A Look at Netflix's Upcoming Earnings Report

Netflix (NASDAQ:NFLX) is set to give its latest quarterly earnings report on Thursday, 2024-10-17. Here's what investors need to know before the announcement.

Analysts estimate that Netflix will report an earnings per share (EPS) of $5.12.

Netflix bulls will hope to hear the company announce they've not only beaten that estimate, but also to provide positive guidance, or forecasted growth, for the next quarter.

New investors should note that it is sometimes not an earnings beat or miss that most affects the price of a stock, but the guidance (or forecast).

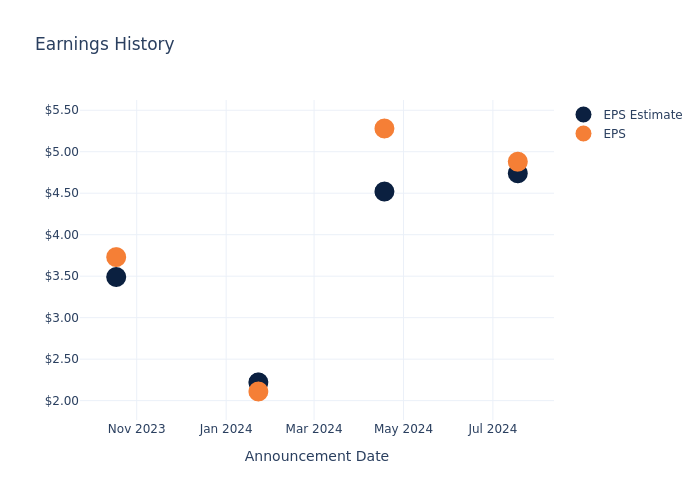

Performance in Previous Earnings

The company's EPS beat by $0.14 in the last quarter, leading to a 1.51% drop in the share price on the following day.

Here's a look at Netflix's past performance and the resulting price change:

| Quarter | Q2 2024 | Q1 2024 | Q4 2023 | Q3 2023 |

|---|---|---|---|---|

| EPS Estimate | 4.74 | 4.52 | 2.22 | 3.49 |

| EPS Actual | 4.88 | 5.28 | 2.11 | 3.73 |

| Price Change % | -2.0% | -9.0% | 11.0% | 16.0% |

Performance of Netflix Shares

Shares of Netflix were trading at $705.98 as of October 15. Over the last 52-week period, shares are up 74.5%. Given that these returns are generally positive, long-term shareholders are likely bullish going into this earnings release.

Analysts' Take on Netflix

Understanding market sentiments and expectations within the industry is crucial for investors. This analysis delves into the latest insights on Netflix.

Analysts have given Netflix a total of 26 ratings, with the consensus rating being Outperform. The average one-year price target is $720.92, indicating a potential 2.12% upside.

Peer Ratings Comparison

The below comparison of the analyst ratings and average 1-year price targets of Walt Disney, Warner Bros. Discovery and Liberty Formula One Gr, three prominent players in the industry, gives insights for their relative performance expectations and market positioning.

- Walt Disney is maintaining an Buy status according to analysts, with an average 1-year price target of $109.69, indicating a potential 84.46% downside.

- Warner Bros. Discovery received a Neutral consensus from analysts, with an average 1-year price target of $10.41, implying a potential 98.53% downside.

- The consensus outlook from analysts is an Buy trajectory for Liberty Formula One Gr, with an average 1-year price target of $81.0, indicating a potential 88.53% downside.

Peer Analysis Summary

Within the peer analysis summary, vital metrics for Walt Disney, Warner Bros. Discovery and Liberty Formula One Gr are presented, shedding light on their respective standings within the industry and offering valuable insights into their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| Netflix | Outperform | 16.76% | $4.39B | 9.88% |

| Walt Disney | Buy | 3.69% | $8.45B | 2.62% |

| Warner Bros. Discovery | Neutral | -6.23% | $3.51B | -25.44% |

| Liberty Formula One Gr | Buy | 36.46% | $255M | 0.37% |

Key Takeaway:

Netflix ranks highest in Revenue Growth and Gross Profit among its peers. However, it has the lowest Return on Equity.

Discovering Netflix: A Closer Look

Netflix's relatively simple business model involves only one business, its streaming service. It has the biggest television entertainment subscriber base in both the United States and the collective international market, with more than 275 million subscribers globally. Netflix has exposure to nearly the entire global population outside of China. The firm has traditionally avoided live programming or sports content, instead focusing on on-demand access to episodic television, movies, and documentaries. The firm recently began introducing ad-supported subscription plans, giving the firm exposure to the advertising market in addition to the subscription fees that have historically accounted for nearly all its revenue.

Netflix: Financial Performance Dissected

Market Capitalization: Boasting an elevated market capitalization, the company surpasses industry averages. This signals substantial size and strong market recognition.

Revenue Growth: Netflix's revenue growth over a period of 3 months has been noteworthy. As of 30 June, 2024, the company achieved a revenue growth rate of approximately 16.76%. This indicates a substantial increase in the company's top-line earnings. As compared to competitors, the company encountered difficulties, with a growth rate lower than the average among peers in the Communication Services sector.

Net Margin: The company's net margin is a standout performer, exceeding industry averages. With an impressive net margin of 22.46%, the company showcases strong profitability and effective cost control.

Return on Equity (ROE): The company's ROE is a standout performer, exceeding industry averages. With an impressive ROE of 9.88%, the company showcases effective utilization of equity capital.

Return on Assets (ROA): Netflix's ROA surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 4.39% ROA, the company effectively utilizes its assets for optimal returns.

Debt Management: With a below-average debt-to-equity ratio of 0.63, Netflix adopts a prudent financial strategy, indicating a balanced approach to debt management.

To track all earnings releases for Netflix visit their earnings calendar on our site.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal