Investors Still Aren't Entirely Convinced By Sichuan Injet Electric Co., Ltd.'s (SZSE:300820) Earnings Despite 34% Price Jump

The Sichuan Injet Electric Co., Ltd. (SZSE:300820) share price has done very well over the last month, posting an excellent gain of 34%. The bad news is that even after the stocks recovery in the last 30 days, shareholders are still underwater by about 7.7% over the last year.

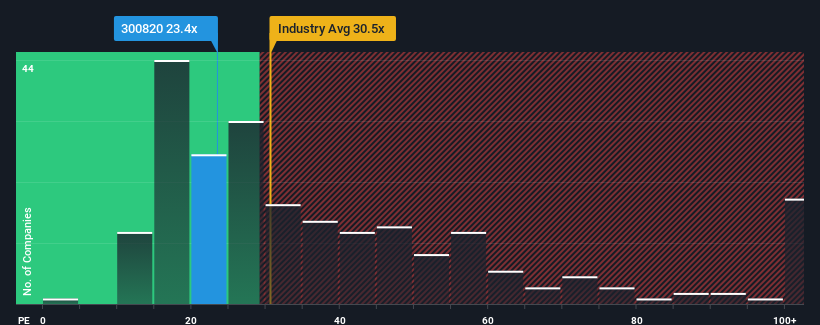

In spite of the firm bounce in price, Sichuan Injet Electric's price-to-earnings (or "P/E") ratio of 23.4x might still make it look like a buy right now compared to the market in China, where around half of the companies have P/E ratios above 32x and even P/E's above 62x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

With its earnings growth in positive territory compared to the declining earnings of most other companies, Sichuan Injet Electric has been doing quite well of late. One possibility is that the P/E is low because investors think the company's earnings are going to fall away like everyone else's soon. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

See our latest analysis for Sichuan Injet Electric

How Is Sichuan Injet Electric's Growth Trending?

The only time you'd be truly comfortable seeing a P/E as low as Sichuan Injet Electric's is when the company's growth is on track to lag the market.

If we review the last year of earnings growth, the company posted a terrific increase of 16%. The strong recent performance means it was also able to grow EPS by 224% in total over the last three years. So we can start by confirming that the company has done a great job of growing earnings over that time.

Looking ahead now, EPS is anticipated to climb by 23% per year during the coming three years according to the five analysts following the company. That's shaping up to be materially higher than the 19% each year growth forecast for the broader market.

In light of this, it's peculiar that Sichuan Injet Electric's P/E sits below the majority of other companies. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

The Final Word

Despite Sichuan Injet Electric's shares building up a head of steam, its P/E still lags most other companies. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of Sichuan Injet Electric's analyst forecasts revealed that its superior earnings outlook isn't contributing to its P/E anywhere near as much as we would have predicted. When we see a strong earnings outlook with faster-than-market growth, we assume potential risks are what might be placing significant pressure on the P/E ratio. At least price risks look to be very low, but investors seem to think future earnings could see a lot of volatility.

It is also worth noting that we have found 2 warning signs for Sichuan Injet Electric that you need to take into consideration.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal