KRX Growth Companies With High Insider Ownership For October 2024

The South Korean market has shown positive momentum, rising 1.1% in the last week and 4.9% over the past year, with earnings projected to grow by 30% annually. In this environment, growth companies with high insider ownership can be particularly appealing as they often signal strong internal confidence and alignment of interests between shareholders and management.

Top 10 Growth Companies With High Insider Ownership In South Korea

| Name | Insider Ownership | Earnings Growth |

| People & Technology (KOSDAQ:A137400) | 16.4% | 35.6% |

| Seojin SystemLtd (KOSDAQ:A178320) | 30.8% | 49.1% |

| ALTEOGEN (KOSDAQ:A196170) | 26.6% | 99.5% |

| Bioneer (KOSDAQ:A064550) | 15.8% | 97.6% |

| Oscotec (KOSDAQ:A039200) | 26.1% | 122% |

| HANA Micron (KOSDAQ:A067310) | 18.3% | 105.8% |

| Vuno (KOSDAQ:A338220) | 19.4% | 110.9% |

| Park Systems (KOSDAQ:A140860) | 33% | 34.6% |

| UTI (KOSDAQ:A179900) | 33.1% | 134.6% |

| Techwing (KOSDAQ:A089030) | 18.7% | 83.6% |

We're going to check out a few of the best picks from our screener tool.

ALTEOGEN (KOSDAQ:A196170)

Simply Wall St Growth Rating: ★★★★★★

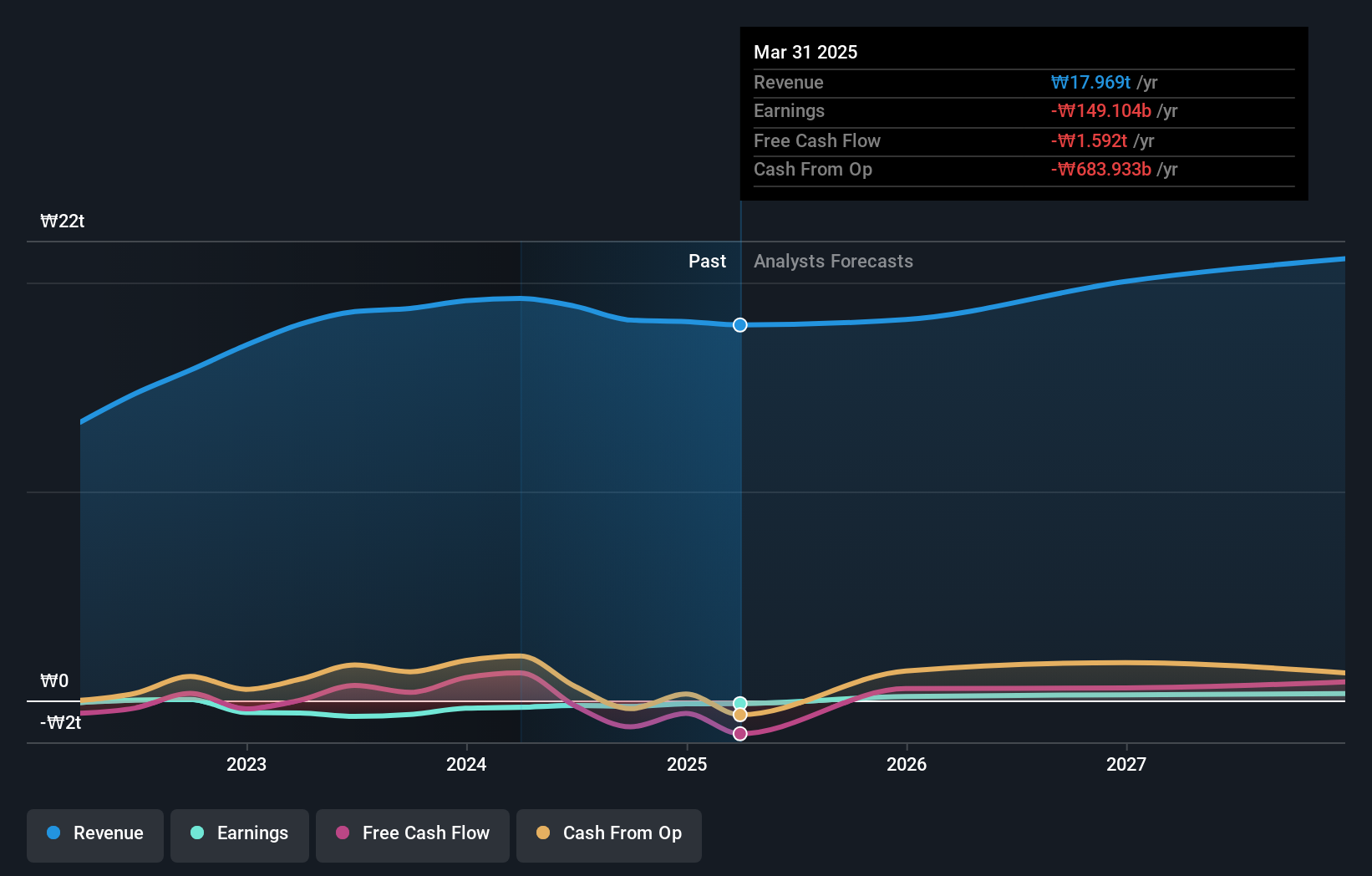

Overview: ALTEOGEN Inc. is a biotechnology company that develops long-acting biobetters, proprietary antibody-drug conjugates, and antibody biosimilars, with a market cap of ₩20.53 trillion.

Operations: The company generates revenue from its biotechnology segment, amounting to ₩90.79 billion.

Insider Ownership: 26.6%

ALTEOGEN is projected to experience substantial growth, with revenue expected to increase by 64.2% annually, outpacing the South Korean market's 10.4%. The company is anticipated to achieve profitability within three years, surpassing average market growth rates. Despite recent shareholder dilution and high share price volatility, ALTEOGEN trades at 70.3% below its estimated fair value and forecasts a very high return on equity of 66.3% in three years, indicating potential long-term value for investors.

- Navigate through the intricacies of ALTEOGEN with our comprehensive analyst estimates report here.

- Our valuation report here indicates ALTEOGEN may be overvalued.

Doosan (KOSE:A000150)

Simply Wall St Growth Rating: ★★★★☆☆

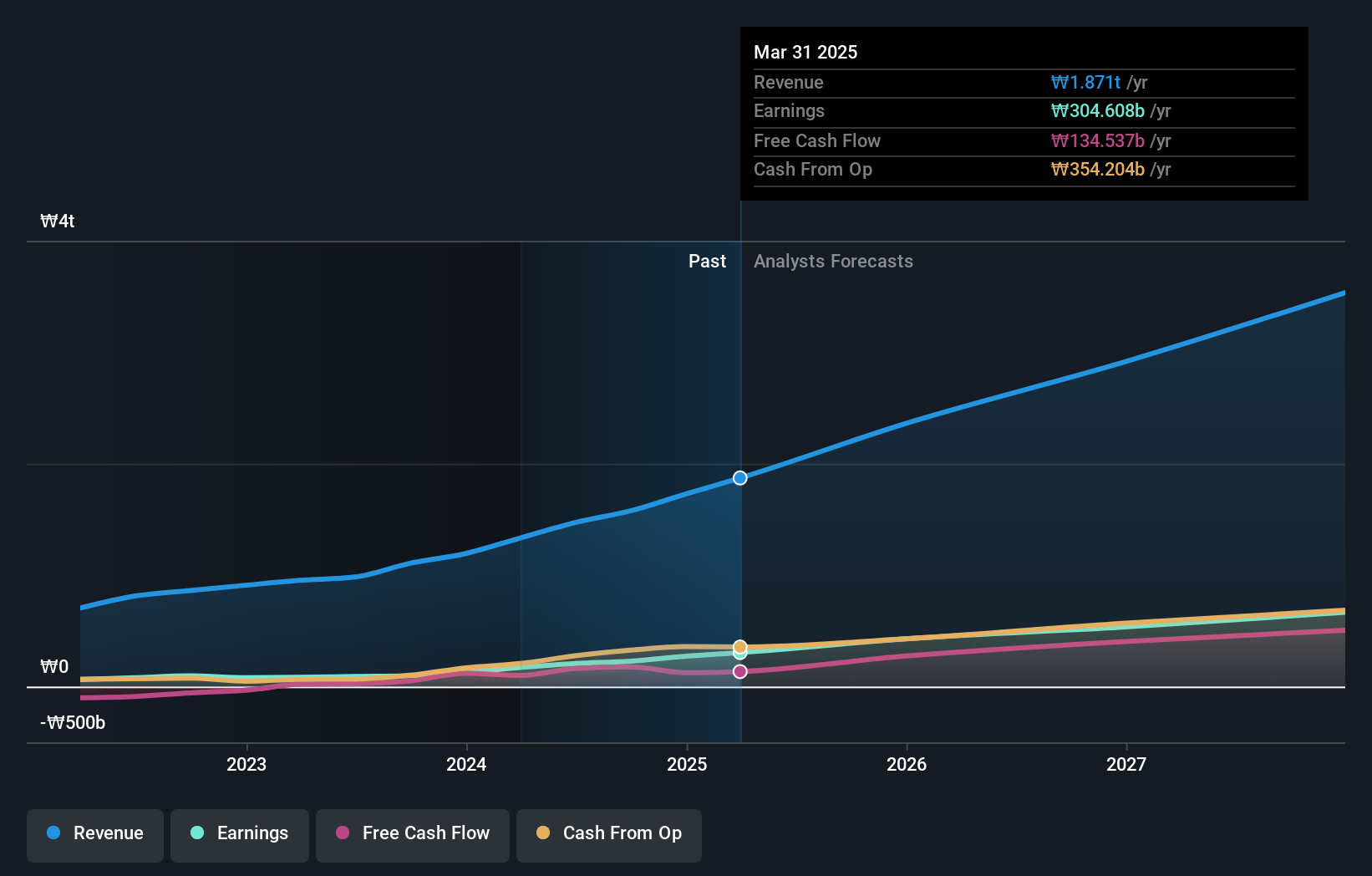

Overview: Doosan Corporation operates in heavy industry, machinery manufacturing, and apartment construction across South Korea, the United States, Asia, the Middle East, Europe, and other international markets with a market cap of ₩2.93 trillion.

Operations: The company's revenue segments include Doosan Bobcat with ₩9.31 billion, Doosan Energy at ₩8.25 billion, Electronic BG contributing ₩855.42 million, Doosan Fuel Cell at ₩279.99 million, and Digital Innovation BU generating ₩286.29 million.

Insider Ownership: 38.9%

Doosan is anticipated to achieve profitability within three years, with earnings forecasted to grow 65.51% annually, surpassing average market growth. Despite a volatile share price and slower revenue growth at 3.7% annually compared to the South Korean market, it trades at 61.5% below its estimated fair value. Recently added to the S&P Global BMI Index, Doosan's return on equity is projected to reach a strong 20%, suggesting potential long-term value for investors.

- Unlock comprehensive insights into our analysis of Doosan stock in this growth report.

- Our valuation report here indicates Doosan may be undervalued.

Samyang Foods (KOSE:A003230)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Samyang Foods Co., Ltd., along with its subsidiaries, operates in the food industry both in South Korea and internationally, with a market cap of ₩4.24 trillion.

Operations: Unfortunately, the provided text does not contain specific revenue segment figures for Samyang Foods Co., Ltd.

Insider Ownership: 11.6%

Samyang Foods is positioned for growth with earnings expected to increase by 21.16% annually, although this lags behind the broader South Korean market's projected growth. The company's revenue is forecasted to rise by 17.9% per year, outpacing the market average of 10.4%. Trading at a significant discount of 59% below its estimated fair value, Samyang Foods offers potential upside according to analysts who predict a stock price increase of 27.4%.

- Dive into the specifics of Samyang Foods here with our thorough growth forecast report.

- The valuation report we've compiled suggests that Samyang Foods' current price could be quite moderate.

Key Takeaways

- Explore the 86 names from our Fast Growing KRX Companies With High Insider Ownership screener here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal