Discovering Undiscovered Gems With Potential In October 2024

As global markets reach new highs, driven by a robust earnings season and despite modest inflation surprises, small-cap stocks have been garnering attention amid shifting economic landscapes. With the S&P MidCap 400 Index hitting record levels, investors are increasingly on the lookout for undiscovered gems that possess strong fundamentals and growth potential in today's dynamic environment.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| PW Medtech Group | 0.06% | 22.33% | -17.56% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| MAPFRE Middlesea | NA | 14.56% | 1.77% | ★★★★★☆ |

| Procimmo Group | 157.49% | 0.65% | 4.94% | ★★★★☆☆ |

| Arab Banking Corporation (B.S.C.) | 190.18% | 16.52% | 21.58% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Britam Holdings | 8.55% | -2.40% | 35.94% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

Teladan Prima Agro (IDX:TLDN)

Simply Wall St Value Rating: ★★★★☆☆

Overview: PT Teladan Prima Agro Tbk, with a market cap of IDR7.51 billion, operates in managing palm oil plantations, mills, and renewable energy businesses through its subsidiaries.

Operations: Teladan Prima Agro generates revenue primarily from its oil palm plantation segment, amounting to IDR3.96 billion. The company's financial performance is characterized by its focus on this core revenue stream, which plays a significant role in shaping its overall business operations.

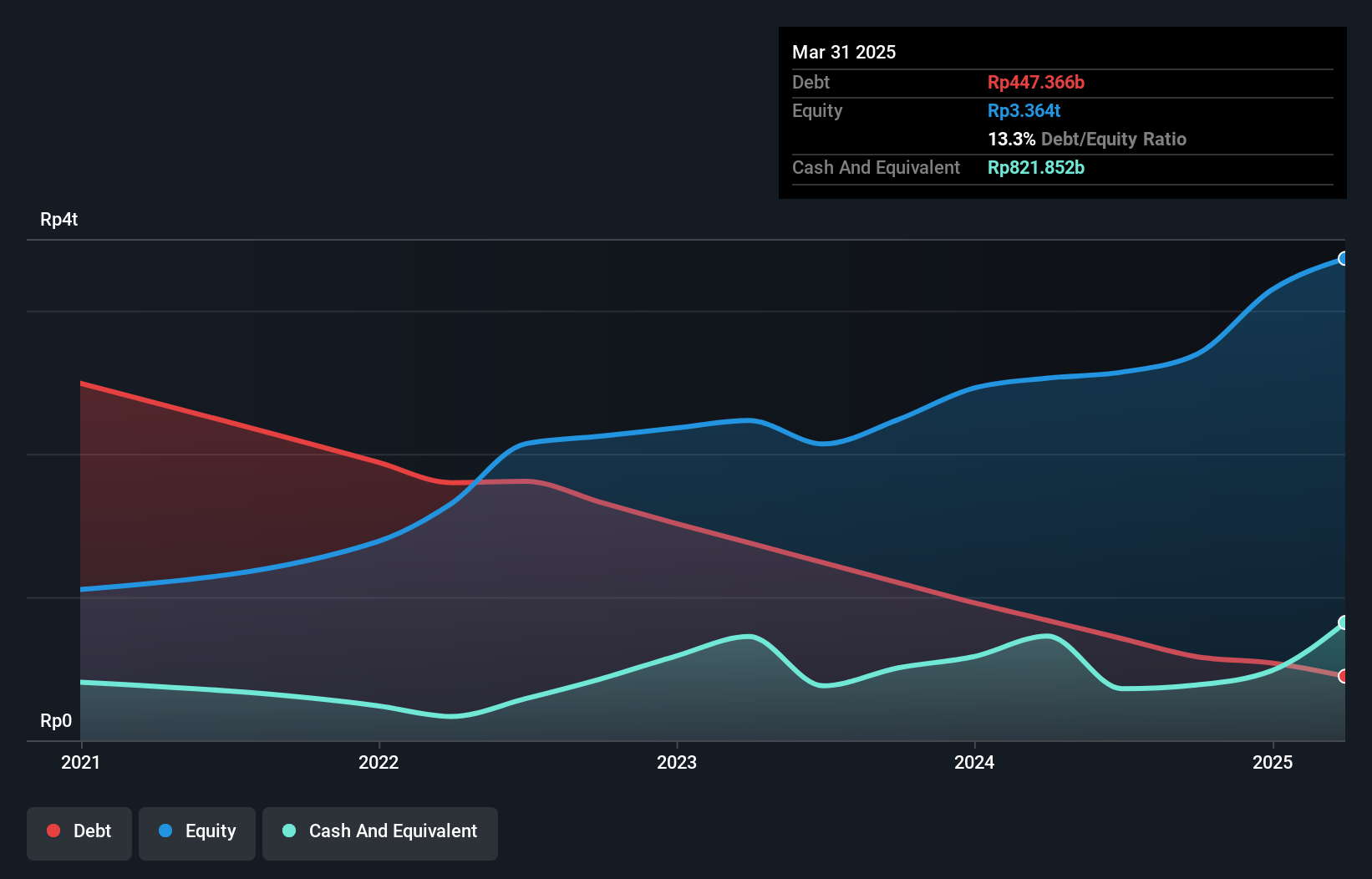

Teladan Prima Agro's earnings growth of 404.8% over the past year outpaced the food industry's -7.4%, showcasing its robust performance. The company's net income for the first half of 2024 was IDR 269,054 million, a significant jump from IDR 63,395 million in the previous year. Trading at 75.8% below estimated fair value suggests potential undervaluation, while a satisfactory net debt to equity ratio of 13.6% indicates sound financial health despite earnings declining by an average of 3.9% annually over five years.

- Click here to discover the nuances of Teladan Prima Agro with our detailed analytical health report.

Evaluate Teladan Prima Agro's historical performance by accessing our past performance report.

Guaranty Trust Holding (NGSE:GTCO)

Simply Wall St Value Rating: ★★★★★☆

Overview: Guaranty Trust Holding Company Plc is a financial holding company for Guaranty Trust Bank Limited, offering commercial banking services across several countries including Nigeria, Ghana, and the United Kingdom, with a market capitalization of NGN1.05 trillion.

Operations: GTCO generates revenue primarily from Corporate Banking (NGN827.44 billion) and Retail Banking (NGN475.41 billion), with additional contributions from SME, Business, Commercial, and Public Sector Banking segments.

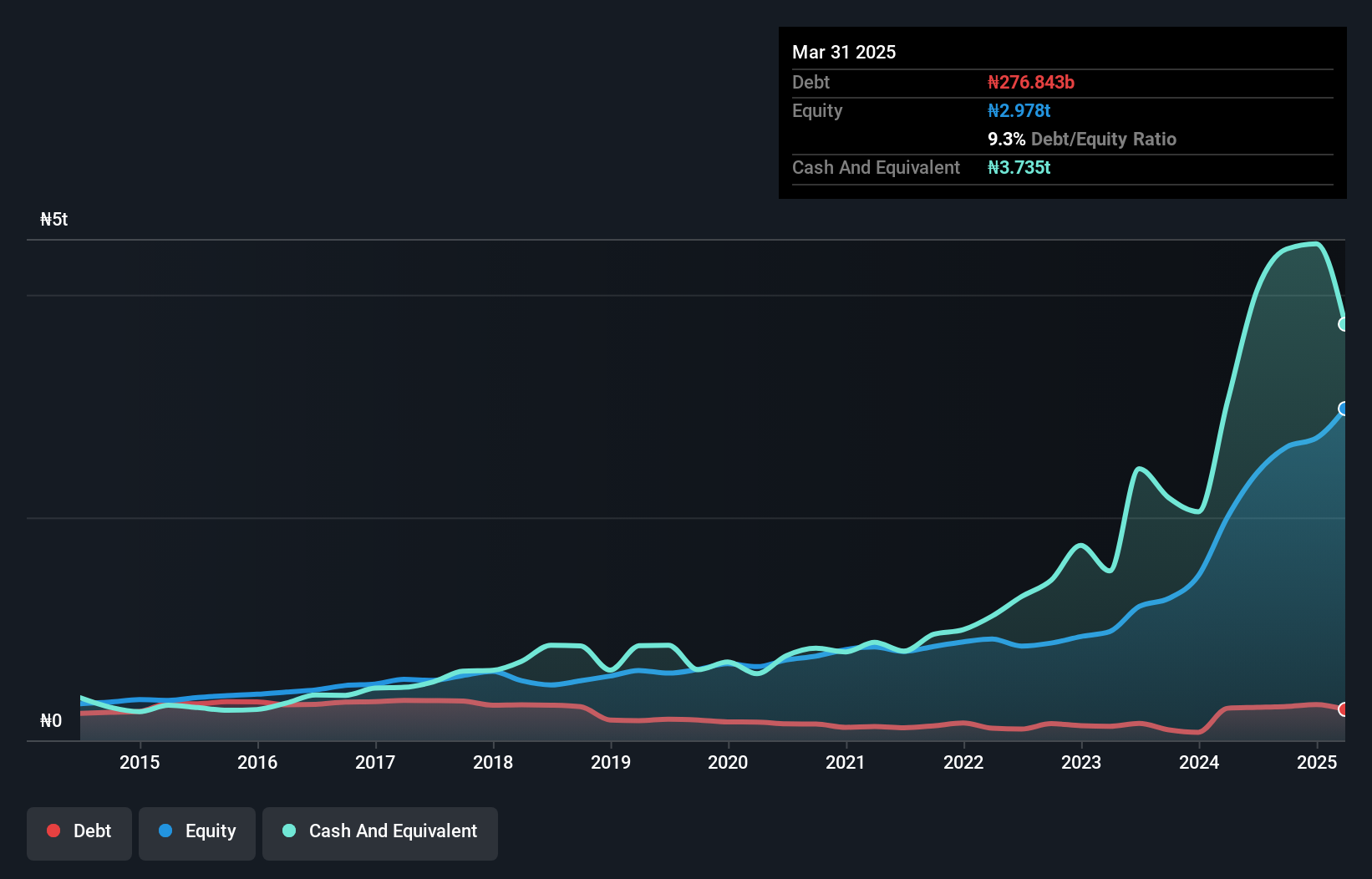

Guaranty Trust Holding, a notable player in the financial sector, boasts total assets of NGN14.51 trillion and equity of NGN2.40 trillion, highlighting its robust financial structure. With total deposits reaching NGN10.55 trillion and loans at NGN3.11 trillion, the company is anchored by primarily low-risk funding sources (87%). Despite a high level of bad loans at 4.3%, it maintains a sufficient allowance for these at 178%. Earnings surged by 212% last year but are expected to decrease annually by 5.6% over the next three years, reflecting potential challenges ahead despite recent strong performance compared to industry peers.

- Click to explore a detailed breakdown of our findings in Guaranty Trust Holding's health report.

Gain insights into Guaranty Trust Holding's past trends and performance with our Past report.

Shinkong Insurance (TWSE:2850)

Simply Wall St Value Rating: ★★★★★☆

Overview: Shinkong Insurance Co., Ltd. is a company that offers property insurance services to both individuals and corporates in Taiwan, with a market capitalization of NT$31.91 billion.

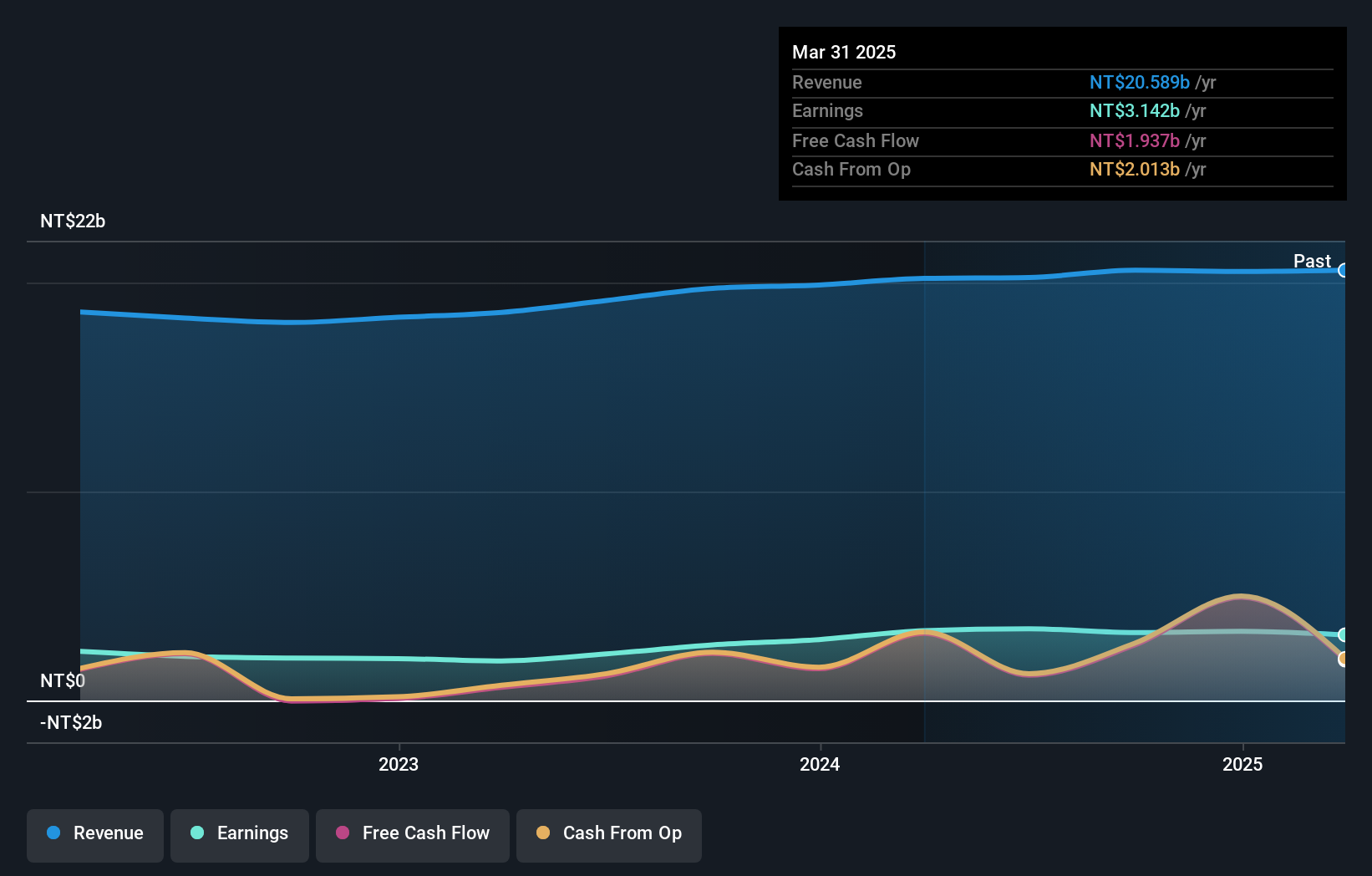

Operations: Shinkong Insurance generates revenue primarily from its property insurance segment, amounting to NT$20.24 billion. The company's financial performance reflects its focus on this core revenue stream within the Taiwanese market.

Shinkong Insurance, a nimble player in the insurance sector, has shown notable financial health with no debt over the past five years. Its earnings have grown at an impressive 15.7% annually, though recent growth of 54.1% lagged behind industry trends. The company is trading significantly below its estimated fair value by 40.7%. Recent earnings reports highlight a revenue increase to TWD 10.32 billion for six months ending June 2024, alongside a share repurchase plan worth TWD 4.82 billion aimed at boosting shareholder value.

- Navigate through the intricacies of Shinkong Insurance with our comprehensive health report here.

Explore historical data to track Shinkong Insurance's performance over time in our Past section.

Summing It All Up

- Explore the 4794 names from our Undiscovered Gems With Strong Fundamentals screener here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal