Market Participants Recognise City Chic Collective Limited's (ASX:CCX) Revenues Pushing Shares 26% Higher

City Chic Collective Limited (ASX:CCX) shares have had a really impressive month, gaining 26% after a shaky period beforehand. Still, the 30-day jump doesn't change the fact that longer term shareholders have seen their stock decimated by the 56% share price drop in the last twelve months.

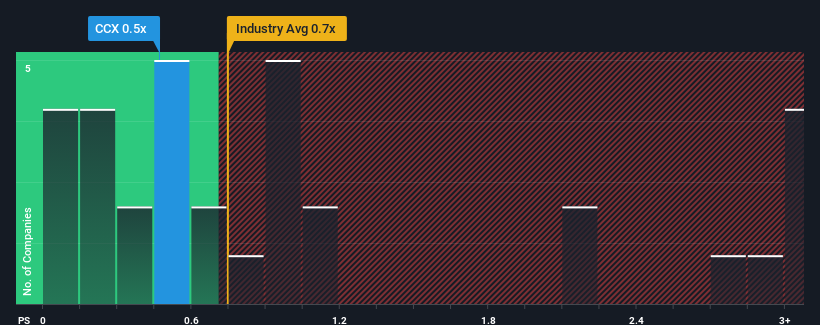

Even after such a large jump in price, there still wouldn't be many who think City Chic Collective's price-to-sales (or "P/S") ratio of 0.5x is worth a mention when the median P/S in Australia's Specialty Retail industry is similar at about 0.7x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for City Chic Collective

How City Chic Collective Has Been Performing

City Chic Collective hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. One possibility is that the P/S ratio is moderate because investors think this poor revenue performance will turn around. If not, then existing shareholders may be a little nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on City Chic Collective.Is There Some Revenue Growth Forecasted For City Chic Collective?

City Chic Collective's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Retrospectively, the last year delivered a frustrating 29% decrease to the company's top line. As a result, revenue from three years ago have also fallen 51% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Shifting to the future, estimates from the three analysts covering the company suggest revenue should grow by 8.6% per year over the next three years. With the industry predicted to deliver 7.8% growth per annum, the company is positioned for a comparable revenue result.

With this information, we can see why City Chic Collective is trading at a fairly similar P/S to the industry. Apparently shareholders are comfortable to simply hold on while the company is keeping a low profile.

The Bottom Line On City Chic Collective's P/S

Its shares have lifted substantially and now City Chic Collective's P/S is back within range of the industry median. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our look at City Chic Collective's revenue growth estimates show that its P/S is about what we expect, as both metrics follow closely with the industry averages. Right now shareholders are comfortable with the P/S as they are quite confident future revenue won't throw up any surprises. Unless these conditions change, they will continue to support the share price at these levels.

Before you settle on your opinion, we've discovered 3 warning signs for City Chic Collective (2 can't be ignored!) that you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal