ASML.US (ASML.US) performance has exploded, revealing the current state of the chip industry: the AI boom has not abated, but it is not enough to drive the “boom cycle”

Lithography giant ASML.US (ASML.US), which has a reputation as the “pinnacle of human technology,” had a rare thunderstorm in performance, causing global chip stocks to plummet. Asmack's weak performance can be described as throwing cold water on chip stocks that have recently rebounded sharply from the “summer sell-off wave.” According to incomplete statistics, since the opening of the US stock market on Tuesday, the total market value of global chip stocks, including Nvidia, AMD, SK Hynix, and Samsung, has evaporated by more than 420 billion US dollars.

The process of announcing Asmack's results can be described as being dramatized. Asma was originally scheduled to release its third quarter earnings report on Wednesday, but the company's staff said that due to a “technical failure,” the financial report was unexpectedly posted on the company's official website early in early trading on Tuesday, which can be called a “broken” Western state. For such a tech giant that holds the core of global chip production capacity, such a major mistake is a rare phenomenon on a historical level.

As a result, global investors were taken aback by Asmack's unusually poor performance: although overall revenue exceeded expectations, the order size was only half of market expectations, while exceeding expectations and lowered next year's sales targets and gross margin guidelines. In this “unexpected early leak” third quarter earnings report, Asmack said that the total volume of Q3 orders was only 2.6 billion euros, which is nearly half of the 5.4 billion euros generally expected by the market. Meanwhile, the company expects total net sales to grow to between €30 billion and €35 billion by 2025, compared to the previous quarter's guidance of €30-40 billion. This latest forecast figure is only in the lower half of the guidance provided by Investor Day 2022, so sales prospects can be described as being drastically cut by Asmat's management.

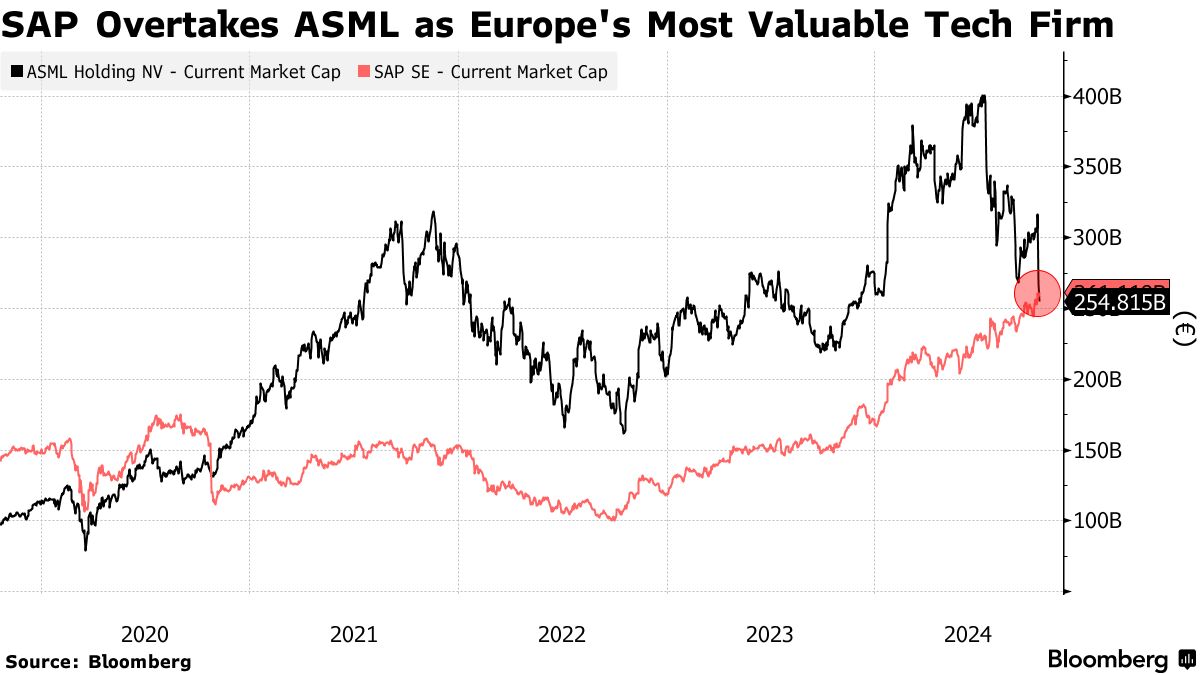

After the financial report was announced, Asmack's ADR fell by more than 17%, and finally closed down 16.26% to $730.43. The company's stock price in the Amsterdam stock market closed down 16%, the biggest one-day decline since 1998, and trading was suspended several times during the day. After Asmack's stock price plummeted, the “highest market capitalization technology company” in the European stock market changed hands as a result. The lithography giant Asmack, which had occupied this title for a long time, relinquished this title to German software hegemon SAP, which has greatly benefited from the AI boom.

In addition to the performance storm, there is news that the US government is considering restricting US companies from selling the most advanced artificial intelligence chips to certain Middle Eastern countries, including flagship data center AI chips that are in high demand from Nvidia and AMD. This news further drove Asmack's stock price to plummet. After all, demand for AI chips from chip giants such as Nvidia may decline as a result, which in turn may cause TSMC to reduce the production capacity of AI chips such as Nvidia. Asmack's performance expectations have also been logically lowered as a result.

However, from a rational investment perspective, Asmack's performance, which has hit global chip stock prices, does not mean that the fervent wave of global artificial intelligence layout is dissipating or cooling down, but this thunderstorm's financial report has revealed the latest developments in the global chip industry. That is, the AI boom is still ongoing. In particular, demand for all types of AI chips focusing on B-side data centers is still very popular, but in fields unrelated to AI, demand is still weak or even declining sharply.

Asmack's chief financial officer Roger Dassen can be said to have supported this market view in his performance statement. The Asmack executive said that demand for chips related to artificial intelligence is indeed surging, but demand recovery in other parts of the semiconductor market is weaker than we expected, causing some logic chip manufacturers to delay lithography machine orders.

Before Asmack's performance skyrocketed, there was an optimistic bullish view in the stock market for a long time. That is, a new round of the “boom cycle” of the chip industry has quietly begun in 2024. However, Asmack's latest performance can be described as causing this bullish view to be questioned by the market, which in turn pushed the market to sell chip stocks. In other words, the AI boom in global enterprises and even the layout of global government agencies has not faded away, yet this AI boom has yet to drive the entire chip industry, including industrial chips, electric vehicle chips, power chips, components, and most consumer electronics core chips, including smartphones, whose demand has been weak for a long time, into a “boom and development cycle.”

After Asmack's performance exploded, some analysts even shouted that even if Asmack's performance was so unimpressive, it actually favors the stock price trend of “AI sellers” such as Nvidia. After all, Asmack's performance shows that demand for AI chips in data centers is still booming. Judging from the stock price trend, Asmack's stock price, which has grasped the lifeblood of chip production capacity, can be said to have drastically outperformed Nvidia. Unwittingly, the market has already used real money to answer who is the biggest winner in chip stocks.

Asmack lowered expectations, which may mean a slight overcapacity in chip production, which is by no means the end of the chip industry

Regarding Asmack's weak performance report, some chip industry analysts said that the weak performance outlook may reflect overcapacity in some chip factories. Large chip foundries, including TSMC, Intel, and Samsung, have already stocked up large amounts of expensive Asmack EUV tools during the COVID-19 pandemic, and these foundry giants are good at transforming and upgrading these tools to produce more high-end AI chips.

Currently, in addition to AI chips, stocks of other types of chips are still high. At the same time, after years of exploring manufacturing processes, chip manufacturers such as TSMC have greatly improved the efficiency of using Asmack lithographs, which also means they can produce more chips and are not in a hurry to order more lithography equipment.

For example, since demand for smartphones and PCs has yet to increase significantly, TSMC, the “king of chip foundry,” may modify and upgrade the EUV of some 5nm and below smartphones and PC chips to increase the production capacity of Nvidia H100/H200 AI GPUs, the latest Blackwell architecture AI GPUs, and AMD MI300 series GPUs, instead of choosing to continue to spend huge sums of money to buy expensive EUV.

Of course, during the period of extreme demand for Nvidia's AI GPUs from 2023 to 2024, Asma's financial reports for multiple quarters showed that TSMC continued to buy the new EUV, but the scale of purchases was not as huge as predicted by some analysts, and the pace of purchases may have stagnated in the third quarter, which comprehensively highlights that as demand for non-AI chips continues to weaken, TSMC and other foundries have been transformed and upgraded to manufacture high-end AI chips. This largely reflects that the AI boom has not driven the entire chip industry into a growth cycle. The chip factory is in a state of slight overcapacity.

Therefore, chip foundries such as TSMC can only wait until factory orders are full before ordering a new EUV or DUV lithography machine. Other analysts said that Asmack's latest forecast is a lagging indicator of the poor performance of these chip factories over the past few months, revealing the latest situation where demand for non-AI in the chip market is currently weak.

“Intel, TSMC, and Samsung may be withdrawing their lithography machine orders from Asmack because they have realized that production capacity is sufficient.” Dan Hutcheson, vice chairman of TechInsights, an analysis company focusing on the technology industry, said in a recent interview.

“Chip factories are utilizing about 81% of their production capacity this year, but manufacturers tend to buy new lithography tools when they reach around 90%. Furthermore, Intel has slowed down the expansion of US factories, and Samsung and TSMC have recently been cautious about expanding chip production capacity.” Hutcheson said.

Handel Jones, CEO of an international business strategy company that tracks the chip manufacturing industry, said that some chip foundries have reduced the steps to use Asmack's flagship lithography machine, and some have reduced it by almost one-third. Using Samsung as an example, he said that in the future, Samsung may be able to use more advanced chip etching technology to reduce the number of steps using Asmack's flagship lithography equipment from five or six to just one or two steps. He said that if it really succeeds, Samsung may have a large amount of chip manufacturing overcapacity on these EUV lithography equipment.

However, Jones, who has been tracking chip industry trends for many years, pointed out that he has not changed his forecast for the entire chip industry. That is, as the productivity of various industries is completely revolutionized after the AI model is updated and iterated, demand for AI chips and AI-specific memory chips will flourish, and the future will inevitably drive the entire chip industry, including industrial analog chips, electric vehicle chips, and consumer electronics SoC chips, into a boom cycle. “This is just a short-term fluctuation in the chip industry. In the long run, everything will be fine.”

The AI boom is still in full swing, but the entire chip industry is not fully benefiting from it

Asmack's performance results show that the fate of global chip companies is clearly divided: AI applications such as ChatGPT and Sora have surged demand for data center server-side AI chips that can handle parallel computing models at the sky level and matrix computation with high computational density, such as Nvidia AI GPUs, which mask extremely sluggish demand in other segments of the industry.

Asmack did not explain in detail why its order volume for the third quarter was less than half of analysts' forecasts. Analysts speculated that the “customers” Asmack was referring to should be Intel and TSMC — the two major chip makers had previously indicated that they would slow down the global chip factory construction process. Faced with shrinking sales of chip products and an increase in net losses in the chip foundry business, Intel is drastically slowing down the chip factory construction process and postponed plans to build new plants in Germany and Poland last month.

Jefferies analyst Janardan Menon from Wall Street said in a report on Wednesday: “Asmack's earnings report shows that while demand for chips related to artificial intelligence remains very strong, recovery in other sectors is lagging behind. This trend is likely to continue until 2025.”

An analysis team from another major bank, Bernstein, said in a recent report: “We are concerned that it will take longer for terminal demand to recover, leading to significant delays in chip capacity expansion, and this is exactly what we need to face as we enter 2025.” “Looks like we might have to wait patiently until the chip industry's cyclical recovery becomes more clear.”

According to the latest semiconductor industry outlook data released by the World Semiconductor Trade Statistics Organization (WSTS), AI-driven memory chips and logic chips such as GPUs and CPUs are the main forces driving the recovery of the entire chip industry. In contrast, WSTS's expectations for the analog chip and microchip market size covering electric vehicles, industrial fields, IoT devices, and a wider range of consumer electronics products such as PS5 and Switch appear to be very sluggish. It is even predicted that the market size of the analog chip sector will grow negatively this year, and it is expected to achieve a weak recovery process next year.

WSTS said the revised forecast for 2024 reflects strong performance over the past two quarters, particularly in the computing terminal market. After a sharp contraction in the market in 2023, WSTS expects that in 2024, there will be two main core chip product categories that will drive double-digit sales growth in 2024, namely total sales in the logic chip category, which includes bursting demand, increased 10.7%, and the memory chip category that best reflects the chip cycle is expected to surge 76.8% in 2024 - WSTS predicts that strong demand for memory chips will focus on HBM used in the field of AI training/inference, and AI data Enterprise-grade DRAM and NAND storage systems that are critical to the efficient operation of the center.

This situation of demand for AI-driven storage and logic chips can be clearly reflected in South Korea's chip inventory and Korean chip export scale. South Korea is home to two of the world's largest memory chip manufacturers, SK Hynix and Samsung.

According to data released by the South Korean government, despite the slowdown in growth, semiconductor exports continued to increase sharply by 37% year on year in September, slightly weaker than the 38.8% increase in August. In the continuously growing chip export data, up to one-third of the increase contributed by HBM storage systems, HBM storage systems, and the core hardware provided by AI chip leader Nvidia — the H100/H200/GB200 AI GPU. HBM and AI GPUs are used in conjunction with H100/H200/GB200 AI GPUs to drive major artificial intelligence such as GPT and Sora Applications are essential. Stronger demand for HBM indicates more intense demand for AI chips.

Wall Street commercial banking giant Bank of America (Bank of America) recently released a research report saying that the global artificial intelligence boom is still in its infancy. It is basically similar to the Internet development path in the 1990s. It can be compared to the “1996 moment” when the Internet was booming, which means that according to the Bank of America analysis team, the AI boom is still in a very early stage.

“Investors may be underestimating the technology's long-term impact and overestimating its short-term potential, but this is a typical characteristic of the tech boom. It is estimated that capital expenditure related to artificial intelligence may reach more than 1 trillion US dollars in the next few years, but compared to the Internet age, the development of artificial intelligence has only just begun.” The Bank of America stated in its report.

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal