Exploring 3 High Growth Tech Stocks in Australia

Over the last 7 days, the Australian market has risen 1.7%, and over the past 12 months, it is up by an impressive 18%, with earnings forecasted to grow by 12% annually. In this robust environment, identifying high growth tech stocks involves assessing their potential to capitalize on technological advancements and market opportunities while aligning with these positive market trends.

Top 10 High Growth Tech Companies In Australia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Clinuvel Pharmaceuticals | 22.32% | 27.42% | ★★★★★★ |

| Adherium | 86.80% | 73.66% | ★★★★★★ |

| DUG Technology | 10.79% | 31.83% | ★★★★★☆ |

| ImExHS | 20.47% | 111.20% | ★★★★★★ |

| Telix Pharmaceuticals | 20.19% | 38.31% | ★★★★★★ |

| AVA Risk Group | 32.56% | 118.83% | ★★★★★★ |

| Careteq | 37.17% | 126.21% | ★★★★★☆ |

| Pointerra | 56.62% | 126.45% | ★★★★★★ |

| Wrkr | 36.31% | 100.29% | ★★★★★★ |

| Adveritas | 57.98% | 144.21% | ★★★★★★ |

Click here to see the full list of 63 stocks from our ASX High Growth Tech and AI Stocks screener.

Let's explore several standout options from the results in the screener.

Life360 (ASX:360)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Life360, Inc. operates a technology platform that helps locate people, pets, and things across various regions including North America, Europe, the Middle East, Africa, and internationally with a market cap of A$4.99 billion.

Operations: The company generates revenue through its software and programming segment, amounting to $328.68 million. Its focus is on providing a technology platform that facilitates the location of people, pets, and things across multiple regions globally.

In the rapidly evolving tech landscape, Life360 stands out with its innovative approach to family safety through technology. The company's recent launch of an updated Tile tracker lineup underscores its commitment to enhancing user experience and safety; these devices integrate seamlessly with the Life360 app, offering features like extended Bluetooth range and a louder ring, priced between $24.99 and $34.99. Financially, Life360 is navigating through growth phases with expected revenue increases of 15.6% annually, outpacing the Australian market's 5.6%. Despite current unprofitability, earnings are projected to surge by 68.47% per year due to strategic expansions and product innovations like the new Tile series which could significantly bolster market presence by catering effectively to consumer needs for security and connectivity.

- Click to explore a detailed breakdown of our findings in Life360's health report.

Gain insights into Life360's historical performance by reviewing our past performance report.

REA Group (ASX:REA)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: REA Group Limited operates an online property advertising business across Australia, India, the United States, Malaysia, Singapore, Thailand, Vietnam, and other international markets with a market capitalization of A$29.59 billion.

Operations: The company generates revenue primarily from its property and online advertising segment in Australia, which contributes A$1.25 billion, followed by financial services in Australia at A$320.60 million, and operations in India at A$103.10 million. The business focuses on leveraging its international presence to support its core advertising operations while managing costs across diverse markets.

REA Group, amidst a challenging landscape, has demonstrated resilience with a 6.5% annual revenue growth rate, outpacing the broader Australian market's 5.6%. Despite a recent dip in net income from AUD 356.1 million to AUD 302.8 million year-over-year, the company is poised for recovery with projected earnings growth of 16.8% annually. This optimism is bolstered by strategic dividend increases and robust shareholder engagement signaled by recent AGMs and earnings calls, reflecting confidence in its financial health and operational strategy. Furthermore, REA's commitment to innovation is evident from its R&D investments aimed at enhancing its digital real estate services platform—a critical move to maintain competitiveness in the interactive media and services industry.

- Click here to discover the nuances of REA Group with our detailed analytical health report.

Assess REA Group's past performance with our detailed historical performance reports.

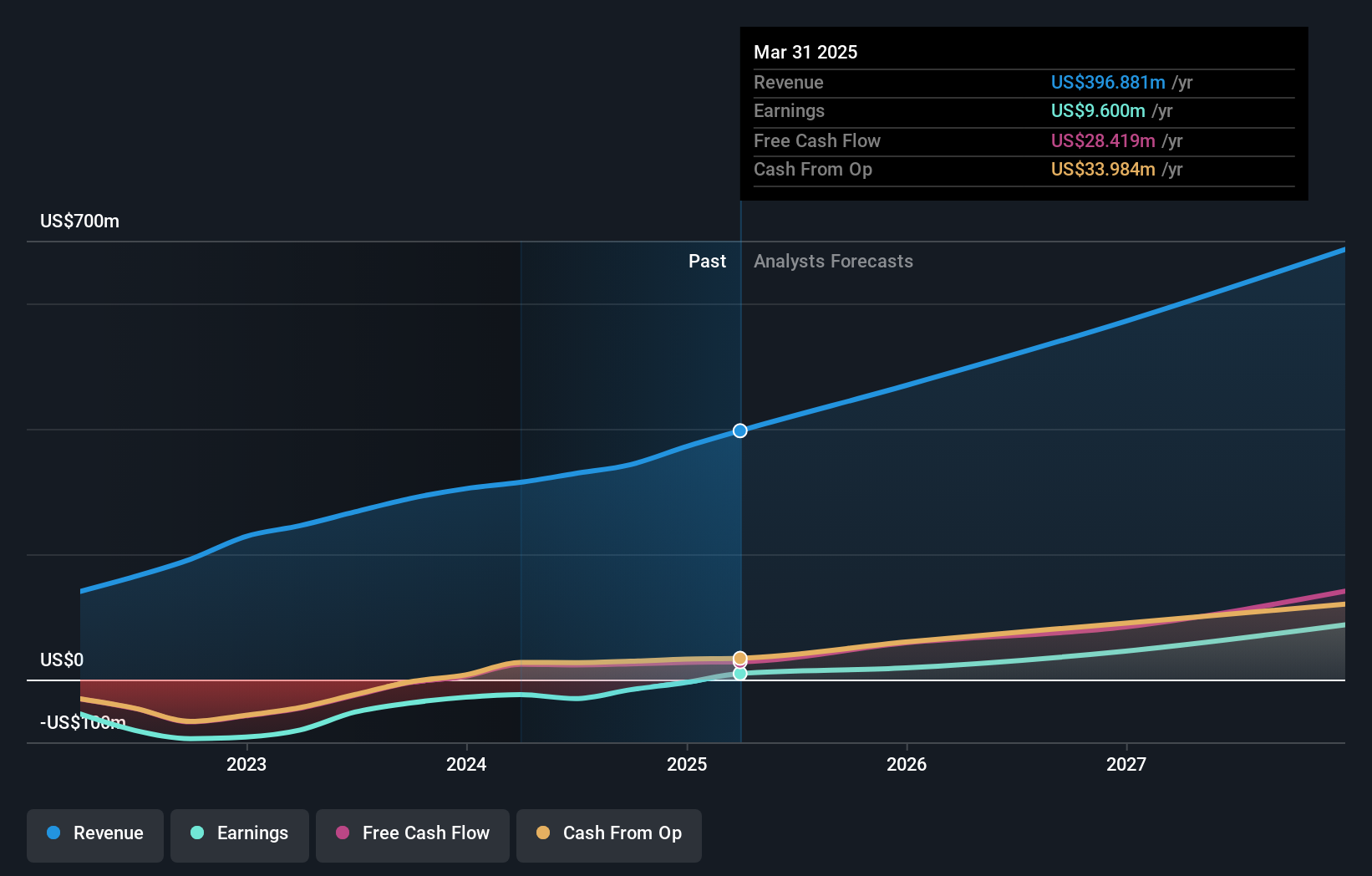

SiteMinder (ASX:SDR)

Simply Wall St Growth Rating: ★★★★★☆

Overview: SiteMinder Limited provides online guest acquisition platforms and commerce solutions for accommodation providers globally, with a market capitalization of A$1.88 billion.

Operations: SiteMinder generates revenue primarily from its software and programming segment, amounting to A$190.84 million. The company's platform facilitates online guest acquisition and commerce solutions for accommodation providers across Australia and internationally.

SiteMinder, amidst a dynamic tech landscape, has shown promising signs with a robust revenue jump of 25.9% to AUD 190.67 million this year. Despite a net loss reduction from AUD 49.3 million to AUD 25.13 million, the firm's aggressive R&D spending underscores its commitment to innovation—critical for staying competitive in the high-stakes hotel software market. With earnings expected to surge by 60.6% annually and revenue growth projected at 19.7%, SiteMinder is strategically positioning itself for profitability and market leadership in the evolving digital hospitality sector.

- Take a closer look at SiteMinder's potential here in our health report.

Examine SiteMinder's past performance report to understand how it has performed in the past.

Next Steps

- Reveal the 63 hidden gems among our ASX High Growth Tech and AI Stocks screener with a single click here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal