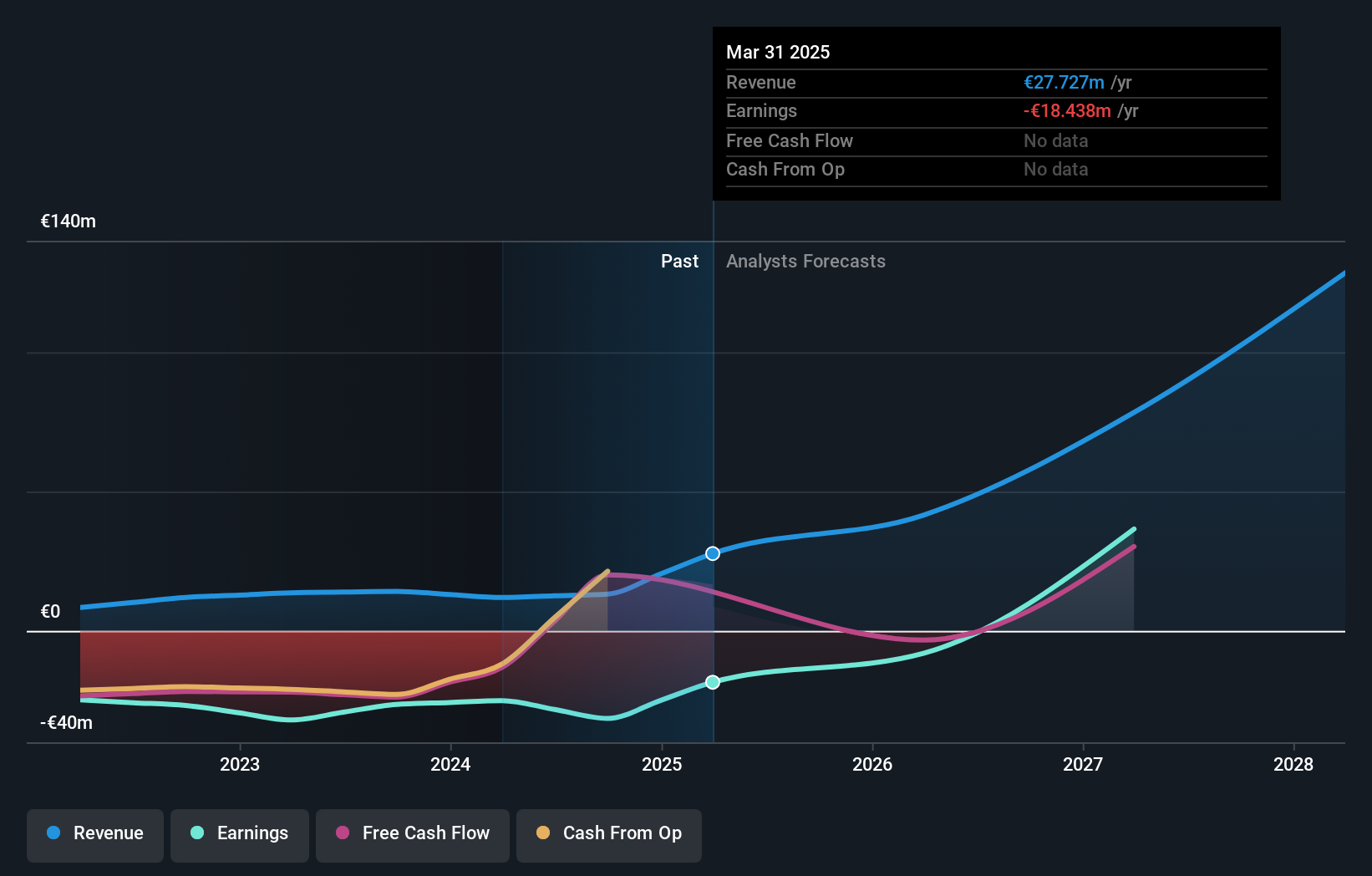

MedinCell (ENXTPA:MEDCL)

Simply Wall St Growth Rating: ★★★★★☆

Overview: MedinCell S.A. is a pharmaceutical company based in France that focuses on developing long-acting injectables across various therapeutic areas, with a market cap of €446.20 million.

Operations: The company generates revenue primarily from its Pharmaceuticals segment, amounting to €11.95 million.

Insider Ownership: 15.8%

Earnings Growth Forecast: 93.9% p.a.

MedinCell, trading significantly below its estimated fair value, is poised for rapid growth with forecasted annual revenue increases of 46.2%, outpacing the French market. Recent strategic collaborations, such as with AbbVie and Teva, bolster its innovative BEPO® technology platform for long-acting injectables. Despite negative equity, MedinCell's addition to the S&P Global BMI Index and anticipated profitability within three years highlight its potential in the pharmaceutical sector amidst governance restructuring.

- Unlock comprehensive insights into our analysis of MedinCell stock in this growth report.

- Upon reviewing our latest valuation report, MedinCell's share price might be too pessimistic.

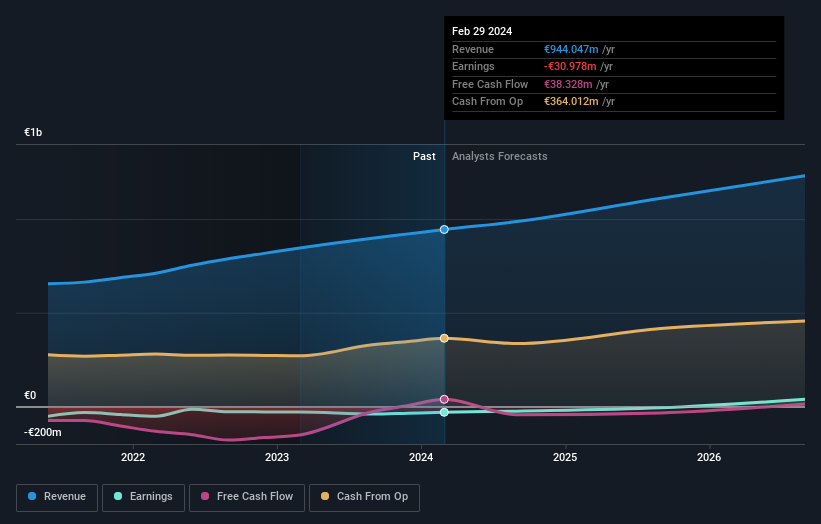

OVH Groupe (ENXTPA:OVH)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: OVH Groupe S.A. offers public and private cloud services, shared hosting, and dedicated server solutions globally, with a market cap of €1.30 billion.

Operations: The company's revenue is derived from three main segments: Public Cloud (€169.01 million), Private Cloud (€589.61 million), and Web Cloud & Other (€185.43 million).

Insider Ownership: 10.5%

Earnings Growth Forecast: 101.4% p.a.

OVH Groupe, trading at 43.3% below its estimated fair value, is projected to achieve profitability within three years, with earnings expected to grow annually by 101.37%. Its revenue growth forecast of 9.7% per year surpasses the French market average of 5.6%, indicating robust expansion potential despite a low future return on equity prediction. The company recently participated in the OCP Global Summit, underscoring its active engagement in industry events and strategic visibility efforts.

- Dive into the specifics of OVH Groupe here with our thorough growth forecast report.

- Our valuation report here indicates OVH Groupe may be undervalued.

Next Steps

- Embark on your investment journey to our 23 Fast Growing Euronext Paris Companies With High Insider Ownership selection here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal