Top Dividend Stocks On The Japanese Exchange For October 2024

Japan's stock markets have shown positive momentum, with the Nikkei 225 Index gaining 2.45% and the broader TOPIX Index up 0.45%, supported by a weaker yen that enhances the profit outlook for exporters. In this favorable economic environment, dividend stocks can be attractive to investors seeking steady income and potential capital appreciation, as they often represent companies with strong financial health and stable earnings.

Top 10 Dividend Stocks In Japan

| Name | Dividend Yield | Dividend Rating |

| Yamato Kogyo (TSE:5444) | 4.18% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.14% | ★★★★★★ |

| Globeride (TSE:7990) | 4.18% | ★★★★★★ |

| Intelligent Wave (TSE:4847) | 3.96% | ★★★★★★ |

| KurimotoLtd (TSE:5602) | 5.27% | ★★★★★★ |

| Innotech (TSE:9880) | 4.81% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.56% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.16% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.79% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.50% | ★★★★★★ |

Click here to see the full list of 446 stocks from our Top Japanese Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

B-Lot (TSE:3452)

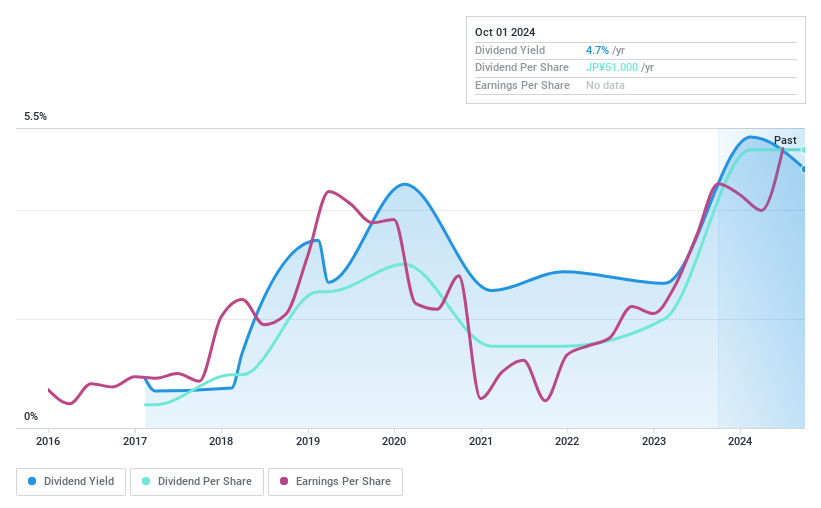

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: B-Lot Company Limited operates in the real estate and financial consulting sectors in Japan with a market cap of ¥22.39 billion.

Operations: B-Lot Company Limited's revenue segments include ¥2.18 billion from the Real Estate Consulting Business, ¥4.31 billion from the Real Estate Management Business, and ¥19.47 billion from the Real Estate Investment Development Business.

Dividend Yield: 4.4%

B-Lot's dividend yield of 4.41% ranks in the top 25% of Japanese dividend payers, supported by a low payout ratio of 24.9%, indicating dividends are well-covered by earnings. However, the company's dividend history is unstable with volatile payments over its eight-year record, and cash flow coverage at a reasonable 64.5%. Recent buyback announcements involving ¥500 million may signal confidence but do not address underlying volatility concerns in dividend reliability.

- Delve into the full analysis dividend report here for a deeper understanding of B-Lot.

- Our expertly prepared valuation report B-Lot implies its share price may be too high.

SuzukiLtd (TSE:6785)

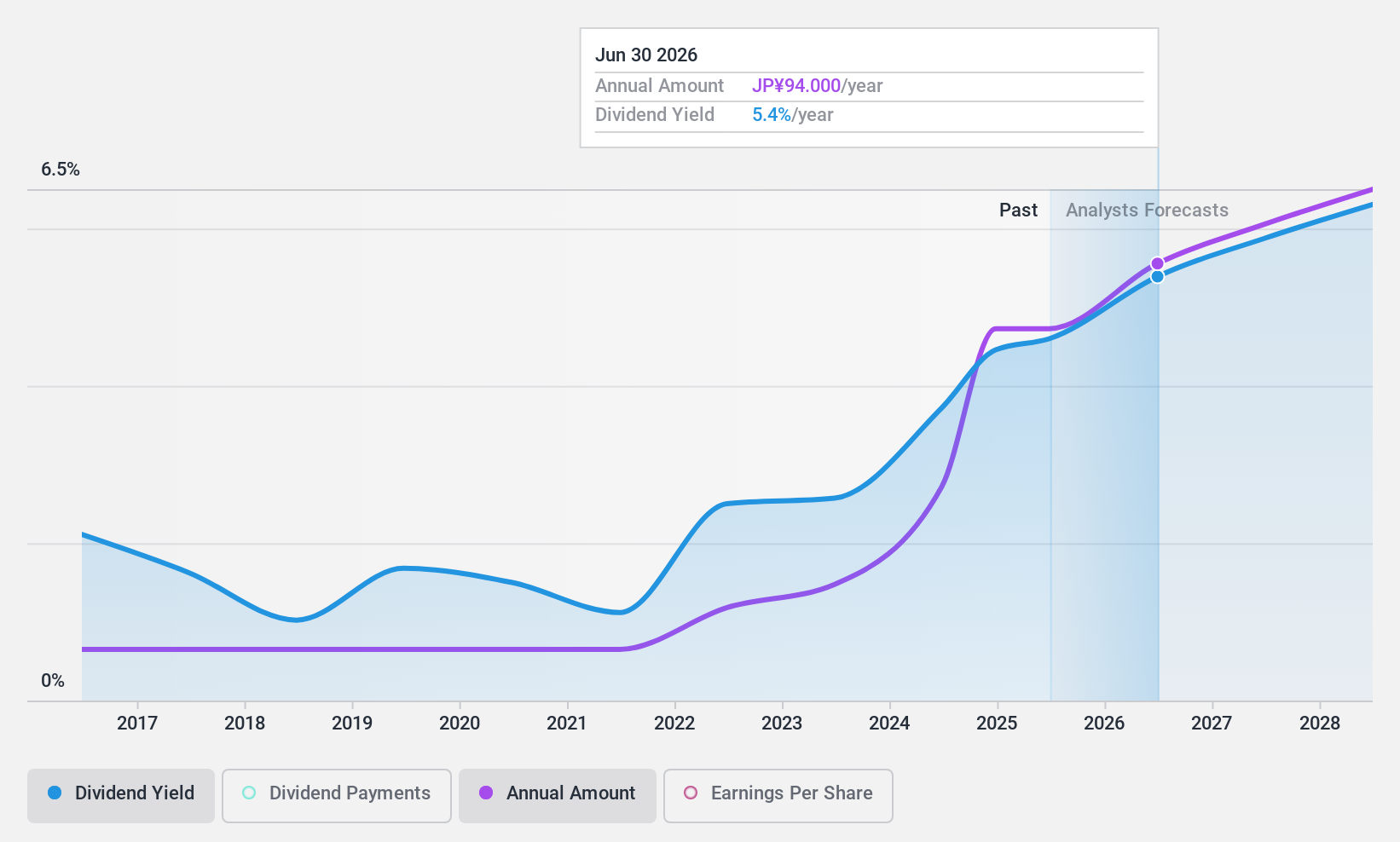

Simply Wall St Dividend Rating: ★★★★★★

Overview: Suzuki Co., Ltd. manufactures and sells connectors for car electronics parts in Japan, with a market cap of ¥24.45 billion.

Operations: Suzuki Co., Ltd. generates revenue through several segments, including Parts at ¥19.21 billion, Mechanical Equipment at ¥6.20 billion, Mold at ¥2.61 billion, and Rent at ¥346.95 million.

Dividend Yield: 4.3%

Suzuki Ltd.'s dividend yield of 4.31% places it among the top 25% of Japanese dividend payers, with stable and growing dividends over the past decade. The payout ratio is a low 29.1%, suggesting strong earnings coverage, while cash flow coverage stands at a comfortable 40.2%. Despite recent share price volatility, Suzuki's inclusion in the S&P Global BMI Index may enhance its visibility among investors seeking reliable dividend stocks in Japan.

- Unlock comprehensive insights into our analysis of SuzukiLtd stock in this dividend report.

- Our comprehensive valuation report raises the possibility that SuzukiLtd is priced lower than what may be justified by its financials.

Shibusawa Warehouse (TSE:9304)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: The Shibusawa Warehouse Co., Ltd. offers logistics and warehousing services both in Japan and internationally, with a market cap of ¥46.60 billion.

Operations: Shibusawa Warehouse Co., Ltd. generates revenue primarily from its Logistics Business, which accounts for ¥68.72 billion, and its Real Estate Business, contributing ¥6.01 billion.

Dividend Yield: 3.4%

Shibusawa Warehouse offers a dividend yield of 3.42%, below the top quartile of Japanese dividend payers. Its low payout ratio of 33.5% indicates dividends are covered by earnings, yet they aren't backed by free cash flow, raising sustainability concerns. Despite this, dividends have been stable and growing over the past decade. The company's Price-To-Earnings ratio is favorable at 10.4x compared to the market average, suggesting potential value for investors focused on earnings coverage rather than cash flow support.

- Click here to discover the nuances of Shibusawa Warehouse with our detailed analytical dividend report.

- The valuation report we've compiled suggests that Shibusawa Warehouse's current price could be inflated.

Turning Ideas Into Actions

- Investigate our full lineup of 446 Top Japanese Dividend Stocks right here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal