Exploring Sweden's Undiscovered Gems This October 2024

As global markets navigate a complex landscape with mixed economic signals, Sweden's stock market offers intriguing opportunities for investors seeking untapped potential. With the pan-European STOXX Europe 600 Index showing positive momentum amid hopes of interest rate cuts, this is an opportune moment to explore lesser-known Swedish stocks that may benefit from favorable economic conditions and strategic positioning.

Top 10 Undiscovered Gems With Strong Fundamentals In Sweden

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Softronic | NA | 3.58% | 7.41% | ★★★★★★ |

| Duni | 29.33% | 10.78% | 22.98% | ★★★★★★ |

| Bahnhof | NA | 9.02% | 15.02% | ★★★★★★ |

| Firefly | NA | 16.04% | 32.29% | ★★★★★★ |

| AB Traction | NA | 5.38% | 5.19% | ★★★★★★ |

| Creades | NA | -25.97% | -24.74% | ★★★★★★ |

| Byggmästare Anders J Ahlström Holding | NA | 30.31% | -9.00% | ★★★★★★ |

| Svolder | NA | -22.68% | -24.17% | ★★★★★★ |

| Linc | NA | 56.01% | 0.54% | ★★★★★★ |

| Solid Försäkringsaktiebolag | NA | 7.64% | 28.44% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

AQ Group (OM:AQ)

Simply Wall St Value Rating: ★★★★★★

Overview: AQ Group AB (publ) is a company that manufactures and sells components and systems for industrial customers across Sweden, other European countries, and internationally, with a market cap of approximately SEK11.89 billion.

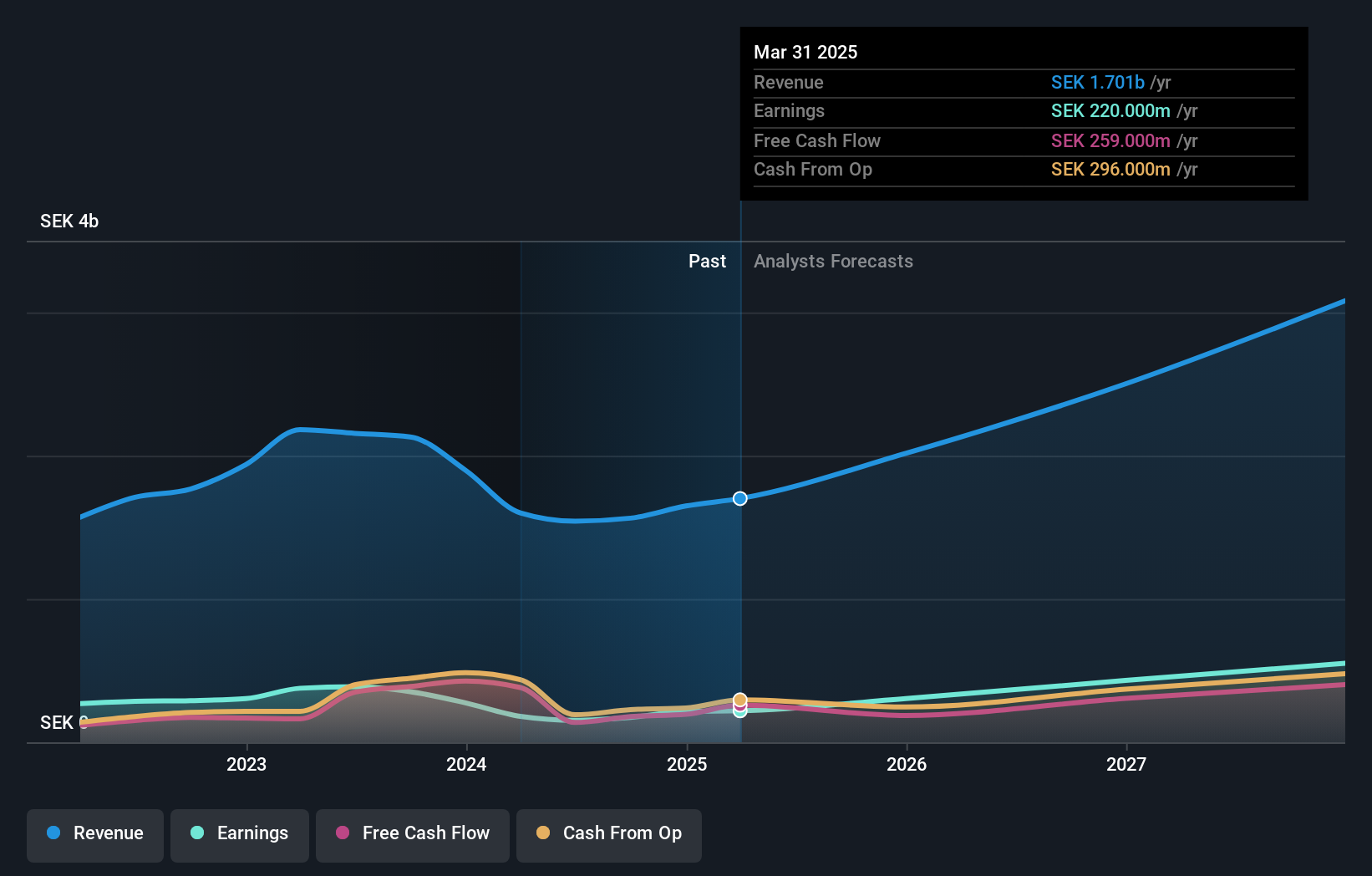

Operations: AQ Group generates revenue primarily from two segments: System (SEK1.78 billion) and Component (SEK7.87 billion). The company's financial performance is influenced by its ability to manage costs within these segments, impacting overall profitability.

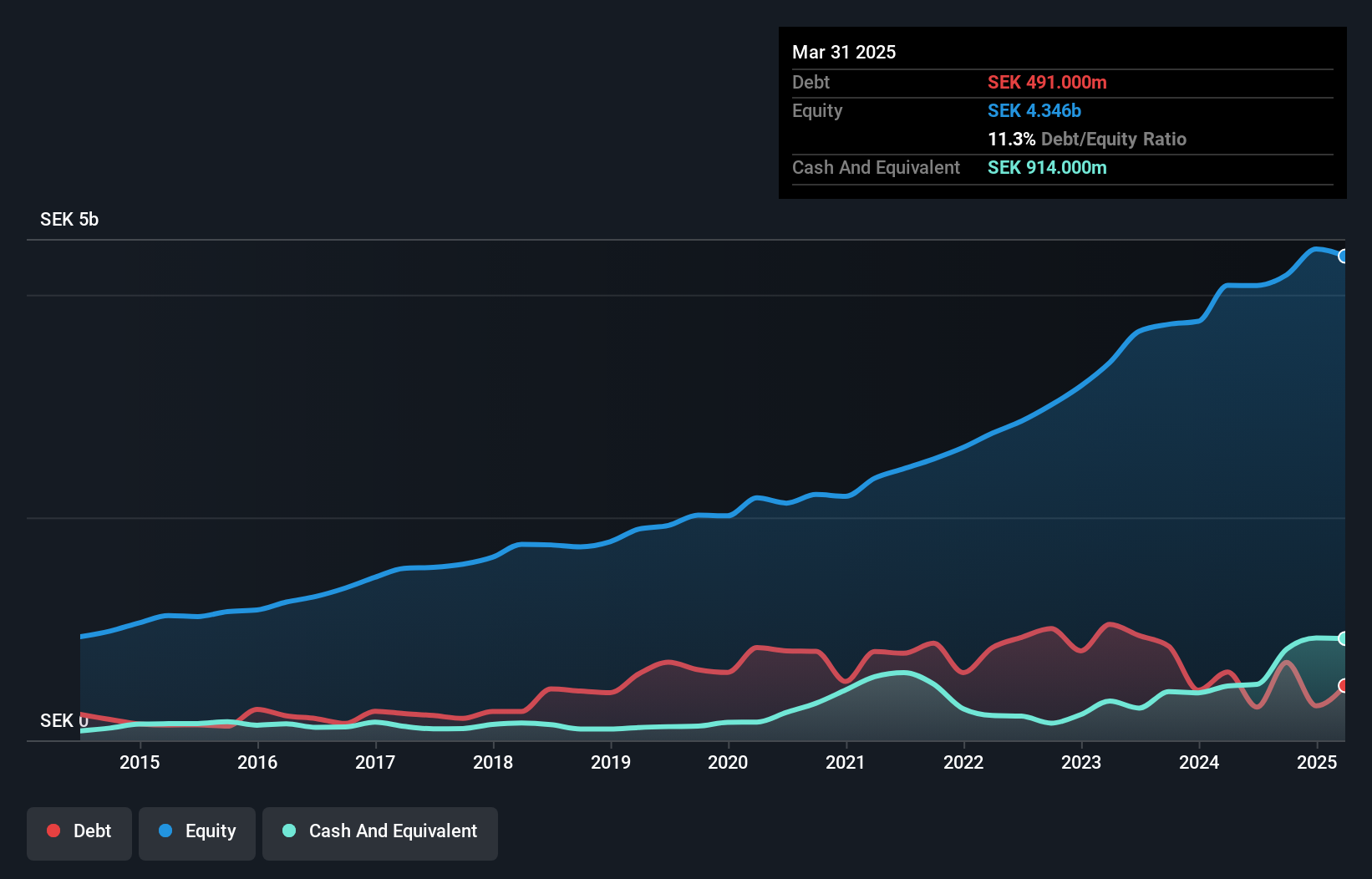

AQ Group, a promising player in Sweden's electrical industry, has seen earnings grow by 19% over the past year, outpacing the industry's 2.5%. The company is trading at a significant discount of 87.5% below its estimated fair value, suggesting potential undervaluation. Over five years, AQ has improved its financial health by reducing its debt-to-equity ratio from 36% to 7%. With interest payments well-covered by EBIT at a multiple of 32 and positive free cash flow reported recently, AQ appears financially robust.

- Click to explore a detailed breakdown of our findings in AQ Group's health report.

Examine AQ Group's past performance report to understand how it has performed in the past.

engcon (OM:ENGCON B)

Simply Wall St Value Rating: ★★★★★☆

Overview: engcon AB (publ) specializes in the design, production, and sale of excavator tools across various international markets including Europe, the Americas, Asia-Pacific regions, and has a market cap of SEK17 billion.

Operations: The company generates revenue primarily from the construction machinery and equipment segment, amounting to SEK1.54 billion. The net profit margin is a key financial metric for assessing profitability.

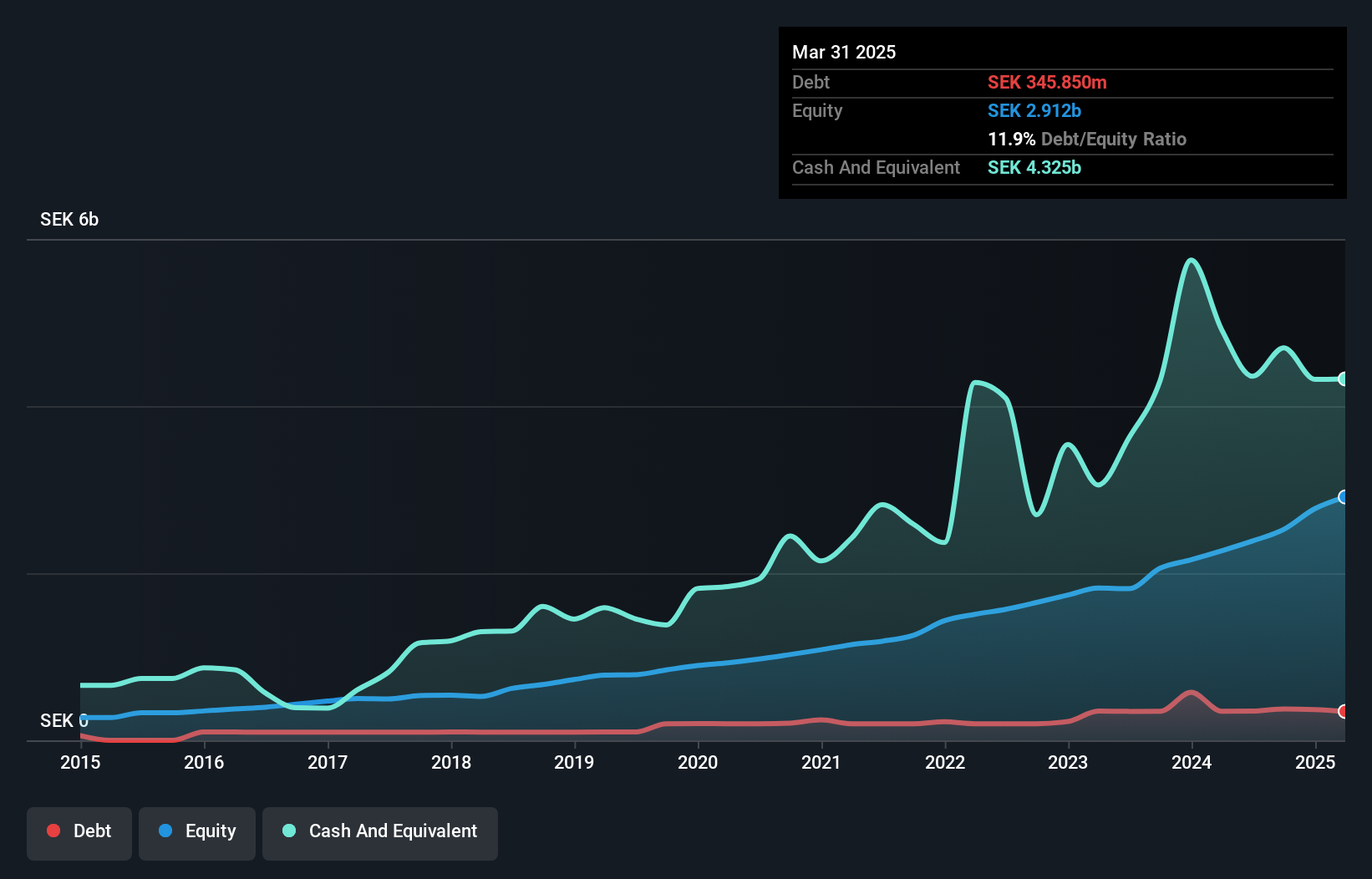

Engcon, a smaller player in Sweden's machinery sector, reported second-quarter sales of SEK 450 million, down from SEK 508 million the previous year. Net income also dipped to SEK 55 million from SEK 83 million. Despite these figures, Engcon maintains a satisfactory net debt to equity ratio of 8.5% and covers interest payments well with EBIT at 20.4x coverage. While profit margins fell to 9.9% from last year's 18%, the company remains profitable with positive free cash flow of SEK 138 million as of October this year.

- Delve into the full analysis health report here for a deeper understanding of engcon.

Review our historical performance report to gain insights into engcon's's past performance.

TF Bank (OM:TFBANK)

Simply Wall St Value Rating: ★★★★☆☆

Overview: TF Bank AB (publ) is a digital bank that offers consumer banking services and e-commerce solutions via its proprietary IT platform, with a market cap of SEK6.77 billion.

Operations: The bank generates revenue primarily from three segments: Credit Cards (SEK511.24 million), Consumer Lending (SEK607.24 million), and Ecommerce Solutions excluding Credit Cards (SEK363.28 million).

TF Bank, a relatively small player in the Swedish banking sector, shows promising potential with its earnings growth of 21.3% over the past year, surpassing the industry average of 11.8%. The bank's robust funding structure is supported by 95% low-risk customer deposits. However, it faces challenges with a high level of bad loans at 10.6%, while maintaining an allowance for these at 62%. Trading at 49% below estimated fair value presents an intriguing opportunity for investors seeking undervalued assets.

- Take a closer look at TF Bank's potential here in our health report.

Understand TF Bank's track record by examining our Past report.

Key Takeaways

- Unlock our comprehensive list of 54 Swedish Undiscovered Gems With Strong Fundamentals by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal